According to ME News, on January 20th (UTC+8), the following is a summary of the latest ARK Fund 2026 internal core outlook report:

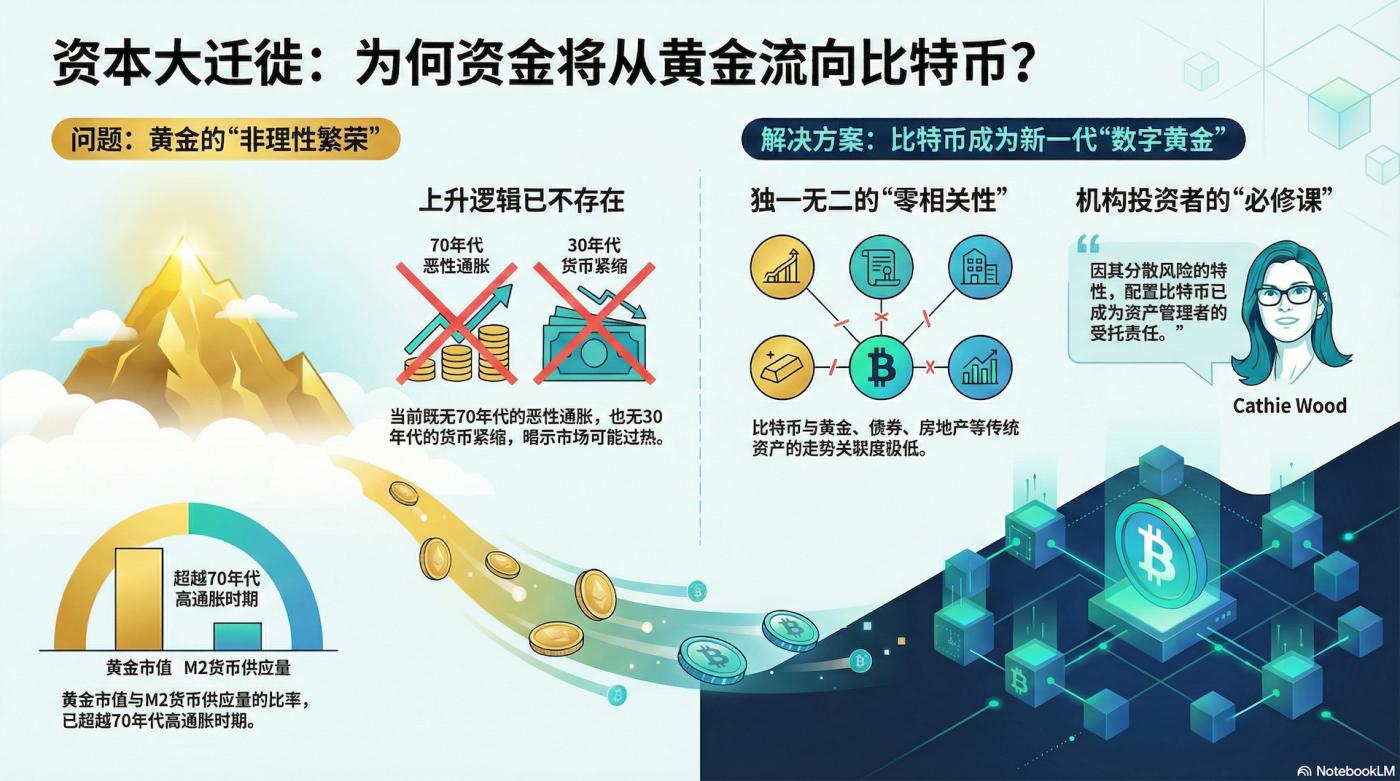

Gold: Irrational exuberance, nearing its peak.

Key conclusion: Gold has over-priced in inflation fears, is at extremely high risk of peaking, and funds will flow out.

Data shows that the ratio of gold market value to US M2 has reached an extreme, exceeding the hyperinflation period of the late 1970s, and is only lower than the Great Depression of the 1930s (when gold prices were fixed and the money supply was shrinking); currently there is no hyperinflation/monetary tightening, which is considered "irrational exuberance".

Logic: AI-driven deflation and a stronger dollar will further suppress gold prices, and funds are likely to shift from gold to less correlated assets such as Bitcoin.

Bitcoin: A must-have in 2026, an independent asset poised for explosive growth.

Key conclusion: Bitcoin is an independent asset, and 2026 will be the year of allocation and explosive growth.

Low correlation: It has extremely low correlation with bonds, gold, real estate, S&P 500, etc., optimizes the Sharpe ratio, and improves the portfolio's return/risk ratio.

Supply scarcity: The issuance decreases according to the algorithm, with a growth rate of about 0.82% in 2026, and then drops to 0.41%, which is better than the expansion of gold supply with demand.

Institutional demand: It has become a "must-learn" for institutions, and is not a shadow of technology stocks, but an independent asset class.

Fund rotation: After gold peaks, excess funds will flow into Bitcoin. Coupled with AI innovation and a deflationary environment, a breakout is expected in 2026.

A stronger dollar puts further pressure on gold.

Key conclusion: The US dollar is poised for a strong reversal, suppressing gold prices and boosting the investment value of Bitcoin.

Policy support: Tax cuts, deregulation, and support for innovation and energy constitute a "turbocharged version of Reaganomics," attracting global capital back to the US and pushing up the dollar.

Historical comparison: During the Reagan era in the 1980s, a strong dollar suppressed gold prices, and this logic will likely repeat itself.

AI-driven deflation + profit explosion, stock market valuations are worry-free.

Key takeaway: High valuations have been absorbed by the explosive growth in AI profits, which is beneficial for risk assets.

Counterintuitive view: The market's high valuations are based on the prediction of declining inflation or even deflation; AI drives accelerated corporate profits, and doubling annual profits can offset concerns about high valuations of 50-100 times P/E.

Gold and Bitcoin have different positioning: gold is a "store of wealth" asset, while Bitcoin is an independent allocation tool for "creating wealth".

Core Investment Recommendations

1. Reduce gold holdings: Avoid the risk of a market top and subsequent correction, and lock in profits.

2. Standard allocation of Bitcoin: As an independent asset, optimize portfolio risk and return, and seize the window of opportunity for explosive growth in 2026.

3. Focus on the AI theme: AI drives profitability and deflation, supporting US stock valuations; pay attention to high-growth technology stocks.

4. Bullish on US Dollar Assets: During a period of dollar strength, prioritize allocating to innovative US assets. (Source: ME)