This article is machine translated

Show original

🚨 THE PRICE OF GOING AGAINST THE CROWD

In 2008, one man made over $800 million by betting against Wall Street.

That man was Michael Burry.

When the market believed that the US housing market could only rise, Burry chose to stand on the opposite side.

And before that bet yielded hundreds of millions of dollars, he paid the price with years of doubt, opposition, and pressure.

Why did he dare to do what no one else dared to do? 🧵👇

MarginATM

@MarginATM

01-19

Bạc mà NGƯỜI BÌNH THƯỜNG đầu tư

vs

Bạc mà NGƯỜI CÓ NIỀM TIN VÀO HỆ THỐNG TÀI CHÍNH TƯƠNG LAI đầu tư 🥹 x.com/MarginATM/stat…

1⃣ Who is Michael Burry?

Michael Burry, born in 1971, is a neurologist by profession. He did not receive formal training in finance, did not grow up on Wall Street, and was not part of the "elite bankers" of that era.

In the early 2000s, Burry began writing investment analyses for financial forums. His articles attracted attention because they were extremely detailed, packed with data, and, most notably, always went against the prevailing market sentiment.

In 2000, he founded the investment fund Scion Capital. Within just a few years, this fund consistently outperformed the overall market, even during the DOT-com bubble burst.

👉 This helped Burry attract significant capital from institutional investors, even though his investment style was XEM "difficult to understand" and "unpleasant".

2⃣ When the whole of America believed in the housing dream, Burry began to see problems.

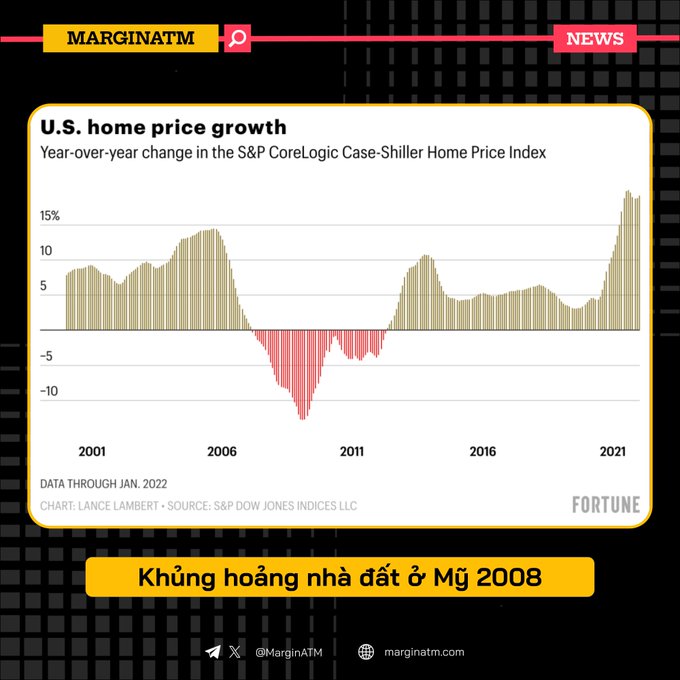

In the early 2000s, the US housing market was booming. Home prices soared, it became easier for people to borrow money to buy houses, and banks were constantly launching new financial products based on mortgage loans.

While most of the market was focused on the price increase, Burry spent time reading through mortgage data sets. And the more he read, the more he saw that things were not right.

Subprime loans were granted to people who were almost incapable of repaying. Initial interest rates were low to attract borrowers, but would increase sharply after a few years.

These risky loans were then packaged into complex financial products like CDOs, and sold on the market with labels like “safe,” “high yield,” and “credit-rated.”

👉 Burry looked at those numbers and saw a very clear outcome: once interest rates adjusted, a wave of defaults would occur.

4⃣ And then the real Big Short happened.

From 2007 to 2008, the US housing market began to collapse. Subprime mortgages defaulted en masse, triggering the collapse of numerous financial products built upon them.

The CDS contracts that Burry held increased sharply in value. And the result:

He personally earned over $100 million.

Scion Capital investors have earned over $700 million.

👉 The Big Short has become one of the most famous trades in modern financial history.

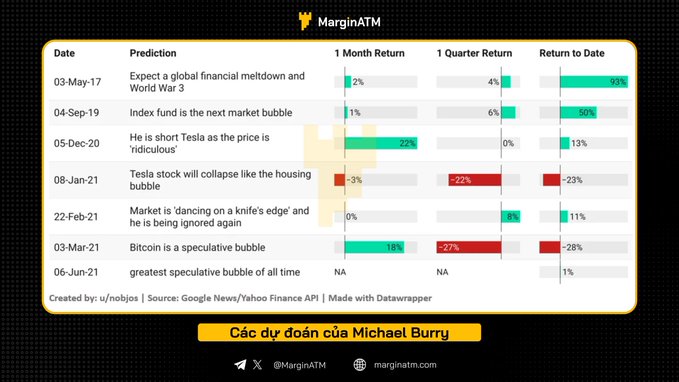

5⃣ After 2008, Michael Burry Continued to Cause Controversy

Following the crisis, Burry continued to offer many controversial opinions on the market: from technology stocks and ETFs to cryptocurrencies.

And of course, not all of his predictions were accurate, and neither was he.

Don't forget to like ❤️ and 🔁 to support the team if you find this post helpful!

MarginATM

@MarginATM

01-19

🚨 “CÁI GIÁ” CỦA VIỆC ĐI NGƯỢC ĐÁM ĐÔNG

Năm 2008, một người đã kiếm được hơn 800 triệu USD khi đặt cược chống lại cả Phố Wall.

Đó là Michael Burry.

Khi thị trường tin rằng nhà đất Mỹ chỉ có tăng, Burry chọn đứng ở phía ngược lại.

Và trước khi cú bet x.com/MarginATM/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content