In the past 24 hours, approximately $96.85 million (about 1.34 trillion won) of leveraged positions in the cryptocurrency market have been liquidated.

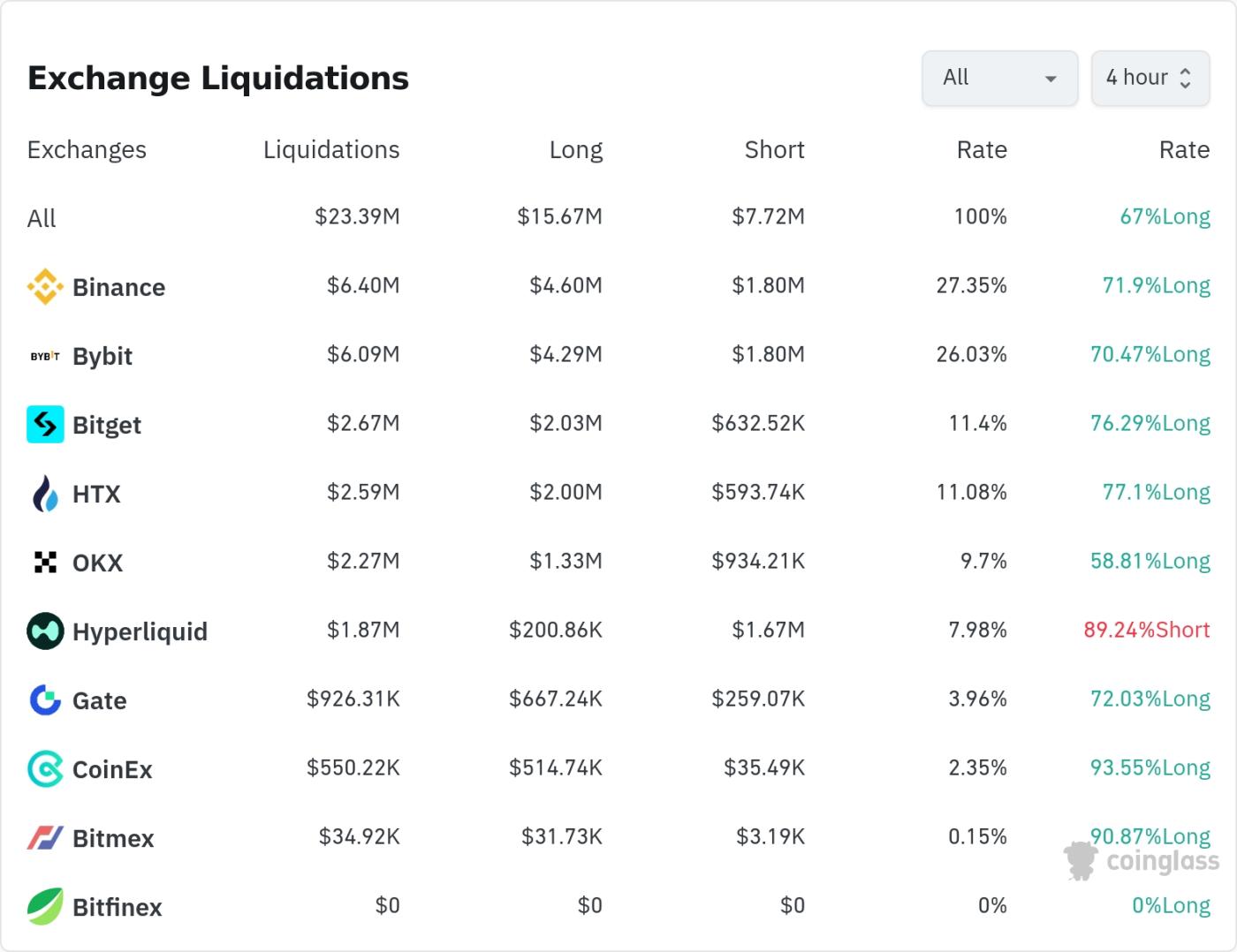

According to the current data, long positions accounted for 67% of the liquidated positions, while short positions accounted for 33%.

In the past four hours, Binance experienced the most position liquidations, totaling $6.4 million (27.35% of the total). Long positions accounted for 71.9% of these liquidations.

The exchange with the second-most liquidations was Bybit, with $6.09 million (26.03%) of positions liquidated, of which long positions accounted for 70.47%.

OKX experienced approximately $2.27 million (9.7%) in liquidations, representing 58.81% of long positions.

It is worth noting that, unlike other exchanges, on the Hyperliquid exchange, the short position liquidation rate is as high as 89.24%, which is an overwhelming majority.

By currency type, Bitcoin-related positions saw the most liquidations. In the past 24 hours, approximately $42.35 million in Bitcoin positions were liquidated; on a 4-hour basis, long positions saw $4.74 million liquidated, while short positions saw $4.05 million liquidated.

Ethereum saw approximately $40.35 million in positions liquidated within 24 hours, with a particularly large liquidation of $7.45 million on the LIT token.

Within 4 hours, Solana saw $510,000 in long positions liquidated and $1 million in short positions liquidated, despite the price reaching $124.56.

Dogecoin is trading at $0.12311. In the past 4 hours, long positions have been liquidated at $310,000 and short positions at $58,700.

In particular, tokens such as HYPE, ZEC, and LINK also experienced significant liquidations. Among them, ZEC saw $236,700 of long positions liquidated and $72,100 of short positions liquidated at a price level of $534.3.

Interestingly, on tokens such as ENA, XAUT, AAVE, and LTC, short positions were liquidated to zero or negligible levels within 4 hours, with liquidations mainly concentrated on long positions.

In the cryptocurrency market, "liquidation" refers to the forced liquidation of positions when traders holding leveraged positions fail to meet margin requirements. This liquidation data reflects market volatility centered on Bitcoin and Ethereum.

Article summary by TokenPost.ai

🔎 Market Analysis

• Approximately $96.85 million in leveraged positions were liquidated within 24 hours, with long positions (67%) being liquidated more than short positions (33%).

• Bitcoin and Ethereum saw record liquidations of $42.35 million and $40.35 million respectively.

Binance and Bybit accounted for 27.35% and 26.03% of the exchanges with the most liquidations, respectively.

💡 Key Strategies

• Unlike other exchanges, Hyperliquid has a high short position liquidation rate (89.24%), confirming a position bias on the exchange.

• Tokens such as ENA, XAUT, AAVE, and LTC have almost no short position liquidations, indicating a bias towards long positions among traders.

• Solana short liquidations outnumbered long liquidations ($510,000 vs. $1 million), potentially signaling a strengthening trend.

📘 Terminology Explanation

Liquidation: The forced liquidation of a leveraged position when the margin held by the trader falls below the maintenance requirement.

• Long position: A position bought in anticipation of an increase in asset prices.

• Short position: A position held in anticipation of a decline in asset prices.

TokenPost AI Notes

This article uses a language model based on TokenPost.ai for article summarization. The main content may be omitted or may not be factual.