If Bitcoin becomes worthless tomorrow, it doesn't matter whether I hold 1%, 2%, 3%, or 0.5% of it, since it will be worthless anyway.

A fleeting glimpse of the guests at Michael Saylor's Tuscan-style estate in Miami would likely lead you to believe it's just another private gathering of the wealthy. Unlimited Iberian ham is served, a DJ blasts electronic music in the spacious Versailles-style ballroom, one of Saylor's at least three yachts is moored by the dock, and a row of smiling staff members are at the entrance to store guests' shoes.

However, the scene at the banquet turned out to be absurd. On New Year's Eve 2024, in front of a giant screen erected on the billionaire's lawn, hundreds of guests witnessed the host's eyes shooting out fluorescent green laser beams.

On screen, Saylor's face was superimposed into clips from well-known movies such as "The Lord of the Rings" and "The Lord of the Rings." He was edited into a heroic character with lasers shooting from his eyes, "blasting" a group of billionaires who questioned cryptocurrency, including Bill Gates and bank executive Jamie Dimon, into ashes.

"Buy it!" Saylor's virtual avatar shouted as his opponents fell one by one.

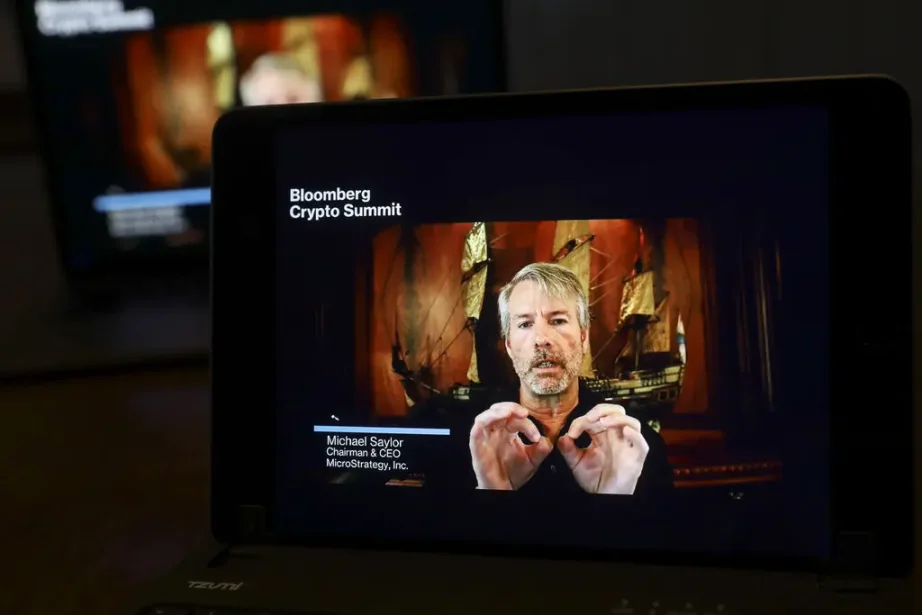

The Bitcoin community has never lacked fervent believers, or even outright fraudsters. But recently, the most talked-about and most criticized person in the entire industry is none other than Michael Saylor. This ambitious business tycoon was accused of tax evasion, having transformed the mediocre tech company Strategy into a "money-making machine" for betting on Bitcoin in just six years.

Strategy's core business is selling enterprise-grade software that helps clients organize sales data into more intuitive reports. Now, that business has become almost a trivial sideline: Saylor has woven a vast web of financial instruments and lending protocols, pouring almost all of the company's available funds into the cryptocurrency market—a highly volatile and relatively loosely regulated field completely unrelated to the company's original business.

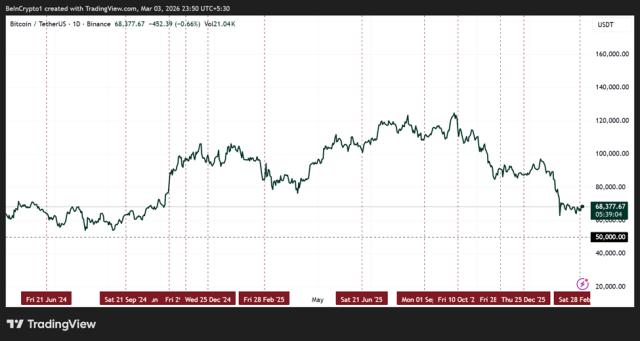

Whether this move was exceptionally bold or incredibly foolish is a matter of debate, with different people likely offering diametrically opposed answers. However, it's undeniable that this strategy was highly successful for a considerable period: Strategy's stock, previously ignored, surged to $474 per share last year as the cryptocurrency market recovered, with the company's Bitcoin holdings representing a proportion of the global supply even surpassing the gold reserves of the Fort Knox vault in the United States.

