Introduction: The crypto market in 2025 is undergoing a paradigm shift from "pure narrative" to "strong ecosystem." Recently, a project called OTOV has rapidly gained popularity in the community due to its unique "staircase" pricing mechanism and strong agricultural background. As a third-party observer, this article will delve into its potential to become the next Meme king by examining its underlying UniAgri exchange ecosystem, community consensus strength, and deflationary model.

I. Ecosystem Background: UniAgri is not just theoretical, but a practical enterprise.

In an era rife with meme coins, most projects rely solely on a single Twitter image to prop up their market capitalization. However, OTOV (One Token One Villa) is backed by UniAgri, a joint venture agricultural exchange.

According to publicly available information:

- Compliance: UniAgri is headquartered in London, UK, and has an operations center in the US, holding a US MSB financial license.

- Core Business: The aim is to deeply integrate traditional agricultural trade with the digital economy to achieve the digital flow of real assets.

- Data Performance: Despite maintaining a low profile in the Chinese-speaking world, I have learned that its daily trading volume has stabilized at over $1 billion.

- Professional Commentary: Deep involvement in the real-world ecosystem provides OTOV with the most scarce "credit anchor" among Meme coins. This is not merely a token, but a value vehicle for the expansion of the UniAgri ecosystem.

II. Core Consensus: A "Moat" Built on a Scale of 500,000 Communities

The lifeline of Meme Coin lies in its community. Having traded cryptocurrencies for many years, I know firsthand that a perfect economic model can collapse due to a liquidity crunch, but strong community consensus can allow a token to rise from the ashes like a phoenix.

The author interviewed a V community leader within the UniAgri platform. The leader revealed that although the community has over 2,000 members and high daily transaction activity, it is only of medium size within the entire UniAgri ecosystem. Currently, UniAgri's global community is conservatively estimated to have exceeded 500,000 members, distributed across more than 20 countries.

Key Insight: While UniAgri has blocked access to some markets, including China, due to compliance constraints, this has actually allowed it to accumulate a large number of high-quality real users in Europe, Southeast Asia, and Africa, providing ample "fuel" for the explosive growth of OTOV.

III. Economic Model: Extremely Aggressive Deflation and the "Staircase" Premium

OTOV's economic model is highly speculative, aiming to artificially increase scarcity through multiple deflationary mechanisms.

1. 30% of the platform's profits will be used for buyback and destruction.

UniAgri allocates 30% of its platform profits to buybacks, essentially channeling the money into a black hole. It's worth noting that UniAgri's transaction fees are 3.5%, approximately 17.5 times that of major exchanges like Binance. This means that for the same transaction size, OTOV receives more than ten times the buyback amount of similar projects.

2. Double deflation model

- 10% deflation in fund transfers

- 10% Deflation in Transactions

This "the more it circulates, the scarcer it becomes" mechanism forcibly filters out short-term speculators and locks in the benefits of long-term holdings.

