XRP is currently trading around $1.86, down approximately 2% in the last 24 hours and nearly 15% in the past month. The price of XRP remains stuck in a descending channel and risks a 41% drop if key levels are broken.

What's noteworthy at this stage is that many groups of buyers are starting to participate. Long-term investors have returned to buying, and short-term investors are also adding in, but there is still a group that remains skeptical. The conflict between these groups keeps the chart leaning towards the pessimistic side.

Long-term investors are returning as the descending price channel remains intact.

XRP price has been trading within a descending channel since the beginning of October. Each bounce has been met with resistance at the upper trendline. This pattern predicts a potential further 41% drop if the Dip is broken. Currently, XRP is approaching the upper trendline, however, some on-chain support signals are beginning to emerge.

Discount channel: TradingView

Discount channel: TradingViewWant to stay up-to-date on more Token news like this? Sign up for editor Harsh Notariya's daily Crypto newsletter here .

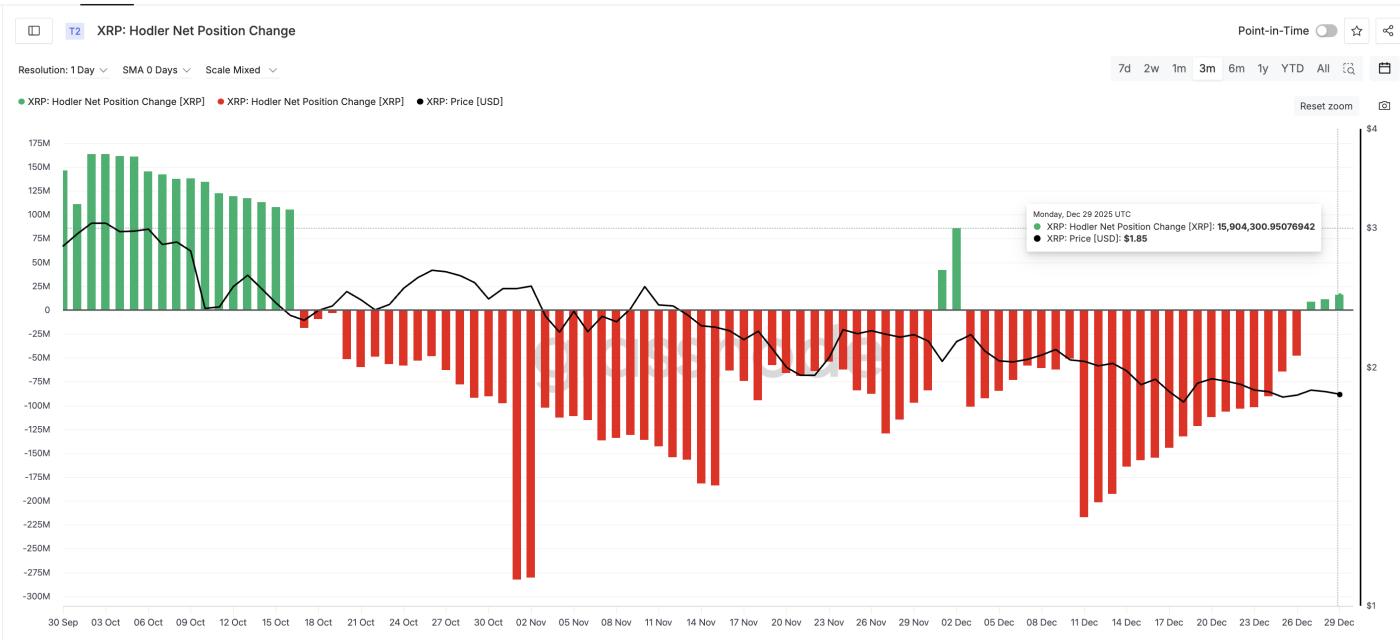

Long-term holder have begun to change their behavior, as evidenced by the Hodler net position change index.

After nearly three consecutive weeks of net selling, the trend reversed in December. From December 3rd to December 26th, XRP holder recorded negative net positions each day. However, on December 27th, long-term holder bought an additional 9.03 million XRP. Then, on December 29th, purchases surged to 15.90 million XRP. This represents a nearly 76% increase in purchases in just 48 hours.

