Bitcoin fell to the $91,000 region on Tuesday after briefly regaining the $94,000 mark the previous day.

New data shows strong selling pressure emerging near key resistance levels, despite continued improvement in underlying demand indicators.

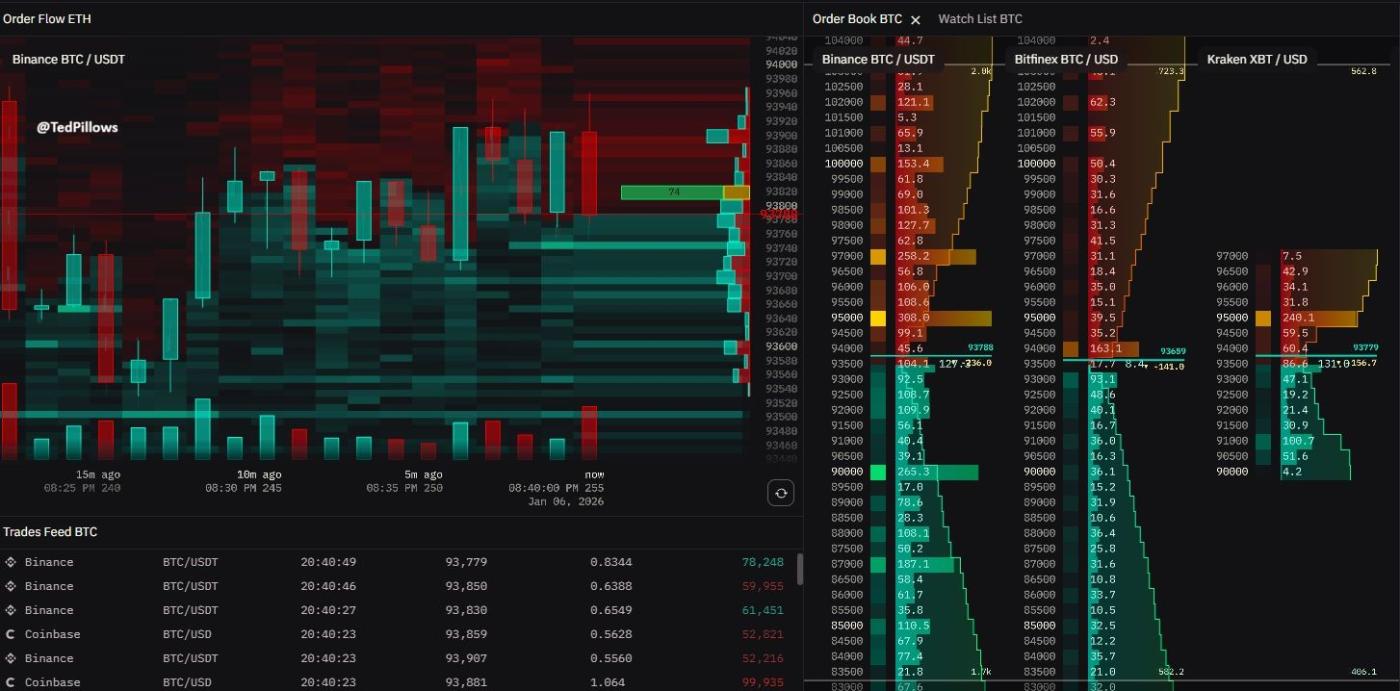

Large sell orders have limited Bitcoin's gains near the $95,000 mark.

This correction occurred after Bitcoin failed to break out of the $94,000–$95,000 range. Order Book data shows that nearly $100 million worth of sell orders are being accumulated on major exchanges around this price level.

The concentration of liquidation in this area has created a "price ceiling," halting Bitcoin's upward momentum and causing many to take profits in the short term.

Large sell orders in the $94,000-$95,000 range.

Large sell orders in the $94,000-$95,000 range.The $91,000 level is currently the entry point for a large number of new buyers who bought in at the beginning of 2025. It appears this group is taking profits after the recent volatility.

Observing the Order Book book heat map also shows that sellers are absorbing buying pressure as Bitcoin reaches this level.

