I. Foresight

1. Macro-level summary and future forecasts

Last week, the US macroeconomic environment was in a quiet window between the year-end and the beginning of the new year, with almost no new major economic data releases. The market mainly digested previous information and adjusted positions and risk management. The overall tone remained consistent with previous assessments: inflation has clearly declined but service sector stickiness remains; the job market continues to cool and demand momentum is weak; and the Federal Reserve confirmed at its December meeting that it has entered a policy observation period after the end of the rate hike cycle. Holiday factors led to low market liquidity, with US Treasury yields and the US dollar remaining at low levels. US stocks traded at high levels but with reduced volatility, reflecting a consensus on a "soft landing" while maintaining caution.

Looking ahead, with the holidays over and a flurry of January economic data (employment, inflation, consumption) returning, the market will reassess the speed and depth of the US economic downturn. For the market, the beginning of the year will see a shift from "expectation-driven" to "data-driven," potentially increasing volatility. Asset price direction will depend more on whether the data supports a path of moderate slowdown rather than recession.

2. Market Changes and Early Warnings in the Crypto Industry

Last week, the cryptocurrency market saw a significant rebound amid low liquidity at the end of the year and the beginning of the new year. Bitcoin quickly recovered from around $90,000, driving a recovery in mainstream assets. Notably, the MEME sector performed exceptionally well in this rebound, with many leading and emerging MEME tokens recording gains far exceeding the market average. Trading volume and on-chain activity both increased, making it a core area for capital speculation and emotional release. Funds clearly shifted from defensive assets to high-elasticity assets, and risk appetite rose rapidly in a short period.

In terms of early warnings, the strength of MEME reflects more the influence of sentiment and liquidity than fundamental improvement, and volatility and the risk of pullbacks have been significantly amplified. Furthermore, with the concentrated return of macroeconomic data in January, the market's repricing of interest rates and liquidity may test this rebound represented by MEME. Overall, the current market is still in a phase of recovery, and the risk of sharp fluctuations after the emotional peak should be closely monitored.

3. Industry and sector hotspots

Mu Digital, a core platform that raised $2.1 million with participation from Cointelegraph, is a unified gateway to top investment opportunities in Asia; RateX, a unified layer that raised a total of $10.4 million with participation from well-known institutions such as Solana, Animoca, and GSR, is a multi-chain leveraged and spot yield trading protocol that provides yield tokenization, as well as the splitting and trading of yield and principal.

II. Hot Market Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. A brief analysis of Mu Digital, a core platform that makes digital assets simpler, safer, and more valuable, which has raised $2.1 million in funding and received investment from Cointelegraph.

Introduction

Mu Digital is a unified gateway to top investment opportunities in Asia. Earn up to 15% on stablecoins regardless of whether the market is bullish or bearish . Mu Digital unlocks the finest yield-generating investment opportunities in Asia—opportunities that were previously typically only available to high-net-worth clients and large financial institutions.

Now, any user with a crypto wallet can directly access Asia’s largest and most reputable government and corporate lenders.