At the time, 60-year-old Saylor had a net worth exceeding $10 billion and had earned titles such as "several naval captains" and even the more direct "Bitcoin savior." On social media, he further fueled the fire by posting sensational messages predicting the imminent collapse of the dollar and urging the public never to abandon cryptocurrency. He once posted on the X platform, "Even if I have to sell a kidney, I will hold onto Bitcoin." Eric Trump, son of President Trump, even hosted him at Mar-a-Lago.

But all of this is just the prelude. Over the past year, Strategy has rapidly launched and promoted a series of investment products, claiming to transform Bitcoin, an asset known for its extreme volatility, into a stable investment option accessible to the general public.

Saylor travels the world in his private jet, spouting obscure financial jargon, promising double-digit fixed returns to investors who buy certain types of stock in his company, and comparing their security to that of bank deposits.

Of course, this is not a real bank deposit; it's just putting all your money into the cryptocurrency market.

As the executive chairman of Strategy and holding nearly half of the company's shares, Saylor's defense of his promises is a complex matter. And as the cryptocurrency market turns downward and the company's investment projects continue to be adjusted, the underlying logic becomes increasingly obscure.

This "guru," who once advised everyone never to sell Bitcoin, has recently hinted that the company may have to make the decision to sell Bitcoin in order to repay loans. Strategy has started borrowing, but instead of using the borrowed money to buy more cryptocurrency, it has hoarded billions of dollars in cash.

To skeptics, this is the latest sign that Saylor is nothing but a complete fraudster, and his deception is about to be exposed in full force.

Strategy's stock price has now fallen by two-thirds from its peak, a drop far exceeding that of Bitcoin itself. The cryptocurrency community is increasingly anxious: if Strategy, one of the market's biggest "whales," begins selling Bitcoin, the entire market could collapse. This would not only affect mainstream financial institutions that do business with Strategy, such as Fidelity, Barclays, and Cantor Fitzgerald, but also countless ordinary investors who entered the market based on Saylor's hype.

Not to mention, dozens of other companies followed suit and significantly increased their holdings of cryptocurrencies, including Trump Media & Technology Group. Strategy's collapse is undoubtedly a disastrous outcome for them as well.

Renowned short Marc Cohodes predicted that Strategy would eventually collapse, and bluntly stated that Saylor was a "preachy preacher who talks nonsense, just like Jim Jones (the cult leader)."

"We've always kept our distance from it," said Jan van Eck, founder of asset management giant Van Eck and a cryptocurrency investor. "It's all just hype."

Senior financial analyst Herb Greenberg called Strategy a "quasi-Ponzi scheme," where the returns for later investors depended entirely on funds injected by new investors.

Neither Saylor nor representatives of Strategy declined to comment on this article.

A year ago, CNBC asked Saylor about the Ponzi scheme allegations, to which he responded, "Like Manhattan developers, whenever real estate appreciates, they issue more bonds to develop new projects. That's why New York has so many skyscrapers, and this model has been going on for 350 years. I prefer to call it an economic model."

The unfulfilled dream of a fighter pilot

Strategy Executive Chairman Michael Saylor attended last year's meeting between President Trump and cryptocurrency industry leaders.

For most of the history of cryptocurrency development, Saylor and his Strategy have never been involved.

This company, headquartered in suburban Virginia and formerly known as MicroStrategy, made its name long before the dot-com bubble burst in the early 2000s with a simple data processing software. This software helped businesses like McDonald's analyze customer information. While the company's revenue and profits weren't particularly impressive, its stock became a market darling as Saylor became a regular in the media.

Saylor's life story is quite legendary. It is said that his dream of becoming a fighter pilot was shattered due to a heart murmur, and he was always prone to making boastful promises that he could never keep.

In 1998, MicroStrategy went public, and Saylor predicted in an interview with Forbes that in the future, "everyone in the world will be inseparable from our technology every moment of their lives." He also shared with employees the possibility of developing brain implant devices.

As the Washington City News commented in 2000: "Saylor's persona is clearly that of a chatterbox who can't stop talking."

