Author: Hotcoin Research

Crypto market performance

Currently, the total market capitalization of cryptocurrencies is $3.09 trillion, with BTC accounting for 58.43% at $1.8 trillion. The market capitalization of stablecoins is $307.5 billion , a slight increase of 0.18% in the last 7 days, with USDT accounting for 60.46%.

Among the top 200 projects on CoinMarketCap , most rose and a few fell, including: BTC up 1.21% in 7 days, ETH up 1.7% in 7 days, SOL up 7.8% in 7 days, RENDER up 48.86% in 7 days, and VIRTUAL up 7.49%.

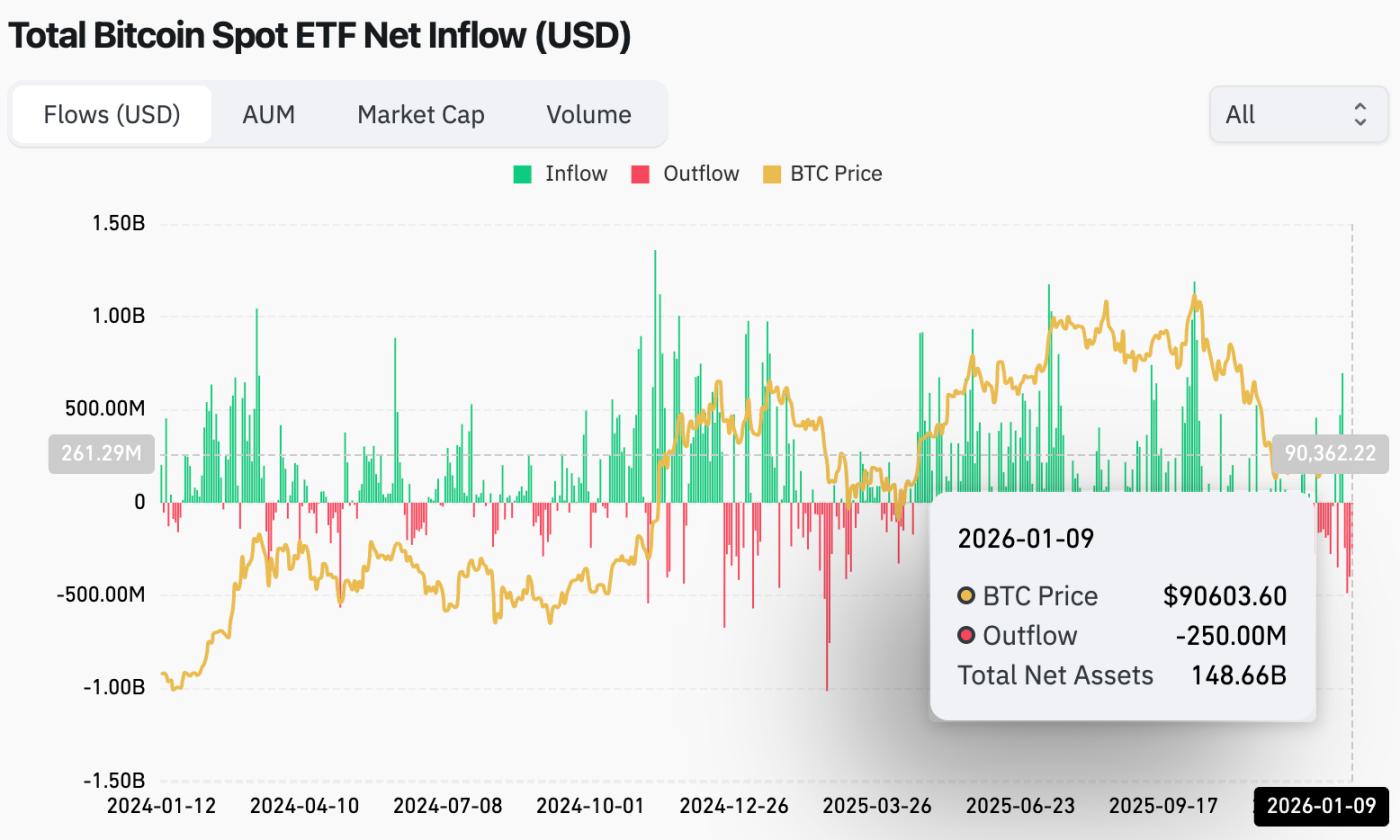

This week, the US Bitcoin spot ETF saw a net outflow of $681 million; the US Ethereum spot ETF saw a net outflow of $68.1 million.

Market Forecast (January 12 - January 18):

The current RSI is 47.56 (neutral range), the Fear & Greed Index is 26 (the index is the same as last week, in the general fear range), and the Alternative Season Index is 56 (neutral, higher than last week).

BTC core range: $89,500-$94,000

ETH core range: $3,100-$3,350

SOL Core Range: $116-$145

The crypto market is expected to maintain a volatile but slightly bullish trend next week, with macroeconomic events being the decisive variable.

Macroeconomic factors (decisive factors):

Federal Reserve Chair nomination: This is the most important macroeconomic variable. Market rumors suggest the nomination may be announced in the week of January 12th. If the final candidate is considered "pro-crypto" or "dovish," it could be a strong catalyst for market gains.

US CPI data (released January 12): will directly impact market expectations regarding inflation and the future path of interest rates.

Supervision and Policy Updates:

The Clarity Act, a digital asset market structure bill, is a key focus of market attention as the US Senate votes on it.

Next week, the market will seek direction amidst the interplay of macroeconomic events and expectations of improved liquidity. The best strategy is to remain cautious until key events unfold, wait for the market to clearly react to the news, and then formulate subsequent plans based on how prices are received at key levels.

