Author | Sudheer Chava, Fred Hu, Nikhil Paradkar

Source | JFQA

Compiled by Yan Zilin

I. Introduction

Since the advent of Bitcoin in 2009, the crypto market has experienced explosive growth. During this period, thousands of crypto tokens—digital assets created on blockchains (a decentralized, distributed digital ledger)—have emerged. These tokens can represent a variety of assets and uses: well-known examples like Bitcoin and Ethereum are primarily used as a medium of exchange or store of value, while other crypto tokens can be used to acquire specific products or services on the blockchain platform, or represent ownership of physical and digital items. Along with market expansion, consumer interest has surged, with over 20% of U.S. adults having invested in, traded, or used crypto tokens (CNBC (2022)), and an estimated 580 million crypto investors worldwide (Crypto.com (2024)).

Despite the significant growth in the retail crypto investor base, direct evidence regarding the characteristics of these investors is scarce due to the anonymity inherent in blockchain technology. Meanwhile, the surge in crypto investors has raised concerns among policymakers, particularly given the extreme volatility of the crypto market. For example, the total market capitalization of crypto reached nearly $2.8 trillion in November 2021, then plummeted to $1.2 trillion in June 2022 before rebounding to $2.6 trillion in May 2024 (Forbes (2024)). This dramatic volatility raises concerns that retail investors may not fully understand the associated risks. Specifically, crypto token returns exhibit a highly positive skewness, implying a tiny probability of achieving extremely high returns (Liu and Tsyvinski (2021), Liu, Tsyvinski, and Wu (2022)). This return pattern resembles lottery products and is highly attractive to investors with a strong gambling preference (Kumar (2009)). Therefore, this paper explores whether gambling preferences can predict retail investor interest in the crypto market. Understanding whether retail investors view crypto tokens as lottery-like products can help policymakers determine appropriate disclosure standards and regulatory frameworks (such as the legislative recommendations made by Lummis and Gillibrand (2023)).

In the absence of direct data, this paper draws upon the work of Da, Engelberg, and Gao (2011), using Google search interest as a proxy variable for retail investor interest, and focuses on two significant types of crypto tokens: Initial Coin Offerings (ICOs) and Non-Fungible Tokens (NFTs). Unlike tokens that serve as general-purpose currencies, ICOs emphasize project investment, while NFTs emphasize digital ownership and collectibles. Consistent with the view that gambling preferences predict crypto interest, this paper finds that regions with higher per capita lottery sales show significantly higher interest in crypto tokens. This finding is also robust to other gambling-related demographic characteristics identified by Kumar (2009) and Kumar, Page, and Spalt (2011). To alleviate concerns that "attention does not equal investment," this paper documents that crypto wallet attention also surges before and after token offerings, and that higher attention is associated with larger fundraising amounts and more participants. Furthermore, this paper excludes other explanatory pathways such as advertising, risk appetite, or distrust of the system.

This paper further explores the token tier factors influencing gambling-driven attention. First, ICO and NFT projects launched during the crypto market bubble attract more attention in regions with high gambling propensity. Second, in the ICO market, tokens with lower opening prices (i.e., more "lottery-like" characteristics) and a lack of Know Your Customer (KYC) protocols (Li, Shin, and Wang (2021)) also generate greater interest in these regions. Furthermore, using the gradual legalization of sports betting in various US states as a natural experiment, this paper finds that attention to token issuance relatively decreases in high gambling propensity regions after legal sports betting is permitted. This suggests that crypto tokens are largely seen as alternatives to traditional gambling products by retail investors.

Finally, this paper examines the relationship between crypto attention and the consequences of consumer credit. Using data from Equifax, we find that in regions with high gambling propensity, consumer credit default rates surge after periods of high crypto attention, and this phenomenon is concentrated in the financially constrained subprime segment. Lag analysis shows that the increase in attention precedes the rise in default rates.