That same year, the U.S. Securities and Exchange Commission filed a lawsuit against MicroStrategy for alleged fraud, accusing the company of fabricating profits that did not exist by falsifying accounting records. Saylor and his partners agreed to pay millions of dollars in personal penalties but neither admitted nor denied the fraud allegations. The company's stock price plummeted, and Saylor was forced to lay off employees, but he subsequently led the company to transform into a mid-sized software vendor and return it to profitability.

Despite remaining incredibly wealthy, Saylor began to emulate the activities of the super-rich. He founded the online university Saylor Academy and converted three apartments in Georgetown into a single, enormous mansion. One of his yachts even made an appearance in the movie "Good Boy."

But Saylor never lost his passion for innovative experimentation: MicroStrategy developed custom software for Apple's tablets and built a new business around social media scraping. He also amassed a large number of internet domain names, including michael.com and mike.com, both of which remain under his control to this day.

However, in 2014, Saylor and the company were once again embroiled in a public relations crisis. This time, disgruntled hedge fund investors accused Saylor of indulging in parties and neglecting the company's operations. The fund pointed out to the company's board of directors that Saylor had turned MicroStrategy into a "Wall Street outcast," and emphasized that the company held more than $350 million in cash, which it could have used for investments to achieve higher returns.

According to an attendee who wished to remain anonymous, Saylor, accompanied by his lawyer, met with a group of investors and promised to dedicate more time to the company's operations. Saylor also assured them that he would find suitable uses for the company's idle cash.

"Breaking free from the shackles of economic enslavement"

However, Saylor made little progress in this area until the COVID-19 pandemic broke out. At that time, MicroStrategy still had $500 million in cash on hand. During the pandemic, Saylor moved to Miami and began having long conversations with his neighbor, early cryptocurrency evangelist Eric Weiss, by the pool. Both of them later mentioned this experience in podcast interviews.

Years ago, Saylor tweeted that Bitcoin's days were numbered. But after about a week of discussions, he completely changed his mind. He firmly believes that the Federal Reserve's measures to combat the pandemic will lead to a devaluation of the dollar, thus giving rise to digital currency alternatives. His distrust of existing government institutions further solidifies this view, which is also a common belief in the cryptocurrency community.

In the podcast, the two recalled that Eric Weiss had suggested Saylor invest a small amount of her personal funds in Bitcoin. However, in June 2020, Saylor suddenly called Eric Weiss, shocked to tell him that she had spent $100 million to buy Bitcoin, when Bitcoin was trading at around $10,000.

MicroStrategy quickly followed suit. In August of the same year, the company announced that it would use the majority of its cash reserves to purchase Bitcoin and repurchase shares from dissenting shareholders.

Saylor publicly described this move as "breaking free from the shackles of economic slavery."

At the same time, there is another important background: during the pandemic, MicroStrategy's core software business was in trouble, with a sharp drop in new customer signings and revenue falling to its lowest level in 20 years.

It is not uncommon for companies to use funds from their balance sheets for external investments. For example, insurance companies operate large investment departments, using premiums to invest and generate profits, which are then used for claims; large retailers also frequently purchase real estate.

MicroStrategy's transformation has been nothing short of radical. The company has gone to great lengths to acquire cryptocurrencies: frequently issuing new shares to the public and borrowing heavily at low interest rates, with the funds raised through these two methods being rapidly poured into the Bitcoin market.

According to the company's financial report, as of March 2021, MicroStrategy held $1.9 billion worth of Bitcoin; a year later, this figure increased to $2.9 billion; and by the end of 2024, it had soared to $23.9 billion.

Saylor's wording also changed accordingly. He began to publicly describe Strategy as a "Bitcoin reserve company," which, in other words, had the sole mission of investing heavily in cryptocurrencies.

Some may wonder what the point of this move is. After all, anyone who wants to buy Bitcoin can easily do so through various channels.

The answer actually has two layers of meaning. First, thanks to Strategy's large-scale use of leverage, when cryptocurrency prices rise, the company's stock price increases far more than Bitcoin itself: for every $100 worth of Strategy stock sold, the company can borrow money to buy more than $100 worth of Bitcoin.

Secondly, the type of bonds the company uses is crucial. Most of Strategy's borrowing is done through convertible bonds. When these bonds mature, investors can choose to exchange them for company stock rather than receiving cash.

Normally, these bonds, like other bonds, require interest payments. However, Strategy's stock price has soared in recent years that some investors are willing to lend to it at near-zero interest rates in exchange for a promise of future conversion into appreciating shares.

In this way, Strategy was able to raise funds at zero cost, and the money raised was naturally used to continue buying more Bitcoin.

