Is the prediction market a beautifully packaged form of gambling, or a revolutionary innovation?

The debate seems to have strayed from the core issue.

The original text was written by @0xJeff, and translated and personally interpreted by @anymose. Only the literal meaning is retained; for the original flavor, you can delve into the original text.

01 When risk is packaged as entertainment

The United States is sliding into the abyss of "hyper-gambling":

The market has seen the emergence of numerous sports betting apps optimized for teenagers, one-click access to prediction markets, and even absurd apps that use coin tosses to decide whether to double the rent... Risk is blatantly packaged as entertainment, which is sad but that's the reality.

Gambling has existed since ancient times:

From bone dice to Roman gladiatorial arenas, from casinos to sports betting, human impulses have been gradually industrialized and infrastructureized. The mechanisms are becoming increasingly sophisticated, and dopamine release is becoming faster and faster—which is precisely why gambling is strictly regulated: it is far too addictive.

02 The self-deception of gambling addicts

Gamblers never realize they are being reckless; they numb themselves with illusions.

- I can't keep losing.

- They'll definitely turn things around in the next game.

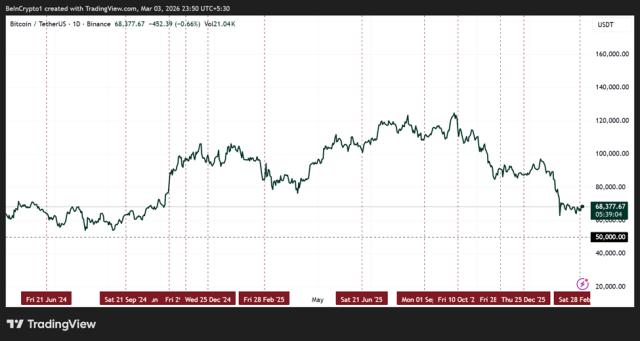

- Prices will return to historical highs.

- It will eventually rise back to my cost price.

They hope, pray, and become hopelessly immersed in their emotions.

A short-sighted perspective, driven by emotions, selectively remembering only winnings, and confident in their ability to capture turning points—while rarely questioning whether the game is manipulated, and even less reflecting on whether they have been swallowed up by the market.

03 What is gambling? The key lies in "advantage".

Stocks, cryptocurrencies, and prediction markets are not gambling in themselves; gambling is participating without an advantage—no matter how much narrative or charts are used to embellish them, they are essentially still based on luck.

The house edge in casinos is only 3%-8%, seemingly small, but it translates into stable profits over a large number of games. The house isn't concerned with winning or losing a single game, but rather with keeping players engaged. Rebates, airdrops, bonuses… everything is designed to retain players.

—Does this thing sound familiar?

04 The Antifragile Structure of Investors

True investors manage risk systematically:

- Probabilistic thinking replaces intuitive judgment

- Replace the obsession with a single win or loss with a perspective of repeated games

- Viewing losses as an inevitable part of the game

- Use discipline to resist the temptation of "boredom"

The secret of top prediction market players lies in this: long-term betting on areas where they have an advantage, and using position management and calculated betting to compound profits and minimize losses.

05 Dangerous Confusion: When Investors Wear the Mask of Gamblers

When investing degenerates into gambling, short-term trading becomes mindset-based holding, position management becomes arbitrary, and emotions replace discipline, congratulations, you've entered "gambling mode."

Buying the buy the dips sounds rational, but buy the dips without an advantage is just another form of gambling, and the crypto market is especially dangerous: volatility, narrative frenzy, and transaction speed all reward the gambler's mentality, but silently punish it in the long run.

06 Becoming the Dealer: Surviving in a Tilted Game

Becoming a bookmaker does not mean opening a casino, but rather:

- Slow down and refuse to be held hostage by the market rhythm.

- Calculate your positions carefully, letting math, not emotions, take the lead.

- Only make a bet when the odds are clearly in your favor.

Many people, after surviving several cycles, mistake luck for ability—don't become one of them.

07 New Year Restructuring: Let the Odds Tilt Towards You

Holidays are a good opportunity to reflect on oneself:

- Admit your mistakes and stop fabricating narratives to cover up your losses.

- Establish a repeatable system of advantages

- Honestly categorize yourself: Which side of the table are you on?

The market will always need liquidity—but you can choose not to be the one who gets drained of liquidity.

08 Appendix: Self-Test for Gambling Dog Index

Review your actions this year, check the applicable items and count them, then view the results below.

- I bought it because a certain coin was trending on Twitter.

- Short-term trading has turned into long-term holding.

- Feeling confident after winning money, they increased their position size.

- Increase position size in order to recover losses

- No exit or stop-loss conditions were set before entry.

- After entering the market, the stop-loss point or psychological stop-loss level was moved.

- Making decisions based on intuition, timelines, or emotions

- Feeling FOMO when seeing prices rise while you don't hold any positions

- I continue trading even when market conditions change significantly.

- I gave back most of my previous profits.

0-2 items: Investor model - Your operations are systematic. Losses may occur, but they are controlled. Your advantages remain solid.

Items 3-5: Investor mindset is unbalanced. You have a system, but you deviate from it due to boredom or emotionality.

Items 6-8: Gambler's Awakening Period

Emotions drive your actions more than the system itself. Bad habits and negative emotions are eroding your profits.

Items 9-10: Deeply Degenerate Gambler

You have become an "exit liquidity provider." All you have left is hope and prayer.

What should we do next? Now is the perfect time to reflect and clarify, so that we can become better versions of ourselves in 2026.