For E-Guardians, who have struggled for the past few years, 2026 may be the year they wait to reap the rewards. However, it is a possibility, not a certainty, and patience and rationality remain essential in this brutal market.

Article by: Nikka / WolfDAO

Article source: MarsBit

Market Status Quo and Key Turning Point

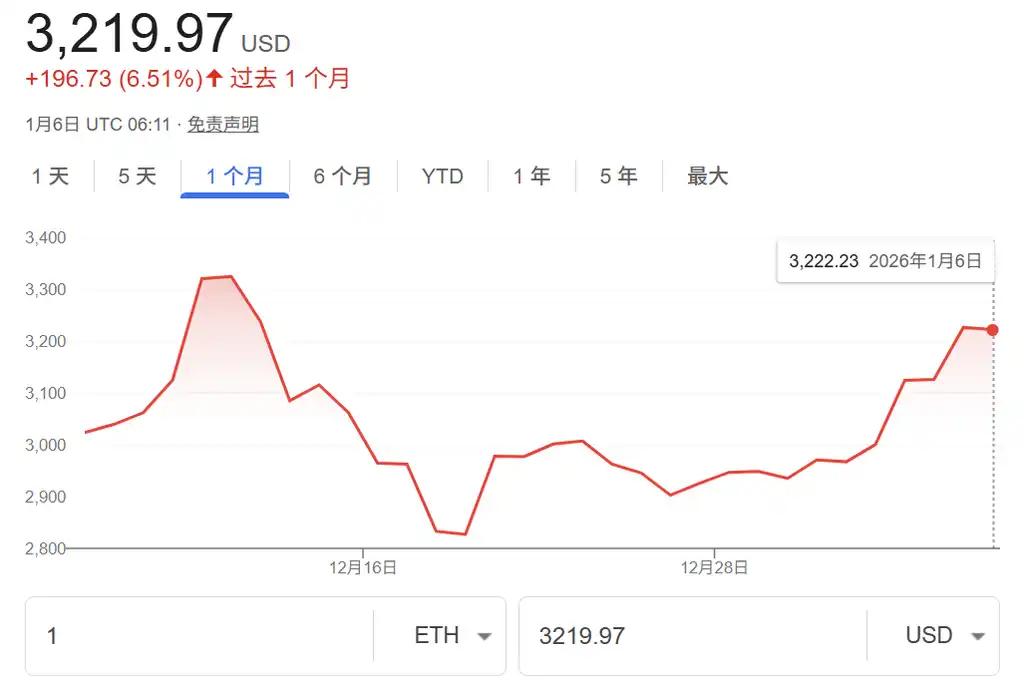

Entering 2026, the total market capitalization of the crypto market has returned to over $3 trillion, with Bitcoin's dominance briefly falling below 60%, sparking discussions about an "alt market boom." Ethereum is at a critical turning point. It has broken through $3,200 in the short term, representing a significant rebound from the lows of late 2025. Although it is still 34% below its high of $4,700 in September 2025, several early signs indicate that ETH may be brewing a structural rally.