Long-term holder buying in: Glassnode

Long-term holder buying in: GlassnodeThis strong buying pressure helped XRP stay near the upper trendline of the descending channel, but it was still not enough to help the price break out of the channel.

Short-term investors joined in — but the big players started selling.

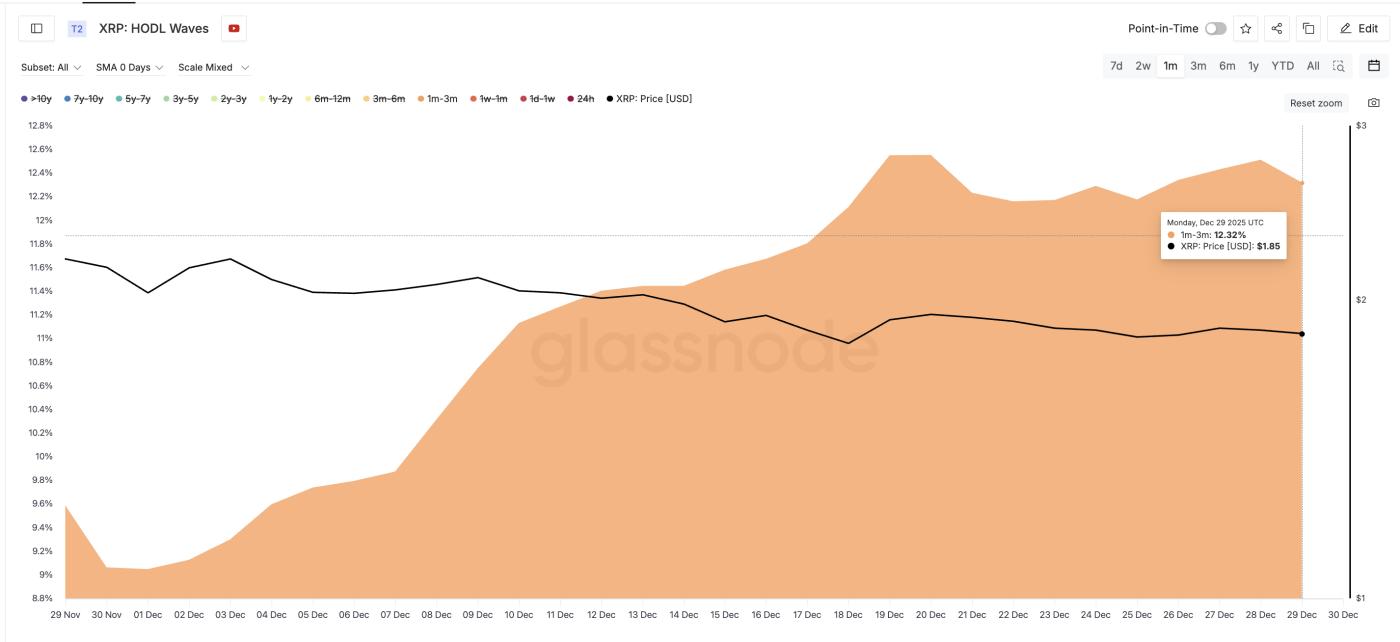

Short-term investors (1–3 months) increased their holdings from 9.58% of the supply on November 29th to 12.32% on December 29th, as shown by the HODL Waves index. This index is typically Chia by the number of days held or the age of the coin.

This group typically provides short-term upward momentum for prices, but is also ready to sell quickly if the market becomes volatile. Their buying is a double-edged sword: it both limits the risk of sharp declines and creates selling pressure if the upward momentum is not strong.

Short-term investors increased their buying: Glassnode

Short-term investors increased their buying: GlassnodeThe sharks are doing the opposite, possibly because they see short-term investors buying heavily amidst price instability.

