Author: Nunchuk

summary

- The paradox of autonomy : maximizing security usually means making it harder to access your Bitcoin, but the need for inheritance is the opposite. Solving this problem without reintroducing trusted intermediaries is the central challenge of digital heritage.

- Custody risks : Relying on third-party custodians (such as exchanges or Bitcoin ETFs) can introduce single points of failure and privacy breaches (because they are all “honeypots”), and increase the risk of physical harm (“wrench attacks”) or asset forfeiture.

- DIY Risks : Completely self-designed and self-executed methods are often fragile and subject to the risk of technical failures or user misoperation, which may result in assets being permanently locked.

- Evaluation framework : A reliable plan must balance six dimensions: autonomy, security, successor experience, privacy, flexibility, and legal compatibility.

- The gold standard : The optimal solution combines “cooperative escrow with an assistant” (providing guidance for successors) with an “automated blockchain fail-safe” (guaranteeing execution even if the vendor fails).

Introduction: The Paradox of Autonomy

Bitcoin has brought true digital autonomy to the world. For the first time ever, individuals can securely hold their wealth without relying on banks, governments, or custodians. This power is encapsulated in the proverb: "No private key, no coins."

However, this profound sense of responsibility presents a unique challenge when planning for the future: the paradox of autonomy .

How can you guarantee that your Bitcoin will be safely transferred to your heirs after your death? Will your approach sacrifice the security of your assets today, or reintroduce trusted third parties (something Bitcoin was originally designed to eliminate)?

- If you give your heirs a copy of your private key now, you increase the risk of them being stolen during your lifetime.

- If you hide your private keys too well, your heirs may not be able to find them.

- If you rely on a company to manage your asset transfers, what happens if that company goes bankrupt or is forced to freeze your assets?

One wrong move could lead to total loss. Blockchain analytics firms estimate that millions of Bitcoins have already been permanently lost—unusable forever—because the private keys controlling them have been lost due to lost hardware, forgotten passwords, or the death of the owner. While it's impossible to know what percentage of these losses are due to failed succession plans, the lack of a proper succession plan poses a significant risk to the wealth of Bitcoin holders.

However, this is also a risk that can be mitigated. This guide provides a comprehensive framework for addressing this challenge. We will explore the realm of Bitcoin inheritance solutions, assess their trade-offs, and propose an emerging standard for protecting Bitcoin for your family.

Chapter 1: The Challenges of Bitcoin Inheritance

To understand the difficulties of inheriting Bitcoin assets, you must first understand what Bitcoin is.

Bitcoin is a "bearer asset," similar to gold. Anyone who obtains the private key (usually represented as a set of 12 or 24 words called a "seed word") can control the corresponding asset using those keys. The Bitcoin network doesn't know anything about identity, death certificates, or court orders. It only knows the cryptographic evidence provided by the private key.

This presents several key challenges to succession:

- The security/availability dilemma : To safeguard your Bitcoin for your lifetime, you want your private keys to be difficult for others to obtain. However, to ensure inheritance, you want your heirs to have easy access to these private keys (when you pass away). If your inheritance plan allows your heirs to easily obtain the private keys, it may not be able to prevent attacks.

- Complexity Barrier : Many security devices (such as multi-signature wallets) require significant technical knowledge to recover. Heirs often lack both the technical knowledge and are overwhelmed with grief, potentially making it impossible for them to complete the recovery process and resulting in the loss of funds.

- "Wrench Attack" Risk : As Bitcoin's value increases, so too does the risk of physical threats and extortion (the so-called "$5 wrench attack"). Security data indicates the emergence of violent and organized crimes targeting known cryptocurrency holders. Simple inheritance schemes, such as leaving a private key in a home safe, create a single point of failure while simultaneously exposing you and your family to these targeted attacks.

- Lifespan issue : When planning for intergenerational wealth, you're dealing with timeframes in decades. How can you trust that the company assisting you with your succession plan will operate for 30 to 50 years?

A robust succession plan must be able to address all of these issues simultaneously.

