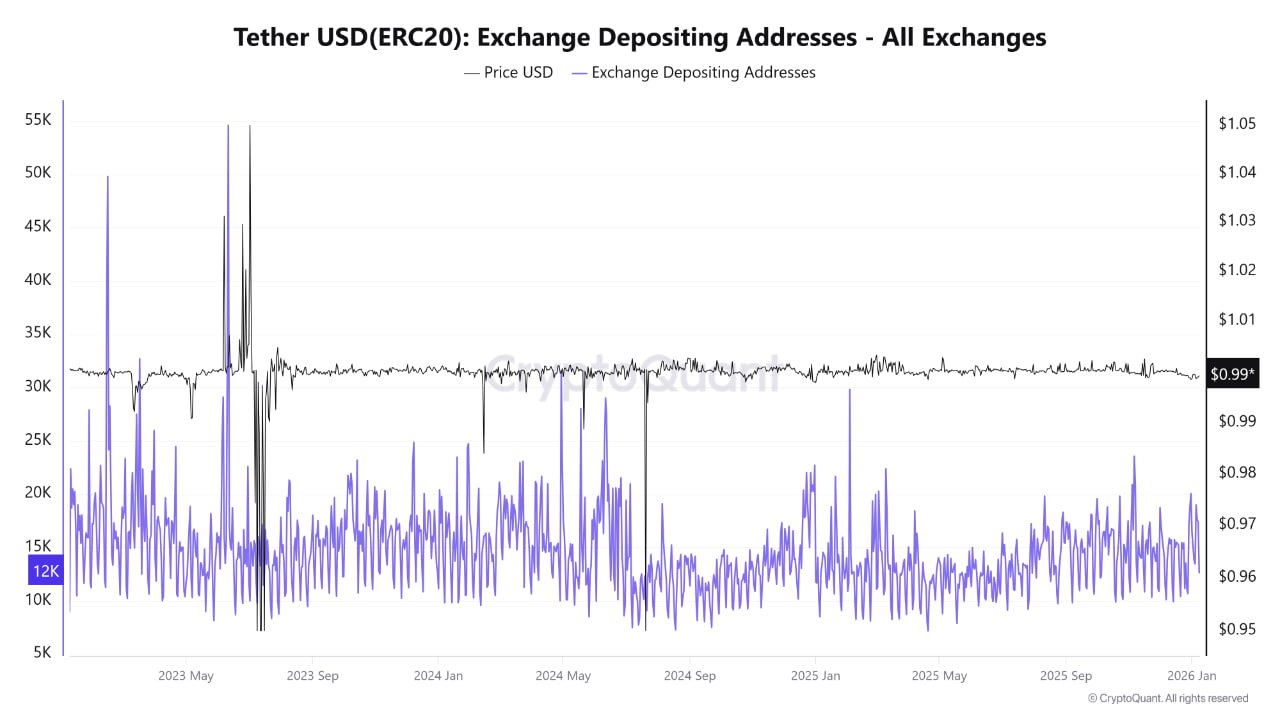

🔗 Original | Author TopNotchYJ 📈 View Chart “The 2026 Crypto Bull Cycle Begins, Liquidity Conditions Are In Place” Currently, the cryptocurrency market has accumulated approximately $60 billion in standby liquidity, or “dry powder,” in the form of exchange reserves. This level of liquidity is historically significant and has the potential to trigger a powerful rally if the conditions are met. The total stablecoin market capitalization has also expanded to approximately $307.8 billion, demonstrating a gradual shift in the financial infrastructure. This suggests that buyers are not yet present, but rather are already prepared. The key trigger is the $60 billion liquidity level. Over the past 30 days, USDT exchange reserves have ranged between $57 billion and $60 billion, maintaining an all-time high. If this figure clearly exceeds $60 billion, it could be interpreted as a global buy signal. USDT, which accounts for approximately 60.7% of market capitalization, is at the center of this trend, and this increased liquidity is likely to directly benefit the networks and exchanges that utilize it. In particular, networks with high stablecoin utilization and the Ethereum ecosystem are expected to benefit relatively more. Some have recently argued for a bearish trend based on the slight decrease in exchange stablecoin holdings, but this interpretation fails to adequately reflect the on-chain structure. While simple fiat currency conversions may appear to be an outflow, actual on-chain data tells a different story. The number of exchange withdrawal addresses (EWA) continues to increase. While some interpret this solely as fiat currency redemption, by 2025, a significant number of stablecoins were exchanged for other cryptocurrencies. The increase in EWA reflects this asset exchange activity. The rise in EWA suggests that investors are diversifying their stablecoin holdings into various cryptocurrencies, such as Bitcoin, Ethereum, XRP, and TRX. This isn't a loss of trust, but rather a sign of growing interest and participation. Recent data shows that there are approximately 27,000 active exchange withdrawal addresses, and the number of exchange deposit addresses has also increased to approximately 12,000 since May 2025, indicating increasing buying pressure through stablecoins. ✏️Summary The approximately $60 billion in stablecoin liquidity accumulated on exchanges and the increasing trend of withdrawal and deposit addresses suggest that the initial conditions for a cryptocurrency bull cycle heading toward 2026 are already in place. [Sign up for a free CryptoQuant membership] Sign up using the link above to receive one month of free access to the Advanced Plan. Analyze market trends in depth with on-chain data! ✖️ Official CryptoQuant X (🇰🇷Korean) ✈️ Official CryptoQuant Telegram (🇰🇷Korean)

This article is machine translated

Show original

Telegram

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content