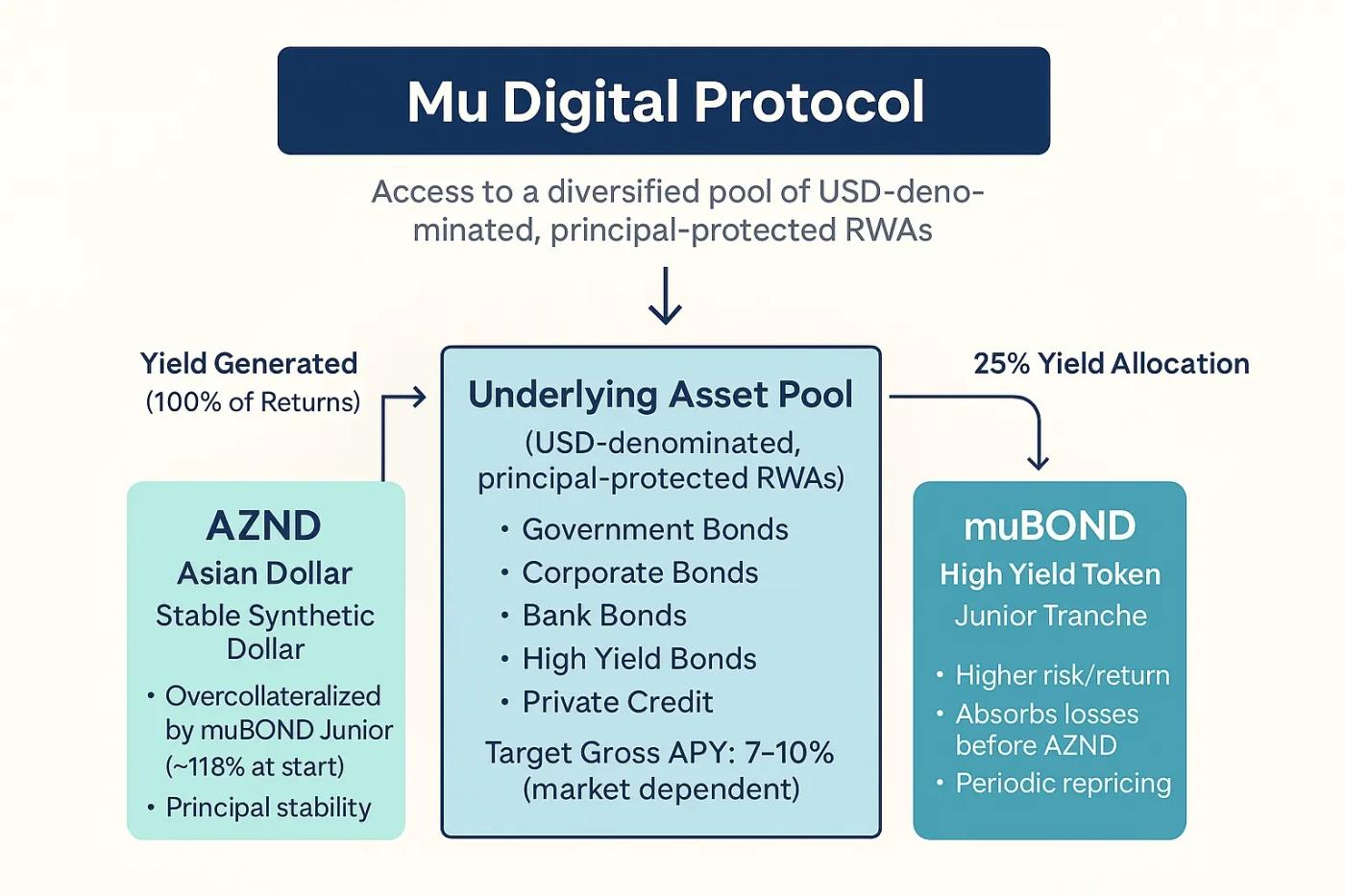

Mu Digital Protocol Architecture Overview

The Mu Digital protocol provides DeFi users with access to a decentralized, principal-protected RWA investment pool denominated in US dollars through a dual-token structure.

Dual-token structure

1. AZND: Asian Dollar

The pursuit of a stable capital dollar

Typically, the leverage is over-collateralized by muBOND's junior positions (approximately 118% at launch).

75% of the returns generated by the asset pool are allocated to the AZND Locking Contract (see Locking).

2. muBOND: High-yield token

Secondary positions: high risk, high potential return.

In the event of a loss, muBOND will assume the loss first (AZND will receive priority protection).

Periodic repricing to reflect the performance of the underlying asset portfolio.

25% of the asset pool's returns will be allocated to muBOND holders.

Underlying Asset Pool

The asset pool consists of high-quality fixed-income assets and is held in custody by a trusted traditional financial custodian.

All assets are denominated in US dollars (no exchange rate risk) and principal is protected upon maturity .

Asset types include, but are not limited to:

Government bonds

Corporate bonds

Bank bonds

High-yield bonds

Private Credit

Mu Digital aims to achieve a gross annualized return (APY) of 7–10% for its asset pool , but actual performance may vary depending on market conditions and the performance of the underlying asset portfolio.

Revenue generation mechanism

Mu Digital provides users with sustainable and predictable returns by investing in a diversified, USD-denominated, and principal-protected fixed-income portfolio across the Asia-Pacific region .

The underlying assets are managed by Golden Hill Asset Management (GHAM) , a traditional financial institution with a team that has the expertise to manage billions of dollars in assets, ensuring the best balance between returns and risks.

The asset pool mainly includes:

Government bonds (credit rating BBB or above)

Corporate bonds (investment-grade bonds of large Asian companies, BBB- and above)

Bank bonds (including those of globally systemically important banks, rated BBB or above)

High-yield bonds (large industrial companies in the Asia-Pacific region, minimum BB).

Private lending (targeted lending projects in cooperation with large financial institutions)

At the same time, Mu Digital and GHAM have jointly developed a comprehensive institutional-grade risk management framework to ensure that user funds are strictly protected while pursuing stable returns.

Risk control mechanism

Mu Digital achieves stable and risk-controlled returns by systematically managing liquidity risk, credit risk, and price risk .

1. Liquidity Risk

At least 80% allocated to highly liquid, freely tradable bonds.

Private lending (with lower liquidity) is strictly limited to no more than 20% of the asset pool.

The proportion of investment-grade bonds is relatively high to reduce volatility.

Maintaining credit lines with prime brokers ensures rapid access to liquidity when selling bonds.

2. Credit Risk

The target is to maintain an average portfolio rating of BBB or above.

Continuously monitor credit events for all positions and regularly assess changes in portfolio ratings.

Private lending must involve co-investment with reputable large financial institutions to reduce counterparty risk.

3. Price Risk

Control the portfolio duration to no more than 5 years to reduce the market value impact of interest rate fluctuations.

Using a maturity ladder structure allows for stable cash flow replenishment and avoids forced sales.

Active management: Take profits when the portfolio performs well.

Transparency and Reporting Disclosure

Mu Digital prioritizes transparency , providing users with a clear understanding of the asset pool's status and protocol health through continuous and verifiable updates.

1. Weekly NAV Report

The fund manager will publish the net asset value (NAV) of the asset pool weekly.

Disclosure of RWA's asset market value changes and actual returns

It may be upgraded to a higher frequency of updates in the future.

2. Monthly Fund Performance Report

GHAM releases monthly performance report (qualitative + quantitative analysis)

Provide portfolio structures by asset type, duration, and credit rating.

Let users understand how investment portfolios follow a risk framework

3. On-chain Treasury Wallet

Establish an on-chain vault to support rapid minting and redemption by authorized users.

Wallet address and balance are publicly available in real time and can be verified on-chain.

These funds are completely segregated from the company's operating funds.

Price stabilization mechanism

Mu Digital ensures the price stability of AZND through a tiered risk tranching structure , with muBOND acting as a junior buffer to bear priority losses, supplemented by an agreement insurance fund for additional protection.

1. muBOND absorbs losses (core stabilization mechanism)

muBOND accounts for approximately 15% of the agreement's TVL , serving as the system's "first loss capital".

If the underlying asset pool experiences a short-term decline in market value due to market fluctuations (such as rising interest rates or widening credit spreads), the loss will be directly reflected in muBOND NAV and will not affect AZND .

AZND may only be affected when the combined loss exceeds the total buffer layers of muBOND .

Example: The portfolio fell by 5%, which was entirely absorbed by muBOND, while AZND maintained its value of $1.

