Kaito launchpad history has been painful: 14 sales, average current ROI ~0.6x, and most launches nuked 50–95% after TGE.

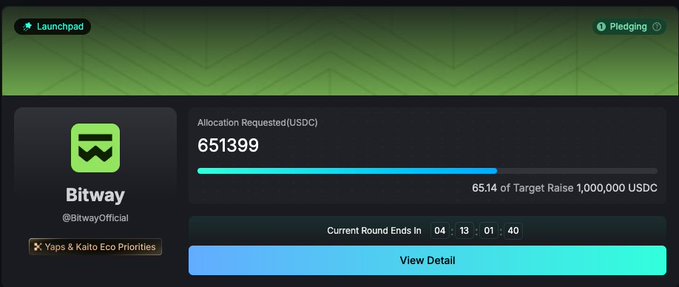

So should we join @BitwayOfficial, the latest popping up on @KaitoAI Capital Launchpad with $80M FDV (down from the $100m last round)? 👇🏻

Bitway is pitching an internet capital gateway by turning idle BTC and stable liquidity into yield rails.

– ex Binance builders, incubated via YZi Labs / EASY Residency, launched through Binance Booster

– two products: Bitway Earn (BNB Chain wealth management) and Bitway Chain (Bitcoin compatible L1 appchain for payments and financing)

– Cosmos SDK dPoS appchain, EVM + WASM, FROST bridge, DLC-style BTC lending, gas-sponsored BTC transfers

– 80k users, 3k–5k DAU, ~$30m AUM

– 2.3m+ addresses and 173m+ BTC payment volume since mainnet beta

– $4.4m seed led by TRON DAO, total $5.8m raised

So, bull case if you’d join:

– BitcoinFi narrative still early and could be big

– gas-free BTC txs + Binance distro is actually differentiated

– real users using revenue-adjacent products before token

– FDV cut from $100m to $80m is at least a nod to reality

– $1m TVL pool on PancakeSwap and Binance Alpha on TGE day, so liquidity shouldn’t be dead-on-arrival

Other risks:

– $80m FDV isn’t cheap for infra still proving scale

– 50% at TGE is a double-edged sword, less instant dumping, but 3 months can get sketchy

– new L1 positioning is always a cage match, even with solid builders

– tokenomics isn’t even out yet, which matters a lot for sizing

keep size sane if you want to join and have a plan for the 50% TGE unlock. just don’t let the shiny backers trick you into oversizing.

bro joined this sale?

Sounds promising, but caution needed.

Tokenomics and scale matter.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content