Some call this model the "flywheel effect," while others call it the "unlimited money printing loophole"—these are terms used by financial professionals to describe it.

But from another perspective, this could also be seen as a disaster that was brewing.

An economic anomaly

Over the past year, Saylor and Strategy's situation has changed dramatically, and the reasons are not simply due to the decline in Bitcoin prices. More importantly, Saylor has begun to target a broader group, which he calls "Bitcoin enthusiasts."

In early 2025, Strategy launched a series of "preferred stock" products, giving them cool names like "Assault" and "Expansion." Investors could receive regular cash dividends ranging from 8% to 11% over a fixed period.

This model sounds similar to traditional corporate bonds, such as airlines using ticket sales revenue to pay bond interest and then using the financing to purchase more aircraft.

However, Strategy's core mission is to buy Bitcoin and wait for its value to appreciate. This model itself does not generate any funds available to pay cash dividends. Dividend funds are only readily available when the price of Bitcoin rises, driving up the company's stock price in tandem; once the price of Bitcoin falls, the entire cycle breaks down instantly.

Despite these fatal flaws, Saylor still touted these investment products as safe and stable assets. Last fall, he declared on a podcast, "It's not exactly a high-yield bank deposit, but it's pretty close."

Alexandre Laizet, deputy CEO of Blockchain Group, previously advised Saylor before founding a publicly traded company in Europe using a similar financing model. Laizet called this model "a major breakthrough in traditional finance."

“Of course,” he added, “we all know it’s not a bank deposit at all.”

How will everything fall apart?

Saylor attended a Bitcoin conference in Las Vegas last year.

The criticisms of Saylor and Strategy have been around for a long time.

On the one hand, investors harbored doubts about Saylor's long history of misconduct. In 2024, he agreed to pay $40 million to settle tax evasion charges against him. Saylor himself had even boasted about his tax evasion methods.

Prominent investors and short firms, including James Chanos, known for exposing the Enron scandal, have repeatedly issued warnings. Their concerns include: Strategy's market capitalization peaked at over $120 billion last summer, a figure that has long exceeded the total value of its Bitcoin holdings.

This means that even if the company liquidates all its assets, it will not be enough to repay shareholders, let alone its debts.

Last December, credit rating agency Standard & Poor's downgraded Strategy's rating to junk status.

S&P points out that in the first half of 2025, Strategy's $8.1 billion "profit" came entirely from unrealized gains on its Bitcoin holdings, rather than from traditional corporate profits.

"If Bitcoin is worthless tomorrow," Saylor declared at an event in Miami last December, "it doesn't matter whether I own 1%, 2%, 3%, or 0.5% of it, because it's all worthless anyway."

To make matters worse, new pressures continue to emerge. In early October last year, trade frictions between the Trump administration and China caused the price of Bitcoin to plummet by 24%, after which Strategy's stock price was more than halved.

According to company disclosures, Strategy's Bitcoin holdings lost $17 billion in value in the fourth quarter of last year.

As of this month, Strategy's loan and preferred stock debt has reached $21 billion.

The company will need to pay more than $844 million to investors in the coming year.

Even greater debt repayment pressures are yet to come. As early as next year, holders of convertible bonds that provided loans to Strategy at interest rates as low as zero will be entitled to redeem their bonds for shares, which Strategy had guaranteed could be worth up to $672 per share.

Currently, the company's stock price is hovering around $171. If the stock price still hasn't reached the promised price by then, Strategy will have to raise funds to cover the difference. Over the next three years, the total amount of these bonds maturing will reach $5 billion.

Saylor has long since abandoned his "I'd rather die than sell Bitcoin" stance. Last month, Strategy announced another share issuance, but unusually, the funds raised were used to stockpile over $2 billion in cash as an emergency reserve. CEO Phong Le stated on a cryptocurrency podcast, "We will sell Bitcoin if necessary." Saylor also separately stated that this move was "rational." However, the company has not yet conducted any sales.

Some people remain convinced of Saylor's belief. "To deny that this is the future trend," said Ed Juline, a former Strategy executive, "is tantamount to declaring that the internet is just a fleeting fad."

On New Year's Eve 2025, Saylor's villa did not host the grand party of the previous year. One attendee recalled that Saylor had told a group of people that he would only hold such a celebration again when the price of Bitcoin reached $1 million. Now, however, Bitcoin's trading price hovers around $95,000.

Saylor's long-term prediction is that Bitcoin will reach $13 million by 2045.