2. Insurance Fund

As an additional capital buffer , it is used to cover potential losses exceeding muBOND.

It is established through the long-term accumulation of agreement fees.

Uses include:

Make up for redemption gap

Provide liquidity during market stress

Stabilizing AZND NAV amidst extreme fluctuations

Tron's Review

Mu Digital's strength lies in its introduction of high-quality USD-denominated fixed-income assets (RWA) from the Asia-Pacific region into DeFi. Through a dual-token tiered structure (AZND + muBOND) , it provides principal protection and sustainable returns, allowing ordinary crypto users to access stable, high-credit investment channels previously only available to institutions. The professional TradeFi team manages the asset pools, coupled with a strict liquidity, credit, and interest rate risk framework, and achieves high transparency through a public on-chain vault and regular NAV reports, making it closer to institutional-grade yield products. However, its disadvantages include: the mechanism relies on TradeFi custody and active management, introducing some centralized credit risk; yield performance is highly correlated with the market interest rate environment of the asset pool; and the stability of AZND depends on the size and sustainability of the muBOND buffer layer and insurance fund, potentially facing capacity limitations in the initial stages.

Overall, Mu Digital has clear advantages in terms of "stable, real yield+ risk stratification protection + strong transparency", but it still needs to be gradually strengthened in terms of scale, risk resistance and decentralization.

1.2. Decoding RateX, a unified layer that raises a total of $10.4 million in funding, with participation from renowned institutions such as Solana, Animoca, and GSR, making on-chain returns more transparent, efficient, and accessible.

Introduction

RateX is a multi-chain protocol for trading leveraged and spot yields , offering yield tokenization, as well as the ability to split and trade yields and principal.

On RateX, users can leverage their trading of yield tokens (YT) for various yield assets (YBA) to capture profit opportunities arising from yield fluctuations with greater capital efficiency.

In addition to leveraged yield trading, RateX also offers two integrated features: Earn Fixed Yield and Yield Liquidity Farming , to meet the yield and risk preferences of different users.

RateX Protocol Framework Analysis

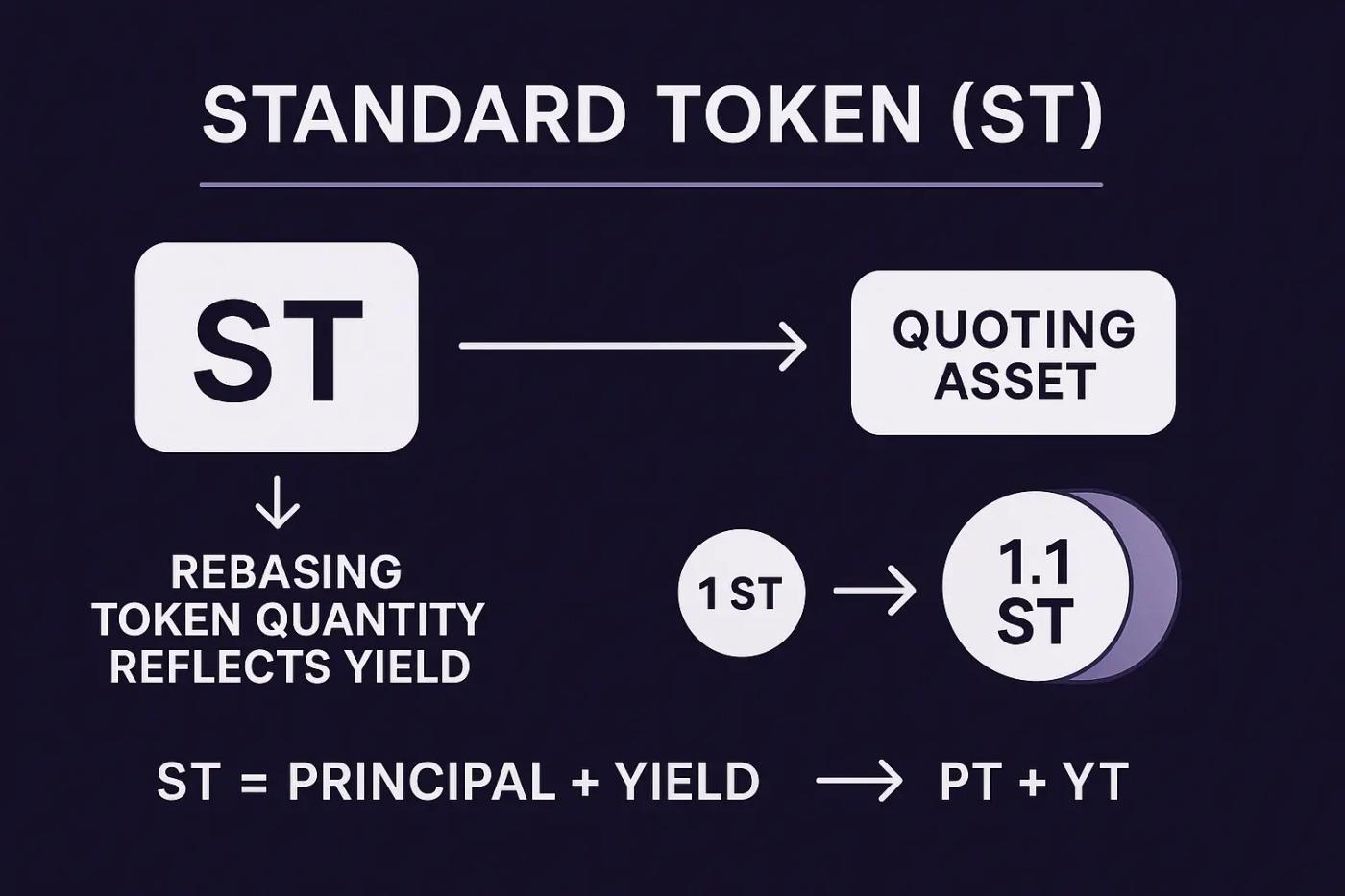

1. Standard Token (ST)

ST is a standardized yield token designed by RateX to uniformly represent the yield performance of various interest-bearing assets.