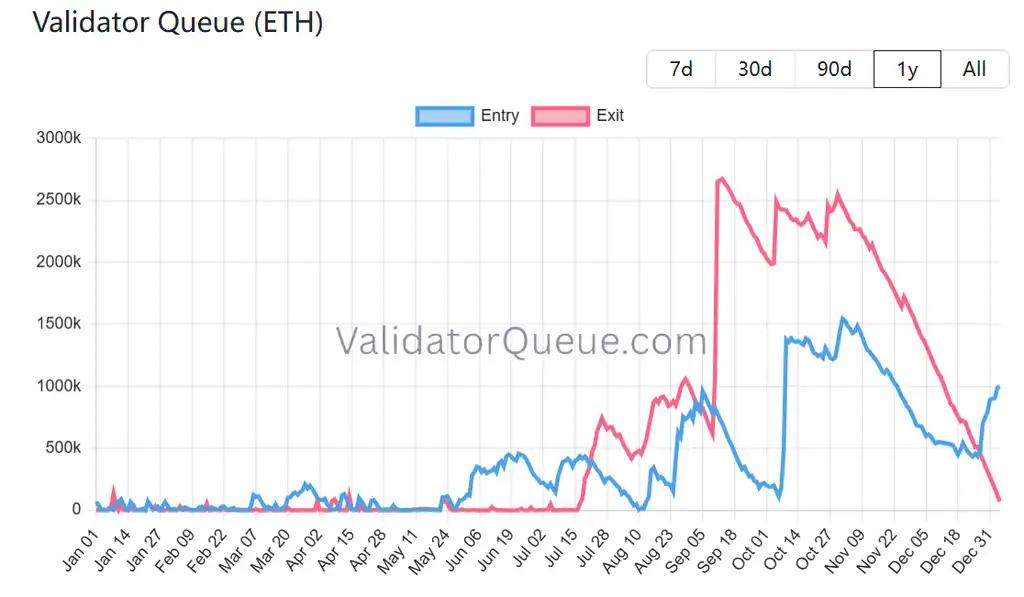

1. Pledge queue reverses: Selling pressure significantly reduced.

The most important catalyst in 2026 will come from a dramatic reversal in the staking queue. For the first time since July 2025, the "switch of roles" will occur, marking a shift in investor confidence from retreat to locking in.

Specifically, when the price of ETH surged to around $4,700 in mid-September 2025, a total of 2.66 million ETH chose to exit staking, creating selling pressure that lasted for several months. After three and a half months of digestion, only about 80,000 ETH remain waiting to exit, meaning the source of selling pressure has been largely eliminated. At the same time, the number of ETH waiting to be staked has surged to 900,000-1,000,000, an increase of approximately 120% from 410,000 at the end of December. This figure is 15 times the number exiting the queue, causing validator activation waiting time to extend to 17 days.

Currently, the total amount of Ethereum staked has reached 35.5 million, accounting for 28.91% of the circulating supply, with an annualized yield maintained at 3-3.5%. Historical data shows that when the entry queue significantly outpaces the exit queue, it often foreshadows a price increase. This supply lock will significantly reduce the liquid ETH on the market, and combined with whales' continuous purchases of over $3.1 billion since July 2025, it forms a strong foundation for a price surge.

2. Institutional Entry: From Passive Holding to Active Participation

If the reversal of staking is a signal on the supply side, then the frenzied entry of institutions is the core driving force on the demand side. BitMine Immersion Technologies, the world's largest Ethereum treasury company, is rewriting the game. The company holds over 4.11 million ETH, accounting for 3.41% of the total supply, but more importantly, it is shifting from "passive holding" to "active interest generation."

In the past eight days, BitMine has staked over 590,000 ETH, worth over $1.8 billion. On January 3rd alone, it staked 82,560 ETH, worth approximately $259 million. The company plans to stake 5% of the total Ethereum supply in the first quarter through its proprietary validator network, MAVAN, with an expected annualized return of $374 million. This aggressive move not only boosted the staking queue but also caused BMNR's stock price to surge by 14%.

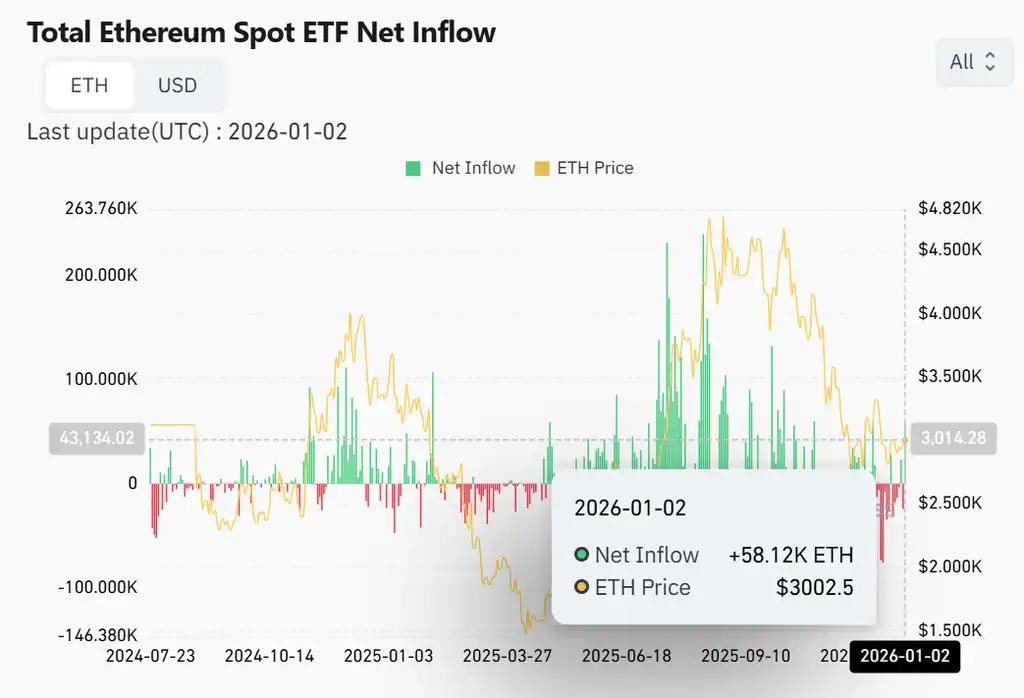

The broader institutional trends are equally noteworthy. ETH spot ETFs saw inflows exceeding $9.6 billion in 2025, with a historical total inflow exceeding $125 billion. The first day of 2026 saw a net inflow of $1.74 billion. BlackRock's ETHA fund holds approximately 3 million ETH, worth nearly $9 billion. Institutions such as Coinbase and Grayscale predict that 2026 will usher in an "institutional era," with more ETP products and on-chain vaults driving a doubling of assets under management.