Chapter 2: Framework for Evaluating Inheritance Solutions

Not all inheritance solutions are equally good. To choose the right path, we need a framework to evaluate their trade-offs. We propose six essential metrics:

1. Autonomy (Trust Minimization)

Does this solution rely on the continued operation or license of a third party (a company, a lawyer, or a government) to execute the succession plan? A truly autonomous plan minimizes trust and ensures that the succession plan can be executed even if the vendor disappears.

2. Security

Can this solution effectively protect the holder's Bitcoin throughout their lifetime? It must be resistant to digital theft, physical threats, and accidental losses. Multi-signature technology (a custodian mechanism requiring multiple keys to transfer funds) is the standard for high security.

3. Heir experience (availability)

How complex is the recovery process for the target heir? If the heir cannot execute it, the plan is useless. Solutions range from completely self-help (requiring technical knowledge) to completely passive (guided by experts).

4. Privacy

Does the solution require you or your heirs to disclose sensitive personal information (KYC)? Inheritance is a sensitive matter; the best solution is based on cryptographic evidence rather than identity.

5. Flexibility

Is updating the entire plan easy? Life states change constantly. You might need to change beneficiaries, replace exposed keys, or adjust the timing of inheritance.

6. Legal compatibility

Can the solution be configured to include a trustee, or be combined with an existing statutory estate plan (will and trust), if the owner wishes?

Chapter 3: The Spectrum of Succession Plans

Inheritance solutions also have a spectrum, ranging from fully centralized to fully self-service. We can broadly categorize the solutions that have emerged into four categories.

3.1 Managed Solutions (Legacy Approach)

Details : Hold Bitcoin on centralized exchanges (such as "Coinbase" and "Kraken"), Bitcoin ETFs (equity index funds), or dedicated digital asset custodians.

Mechanism : The custodian controls the private key. Inheritance relies entirely on traditional legal procedures, authentication, and the custodian's user terms.

| Dimension | Evaluate |

|---|---|

| autonomy | Very low . Counterparty risk is the highest ("no private key, no coin"). Custodians can freeze or confiscate your assets. |

| Security | Moderate . They are vulnerable to large-scale hacking attacks, bank failures, and government seizures, despite being protected by institutional controls. In particular, the vast majority of Bitcoin ETFs heavily rely on the same centralized custodian, creating a significant systemic point of failure. |

| Heir Experience | Low . While the process is familiar, heirs face a "double intermediary problem": they must navigate between the stringent compliance bureaucracy of the exchange and the traditional probate court system. The entire process can be lengthy, often taking months or even years. Furthermore, probate records are usually public, potentially exposing your heir's identity and the value of the estate to criminals. |

| Privacy | Very low . Mandatory KYC/AML compliance. Furthermore, centralized databases are huge "honeypots" for hackers. This happens repeatedly: custodian databases holding sensitive customer information ( identity , home address , asset amount ) are breached and leaked to criminals, increasing the risk of targeted personal attacks. Even large ETF issuers are vulnerable; in 2024, a Fidelity database breach exposed the Social Security numbers and driver's licenses of over 77,000 customers. |

| flexibility | Medium . While Bitcoin ETFs typically allow designated beneficiaries (for transfer upon death), most cryptocurrency exchanges do not. This forces assets into probate unless the account is registered as a trust from the outset—a feature usually reserved for high-net-worth and institutional accounts. |

| Legal compatibility | High . Fully compatible with traditional legal systems. |

Conclusion : Very convenient, but lacks autonomy. This approach sacrifices Bitcoin's core advantages in exchange for a familiar inheritance system.

3.2 DIY Solution (Completely Autonomous)

Details : The holder is fully responsible for establishing and managing the estate plan, without bringing in professional assistants.

Mechanism : There are many DIY methods, each with its own trade-offs and failure modes:

- Simple backup/cloning of private key sets : Provides a complete copy of the seed key or a hardware signer to the successor.

- Failure Mode : High risk of theft during the holder's lifetime; due to increased attack interface. Significant risk of personal attacks (extortion) against the holder and heirs.

