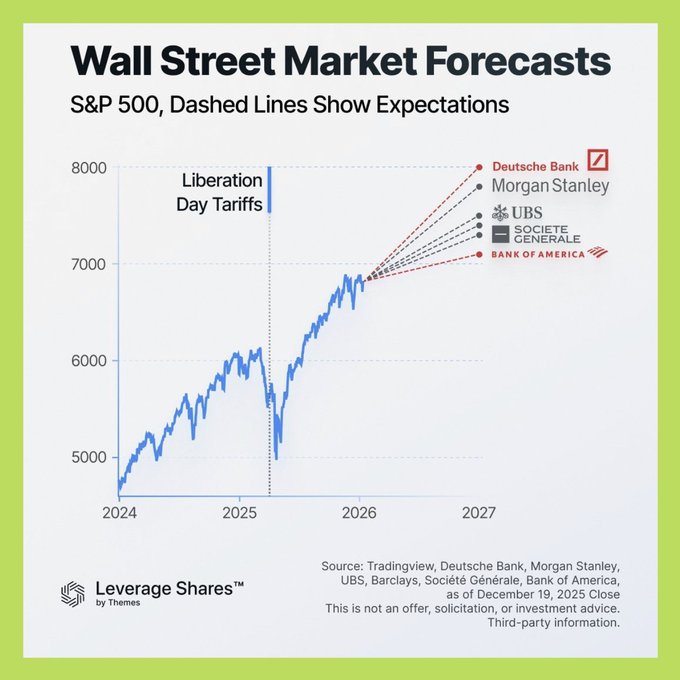

Wall Street's target for the S&P 500 by the end of 2026 👇 Oppenheimer: 8,100 Deutsche Bank: 8,000 Capital Economics: 8,000 Morgan Stanley: 7,800 Wells Fargo: 7,800 RBC Capital Markets: 7,750 Evercore ISI: 7,750 Yardeni Research: 7,700 Fundstrat: 7,700 Citigroup: 7,700 Goldman Sachs: 7,600 KKR: 7,600 JPMorgan: 7,500 HSBC: 7,500 UBS: 7,500 Barclays: 7,400 CFRA: 7,400 Société Générale: 7,300 Bank of America: 7,100 Stifel Nicolaus: 7,000 In summary 📌 - Highest: 8,100 - Lowest: 7,000 - Medium: 7.635 - Median: 7,700 💯 FOR THOSE WHO DON'T KNOW WHAT THE S&P 500 IS? The S&P 500 is an index representing the 500 largest companies in the United States, including Apple, Microsoft, Nvidia, Amazon, and others. It is often XEM a "thermometer" of the US stock market and reflects the overall health of the US economy better than looking at a single stock. The S&P 500 is currently fluctuating around 6,900 points, nearing the 7,000 mark for the first time in history, and has surged strongly over the past 10 years with an Medium increase of approximately 10–17% per year, demonstrating the long-term upward momentum of the US stock market over the past decade. When large institutions forecast the S&P 500 to reach 7,500–8,000 points, it means they expect the total earnings and size of US businesses to continue growing over the next few years. For individual investors, tracking the S&P 500 helps understand the long-term trend of the market, rather than having to guess the right or wrong of individual stocks.

This article is machine translated

Show original

Upside GM

@gm_upside

12-27

💥 Goldman Sachs nhìn về 2026: 10 câu hỏi quyết định dòng tiền

📍1. AI sẽ phát triển theo hướng nào trong 2026?

Không chỉ là chatbot. Trọng tâm có thể chuyển sang robot, xe tự lái, kính thông minh và câu hỏi quan trọng nhất: AI có thực sự giúp doanh nghiệp x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content