Written by Eric, Foresight News

On December 17th, ETHGas, the Ethereum blockchain futures market, announced the completion of a $12 million funding round, led by Polychain Capital, with participation from Stake Capital, BlueYard Capital, Lafayette Macro Advisors, SIG DT, and Amber Group. Founder Kevin Lepsoe stated that ETHGas completed an undisclosed pre-seed funding round of approximately $5 million in mid-2024.

In addition, Lepsoe stated that Ethereum validators, block creators, and relay nodes have committed approximately $800 million to support market and product development, but this is not in the form of cash investment; rather, it is in the form of providing liquidity to the ETHGas market in the form of Ethereum block space.

Although the project is defined as a blockchain futures market, its true vision is to realize "Real-Time Ethereum".

Block order

Ethereum co-founder Vitalik Buterin proposed the concept of a gas futures market earlier this month, with the core aim of solving the problem of Ethereum gas volatility. Similar to the logic of commodity futures in the current market, the biggest benefit of locking in futures for futures is to make gas costs predictable and controllable.

In this way, DApps can lock in gas cost costs before events such as user token airdrops and design activities to subsidize users. L2 can also buy futures when gas fees are lower to reduce the cost of packaging and submitting data to L1 and make the cost of transactions on L2 stable and predictable, thus serving some businesses that need to calculate costs in advance, such as the tokenization of US stocks.

According to the documentation, ETHGas itself will also launch a zero-code tool called Open Gas specifically for DApps to help them provide gas subsidy programs. This tool will allow users to claim the gas fees consumed on the ETHGas platform after using DApps.

The design and development of the gas futures market is not particularly difficult; essentially, it requires establishing an on-chain futures trading market with sufficient liquidity. ETHGas's "killer feature," however, is its blockchain auction market.