- Pre-signed transaction (“disable switch”) : Creates a valid Bitcoin transaction that sends funds to the heir’s address, but the transaction is time-locked (via

nLockTime), so it can only be broadcast at the designated time.- Failure Mode : Operational Vulnerability . This approach has been widely discussed, but it is dangerous in practice for the following three reasons:

- UTXO invalidation : Once you withdraw Bitcoin from this wallet, the pre-signed transaction may become invalid; or if you use the wallet to receive Bitcoin, the pre-signed transaction may not be able to transfer all the balance. You must continuously re-sign new transactions.

- Fee fluctuations : You must set mining fees for transactions that won't be broadcast for several years. If fees spike, the transaction will get stuck and won't be confirmed by the block; if fees drop sharply, you'll overpay.

- Destination rigidity : You must specify the heir's destination address today (it cannot be changed). If the heir's wallet is exposed, or lost after 10 years, you must recreate the entire process to change the flow of funds.

- Failure Mode : Operational Vulnerability . This approach has been widely discussed, but it is dangerous in practice for the following three reasons:

- Shamir Private Key Splitting (SSS) : Splits the seed key into several parts and distributes them.

- Failure Mode : Correct execution is extremely complex. SSS lacks a common industry standard: fragments created using one SSS tool often cannot be merged using another, creating a "vendor lock-in" risk for your successors. There is a high risk of misoperation during creation and restoration.

- DIY multi-signature/time locks : Building advanced protocols using open-source tools.

- Failure mode : High technical complexity. Lack of support for successors.

| Dimension | Evaluate |

|---|---|

| autonomy | Very high . Minimize dependencies on third parties. |

| Security | Uncertain . High risk of user error. Simple backups are very vulnerable to theft and physical attacks; professionally designed backups are very secure. |

| Heir Experience | Very low . The burden on heirs is high, requiring them to execute complex restoration procedures without guidance. |

| Privacy | High . No KYC required. |

| flexibility | Low . Safely modifying a plan is quite complex. |

| Legal compatibility | Low . Without professional technical guidance, it is difficult to implement correctly. |

Conclusion : This approach maximizes autonomy, but also maximizes complexity and risk. It requires both the holder and the successor to be technically proficient; and it often carries a high risk of misoperation.

3.3 Collaborative Custody with Assistants (Off-Chain Solution)

Details : Significant improvements to DIY and custodial solutions. These services help users build a multi-signature wallet: the vendor holds one key, while the user holds the others.

Mechanism : The inheritance logic—such as requiring a waiting period (time lock) or a survival check—is managed outside the blockchain by the supplier's platform. When claiming an inheritance, the supplier must actively participate, either by co-signing a transaction or by releasing the key after verifying the application or the holder's incapacity.

Case studies : Nunchuk (off-chain protocol), Casa, Unchained Capital, Bitkey.

| Dimension | Evaluate |

|---|---|

| autonomy | Medium . Although users control the majority of the keys, the legacy transfer process still relies entirely on the active involvement of the provider. This is the “ resilience gap ”: if the provider has a problem, the legacy plan may also have problems. |

| Security | High . Multi-signature wallets offer robust security, eliminating single points of failure. |

| Heir Experience | High . Suppliers provide guidance and support to successors (“smooth path”), significantly reducing complexity. |

| Privacy | Uncertain . While the technology itself doesn't mandate KYC, many vendors implement mandatory authentication (e.g., Unchained) or conditional KYC for faster recovery (e.g., Casa). However, completely KYC-free solutions also exist (e.g., Nunchuk). |

| flexibility | High . Because the logic is processed outside the blockchain, the plan is easy to update and not expensive. |

| Legal compatibility | High . Easy to selectively integrate trusts and estate plans. |

Conclusion : A good balance has been struck between security and convenience, but it still depends on the long-term survival of the vendor. Users who value privacy must carefully select a vendor that promises no KYC requirements.

