CoinFound and ME News have jointly produced a weekly report on crypto concept stocks, reviewing noteworthy information from the past week's sub-sectors of the crypto concept stock market.

Article author: CoinFound

Article source: ME News

Industry Overview:

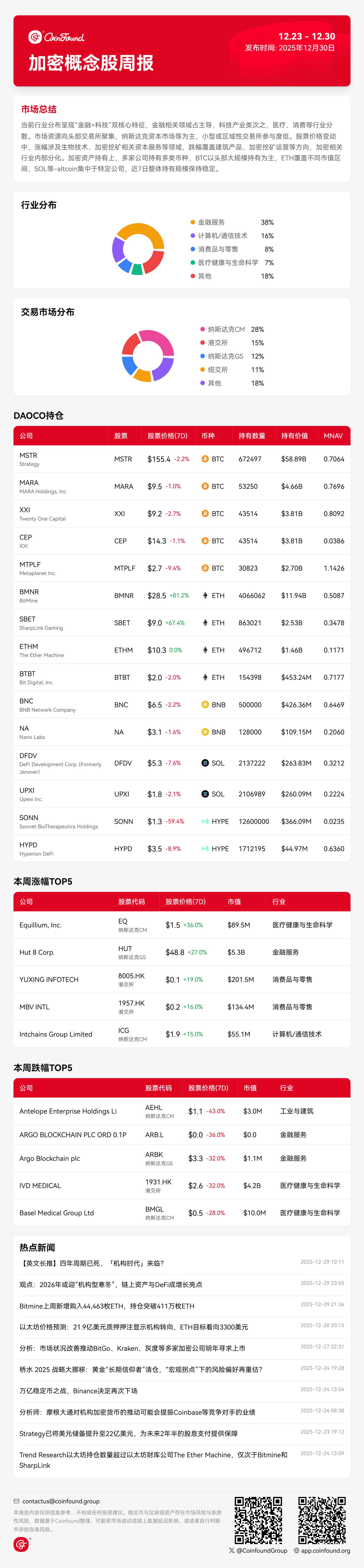

The current industry distribution exhibits a dual core characteristic of "finance + technology," with finance-related fields dominating, followed by technology industries, while healthcare, consumer goods, and other sectors are more dispersed.

Market resources are concentrated in leading exchanges, such as Nasdaq Capital Market, while smaller or regional exchanges have low participation.

In stock price fluctuations, gains were seen in sectors such as biotechnology and cryptocurrency mining-related capital services, while losses covered areas such as construction products and cryptocurrency mining operations, indicating a divergence within the cryptocurrency-related industry.

Industry distribution trends:

Financial-related fields (including capital services and asset management) hold an absolute dominant position.

Secondly, there are technology or industrial sectors such as software (infrastructure and applications), engineering and construction, video games and multimedia, and semiconductors.

The healthcare (distribution, equipment, facilities), consumer (retail, food, luxury goods), and manufacturing (electronic components, apparel) industries are relatively dispersed, and the overall industry concentration exhibits a dual-core characteristic of "finance + technology".

Stock price trend:

Characteristics of price increases: The top-performing companies cover fields such as biotechnology, cryptocurrency mining-related capital services, consumer electronics, apparel manufacturing, and semiconductors. Among them, cryptocurrency mining-related capital services companies entered the top gainers list due to their industry characteristics.

Characteristics of the declines: Companies with the largest declines included those in construction products, crypto mining operations, medical distribution (related to DeFi/RWA asset tokenization), and medical facilities (holding crypto treasuries). Crypto-related industries appeared on both the gainers and losers lists, showing an internal divergence.

Crypto asset holding trends:

BTC holdings are primarily large-scale, with leading companies holding significantly larger amounts.

ETH holdings are distributed across different market capitalization ranges, covering companies from large to small.

SOL, HYPE, and others hold concentrated stakes in specific companies.

Over the past seven days, the cryptocurrency holdings of most companies have remained unchanged, and the overall holding size has remained stable.

Market Dynamics Review:

In its year-end report, Cantor Fitzgerald pointed out that the crypto market may be entering a new "Crypto Winter," but unlike previous panic sell-offs, this round is more "institutionalized."

Bitmine purchased an additional 44,463 ETH last week, bringing its total holdings to over 4.11 million ETH.

Improved market conditions are prompting several crypto companies, including BitGo, Kraken, and Grayscale, to seek IPOs next year.

Strategy has increased its dollar reserves to $2.2 billion to secure dividend payments for the next two and a half years.

Coinbase has been named one of the top three fintech stocks for 2026, with a target price of $415.

Greenridge Capital gave Cango a "Buy" rating with a target price of $4.00; Bitcoin mining difficulty was raised by 0.04% to 148.26T.

Summarize:

Overall, in 2025, listed companies related to crypto showed structural differentiation amid price fluctuations, with institutional positioning (such as treasury holdings and IPO preparations) becoming mainstream. The crypto market as a whole experienced a year-end correction, with Bitcoin prices fluctuating between $85,000 and $90,000, and a total market capitalization of approximately $3 trillion. Retail interest weakened, but institutional activity continued, indicating that the market is transitioning to maturity. This suggests that in 2026, the market will focus more on fundamentals and regulatory clarity, rather than simply trading activity.