This paper contributes to several areas of literature: First, it provides new perspectives on the characteristics and motivations of retail investors in ICO market research (Li and Mann (2025), Lee and Parlour (2021), Cong, Li, and Wang (2021, 2022), etc.); Second, it enriches the NFT literature, revealing the relationship between retail investor attention and primary market performance (Kong and Lin (2021), Borri, Liu, and Tsyvinski (2022), Oh, Rosen, and Zhang (2023)); Third, it expands the literature on the impact of gambling preferences on the prices and trading volumes of financial products (Barberis and Huang (2008), Bali, Cakici, and Whitelaw (2011), Kumar (2009), Green and Hwang (2012)); Fourth, it connects research on retail investor behavior (Barber and Odean (2000, 2008), Welch (2022), Fedyk (2022), Barber et al.). (2022)); Finally, this paper supplements emerging literature on crypto investor characteristics (Dhawan and Putniņš (2023), Hackethal et al. (2022), Kogan et al. (2024), Aiello et al. (2023), Divakaruni and Zimmerman (2024), Sun (2023)), demonstrating that gambling preferences are an important factor in predicting retail crypto market interest.

II. Data and Descriptive Statistics

This section introduces the data sources used in the study and the descriptive statistics of each variable in the regression analysis.

III. Regional Gambling Tendencies and Retail Investors' Attention to Cryptocurrency

This study examines how regional differences in gambling propensity affect the attention received by crypto tokens by estimating the following general regression model:

A. Robustness test: Substitute game preference index

IV. Factors Driving Attention to Game Theory Tokens

In this section, we explore the factors that modulate retail investors’ game-theoretic interest in crypto tokens, including the characteristics of the tokens themselves and changes in the external game environment.

A. Token Feature Analysis

This article examines specific token properties that may induce gambling psychology in retail investors.

1. Low Price Characteristic (Lottery-like Attribute): According to existing literature (Kumar (2009)), low price is a core characteristic of lottery-like stocks. Empirical studies have found that ICO projects with lower opening prices on the first day of trading receive significantly more attention from regions with high gambling propensity than high-priced projects. The interaction term coefficient shows that low-priced tokens receive an additional 5% increase in attention in these regions.

2. Know Your Customer (KYC) Agreements and Risk Preference: Price manipulation tactics such as "pump and dump" (P&D) schemes are common in the crypto market, and these projects typically have weak KYC checks. Research has found that ICOs lacking KYC agreements attract significant attention from retail investors in regions with high gambling propensity, suggesting that these investors are more inclined to participate in high-risk, poorly regulated projects.

3. Market Bubble/Boom Effect: This paper defines the period from the second half of 2017 to the beginning of 2018 as the "boom period" of the ICO market, and the price surge in the NFT market from 2021 to 2022 as the "explosion period." Regression results show that token projects launched during these two periods received significantly more attention from regions with high gambling propensity than during non-bubble periods. For NFTs, regions with high gambling propensity showed approximately 23% more attention to tokens during the bubble period than during the non-bubble period.

B. The impact of legalizing sports betting

To further confirm that crypto attention is driven by gambling preferences, this paper uses the phased legalization of sports betting in various US states as a natural experiment. If crypto tokens are seen as alternatives to gambling, then attention to tokens should decrease when legal betting channels emerge. This paper estimates the following regression model:

PostSG is a dummy variable that takes the value 1 when the state where DMA d is located has legalized sports betting and the ICO occurs after the legalization date.

Main conclusions:

1. Significant substitution effect: Empirical results show that after the legalization of sports betting, the attention paid to ICOs in relevant regions has decreased significantly.

2. Regions with high gambling propensity react more strongly: After introducing the interaction term between "legalization of gambling" and "regional per capita lottery sales," a significant negative correlation was found. This indicates that in regions with already high gambling propensity, the opening of sports betting has the most pronounced "crowding-out effect" on attention to crypto tokens.

