Michael Saylor, formerly the leader of MicroStrategy, has consistently pursued a strategy of steadily accumulating Bitcoin, further solidifying his leading position among publicly traded companies holding BTC.

Similarly, Tom Lee's BitMine technology is also demonstrating its influence in the Ethereum sector, leading the way among publicly traded companies owning ETH.

Peter Schiff criticizes the strategy of holding billions of dollars worth of Bitcoin.

Last week, Strategy purchased an additional 1,229 BTC for a total value of approximately $108.8 million, at an Medium price of $88,568 per coin. The company now holds a total of 672,497 BTC, purchased at an Medium price of $74,997 per Bitcoin, totaling approximately $50.44 billion.

Strategy reports a BTC yield of 23.2% year-to-date in 2025, with untapped profits reaching $8.31 billion, representing an increase of approximately 16% over the past five years.

Despite the impressive figures, investor and gold enthusiast Peter Schiff remains skeptical about Strategy's effectiveness. Schiff argues that a 16% increase in "paper" returns over five years means an average annual return of just over 3% – quite low compared to traditional investment channels .

“MSTR would have performed better if Saylor had chosen to buy almost any other asset instead of Bitcoin,” Schiff commented , suggesting that hoarding Bitcoin might not have been an optimal Capital allocation.

While Schiff questioned the effectiveness of Strategy's Bitcoin holdings, this approach reflects a general trend of large organizations accumulating digital assets.

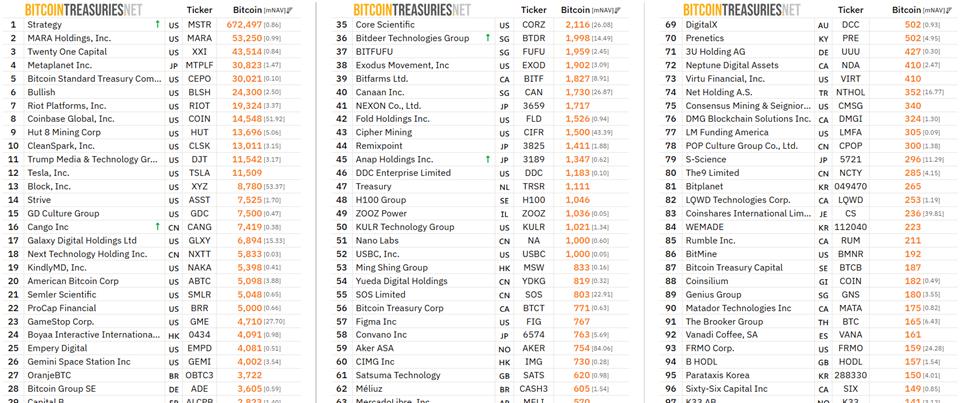

Some publicly traded companies hold the most BTC . Source: Bitcoin Treasurers

Some publicly traded companies hold the most BTC . Source: Bitcoin TreasurersMicroStrategy's long-term buy-and-hold strategy also demonstrates belief in Bitcoin as a store of value, although many still debate the opportunity cost and the actual returns achieved .

Tom Lee's BitMine aims for an 'Alchemy of 5%' with Ethereum.

Besides Strategy's Bitcoin strategies, Tom Lee's BitMine Immersion (BMNR) also made notable moves with Ethereum.

Last week, BitMine purchased an additional 44,463 ETH, bringing its total holdings to 4,110,525 Ether Token , worth $12.02 billion. This represents 3.41% of the total ETH supply.

In addition, BitMine holds 408,627 ETH Stake, with its MAVAN Staking solution expected to officially launch in Q1 2026.

BitMine's total digital assets, cash, and "moonshot" investments currently stand at $13.2 billion, including $1 billion in cash and $23 million in other strategic investments.

This company receives backing from institutional investors such as Cathie Wood (ARK) , Founders Fund, Pantera, Galaxy Digital, Kraken , and individual investor Tom Lee. BitMine is also one of the most actively traded stocks in the US , with an Medium daily volume of $980 million, ranking 47th out of 5,704 listed stocks.

The contrasting approaches of Strategy and BitMine further highlight the debate among investment institutions regarding cryptocurrencies. While Strategy focuses on accumulating Bitcoin, BitMine prioritizes expanding its Ethereum holdings and Staking activities .

Both approaches reflect increasing institutional confidence in digital assets, while Schiff's comments highlight the tension between long-term holding strategies for profit and the need for realistic investment performance evaluation.

BitMine will hold its Annual General Meeting at Wynn Las Vegas on January 15, 2026, with several key plans aimed at achieving its "5% Equity" target for ETH.

Meanwhile, Strategy continues to quietly accumulate Bitcoin, maintaining its position as the world's largest BTC holder, despite the ongoing risks associated with potential exclusion from MSCI .