Meanwhile, on-chain large-scale holders accumulated over 10 million ETH in 2025, setting a new historical record. These figures collectively point to one fact: institutions no longer view ETH as a purely speculative asset, but rather as a yield-generating infrastructure asset.

3. Technological Upgrades: Evolving Towards a Global Settlement Layer

2025 is a big year for Ethereum technology. The Pectra and Fusaka upgrades were implemented, laying a solid foundation for further growth in 2026. This is not just a simple performance optimization, but a strategic transformation—building Ethereum into a high-throughput, low-cost global settlement layer.

The Pectra upgrade, scheduled for completion in the first half of 2025, features a key breakthrough in EIP-7251, which raises the validator staking cap from 32 ETH to 2048 ETH. This significantly facilitates large-scale staking by institutions, while also increasing blob capacity, optimizing the validator mechanism, and reducing network congestion. This removes the technical obstacles for aggressive staking activities by institutions like BitMine.

More importantly, there's the Fusaka upgrade. Implemented in December 2025, this upgrade introduces PeerDAS (Peer-to-Peer Data Availability Sampling), completely changing the way Layer 2 data is stored. Full nodes don't need to download all blob data, theoretically supporting more than an 8x increase in blob capacity, and Layer 2 costs are expected to further decrease by 40-90% in 2026. EIP-7892 allows for dynamic adjustment of blob parameters in the future, enabling continuous expansion without hard forks—a systemic guarantee of long-term scalability.

The roadmap extends to 2026 and is even more aggressive. The anticipated Glamsterdam upgrade will introduce Verkle Trees, enshrined proposer-builder separation (ePBS), and block-level access lists, pushing Layer 1 TPS to over 12,000 and strengthening the MEV extraction mechanism, significantly improving network efficiency and yield capture capabilities. These technological advancements are not just theoretical—smart contract deployments and invocations have reached record highs, and on-chain activity has reached unprecedented levels.

4. RWA Monopoly: Monopolists of a Trillion-Dollar Opportunity

Ethereum's dominance in the tokenization of real-world assets is becoming the strongest narrative engine for 2026. This isn't just self-congratulation within the crypto community; it's a vote cast with real money by traditional financial institutions.

According to the latest statistics from RWA.xyz, the total value (TVL) of tokenized assets on the Ethereum blockchain has reached $12.5 billion, representing a market share of 65.5%, far exceeding BNB Chain's $2 billion and Solana and Arbitrum's less than $1 billion each. Wall Street giants such as BlackRock and JPMorgan have already massively deployed tokenized government bonds, private credit, and fund products on the blockchain. The RWA market is projected to grow by over 212% by 2025, exceeding $12.5 billion in total size, while institutional research shows that 76% of asset management companies plan to invest in tokenized assets before 2026.

Analysts predict that the RWA market will expand more than tenfold by 2026.** Ethereum, as the most mature and secure settlement layer, will directly capture the vast majority of the value of this trillion-dollar opportunity. A clearer regulatory framework—particularly the CLARITY Act and the stablecoin bill expected to be passed in the first half of the year—will further accelerate this process.

The stablecoin sector is similarly one-sided. Ethereum carries over $62 billion in circulation, accounting for over 62% of the total, and 68% of DeFi TVL. Institutional-level scenarios such as B2B payments and cross-border settlements are rapidly migrating on-chain, and an Artemis report shows that Ethereum stablecoin B2B payment volume will steadily increase between 2024 and 2025. This is not speculative capital, but a genuine demand from the real economy.

Summarize

With the combined forces of supply, demand, and technology, Ethereum is highly likely to achieve a narrative reversal from "follower" to "leader" in 2026. This will be an institutionally driven structural bull market, rather than a speculative frenzy driven by retail investor sentiment.

For E-Guardians, who have struggled for the past few years, 2026 may be the year they wait to reap the rewards. However, it is a possibility, not a certainty, and patience and rationality remain essential in this brutal market.