Solana has experienced a slight recovery after a prolonged period of weakness, thanks to growth in on chain activity. Increased user engagement with the network has boosted activity metrics, contributing to price stability.

Although SOL is still under pressure, the increase in volume could be the factor that helps this altcoin bounce back in the short term if demand continues to be sustained.

Solana is embarrassing the CEX exchanges.

Solana 's performance in 2025 has surpassed many centralized exchanges based on volume. According to Artemis researcher ZJ, activity on Solana 's decentralized exchanges this year reached $1.6 trillion. This figure places Solana second globally, behind only Binance with $7.2 trillion in volume.

Want to stay updated on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

Solana versus centralized exchanges. Source: ZJ

Solana versus centralized exchanges. Source: ZJData shows that Solana 's on- chain trading is growing very rapidly. Solana has surpassed Bybit, Coinbase Global, and Bitget in total volume. Chia to ZJ on X, just a year ago, Solana was ranked fifth among major trading platforms.

“Just a year ago, Solana was ranked 5th among the major CEXs. Now, in 2025, Solana has risen to 2nd place, behind only Binance after surpassing Bybit. The strong growth of propAMMs and CLOBs in recent months has helped fuel Solana’s growth. It’s hard not to feel optimistic looking ahead to 2026,” ZJ Chia .

Solana investors are holding onto Token.

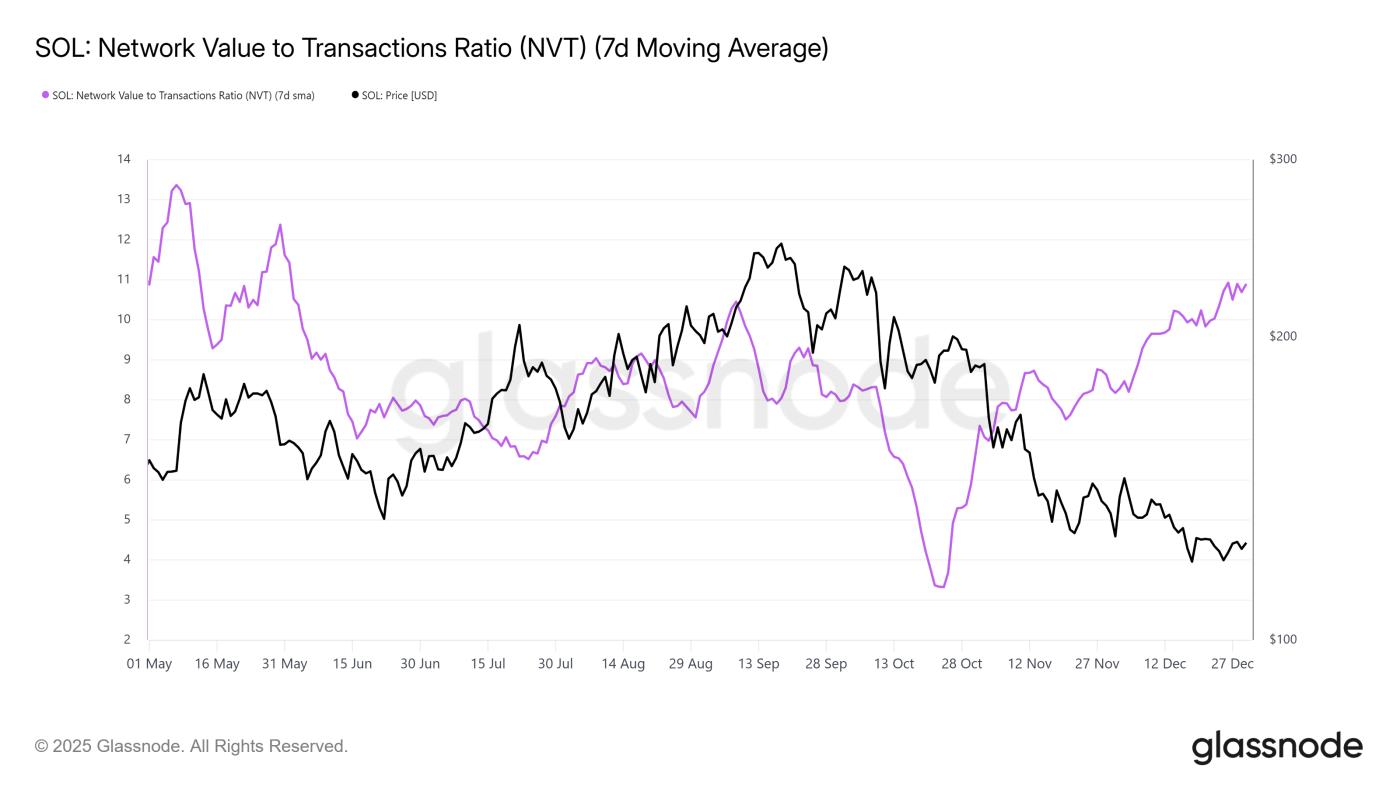

Despite strong trading activity, valuation indicators suggest caution is needed. Solana 's Network Value to Transactions (NVT) ratio is steadily increasing and is currently at its highest level in seven months. Historically, a high NVT ratio signals downside risk because market value increases faster than actual trading demand.

