Crypto regulation moves from discussion to institutional structure

During 2025, the global cryptocurrency regulatory landscape underwent a significant transformation, shifting from a state primarily characterized by theoretical discussions, scattered judicial precedents, and fragmented policy signals, to a more concrete legislative and regulatory system implemented across multiple jurisdictions. In this process, specific regulation of stablecoins gradually rose to the forefront of policy, reflecting regulators' growing concern about liquidity risks, reserve management, and the potential systemic impact of digital assets.

One of the most influential regulatory developments occurred in the United States. The GENIUS Act, which came into effect on July 18, 2025 , established a federal-level regulatory framework for payment-type stablecoins. The Act explicitly requires certain stablecoins to be backed 1:1 by US dollars or other low-risk assets and introduces a parallel federal and state-level regulatory structure to enhance transparency and consumer protection.

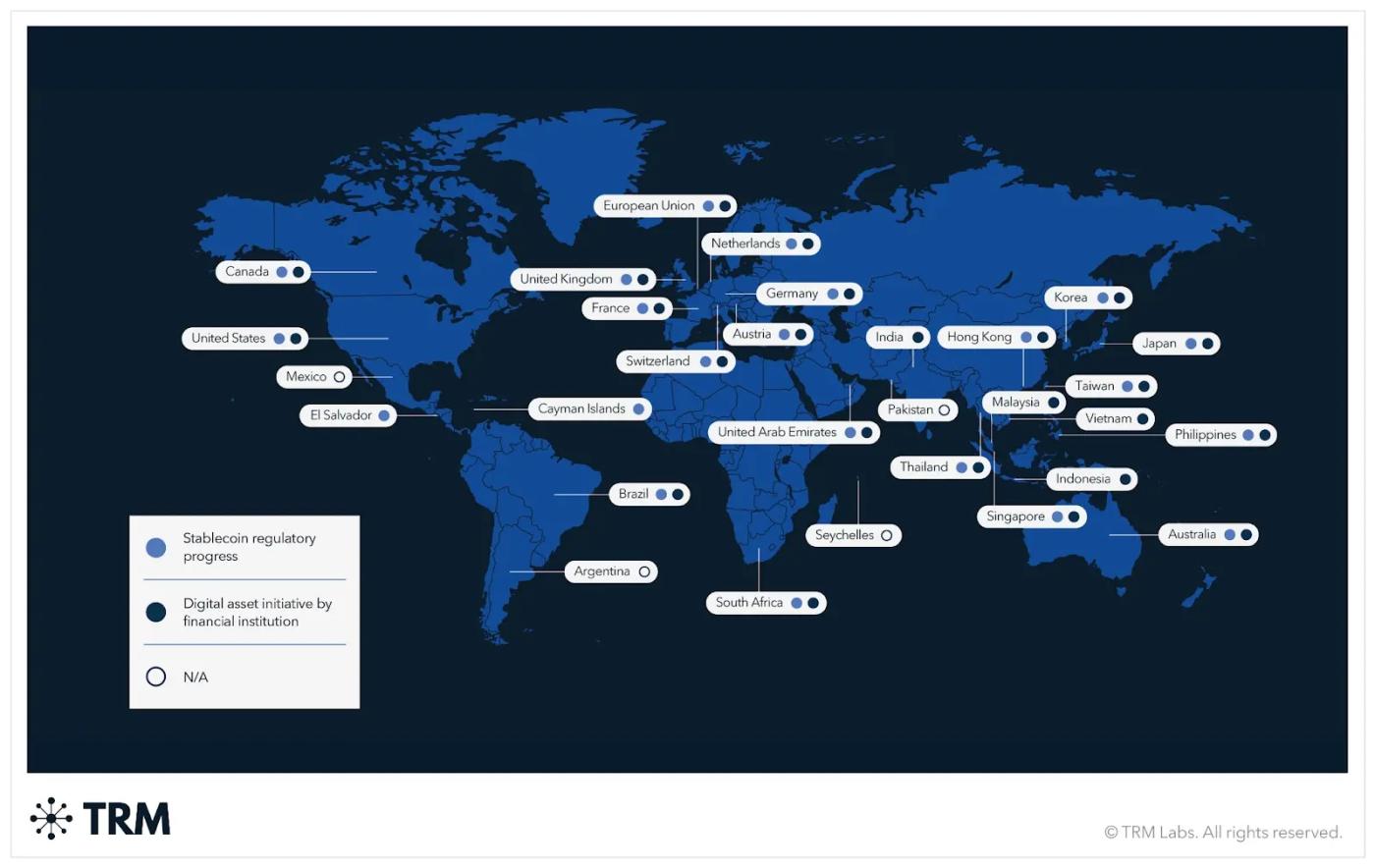

More than 70% of jurisdictions are advancing stablecoin regulatory rules.

According to a global crypto policy review report published by TRM Labs in 2025 (covering 30 jurisdictions ), over 70% of jurisdictions listed stablecoin regulation as a key issue that year. This percentage clearly demonstrates that a regulatory consensus surrounding digital cash and payment infrastructure is gradually forming globally.

At the same time, the report also pointed out that about 80% of the surveyed jurisdictions published digital asset-related plans involving banks or regulated fintech institutions, indicating that as the regulatory framework gradually becomes clearer, traditional financial institutions are gaining a clearer institutional path to participate in the construction of crypto asset infrastructure in a compliant manner.

The US OCC has explicitly stated that banks are involved in the transfer of crypto assets.

In the United States, regulatory clarity extends beyond legislation to include operational guidelines for banking businesses. In early December 2025 , the Office of the Comptroller of the Currency (OCC) issued an explanatory letter clarifying that national banks can conduct so-called **"risk-free principal" crypto asset transactions** on behalf of clients. Under this model, banks act as intermediaries facilitating the transfer of clients' crypto assets without assuming balance sheet risk.