3.4 Self-service collaborative custody (in-chain method)

Details : A new paradigm in the field of Bitcoin inheritance . This approach combines the convenience and security of assisted co-custodial with the reliability of autonomous enforcement through the Bitcoin network.

Mechanism : Using advanced Bitcoin technology (such as Miniscript ), the inheritance logic (time lock) can be directly embedded in the Bitcoin blockchain. When the time lock expires, the requirement to transfer funds automatically changes, allowing the heir to obtain the funds without the need for supplier intervention.

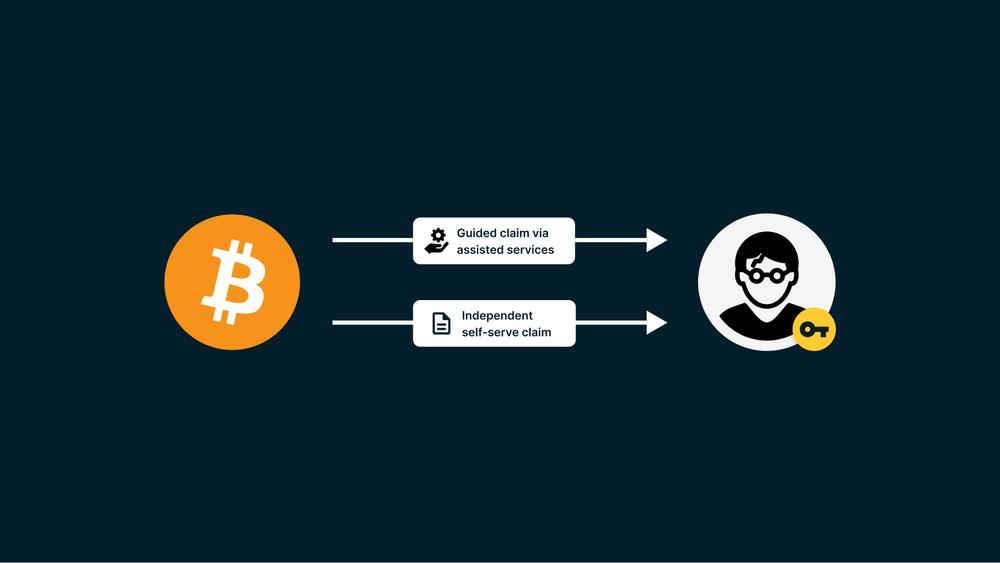

This creates a " smooth path + fail-safe " model:

- Smooth Path (with assistance): As long as the supplier is still operating, they can provide guided help and support to the successor to achieve a smooth recovery process.

- Failure insurance (fully autonomous): If the supplier cannot be contacted, or the supplier has ceased operations, the on-chain time lock ensures that the successor can still use open-source tools to autonomously recover funds.

Case Study: Nunchuk (In-Chain Protocol)

| Dimension | Evaluate |

|---|---|

| autonomy | Very high . Maximum level of trust minimization. The succession plan was designed to outlive the company that created it. |

| Security | High-end . Built on a robust multi-signature wallet architecture. |

| Heir Experience | High . It provides the convenience of a "smooth path" (guided assistance) and the guarantee of "failure insurance" (autonomous recovery) as a backup. |

| Privacy | High . Can be implemented without KYC (as Nunchuk did), relying on cryptographic evidence rather than identity. |

| flexibility | Medium . Because the plan is enforced on-chain, modifying it (e.g., changing the ongoing practice of time locks) requires migrating funds to a new wallet, which will incur network fees. |

| Legal compatibility | High . It can be configured for selective joining to a trust and integrated with an estate plan. |

Conclusion : The optimal balance. This approach eliminates the “resilient gaps” of off-chain solutions, providing the highest degree of autonomy and privacy without sacrificing security and successor experience.