3. Conclusion Summary: This finding strongly demonstrates that retail investors view crypto tokens as alternatives to traditional betting products. Their focus on the crypto market diminishes when residents have access to legitimate sports betting channels to satisfy their gambling appetites.

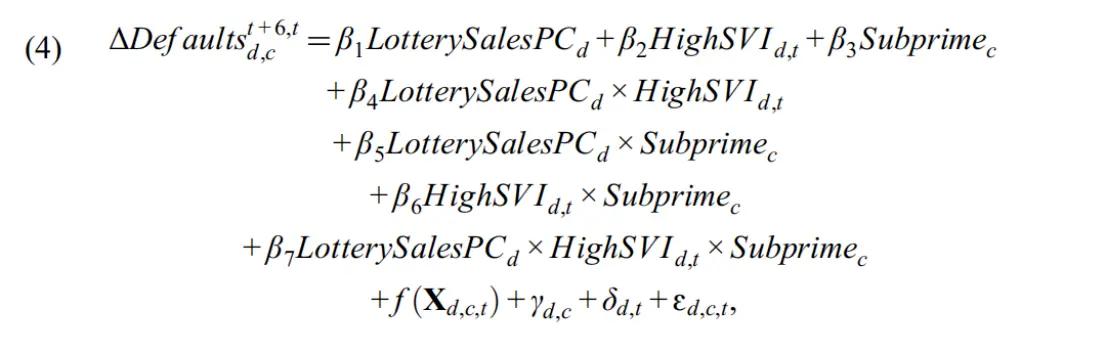

V. Retail Investors' Attention to Encryption and the Consequences of Consumer Credit

Existing research (Barber and Odean (2000); Barber et al. (2022)) indicates that retail investors tend to underperform in traditional stock markets. If they perform similarly poorly in the crypto market, they may face financial distress. Therefore, this section examines the association between retail investor crypto engagement and subsequent consumer credit consequences, and investigates how this association varies with consumer credit constraints. This paper measures credit constraints using credit scoring and categorizes them into subprime borrowers (those with higher credit scores) .

VI. Conclusion

This article delves into the fundamental drivers of retail investor participation in the cryptocurrency market, finding that gambling preferences are the core factor explaining this phenomenon . By analyzing Google Trends search data, this article confirms that in regions with higher per capita lottery sales and a stronger speculative atmosphere, retail investors show significantly higher interest in Initial Coin Offerings (ICOs) and Non-Fungible Tokens (NFTs) projects compared to other regions. This interest is not inflated; it is highly synchronized with the download and use of crypto wallets and directly and positively impacts the amount of funding raised and the number of participants in the primary market.

Further moderating effect analysis shows that this gambling-driven investment motive is particularly strong during market "bubbles" and when tokens possess "lottery-like characteristics" (such as extremely low unit price, lack of identity verification protocols/KYC, and susceptibility to price manipulation). The study also found, through a natural experiment using the legalization of sports betting in various US states, that when legal betting channels emerge, the previously active attention to crypto tokens significantly decreases, strongly suggesting that retail investors view crypto tokens as alternatives to traditional gambling products.

Most importantly, this speculative behavior based on gambling preferences poses a substantial threat to the financial health of individuals and society. Using micro-data from Equifax Credit Bureau, the study found that the surge in crypto interest in regions with high gambling propensities often foreshadows a rise in consumer default rates in the following months, and this credit deterioration is concentrated entirely among the subprime borrowers with the weakest financial resilience. This finding shatters the simplistic illusion that "crypto assets are inclusive financial instruments," revealing their potential predatory nature as speculative tools that plunder the wealth of the lower classes. In conclusion, this paper provides important academic evidence for global regulators: crypto assets are largely used by retail investors as a new form of gambling; regulation of these assets should not be limited to financial risks but should also consider public health and consumer protection, establishing stricter disclosure standards and entry thresholds.