This clarification is significant. Previously, many US banks were cautious about executing crypto transactions for their clients due to uncertainty about which crypto-related activities fell under the category of permitted banking business. The OCC's analogy of risk-free crypto asset transfers to brokerage services in traditional securities and derivatives markets provides a clear path for banks to participate in crypto asset settlement activities within a compliant framework.

Furthermore, on December 12, 2025 , the OCC conditionally approved the national trust bank license applications of five digital asset-related companies , including institutions specializing in custody and settlement services. This move could further accelerate the process of crypto assets entering the mainstream financial system through federal regulatory oversight.

US policy changes resonate with global regulatory momentum.

The regulatory developments in the United States are highly consistent with global policy trends. Analysis from multiple independent policy tracking agencies shows that an increasing number of jurisdictions are proposing or implementing regulatory frameworks that simultaneously cover stablecoins and the broader digital asset infrastructure.

The regulatory focus has also shifted from early "regulatory sandbox" experiments to legally binding institutional arrangements aimed at protecting wallet users and maintaining financial stability. These frameworks typically focus on operational risk, liquidity management, reserve transparency, and preventing regulatory arbitrage, and are implemented through stricter disclosure requirements, reserve audit mechanisms, and clear division of regulatory responsibilities.

From uncertainty to structural clarity

In summary, these developments signify a structural shift in global digital asset policy. Regulatory approaches are gradually transitioning from a fragmented and uncertain regulatory environment to a more coherent and consistent institutional framework, with a focus on the integrity of stablecoins, the boundaries of bank participation, and consumer protection.

This shift reflects a growing consensus among policymakers: without a clear regulatory framework, the expansion of stablecoins and other digital assets could introduce risks similar to those in the traditional financial system at the levels of liquidity, reserves, and systemic issues.

By establishing clearer regulatory expectations and a legally binding institutional framework, regulators aim not only to reduce risks but also to create conditions for broader institutional participation, thereby laying the foundation for deeper integration of digital assets with the mainstream financial system in the future.