Bitcoin's price has spent several consecutive trading sessions attempting to break above the $90,000 mark on the daily chart. The "king" of the cryptocurrency market has been fluctuating just below this psychological threshold for nearly three weeks.

The prolonged accumulation suggests a gradually building upward momentum; however, if whales continue selling, the breakout could be further delayed.

Bitcoin whales are selling aggressively.

The activity of super whales has become more intense since the end of December 2025. Wallets holding between 10,000 and 100,000 BTC have sold a total of over 50,000 BTC in just four days, bringing their balances to their lowest level in the past two months. At current prices, the value of sales has exceeded $4.47 billion, demonstrating caution among the market's largest holders.

Whale selling typically signals a decline in confidence among major market participants. Due to their size, their actions often shape overall price trends. However, despite this pressure, Bitcoin's price continues to rise , suggesting that other investor groups, including many retail investors, are absorbing supply and supporting the current upward momentum.

Bitcoin whales hold these holdings. Source: Santiment

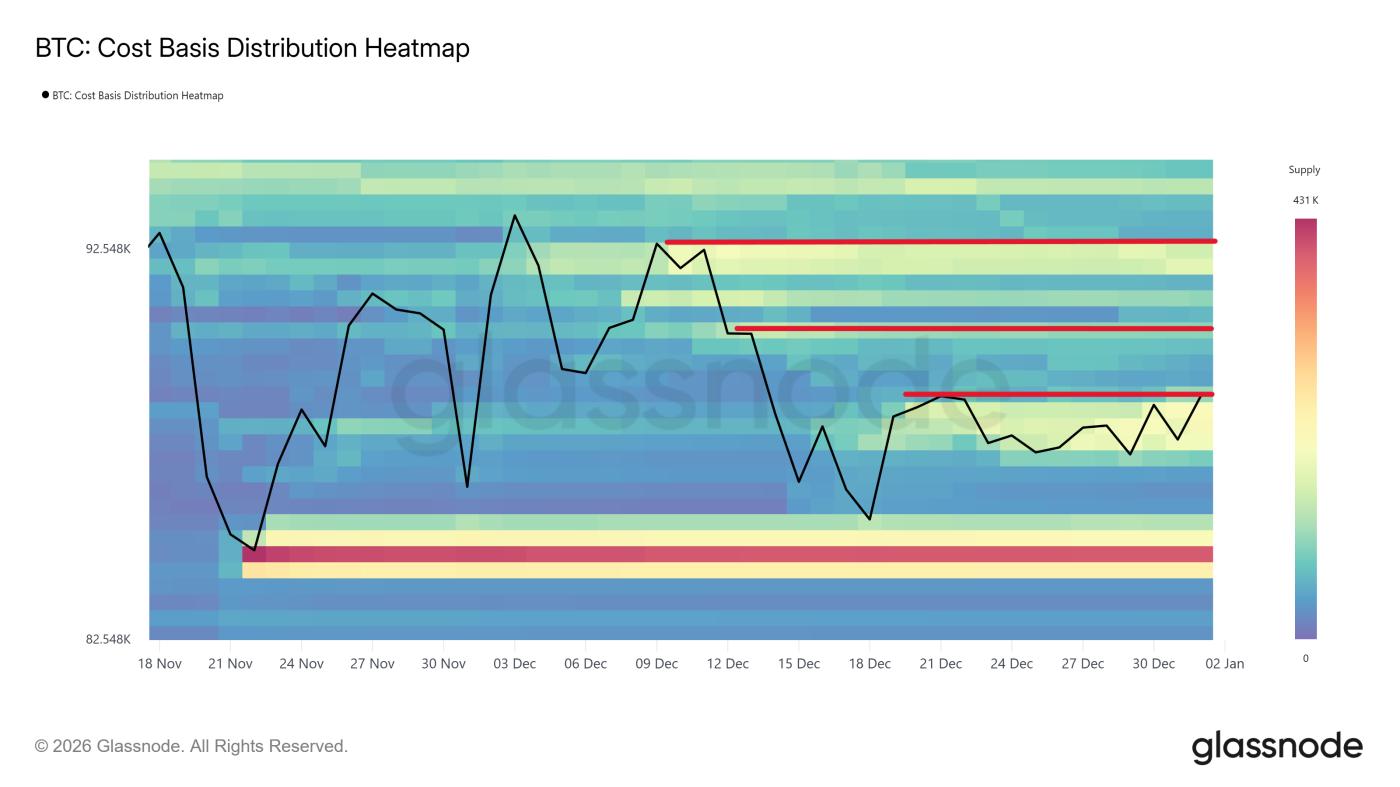

Bitcoin whales hold these holdings. Source: SantimentMacroeconomic data also provides further insight into Bitcoin's stability. The Capital distribution heatmap reveals three notable resistance zones. The first zone (red line just above the price) is located between $88,000 and $88,500, where approximately 201,474 BTC are accumulated, setting the stage for strong demand for the price.

The next resistance appears near $90,500 – linked to a total purchase volume of 97,766 BTC. If this price zone is breached without significant profit-taking pressure, the potential for Bitcoin to continue rising is wide open. Beyond that, $92,700 becomes a crucial area, with approximately 170,763 BTC accumulated in the past providing support for the price.

Bitcoin has broken through the resistance zone below, consolidating short-term strength. Holding above $88,500 helps mitigate downside risk. However, for the upward momentum to be sustained, traders should refrain from selling once the price surpasses their previous Capital levels.

Bitcoin Capital heatmap. Source: Glassnode

Bitcoin Capital heatmap. Source: GlassnodeThe price of BTC needs to hold this support level.

Bitcoin is trading around $89,543 at the time of writing, still below the downtrend line that has lasted for over a month. Despite remaining technical resistance, Bitcoin's price is consolidating toward the $90,000 mark. This pattern often signals potential for significant price swings when sufficient momentum builds.

The possibility of breaking above $90,000 is becoming increasingly clear. If the $90,308 level holds as support, the uptrend will be strengthened. In that case, Bitcoin's next target could be $92,031, provided that selling pressure from whales doesn't intensify and demand from other groups, especially retail investors, remains stable.

Bitcoin price analysis. Source: TradingView

Bitcoin price analysis. Source: TradingViewThe risk of a correction remains if large whales intensify their selling. Increased selling pressure could halt the breakout momentum and pull the price of BTC back down to the support zone of $88,210. In that case, Bitcoin would continue to fluctuate within a narrow range and a sustainable uptrend above $90,000 would not be confirmed.