Welcome to the US Crypto News Morning Briefing—a compilation of the most important crypto developments of the day, just for you.

Grab a cup of coffee and catch up on the news, because what's happening with Bitcoin, MicroStrategy, and pension funds is more than just typical market stories. From the quiet moves of large institutions to complex Capital strategies, the latest filings reveal opportunities, risks, and noteworthy debates.

Crypto news of the day: Louisiana pension fund invests in MicroStrategy amid controversy over Bitcoin strategy.

The Louisiana State Retirement Fund for State Employees (LSERS) has just revealed a $3.2 million investment in MicroStrategy (MSTR). This move demonstrates growing interest from institutions in indirectly accessing Bitcoin.

Bitcoin Treasurers cited information from a recent 13F filing showing that the pension fund holds 17,900 shares of Strategy.

This amount represents only 0.2% of the fund's total $1.56 billion portfolio. This reflects the growing interest of public pension funds in accessing crypto-related assets.

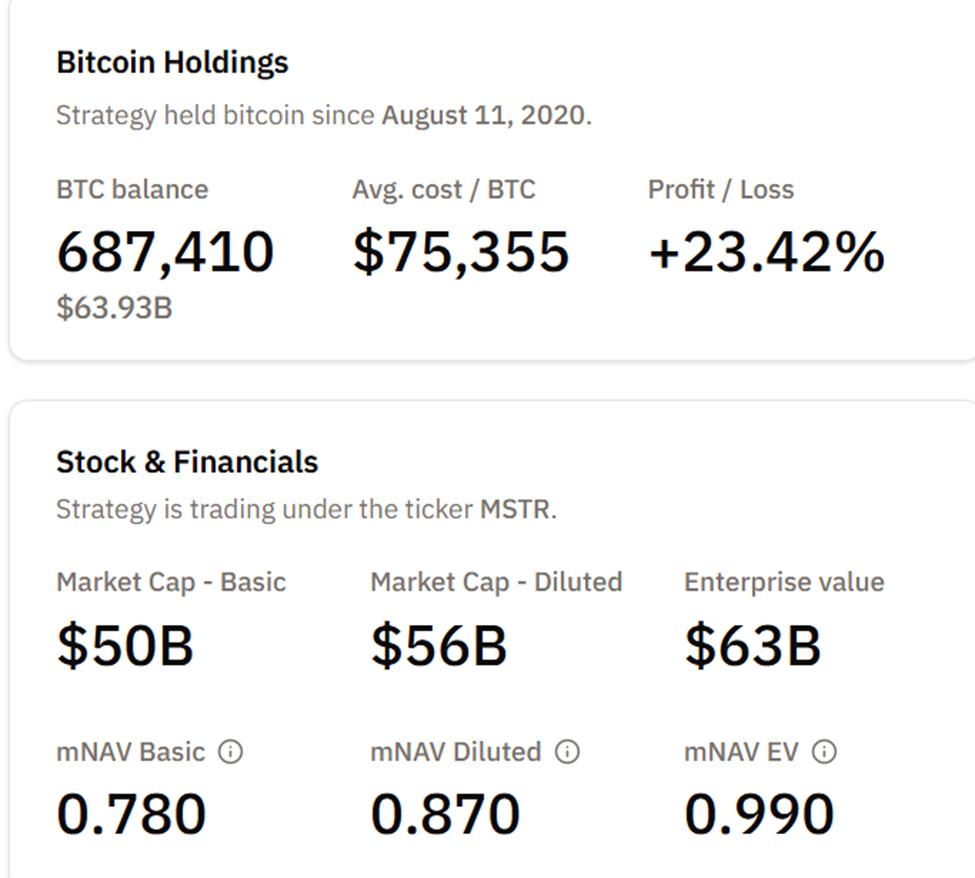

MicroStrategy, led by CEO Michael Saylor, currently holds over 687,000 BTC, making MSTR stock a representative option for those looking to invest in Bitcoin.

Many proponents argue that Saylor's strategy is more than simply hoarding . Through the issuance of stocks and bonds, the company has channeled Capital needs into large-scale Bitcoin purchases, reducing the circulating supply and strengthening its balance sheet.

“The real breakthrough is that the market sees these STRC-type products as almost like stablecoins. There’s no forced sell-off, no structural risk. The operating framework is solid. It operates like a tank – market volatility can’t knock it down because there’s no short-term debt pressure,” wrote Joss , a prominent user on X.

MicroStrategy Increases Bitcoin Stockpiles: A Bullish Signal and Concerns About Share Dilution

MSTR's recent moves also clearly demonstrate this strategy. According to BeInCrypto, Strategy is planning to purchase an additional 13,627 BTC worth a total of $1.25 billion . If executed, the company's total Bitcoin holdings would exceed 700,000 BTC, equivalent to approximately 3.3% of the total Bitcoin in circulation globally.

Many traders believe that the technical breakouts in MSTR stock, along with the continuous buying activity, indicate that Saylor's Bitcoin machine is becoming increasingly powerful.

However, not all investors were convinced. Some argued that preferred stock options like STRC, while raising Capital for the company , actually reduced the actual Bitcoin holdings of existing MSTR shareholders.

Each time new preferred stock is issued, the existing shareholders' rights to the BTC are reduced. At the same time, this requires the company to issue additional common stock to pay dividends, potentially eroding shareholder value over time.

"The more STRCs are issued, the less BTC MSTR shareholders actually hold," commented Pledditor , a prominent user on X.

Daily chart

The amount of BTC that Strategy currently holds. Source: Bitcoin Treasureries

The amount of BTC that Strategy currently holds. Source: Bitcoin TreasureriesBrief Alpha information

Here's a summary of some of the most prominent US crypto news stories you should check out today:

- Gold prices hit a new high while Bitcoin plummeted due to escalating tariff tensions between the US and the EU.

- Five bearish market signals have emerged, causing concern for Bitcoin in January 2026 .

- Inflows into crypto investment funds have exceeded $2 billion amid rising global macroeconomic risks.

- Solana ETFs recorded their first outflows in four weeks as the SOL price dropped to $130 .

- The market is expected to reach record volume amid concerns about Shard.

- Are aliens real? A former Bank of England employee links Bitcoin to cosmology .

- Four major US economic events are expected to influence Bitcoin market sentiment this week.

- Bitcoin broke through a 150% profit-taking surge but still maintained a 13% gain; the chart analyzes the reasons in detail .

Overview of the cryptocurrency and stock markets before trading begins.

| Company | Closing price on January 16, 2024 | Overview before trading hours |

| Strategy (MSTR) | 173.71 USD | 174.27 USD (+0.32%) |

| Coinbase (COIN) | 241.15 USD | 241.15 USD (+0.00%) |

| Galaxy Digital Holdings (GLXY) | 34.31 USD | 34.45 USD (+0.41%) |

| MARA Holdings (MARA) | 11.36 USD | 11.45 USD (+0.79%) |

| Riot Platforms (RIOT) | 19.23 USD | 19.31 USD (+0.44%) |

| Core Scientific (CORZ) | 18.89 USD | 18.98 USD (+0.48%) |