This discrepancy suggests that expectations may be outpacing actual activity on the network. When network value increases but usage doesn't increase proportionally, prices will typically correct. A high NVT often signals the potential for short-term price declines, making SOL recoveries more difficult.

Solana's NVT index. Source: Glassnode

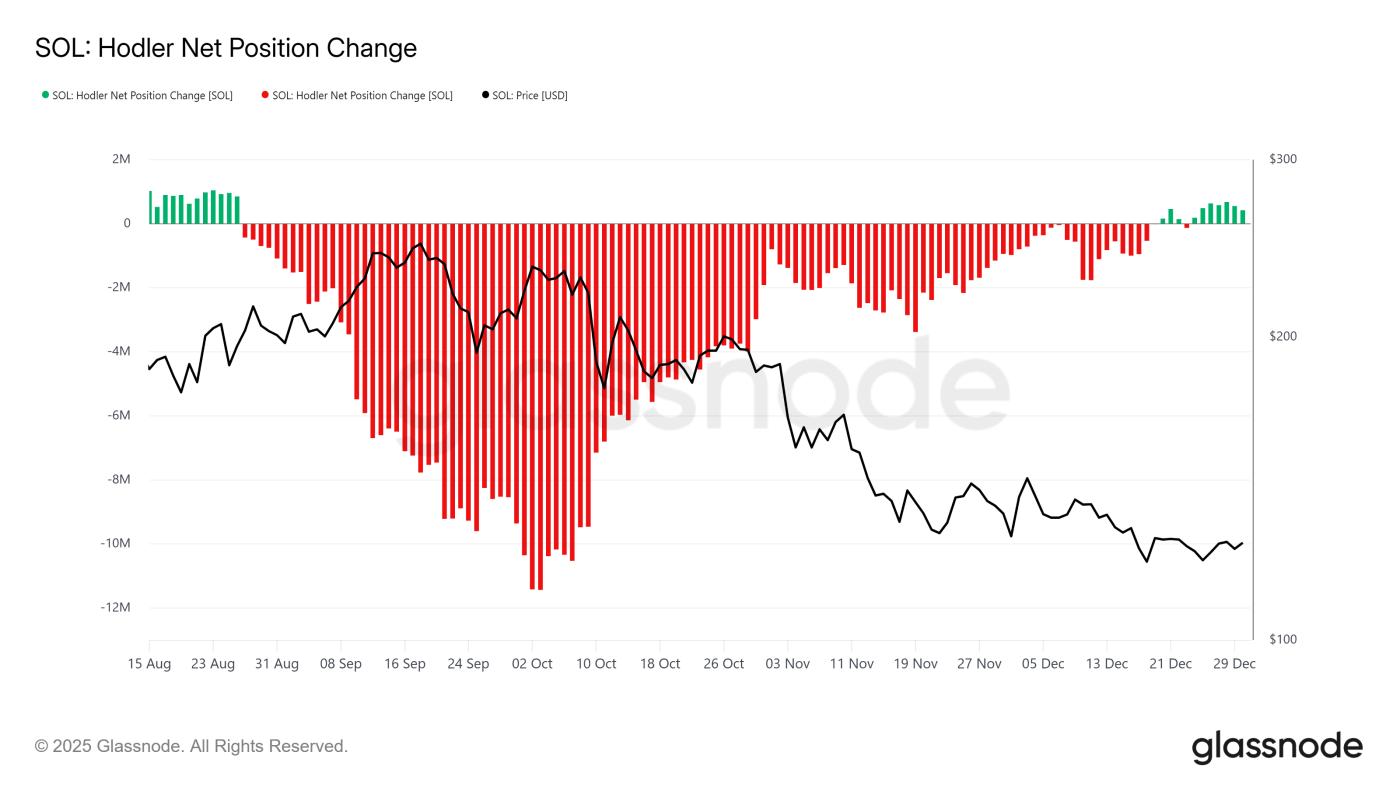

Solana's NVT index. Source: GlassnodeThe behavior of long-term investors offers a more balanced perspective, easing concerns about a downward trend. The net change in HODLer positions recorded a significant shift over the past week. After nearly four months of continuous selling, long-term investors have returned to accumulating positions.

This is crucial because long-term investors often play a Vai in stabilizing prices during periods of high market volatility. Their return to buying demonstrates confidence in Solana's long-term future . This support can help absorb selling pressure, reducing the risk of a sharp decline even when short-term indicators remain quite mixed.

Solana's changing HODLer status. Source: Glassnode

Solana's changing HODLer status. Source: GlassnodeSOL price may break through the current level.

Solana is currently trading around $126 at the time of writing and is facing resistance in this price range. Although the price has stabilized recently, SOL still has the potential to end 2025 down approximately 33%. This suggests that the current recovery is merely a correction, not a true uptrend.

In the short term,Solana could retest the resistance zone around $130 if buying pressure from long-term investors remains strong. Without strong participation from retail investors or new capital inflows, upside potential will be limited. If momentum weakens, a consolidation phase below $126 could continue.

Solana price analysis. Source: TradingView

Solana price analysis. Source: TradingViewThe downside risk remains. If support at $123 is not held, SOL could fall to $118. If this scenario occurs, the bullish outlook will be invalidated and the broader downtrend will continue until strong capital inflows return.