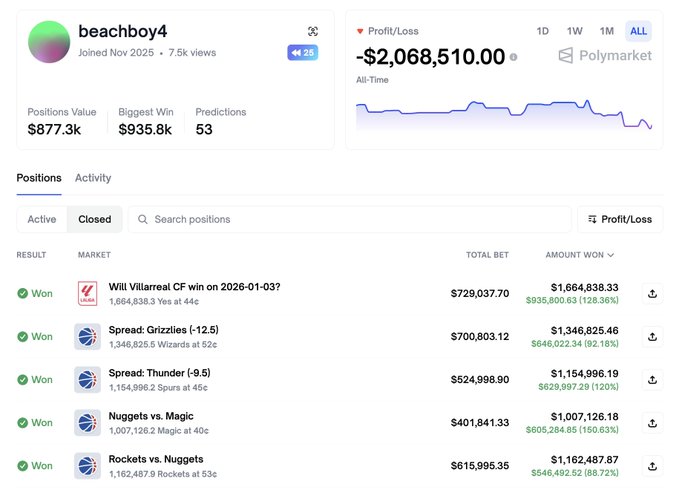

Trader "beachboy4" lost over $2M in just 35 days on #Polymarket!

1/ Let's dig into his trades to see how he lost money and what lessons we can learn.

7/ Hidden truth: the trader wasn’t unlucky

This wasn’t bad luck.

This wallet had:

Negative payoff asymmetry

No defined max loss per position

No edge in efficient markets

No probability discipline

Loss was inevitable.

8/ How to avoid repeating this mistake (practical rules)

Rule 1: Avoid high-price entries

Be extremely cautious above 0.55

Especially avoid 0.65+ unless you have strong informational edge

Rule 2: Cap single-event risk

Max 3–5% of total capital per event

One outcome should never decide your account

Rule 3: Trade price movement, not just resolution

Take partial profits

Cut losses when probability collapses

Don’t wait for “yes or zero”

Rule 4: Track win rate vs break-even rate

If your win rate < break-even → stop and reassess

Volume won’t fix a negative expectancy

Rule 5: Kill losing markets early

Persistent underperformance = no edge

Remove those markets entirely

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content