Its core mechanism:

Prices are constant, and revenue is reflected in quantity (Rebase).

The price of each unit of ST is fixed and equal to the valued asset (e.g., always equal to 1 SOL).

The returns do not increase the "token price," but rather automatically increase the amount of ST in your account to reflect an equivalent value of the returns.

Example:

1 JitoSOL → After one year, due to a 10% APR, it becomes 1.1 SOL.

However, the price remains 1 ST-JitoSOL, but the quantity changes to 1.1.

→ All profits are reflected in the quantity.

The value composition (decomposability) of ST

The value of ST at any given time = Principal (PT) + Profit (YT)

Upon expiration:

ST_maturity = Principal + Yield

Current moment:

ST_present = PT_present + YT_present

→ This allows RateX to cleanly split and trade principal/profit.

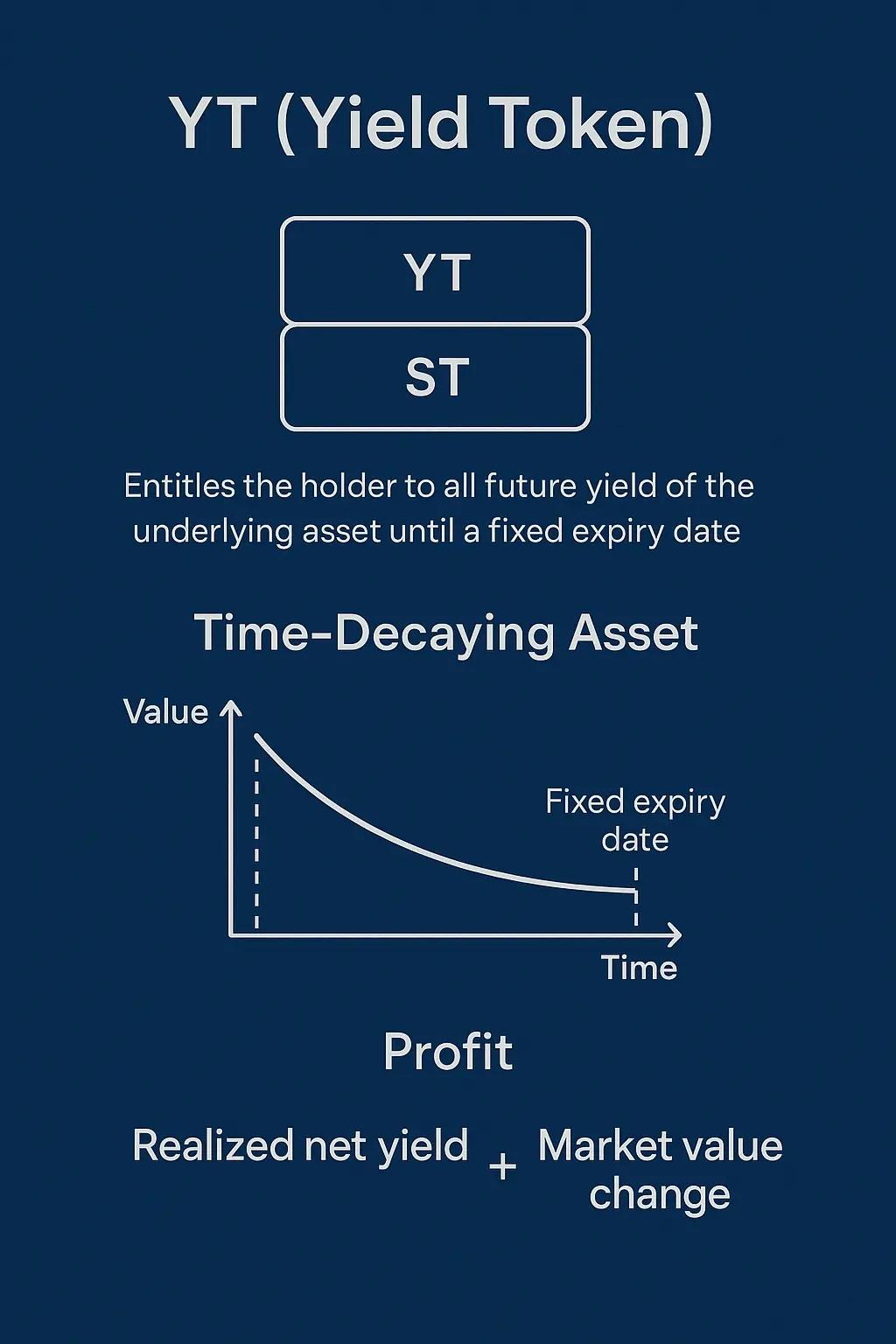

2. Yield Token (YT)

YT (Yield Token) represents all future income rights generated by a certain interest-bearing asset (YBA) from now until a fixed maturity date .

For example: YT-mSOL-2412 = owns all mSOL staking rewards from now until 2024/12/28.

YT's key feature: time decay

YT is an asset whose value decreases over time :

The closer to maturity, the less future returns you can receive.

Therefore, the price of YT gradually approaches 0.Continuous income during the holding period → Reduced remaining future income

YT's profit sources (two parts)

The returns from holding YT come from:

Realized Net Yield

Actual revenue received - YT - Value that decays over time (time amortization)Market Value Change

Current YT price - Remaining unamortized value at the time of purchase

YT pricing: determined by the "implied yield".

