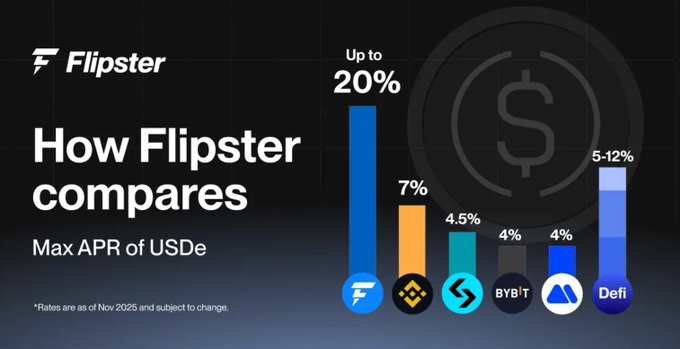

Flipster USDe Earnings: Leading the Stablecoin Market with 20% Annualized Return In the market environment of late 2025 and early 2026, traders often faced a dilemma: deposit stablecoins into lending platforms to earn returns (such as Aave's 6.6%), or lock them up in DeFi protocols, sacrificing liquidity for higher returns. Flipster (@flipster_io) broke this deadlock by launching a USDe earning program with up to 20% APR. Its yield is not only 3-5 times that of mainstream CEXs (such as Binance and Bybit), but also superior in liquidity to lock-up protocols like Pendle. ■ In-depth analysis of earning assets and margin mechanisms Flipster (@flipster_io)'s underlying logic lies in transforming Ethena's synthetic USDe into a "productive" trading fuel: ① "Earn while trading": This mechanism allows USDe to be used as margin for perpetual contracts while still contributing to the earning base. ② Tiered bonus logic: The system uses 24... Hourly random snapshots calculate the average balance, and an additional APR is added based on the user's 30-day trading volume. ③ Zero lock-up and zero friction: Through SDK and multi-channel integration (minting, conversion, spot trading), users can seamlessly enter and exit USDe positions. Flipster's (@flipster_io) practices are not only a game of yield, but also a redefinition of stablecoin asset sovereignty and efficiency.

This article is machine translated

Show original

Flipster

@flipster_io

01-02

Top Gainers & Losers Today! 🔥

📈 Top 3 Gainers

🥇 $HOLO | @HoloworldAI

🥈 $PEPE | @pepecoineth

🥉 $MOG | @mogcoin

📉 Top 3 Losers

🥇 $0G | @0G_Foundation

🥈 $BEAT | @Audiera_web3

🥉 $POWER | @PowerPrtcl

Check them out on Flipster now 👀

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content