This article is machine translated

Show original

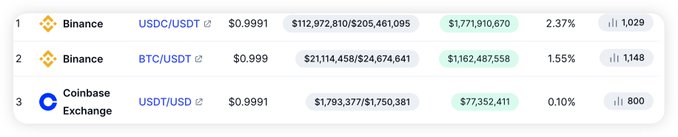

The main problem lies in the devaluation of USDT. Relatively speaking, USDC is used less in China and Asia. When there is a large sell-off of USDT, the price of USDT against fiat currency will show a negative premium, while USDC remains pegged to 1 US dollar, resulting in a negative premium for USDT against USDC.

The recent devaluation of USDT is also due to factors including S&P's downgrading of Tether's rating to "Week" and regulatory pressure in China.

BITWU.ETH

@Bitwux

12-30

为什么现在没有相关理财活动,usdc的溢价还越来越高了?

市场越熊,usdc越受欢迎的逻辑是什么?

Thankfully, they were all replaced with USDC.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content