The price of YT is entirely determined by its implied yield because:

ST = PT + YT

Selling YT is equivalent to selling the future earnings of ST, leaving only PT.

Holding PT until maturity will eventually result in receiving ST.

→ Therefore, the price of YT = market expectation of future yield (implied yield).

The price ratio of YT/ST is a univariate function of implied yield— the implied yield is the sole determinant of YT.

3. Principal Token (PT)

PT represents the principal portion of a yield-earning asset (YBA) . Holding PT means receiving the principal value of the corresponding ST (i.e., the equivalent number of STs) at maturity.

How PT is formed

Users can:

Buy an interest-bearing asset (such as stETH).

Sell off its future earnings portion (YT)

→ What remains is PT (only retaining the principal exposure).

The essence of PT valuation: the discounted principal value of ST stocks.

The value of PT = the present value of ST's principal, discounted by the implied rate of return.

In other words:

The higher the implied yield, the lower the discounted price of PT (cheaper).

Longer duration → Higher discount → Cheaper PT

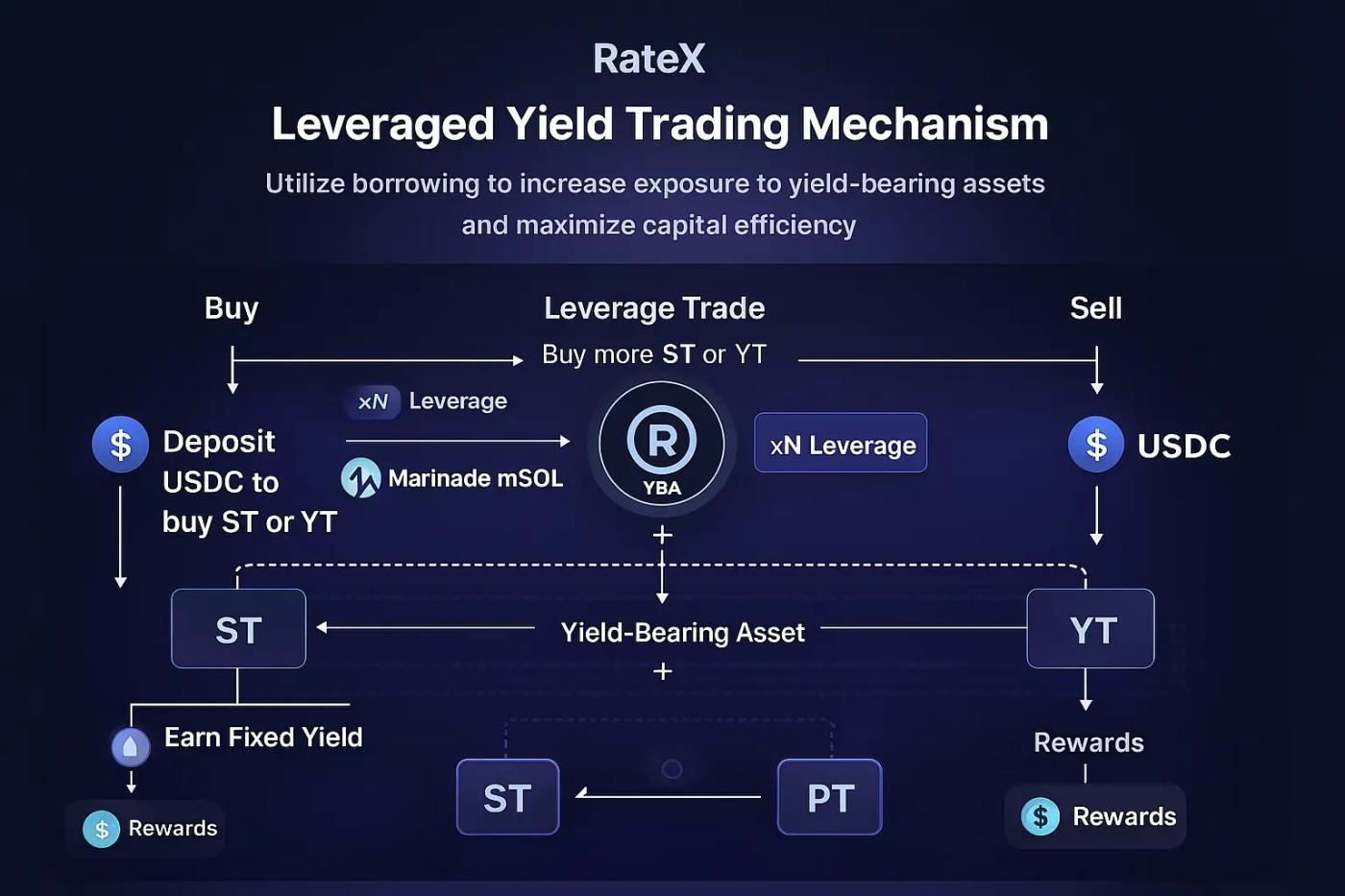

RateX Leveraged Yield Trading Mechanism Analysis

RateX allows users to leverage their yield tokens (YT or ST) of various yield-bearing assets (YBA) , which means using borrowing or margin to amplify their yield exposure.

Users can obtain the right to the income of the underlying asset/principal split by purchasing ST/YT, and can also borrow/lend these tokens to amplify returns or hedge against yield fluctuations.

Two new features have been added: Earn Fixed Yield and Yield Liquidity Farming , to accommodate different risk appetites and yield strategies.

Fixed income is suitable for conservative investors;

Liquidity mining is suitable for active users who seek high alpha.

Why is this mechanism attractive?

High capital efficiency : Through leverage and token splitting, a small amount of capital can amplify the profit exposure.

High flexibility : Users can freely choose fixed income, liquidity mining or leveraged income trading to adapt to different risk preferences and market cycles.

