Since the beginning of 2025, Bitcoin has not closed a single monthly candle below $80,000. Therefore, this is currently a crucial and very solid support zone.

However, signals from the Coinbase Premium Index are threatening this support level. Experts still see reasons to be optimistic even if the price breaks through the aforementioned support.

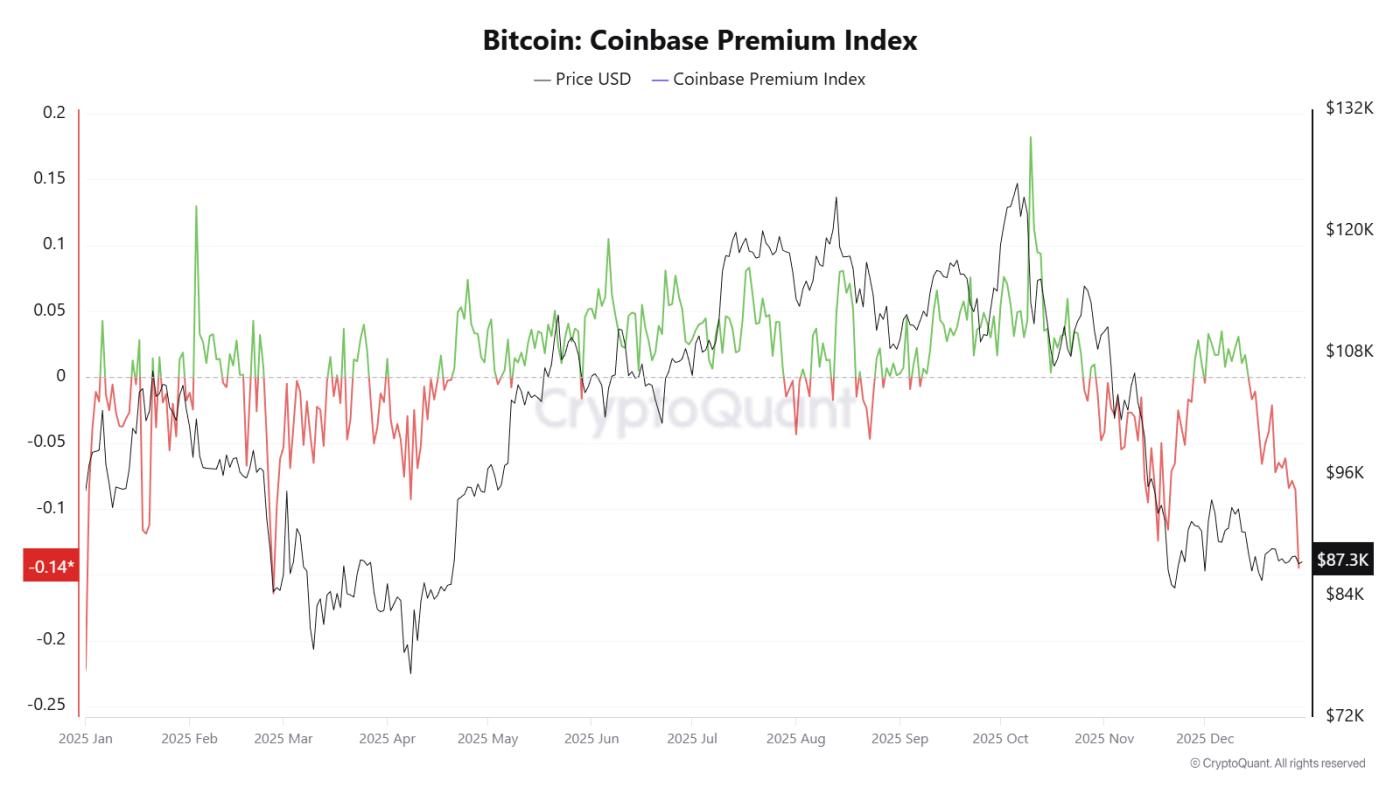

The Coinbase Premium Index for Bitcoin has fallen to its lowest level since February 2024.

The Coinbase Premium Index is an indicator that measures the price difference between Coinbase (in the US) and Binance (globally) for Bitcoin. Typically, this index reflects buying demand from institutional investors in the US.

When the index turns negative, it indicates strong selling pressure coming from the US. This is also a significant factor driving down the price of BTC .

The Coinbase Premium Index of Bitcoin. Source: CryptoQuant .

The Coinbase Premium Index of Bitcoin. Source: CryptoQuant .According to CryptoQuant data, as of December 30th, the index was at -0.14. This is the lowest level since February 2024.

This index remained negative for 16 consecutive days in December 2024. During this period, Bitcoin was unable to close a single weekly candle above $90,000.

Therefore, many experts believe that Bitcoin has not yet truly Dip . Selling pressure from US investors shows no clear sign of ending.