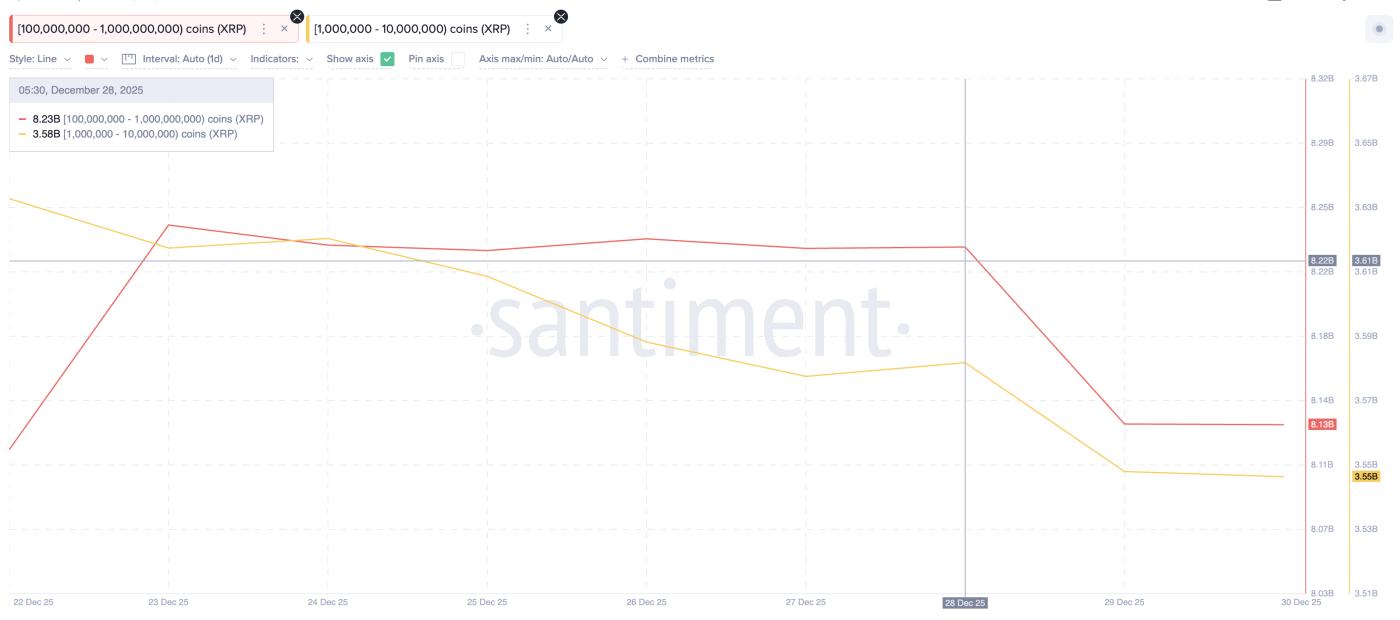

The group holding between 100 million and 1 billion XRP reduced their holdings from 8.23 billion to 8.13 billion on December 28th, a decrease of 100 million XRP, meaning they sold nearly $186 million worth of the cryptocurrency.

The group holding between 1 million and 10 million XRP also saw their holdings decrease from 3.58 billion to 3.55 billion XRP, a drop of 30 million XRP, equivalent to selling pressure of approximately $55 million.

Whales sell off XRP: Santiment

Whales sell off XRP: SantimentThe selling pressure from large investors while two new groups of holder continuously bought has created a tug-of-war in the market. This makes it difficult for prices to break out significantly, causing them to repeatedly return to the middle range instead of overcoming resistance. If short-term investors Dump when prices bounce up, large investors continuing to reduce their positions could cause prices to plummet even faster.

XRP price levels will determine the next trend.

The XRP market is currently at a crossroads. The XRP price remains within a descending channel. Holding above $1.79 would prevent a premature break Dip . Maintaining above this level, coupled with long-term holder , could push the price towards $1.98. A close above $1.98 would break the bearish pattern, potentially sending the price back to $2.28, where upward momentum could return.

But the risks are very clear.

XRP Price Analysis: TradingView

XRP Price Analysis: TradingViewIf the $1.79 level is breached, the next support zones for XRP are $1.64 and $1.48. A loss below $1.48 would break the current price channel, increasing the risk of a further 41% drop to around $1.27 or lower.

Currently, buying pressure from retail investors has not yet changed the overall situation. It has only slowed down the price decline. For the trend to reverse, the return of "whales" is needed. Before this happens, any pullback within the price channel could be an opportunity to sell and take profits.