Liquidity and tradability : Yield Token / Standard Token / Principal Token are all tradable assets, and users do not need to lock them up or hold them for a long time.

Configurable returns and risks : Users can customize their return/risk profile through token splitting and leverage.

Tron's Review

RateX's advantage lies in its ST/PT/YT splitting model and leverage mechanism, which allows users to freely combine the income rights of interest-bearing assets with the principal to form a highly flexible and capital-efficient leveraged income trading market . Users can amplify their income, lock in fixed income, or participate in income liquidity mining at a lower cost and with greater flexibility in a multi-chain environment, while obtaining a more transparent and combinable income structure design.

However, its disadvantages are: the profit splitting and leverage structure are relatively complex, and the understanding threshold for ordinary users is relatively high; at the same time, leverage amplifies both the returns and the risks; the time decay of YT and changes in implied yield need to be actively managed, otherwise losses may occur; finally, the system relies on the stability of the interest-bearing assets themselves and the on-chain liquidity, and may experience increased volatility or liquidity pressure in extreme market conditions.

2. Detailed Explanation of Key Projects for the Week

2.1. Detailed Explanation of Pruv Finance, the On-Chain Standardization Entry Point for Trusted RWA, with a Total Funding of $3 Million Led by UOB

Introduction

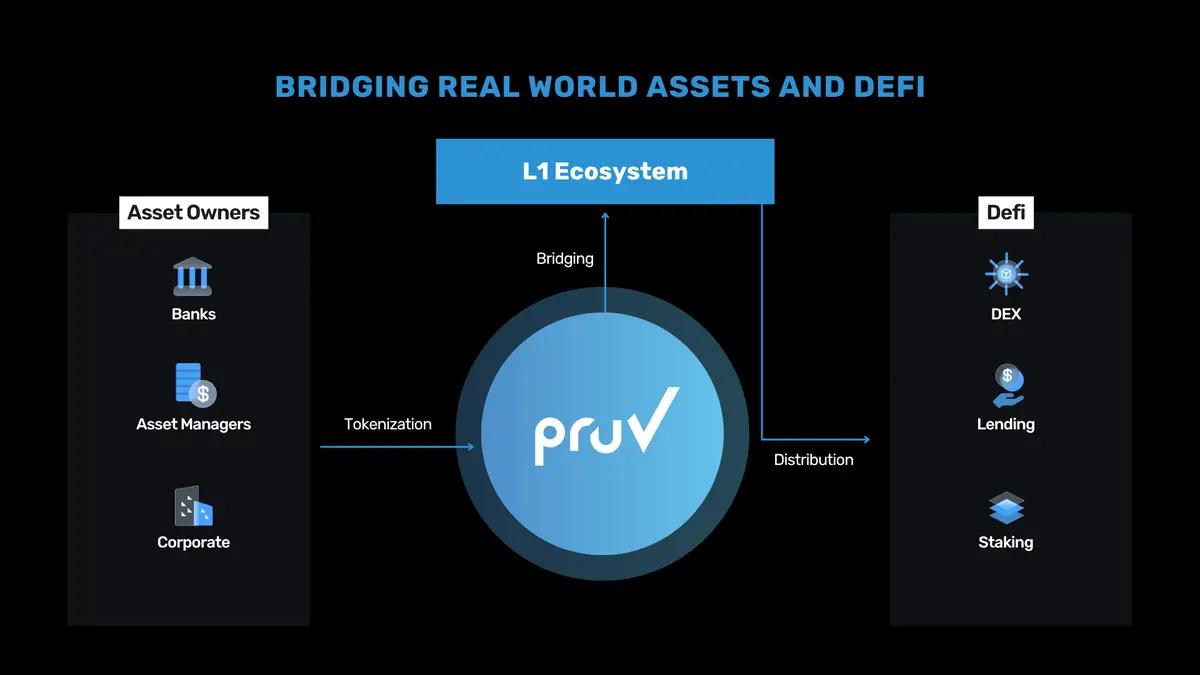

Pruv Finance is an RWA infrastructure that brings real-world assets into the DeFi ecosystem. It allows users to access trusted, tokenizable real-world assets that are freely tradable and fully combinable and interoperable with DeFi protocols across multiple chains.

Architecture Overview

Pruv connects a diverse network of participants and streamlines and standardizes the entire lifecycle of real-world assets—from asset acquisition, tokenization, distribution to DeFi integration.

Pruv selects high-quality assets from trusted partners in the global market, ensuring that all assets meet strict compliance and due diligence standards. Only assets that have passed verification and are ready for regulatory approval are allowed into the ecosystem.

Once assets pass review, they are tokenized on-chain, with smart contracts managing their ownership, profit distribution, and regulatory rules to ensure security and trustworthiness. Tokenized assets will first be distributed to qualified partners, including multiple L1/L2 foundations (such as Avalanche, Polygon, and Stellar). Subsequently, these RWAs can be bridged across chains to networks such as Polygon, Avalanche, Sei, Manta, and Stellar, allowing users to access and use them within any ecosystem.

All DeFi users can trade, integrate, and earn yields on these assets on-chain, unlocking real yield and composable financial opportunities across the ecosystem. Meanwhile, Pruv continuously monitors asset performance, compliance, and security, enabling users to participate in investments in a stable and trustworthy environment.