"The biggest signal for a short-term Dip is when the premium on Coinbase returns," investor Johnny commented .

A similar sharp drop occurred in February 2024, causing Bitcoin's price to break through the $80,000 support level. However, the price recovered strongly shortly afterward.

Therefore, given the current sharp decline, there's a high probability that BTC could repeat the above scenario.

December 2024 also marked the second consecutive month of net outflows from Bitcoin ETFs. However, the outflows in December decreased significantly compared to the previous month.

Net cash flow from Bitcoin Spot ETF. Source: SoSoValue .

Net cash flow from Bitcoin Spot ETF. Source: SoSoValue .Observations in February 2024 and early March 2025 also showed a similar phenomenon. This reflects that US investors were still selling, but at a significantly slower pace.

This situation creates conditions for Bitcoin's price to recover. The price may even temporarily drop below $80,000 before bouncing back up.

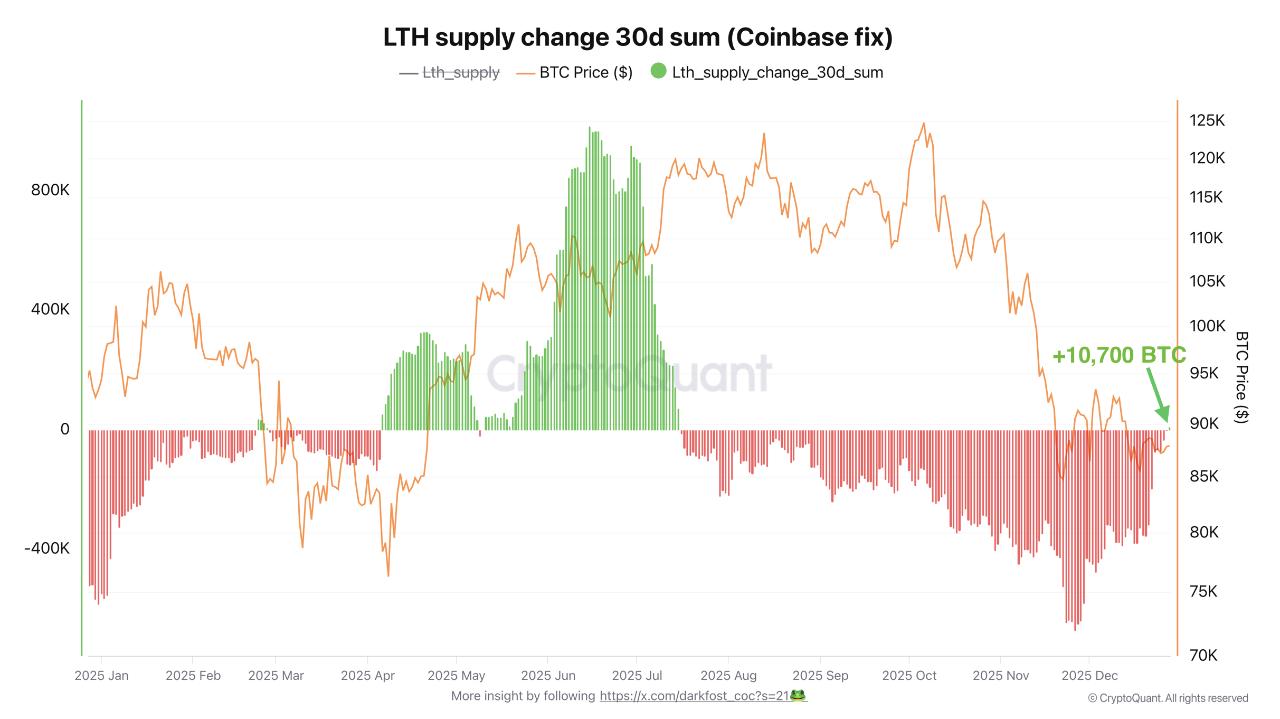

Meanwhile, long-term (LTH) investors have eased selling pressure. The amount of Bitcoin they hold is showing signs of increasing again.

Supply fluctuations for long-term holdings (LTHs). Source: CryptoQuant

Supply fluctuations for long-term holdings (LTHs). Source: CryptoQuantData from CryptoQuant shows that the supply of LTHs shifted from distribution to accumulation by the end of December 2024. Approximately 10,700 BTC moved into long-term holdings. This is the first positive signal from this group since they stopped selling in July 2024.

“Currently, this volatility is still quite modest, but not insignificant…Historically, such movements often signal a period of sideways consolidation or may even lead to a recovery trend, depending on the overall market context,” Chia expert Darkfost.

In summary, the Coinbase Premium Index remains at record lows, and outflows from ETFs continue. However, positive signals from long-term holders are offering some hope. If selling pressure continues, BTC could temporarily break through the $80,000 level. Nevertheless, a rebound is possible at any time .