BitMine's proposal to drastically increase the number of shares it is allowed to issue has faced growing opposition from shareholders, even though the company remains committed to considering Ethereum a core asset in its treasury.

Although Tom Lee calls this move a step that provides long-term flexibility rather than immediate dilution, an increasing number of investors are expressing concerns about the structure, timing, and rights embedded in the proposal.

5 reasons why Tom Lee's BitMine strategy hasn't attracted supporters.

Tom Lee's proposal to increase the number of shares BitMine is authorized to issue aims to bolster the company's long-term confidence in Ethereum.

But instead, this exposed a growing Chia as concerns arose that the proposal undermined corporate governance at a time when the risk of share dilution was increasing.

Opponents aren't necessarily denying faith in Ethereum; they're simply questioning whether the structure, timing, and benefits of the plan truly protect shareholder value. Currently, there are five main reasons why Lee's strategy isn't receiving much support.

1. The sense of urgency undermines the narrative of "future Chia ."

One of the most criticized aspects is the timing of the proposal. Tom Lee argues that a future stock Chia , possibly when Ethereum reaches very high prices, is a reason to allow the issuance of additional shares now.

However, investors argue that this argument is not appropriate given BitMine's current situation. Currently, the company has issued approximately 426 million shares out of the 500 million allowed, leaving little room for maneuver.

“Why authorize the issuance of additional shares now for a stock Chia plan that is still a long way off?” one analyst questioned , adding that shareholders “will happily vote in favor if/as long as the share price is actually in line with the Chia .”

Opponents argue that this rush is actually due to BitMine needing to issue more shares to continue buying ETH.

2. Scaling up without protection limits.

The scale of this proposal, ranging from 500 million to 50 billion shares allowed for issuance, has also caused concern among investors.

Even with BitMine's stated goal of allocating 5% of its assets to ETH , the company would only need to issue a very small fraction of that $50 billion.

“So why offer up to 50 billion shares?” analyst Tevis wrote, arguing that this was an “overstepping step” and would give management “unprecedented power.”

Critics argue that this proposal would eliminate the requirement for future shareholder approval, effectively removing a crucial control mechanism within the company.

3. ETH 's growth relative to shareholder value

Another point of contention is the leadership compensation structure. Proposal #4 links Tom Lee's performance bonus to his total ETH holdings instead of ETH per share.

Although investors support performance-based rewards, some argue that the chosen index will encourage scaling at all costs.

Tevis warns that using "Total ETH" as the KPI could reward management even if shareholders ' ETH per share is diluted. Meanwhile, using ETH per share as the target would help protect the interests of small investors.

4. Concerns about issuing shares below NAV value.

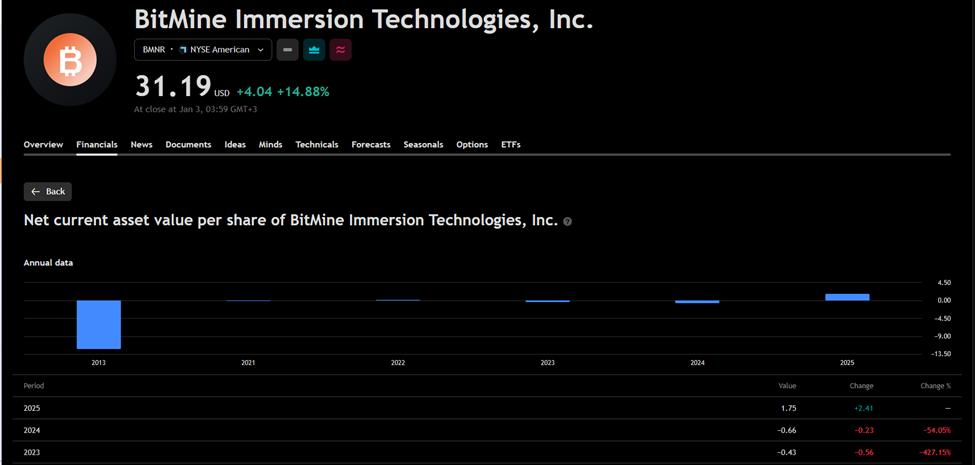

Concerns about stock dilution are growing as BitMine no longer trades above its net asset value (NAV). Tevis used to be "unaffected by dilution" when its stock price was above NAV, but the situation has changed as the two figures approach each other.

BitMine's Net Asset Value (NAV). Source: TradingView

BitMine's Net Asset Value (NAV). Source: TradingViewOpponents argue that if widely licensed, BitMine could easily issue new shares at a price below its NAV, permanently reducing the amount of ETH backing each share.

"If BMNR issues new shares at a price lower than its NAV… the amount of ETH backing each share will be permanently reduced," Tevis stated.

5. ETH stock and spot are under scrutiny.

The debate intensified when some investors argued they should hold onto ETH for peace of mind. Others agreed, warning that the proposal “paves the way for unexpected shareholder dilution through ATM-style share issuance.”

Despite facing considerable opposition, many dissenting shareholders continue to believe in Ethereum's prospects and support BitMine's overall strategy.

What they really want is clearer governance limits, rather than granting unlimited power to the leadership in controlling one of the most volatile asset classes in the cryptocurrency market.