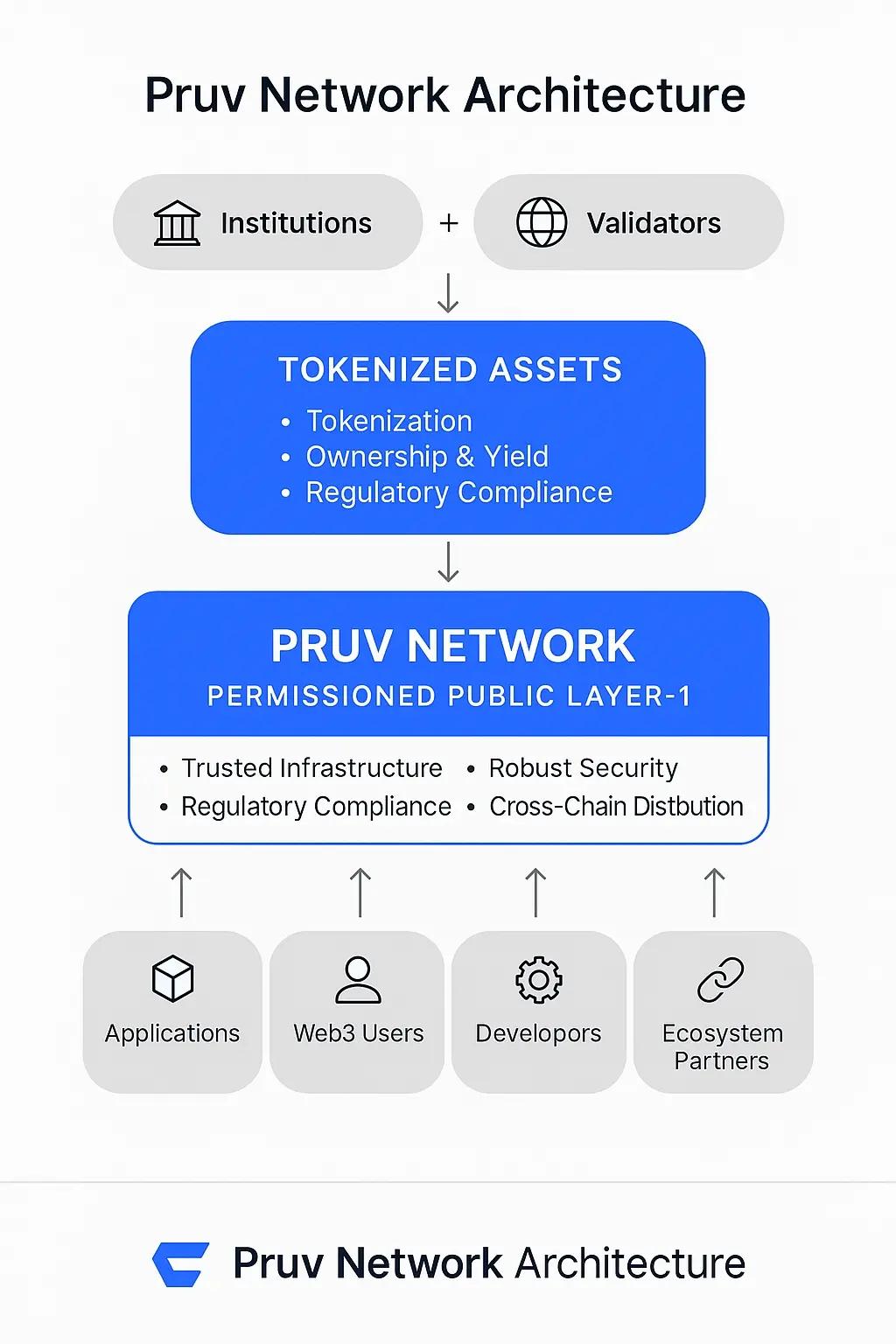

Pruv Network Analysis

Pruv Network is a financial-grade Layer-1 blockchain specifically designed for the tokenization of real-world assets, aiming to securely and compliantly bring traditional financial assets into Web3. The network only allows licensed financial institutions worldwide to act as validator nodes, ensuring the security and trustworthiness of asset issuance, management, and settlement.

Two-way infrastructure for TradeFi and DeFi

Currently, public blockchains lack regulatory capacity and are not suitable for high-value financial assets; while private blockchains are secure, they lack interoperability and liquidity.

As a permissioned public blockchain , Pruv Network combines transparency, regulatory compliance, and cross-chain liquidity, perfectly meeting the needs of financial institutions.

It is:

Traditional financial participants (banks, asset management companies, bond issuers)

Web3 community (DAO, L1/L2 Foundation, DeFi protocols)

Provides a reliable RWA distribution and integration platform.

Core advantages

1. Trusted Infrastructure

The verification nodes consist of licensed financial institutions (such as licensed banks and investment institutions in Asia) and possess bank-level governance and security.

2. Strong compliance

Built-in KYC/AML, audit trail, privacy protection, and compliance modules meet global regulatory requirements.

3. High performance and composability

It provides low-cost, high-throughput, cross-chain interoperability capabilities, supporting real-time settlement and cross-chain asset flow for financial-grade applications.

4. Financial institution friendly

It addresses the regulatory risks of public blockchains and the liquidity challenges of private blockchains, making it an ideal foundational layer for banks and institutions to access the blockchain.

Multi-layer security architecture

Pruv Network employs a bank-grade, multi-layered security architecture, including:

Secure PoS consensus

End-to-end encryption

Multisignature Wallet

Real-time threat monitoring

Fully audited smart contracts

Regular penetration testing – ensuring the security of asset tokenization and large-scale financial applications.

Comprehensive regulatory compliance module

Built-in network:

KYC/AML Identity Management

CTF Prevention Mechanism

Intelligent compliance module (automatically executes compliance rules)

Traceable audit logs

Complies with GDPR and other privacy protection requirements

This enables it to meet the needs of the global financial regulatory system.

Tron's Review

Pruv's advantage lies in its status as a permissioned public blockchain (LP1) specifically designed for Real-World Assets (RWAs). With licensed financial institutions worldwide acting as validator nodes, it achieves bank-grade security, strong regulatory compliance, and trusted asset issuance and cross-chain distribution, providing institutions and Web3 users with a high-quality, reliable asset infrastructure. Simultaneously, it addresses the lack of regulatory capabilities in traditional public blockchains and the lack of interoperability in private blockchains, enabling true integration of traditional finance and DeFi, and unlocking the scalable growth potential of institutional-grade RWAs.

