As of 9:10 AM on January 5th, a number of stocks in the digital asset market were showing short-term bullish trends. Analysis of trading volume and returns revealed a concentration of investor sentiment in certain specific stocks. In particular, Infinite (IN), Pepe (PEPE), and Zora (ZORA) all ranked high on short-term supply and demand indicators, indicating signs of a short-term theme forming.

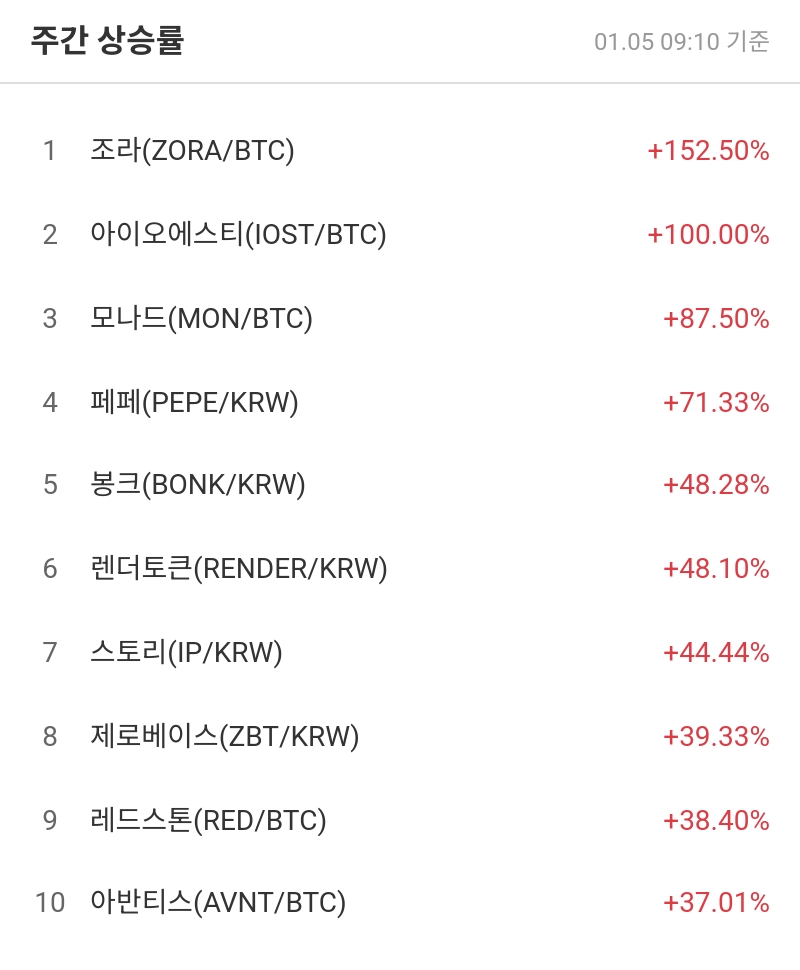

[Period-by-period increase rate]

Pepe (PEPE/KRW) has shown a strong short-term recovery, rising +75.08% over the past week and +53.85% over the past month. However, it is still down -65.88% over the past year, a significant drop from its high. Bonk (BONK/KRW) and Render Token (RENDER/KRW) also showed notable short-term buying, recording weekly returns of +53.10% and +52.94%, respectively. Monad (MON/KRW) and Penge Penguin (PENGU/KRW) have also recently surpassed 30% in weekly gains, joining the short-term surge.

[Top 10 Weekly Growth Rates]

1st place ZORA (ZORA/BTC) +152.50%

2nd place IOST (IOST/BTC) +100.00%

3rd place Monad (MON/BTC) +87.50%

4th place: Pepe (PEPE/KRW) +71.33%

5th place: BONK (BONK/KRW) +48.28%

6th place: Render Token (RENDER/KRW) +48.10%

7th place Story (IP/KRW) +44.44%

8th place: Zerobase (ZBT/KRW) +39.33%

9th place: Redstone (RED/BTC) +38.40%

10th place: Avantis (AVNT/BTC) +37.01%

The most notable stock this week was ZORA (ZORA/BTC), which surged by a staggering +152.50%, becoming the only BTC market stock to post triple-digit returns. IOST and MON also saw strong gains, indicating that BTC market stocks are at the center of the overall bull market.

[Top 5 Daily Buying Strength]

1st place Infinite (IN/KRW) 500.00%

2nd place: Nervos (CKB/KRW) 500.00%

3rd place: AWE (AWE/KRW) 500.00%

4th place: SAFE (SAFE/KRW) 500.00%

5th place Metadium (META/KRW) 500.00%

In terms of buying intensity, Infinite (IN/KRW) recorded 500.00%, demonstrating the strongest buying advantage. CKB, AWE, SAFE, and META also recorded similar figures, reaching 500%, indicating a very high concentration of short-term supply and demand. This extremely strong buying intensity suggests that market participants are focused on short-term expectations.

[Top 5 Daily Selling Strength]

1st place Power Ledger (POWR/KRW) 0.00%

2nd place IQ (IQ/KRW) 0.00%

3rd place: Anchor (ANKR/KRW) 0.00%

4th place: Aha Token (AHT/KRW) 0.00%

5th place: Emble (MVL/KRW) 0.00%

Based on sell-off intensity, five stocks—POWR, IQ, ANKR, AHT, and MVL—all recorded 0.00%, revealing significantly lower selling pressure than buying. This could be interpreted as a easing of short-term selling pressure or a loss of liquidity, and it also suggests the possibility of a trend reversal for some stocks.

This week, the market witnessed a clear trend of thematic supply and demand concentration, with short-term gains and strong buying activity. However, some stocks remain highly volatile, requiring investors to employ a risk management strategy.

Get real-time news... Go to TokenPost Telegram

Copyright © TokenPost. Unauthorized reproduction and redistribution prohibited.