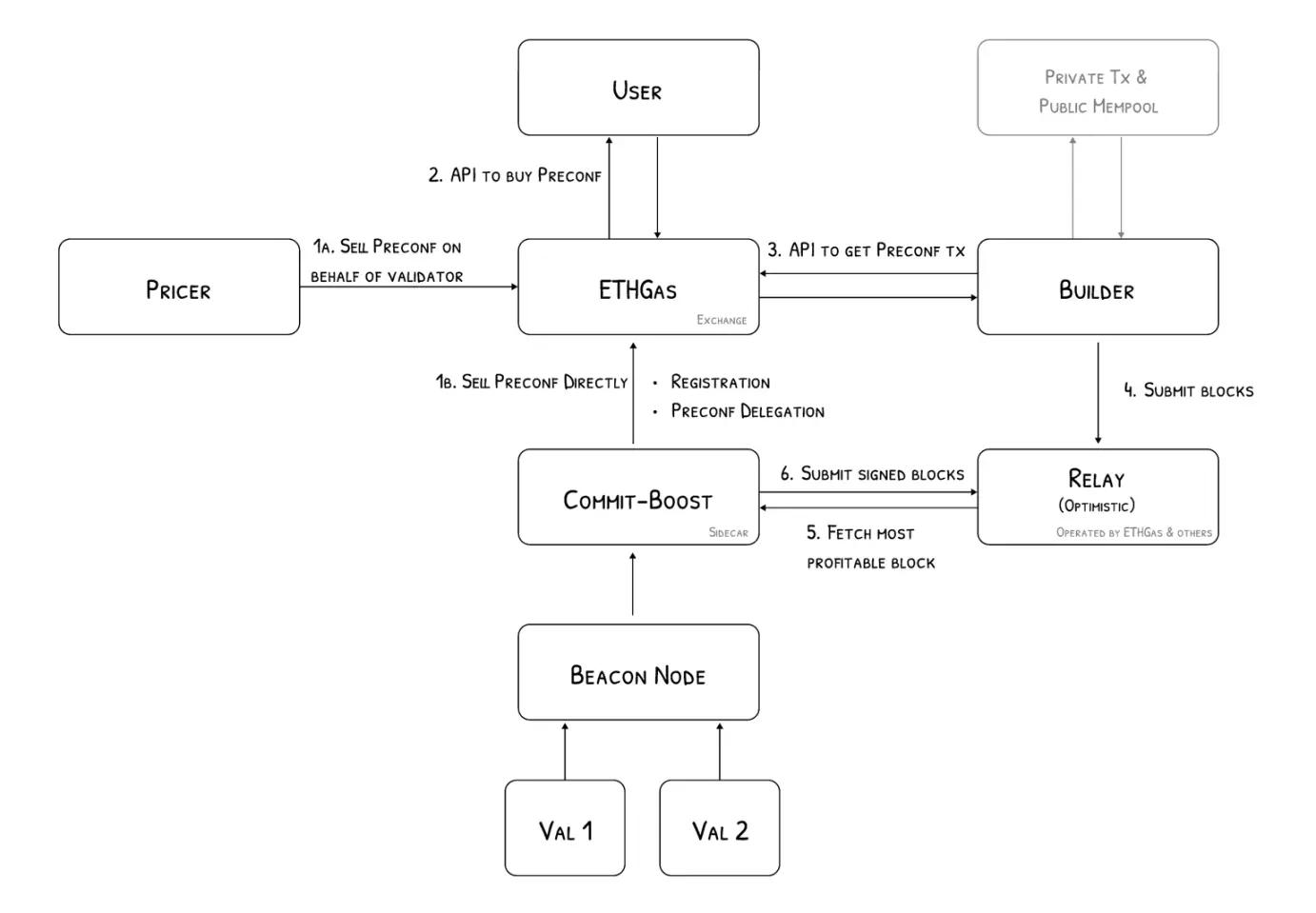

This auction marketplace, called Blockspace, allows Ethereum validators, block creators, and relay nodes to bid for space in subsequent blocks. This ensures that a bidder's transaction will be included in the next block and guarantees efficient transaction execution. Furthermore, bidders can even win the entire next block, ensuring it contains only their own transactions or transactions from other bidders.

If we compare transactions to parcels, ensuring a block contains a transaction is like ensuring the parcel is loaded onto the transport plane, while ensuring the execution of a transaction is like ensuring the parcel is delivered to its intended recipient on time. Acquiring a complete block is like renting an entire aircraft to transport your parcels, but you can also sublet any extra space to other parcels.

ETHGas's ultimate goal is to achieve "real-time transactions" on Ethereum through Blockspace. This "real-time transaction" is only in quotes because the completion of transactions on the Ethereum mainnet requires the completion of the block's on-chain processing. However, if it can be guaranteed that a transaction will be included in the next block, it can be considered "completed" to some extent. We can understand ETHGas as an execution layer on top of Ethereum, but how real-time transactions will be reflected on the front end remains to be seen and will require further clarification from ETHGas.

The core idea of ETHGas is to establish an orderly block space, rather than the current chaotic bidding war for block space and the resulting large number of uncontrollable MEV transactions. By attracting infrastructure operators to join the Blockspace with predictable returns, ETHGas aims to create sufficient liquidity for real-time transactions. The resulting efficiency improvements attract various DApps, which in turn attract users through Open Gas. These users then bring more transaction volume into the ETHGas network, increasing the revenue of infrastructure operators and creating a positive cycle.

Challenges beneath the beautiful vision

For a DApp that is about to conduct a token airdrop, it is possible to estimate the number of transactions that will receive the airdrop and pre-order n blocks after a certain time, and then provide a gas subsidy plan, so as to achieve a token application activity with controllable budget and without causing network congestion.

While such a concept is appealing, allowing block space to be auctioned could cause many foreseeable problems.

First, if institutional users can auction block space without restrictions, they could potentially acquire large quantities of blocks and resell them to retail investors. While this would guarantee and stabilize validators' returns, it would actually increase transaction costs for retail investors. In this scenario, retail investors lack the technical capabilities to compete with institutional users. Furthermore, even if retail investors could participate in auctions or use the futures market to hedge against rising gas fees, it would still essentially increase transaction costs.

Furthermore, the futures market can also become a tool for market manipulation. For example, large players might deliberately generate a large number of on-chain transactions to increase gas and profit in the futures market, but this could lead to increased transaction costs for other users on the Ethereum mainnet. Additionally, DApp operators, knowing the specific timing of their plans that could cause a surge in transaction volume, can profit in advance through operations in the futures market, making it an arbitrage market for those with informational advantages, causing unpredictable losses for ordinary users who simply use market hedging.

The emergence of a new trading market inevitably means arbitrage opportunities arising from information asymmetry, which can affect the market's ability to solve problems. For ETHGas, balancing this issue and preventing a "positive cycle" from becoming a "death spiral" may require some necessary restrictive measures.