Its disadvantages are: its operating model is highly dependent on institutional nodes and regulatory frameworks, and its degree of decentralization is relatively limited; the introduction of assets and the construction of the ecosystem require a long period of institutional cooperation; and early liquidity and the developer ecosystem may require more time to cultivate.

III. Industry Data Analysis

1. Overall Market Performance

1.1. Spot BTC vs ETH Price Trends

BTC

ETH

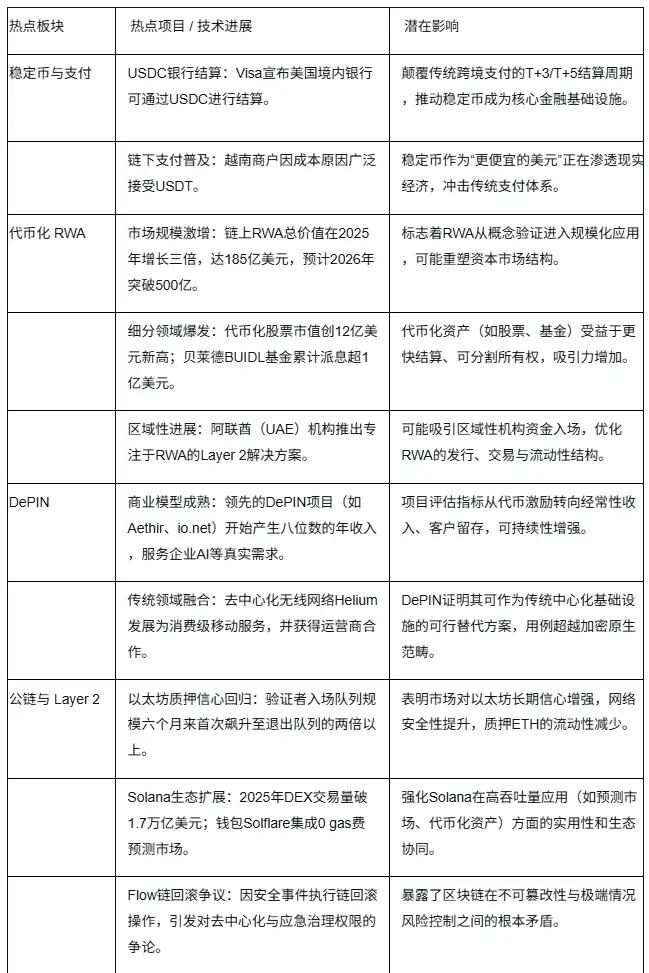

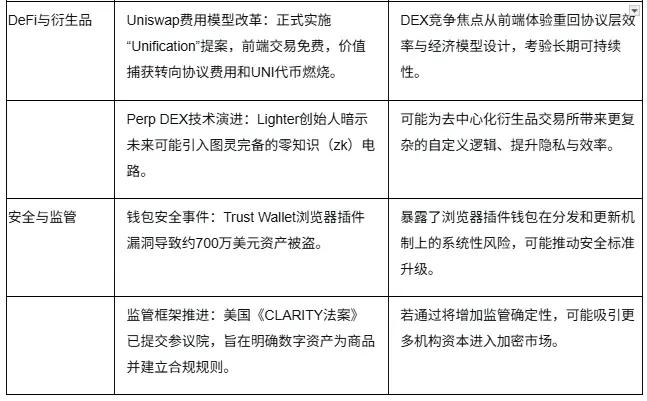

2. Summary of Hot Sectors

IV. Macroeconomic Data Review and Key Data Release Schedule for Next Week

Key data released this week:

January 9: US December Unemployment Rate; US December Seasonally Adjusted Non-Farm Payrolls

V. Regulatory Policies

USA

Regulatory Framework Shift: The chairman of the U.S. Securities and Exchange Commission (SEC) stated that a proposed framework for an "innovation exemption" for digital asset companies is planned to be released in January 2026. This framework aims to provide regulatory flexibility for crypto projects, allowing them to test new products under supervised conditions without immediately meeting full securities registration requirements.

Legislative progress pending: The Clarity Act on Digital Asset Markets, which aims to clarify the commodity attributes of digital assets and delineate the regulatory responsibilities of the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), is still awaiting Senate review, and it is uncertain whether it will pass in January 2026.

EU

New tax transparency rules take effect: From January 1, 2026, the OECD-led Crypto Asset Reporting Framework (CARF) will come into effect in 48 jurisdictions, including EU member states. This framework requires crypto service platforms to collect and report data such as users' tax residency and transaction information to enable automatic cross-border tax information exchange.

Comprehensive regulation is underway: the EU's Crypto Asset Markets Regulation (MiCA) is being fully implemented. For example, Spain has required all crypto service providers to obtain MiCA licenses by July 1, 2026.

U.K.

Simultaneous implementation of new tax regulations: Similar to the United States and the European Union, the United Kingdom will also implement the OECD's Crypto Asset Reporting Framework (CARF) from January 1, 2026, to strengthen the collection and cross-border exchange of tax information on crypto asset transactions.

Building an Independent Regulatory System: Following Brexit, the UK is committed to establishing an independent regulatory system for cryptocurrencies. The Financial Conduct Authority (FCA) plans to finalize relevant regulations by the end of 2026, with the core objective of protecting consumers and maintaining market integrity.

Other regions

Uzbekistan: The country reportedly plans to promote stablecoins as an official payment method within a new regulatory sandbox starting January 1, 2026. This sandbox will also support the trading of security tokens.