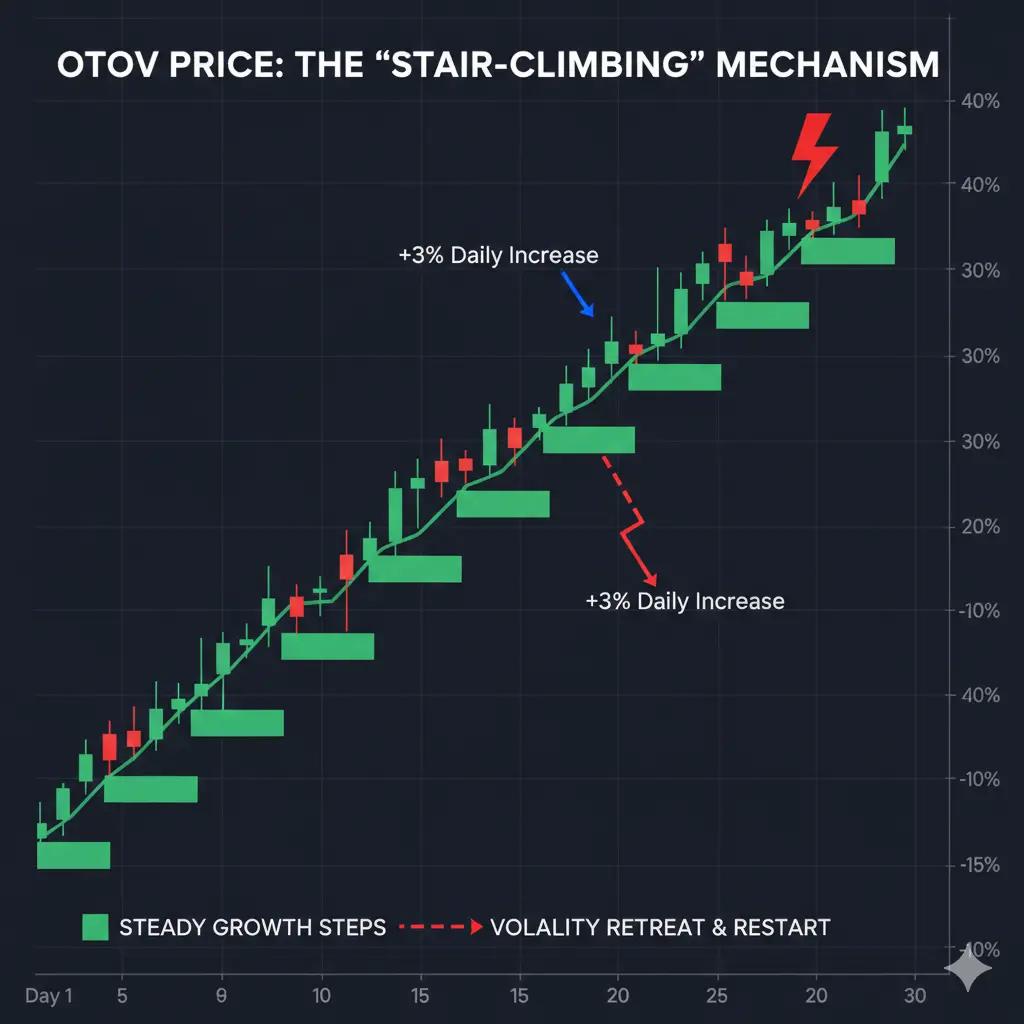

3. Unique "stair-climbing" mechanism

OTOV employs a price management model with a daily growth rate of 3%. If market volatility breaks through the support level, the price will retreat one level the following day before resuming growth.

- Function: It avoids the "roller coaster" price fluctuations common in Meme coins.

- Psychology: This steady upward rhythm can greatly enhance the holder's confidence in holding the position.

IV. Issuance Fairness: 100% Long-Term Value of Mining Output

The core logic of OTOV (such as OTOV6666) lies in 100% transaction mining. This means there is no so-called "insider trading" or project teams reserving selling pressure. All tokens come from real transactions, which is an excellent advantage in the meme field.

My research: Randomly opening trading apps, I found that OTOV still managed to achieve a daily increase of over 20% without a large-scale, overwhelming advertising campaign. This "low-key pump" demonstrates a strong internal consensus driving force.

V. Conclusion: Will OTOV be the next king of memes?

From a rational third-party perspective, OTOV possesses all the prerequisites for a breakout:

- Backed by real industry: Unlike "air coins", it is supported by agricultural trade industry worth tens of billions.

- Violent deflation: 30% profit buyback + 10% transaction losses.

- Incremental logic: 500,000 existing users are gradually converting to OTOV.

In the cryptocurrency market, miracles often happen to memes with strong ecosystems. Whether OTOV can reach the top depends on the speed of its global community's growth. But based on its current performance, it is undoubtedly the most noteworthy dark horse right now.

Disclaimer: This article is for industry observation and project analysis only and does not constitute any investment advice. The cryptocurrency market is extremely risky; participation requires caution.