Overview of Bitcoin inheritance

The table below summarizes the trade-offs between different methods:

| characteristic | Custody (Exchange/ETF) | DIY (Completely Independent) | Assisted co-location (off-chain) | Self-organized collaborative custody (on-chain) |

|---|---|---|---|---|

| autonomy | Very low | Very high | medium | Very high |

| Security | medium | uncertain | high | high |

| Heir Experience | Low | Very low | high | high |

| Privacy | Very low | high | uncertain | high |

| flexibility | medium | Low | high | medium |

| Legal compatibility | high | Low | high | high |

Chapter 4: Optimal Balance: When Autonomy Meets Assistance

The evolution of Bitcoin inheritance solutions aims to minimize trust while improving ease of use.

The emergence of autonomous cooperative trusteeship (Category 4) represents a paradigm shift. It resolves the central contradiction between the need for assistance and the demand for autonomy.

The “smooth path + fail-safe” model acknowledges that while autonomous recovery is necessary, assisted recovery is preferred.

- A smooth path provides emotional stability. It ensures that heirs have access to professional guidance during difficult times, reducing anxiety and the risk of misoperation. This continuous support is a key value of collaborative escrow providers.

- Failure insurance provides resilience. It guarantees that no matter what happens, your legacy is protected, enforced by the immutable rules of the Bitcoin network.

This dual-path approach combines the advantages of both: the convenience of high-quality services today, and the guarantee of autonomous execution tomorrow.

Chapter 5: Heritage Planning Integrating Tradition

One of Bitcoin's greatest strengths is its ability to facilitate private, direct transfers of wealth. Because the Bitcoin network operates entirely on keys—it doesn't understand court orders or know the user's identity—it enables the technically direct transfer of assets, bypassing traditional probate and the associated public disclosure and delays.

However, some people may prefer to combine their Bitcoin reserves with formal estate planning, such as a will or trust. Robust Bitcoin inheritance solutions should also provide the flexibility to support these options.

The role of trust and trustee

You might want your assets transferred in a controlled manner, rather than all at once; or you might want a trusted advisor to manage the process. That's the role of a trustee.

Collaborative custody solutions (including off-chain and on-chain methods) can facilitate this integration:

- Add a trustee : The trustee can be designed as the primary beneficiary (rather than the ultimate heir) to carry out the disbursement process. Then, according to the law, the trustee has a designated person to distribute the assets in accordance with the terms of the trust.

- Dividing the private key : You can construct an inheritance mechanism where the heir holds the necessary private key, while a legal expert (such as a probate attorney or trustee) holds the necessary instructions or configuration files (the "map" to the safe). Both parties must cooperate to access these assets, ensuring the entire process conforms to the structure of an estate plan.

Tax impact

Although Bitcoin is a decentralized protocol, its inheritance is taxable in most jurisdictions. Proper planning has a significant impact on financial benefits.

- Set-up in Basis : In jurisdictions like the United States, inheriting an asset typically resets its cost basis to its fair market value at the time of the holder's death . This can significantly reduce capital gains tax if the heir subsequently sells the asset.

- Estate tax : If the total value of your estate (including Bitcoin) exceeds a certain threshold , you may have to pay estate tax.

A robust inheritance plan ensures that your heirs not only receive the private key and the wealth, but also can liquidate a portion of it (if necessary) to pay the taxes within the legally mandated timeframe.

Conclusion: The Evolution of Inheritance

Safeguarding your Bitcoin for the next generation is the final step in your adventure toward financial autonomy.

Solutions for Bitcoin inheritance have seen significant development. We have moved from high-risk custody solutions and highly complex DIY solutions to a more balanced, collaborative custody approach.

Today, the emergence of autonomous, on-chain solutions marks a new standard. By leveraging the power of the Bitcoin protocol, we can create truly trust-minimized succession schemes—designed to withstand the test of time and outlive the companies that developed them.

By choosing solutions for your heirs that offer both a guided “smooth path” and an independent “failure insurance” safety net, you can ensure that the wealth you have worked so hard to earn will provide security for your descendants.

Disclaimer: The information provided in this guide is for general informational purposes only. It should not be considered as financial, investment, tax, or legal advice. Ownership and inheritance of Bitcoin involve significant technical aspects and legal complexities that vary by jurisdiction. You should consult a qualified professional before making any decisions concerning your estate planning.

(over)