Understanding the present

Review of the week's major events

- On January 3rd, after 2 PM Beijing time, a massive explosion was heard in Caracas, the capital of Venezuela, triggering air raid sirens and causing a power outage in the southern part of the city near a large military base. This event may have caused a slight decline in the cryptocurrency market.

- According to a post on social media by a CBS News reporter, U.S. officials revealed that President Trump has ordered strikes against targets in Venezuela, including military facilities. The post stated, "This marks an escalation of the Trump administration's pressure campaign against the Maduro regime early Saturday morning."

- On January 6, according to Business Insider, an insider who had profited hundreds of thousands of dollars by accurately betting on the political future of Venezuelan President Nicolás Maduro was trying to prevent government officials from doing similar things.

- On January 6, according to CoinDesk, Buck Labs launched the crypto token BUCK, positioned as a "Savings Coin" for non-US users, focusing on providing passive returns on USD-denominated crypto assets, rather than traditional stablecoins;

- On January 7th, according to Bitget TradFi data, spot gold and silver began a strong rebound around January 3rd. As of press time, spot gold had touched $4,500, just $50 away from its all-time high; spot silver has climbed back above $82, currently trading at $82.4, only 15% away from its all-time high.

- On January 8th, the US released its December ADP employment data last night, showing a moderate recovery in the US job market. As a result, the probability of a January rate cut on the CME FedWatch tool has fallen to 11.1%, down from 17.7% yesterday.

- On January 7, Falcon Finance announced the launch of a new off-chain Bitcoin yield vault designed for Bitcoin holders who want to earn yields without changing their long-term holdings. The expected annualized yield is between 3% and 5%, and payments are made in Falcon's USD-denominated asset, USDf.

- On January 8, Bank of America upgraded Coinbase's rating to "buy," citing reasons including accelerated product expansion, strategic adjustments, and a more attractive current valuation. Bank of America noted that Coinbase's stock price has retreated approximately 40% from its July high, but product momentum is improving in the second half of the year.

- On January 9, SIFMA, a major Wall Street lobbying organization, held an unannounced closed-door meeting with several crypto industry representatives on Thursday to discuss key disagreements in the U.S. crypto market structure bill and made some progress on DeFi-related provisions.

Overall Economy

- On January 7, the US December ADP employment figure was 41,000, below the expected 47,000 and the previous month's -32,000, meaning the "mini-nonfarm payrolls" figure was lower than expected.

- On January 8, the number of initial jobless claims in the United States for the week ending January 3 was 208,000, compared with an expected 210,000 and a revised previous figure of 200,000 from 199,000.

- On January 9th, the US unemployment rate for December was 4.4%, lower than the expected 4.5% and the previous month's 4.6%.

- On January 9, according to CME's "Fed Watch" data, the probability of the Federal Reserve cutting interest rates by 25 basis points in January was 12.6%, and the probability of keeping interest rates unchanged was 87.4%.

ETF

According to statistics, from January 4th to January 9th, US Bitcoin spot ETFs saw a net outflow of $681 million. As of January 9th, GBTC (Grayscale) experienced a total outflow of $25.365 billion, currently holding $14.711 billion, while IBIT (BlackRock) currently holds $70.249 billion. The total market capitalization of US Bitcoin spot ETFs is $120.562 billion.

Net outflow from the US Ethereum spot ETF : $68.1 million.

Predicting the future

Project progress

- The results of the second round of applications for Monad Momentum will be communicated to applicants by January 13th.

- A special meeting of Nasdaq-listed medical technology company Semler Scientific will be held on January 13, 2026, to approve a proposed merger with Bitcoin asset reserve company Strive. The merged entity will hold nearly 13,000 bitcoins, placing it among the top five Bitcoin reserve companies globally.

- The Aster Phase 4 airdrop query will open on January 14, 2026, and the claim window will open on January 28, 2026.

- The BSC mainnet Fermi hard fork upgrade is scheduled to launch on January 14, 2026 at 10:30 AM. This upgrade will reduce the block interval from 750 milliseconds to 450 milliseconds to improve network throughput and transaction processing efficiency.

- BitMine plans to hold its annual shareholders meeting on January 15, 2026, at the Wynn Hotel in Las Vegas.

- MSCI will decide whether to remove Strategy from the index on January 15, 2026.

- The UK Financial Conduct Authority (FCA) recently launched a regulatory sandbox for local stablecoin issuers looking to test their stablecoin solutions. The deadline for applications to the sandbox is January 18th.

Important events

- At 21:30 on January 13, the United States will release its December unadjusted CPI annual rate.

- At 21:30 on January 15, the United States will release the number of initial jobless claims (in thousands) for the week ending January 10.

Token unlocking

- Aptos (APT) will unlock 11.31 million tokens on January 11, worth approximately $21.04 million, representing 0.7% of the circulating supply.

- Starknet (STRK) will unlock 126 million tokens on January 15, worth approximately $10.95 million, representing 4.83% of the circulating supply.

- Sei (SEI) will unlock 55.56 million tokens on January 15, worth approximately $6.89 million, representing 1.05% of the circulating supply.

- Arbitrum (ARB) will unlock 92.65 million tokens on January 16, worth approximately $19.55 million, representing 1.86% of the circulating supply.

- ZKsync (ZK) will unlock 175 million tokens on January 17, worth approximately $5.79 million, representing 3.16% of the circulating supply.

about Us

Hotcoin Research, the core research arm of the Hotcoin exchange, is dedicated to transforming professional analysis into practical gains for you. We analyze market trends through our "Weekly Insights" and "In-Depth Research Reports"; and with our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers also engage with you face-to-face via live stream, interpreting hot topics and predicting trends. We believe that warm support and professional guidance can help more investors navigate market cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing in it inherently carries risk. We strongly recommend that investors fully understand these risks and invest within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Email: labs@hotcoin.com