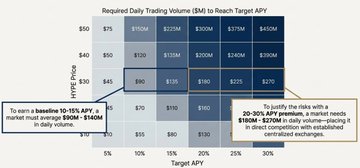

The "FUD" assessment of @HyperliquidX's HIP-3 does highlight some issues, but I saw comments jokingly comparing the target 30% APY to Luna-level performance, and that's exactly what hit the nail on the head: Economically speaking, @lordjorx's analysis does make sense. Consider this: deploying a HIP-3 marketplace requires staking 500K HYPE, has a 7-day unstaking lock-up period, and carries the potential risk of slashing penalties. This means that only daily transaction volume between 90m-270m can outperform the native staking APY of 2.2% through transaction fees. The numbers are clear, and indeed, looking at the economic model alone, the HIP-3 mechanism is very unfriendly to deployers, making it difficult for small and medium-sized projects to withstand the pressure. However, the problem lies in the flawed logic of this analytical framework. In my view, HIP-3 at this stage is merely Hyperliquid's ecosystem expansion strategy, largely consistent with the logic of OP Stack and Arbitrum Orbit. The goal is to use future market growth expectations to tell a B2B story that supports the current deflationary expectations for HYPE. For example, rapidly expanding into equity PERP (pre-IPO), RWA, gold reserve futures, bond and foreign exchange, prediction markets, and even CS (presumably referring to a specific type of market) derivatives markets—these are all long-tail assets geared towards the future. The key is the scale effect of the overall market stack, opening up the ecosystem's potential. In other words, Hyperliquid's HIP-3 protocol doesn't aim to make money in every market, let alone earn 20-30% APY. It might just focus on the current 500k staking lock-up and 50% fee repurchase of HYPE. As long as there's a continuous stream of sub-markets being established and the overall trading volume of the HIP-3 market continues to expand, that's sufficient. This is a completely different mindset from Luna and Anchor's UST seigniorage subsidy of 20% APY. Luna was a zero-sum game, while HIP-3 is an expectation of incremental growth, nothing more.

This article is machine translated

Show original

Jordi in Cryptoland

@lordjorx

12-26

HIP-3 markets are not sustainable.

While everyone is hyped about permissionless markets, we need to talk about the math.

Delegating $HYPE to third-party deployers for LSTs isn't just about yield; it's about taking on massive risks: locked capital, slashing, and conflict of x.com/etherfi_VC/sta…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content