When the upward momentum stalled, leveraged traders began exiting positions, causing the price of Bitcoin to fall sharply to $91,000. This move primarily reflected the market's structural state, rather than a sudden shift in sentiment.

A price reversal is still possible.

Despite price corrections, on-chain data and cash flow suggest the overall trend remains positive.

Data from CryptoQuant shows that the ratio of Bitcoin reserves to stablecoins on Binance is increasing again, signaling growing buying power waiting for the right opportunity in the market.

A higher ratio indicates that many traders are holding stablecoins, waiting for a good opportunity to buy, and they tend to participate actively in price corrections rather than "buying at the peak" when prices rise too sharply.

Such accumulation of liquidation is often a preparatory step for consolidation phases, in which prices fluctuate within a certain range before the next phase of volatility. This also means that the market is unlikely to experience sharp, rapid price surges in a short period of time.

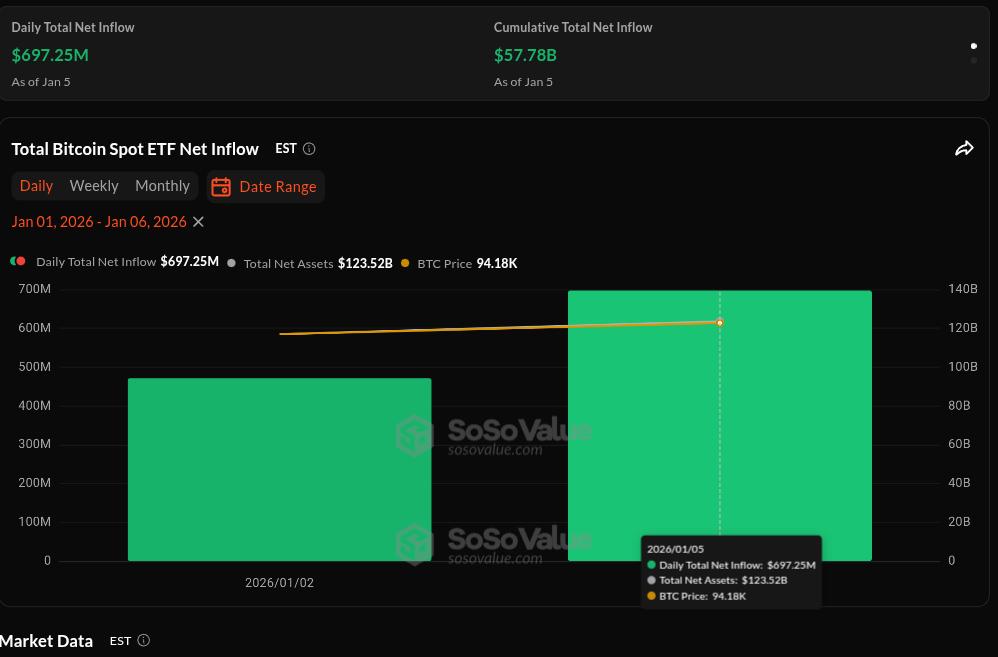

Demand from large institutions remains strong. Bitcoin spot ETFs attracted approximately $697 million in net inflows as of January 5, 2025, bringing total inflows close to $58 billion.

Daily inflows of funds into Bitcoin ETFs. Source: SoSoValue

Daily inflows of funds into Bitcoin ETFs. Source: SoSoValueImportantly, this money continues to flow into ETFs even as Bitcoin struggles at resistance levels, indicating that long-term investors continue to accumulate rather than speculate short-term.

The contrast between strong ETF inflows and weak Bitcoin prices in the short term highlights the widening gap between different investor groups.

Long-term investors continued to buy, while short-term traders mainly reacted to technical price levels and liquidation clusters. This contrast prevented Bitcoin from holding the $94,000 mark without triggering a massive sell-off in the market.

There are no signs that Bitcoin is being dumped heavily on exchanges for sale or that large holder are Dump aggressively during this price drop.

At this point, the data leans towards Bitcoin consolidating sideways rather than reversing its trend. To break above $95,000, the market needs more sustained spot buying pressure, thinner selling liquidation , and more positive signals from other riskier markets.

Until that happens, a correction to Bitcoin's lows around $90,000 is understandable as the market digests the earlier gains.