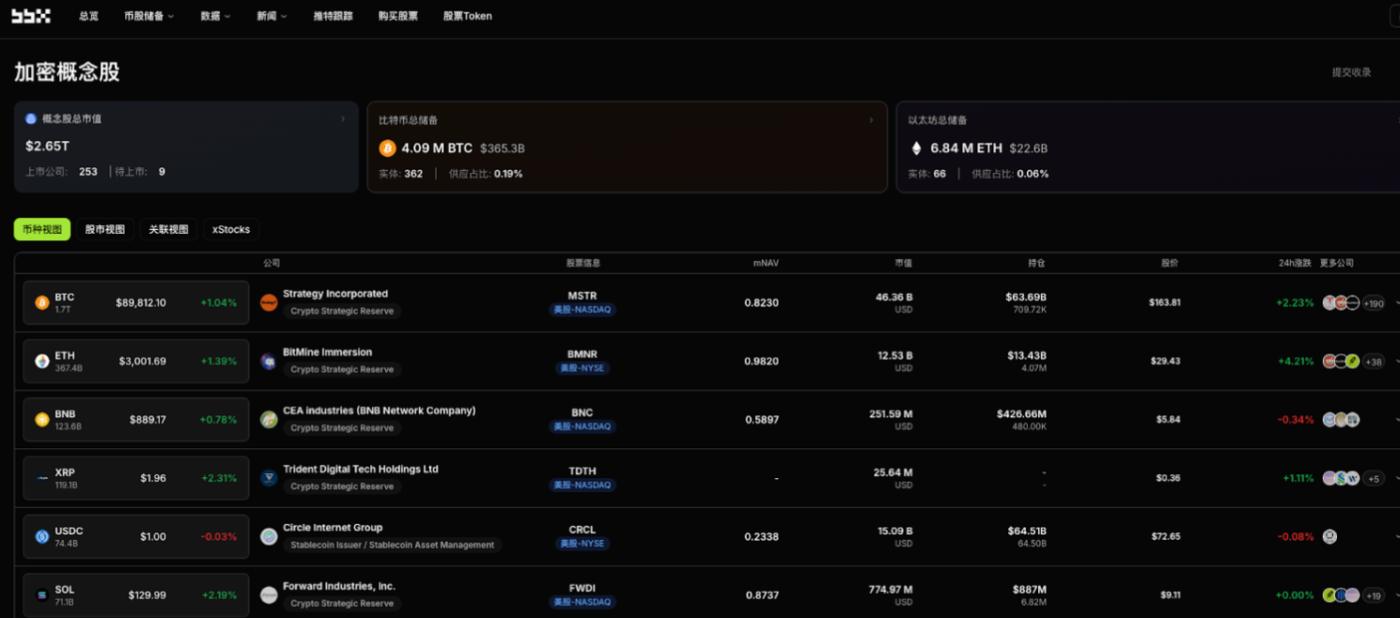

According to ME News, on January 21st (UTC+8), BBX Crypto Concept Stock Information reported a surge in global listed companies' cryptocurrency treasury holdings yesterday. Unlike the gradual growth of the previous days, leading whale and mining companies announced billion-dollar-level plans for increased holdings and financing, demonstrating strong institutional confidence in the 2026 Bitcoin bull market cycle.

Head whale holdings confirmed

- Strategy (NASDAQ: $MSTR) has officially confirmed previous market speculation in its latest filing with the SEC. The company disclosed that between January 12 and January 19, it used funds raised through an "ATM issuance" scheme to purchase 22,305 Bitcoins (BTC) at an average price of $95,500 per BTC in a single transaction, for a total transaction value of $2.13 billion.

This increase not only set a new record for the company's largest single purchase, but also brought its total Bitcoin holdings past the 430,000 mark. Strategy's CEO reiterated in yesterday's investor call that the company remains committed to converting every dollar of capital premium into Bitcoin reserves.

Mining companies prepare massive financing

Marathon Digital Holdings (NASDAQ: $MARA) announced yesterday the launch of an $850 million convertible senior note offering. The company stated in its announcement that the net proceeds, after deducting offering expenses, will be primarily used for "acquiring additional Bitcoin" and general corporate purposes.

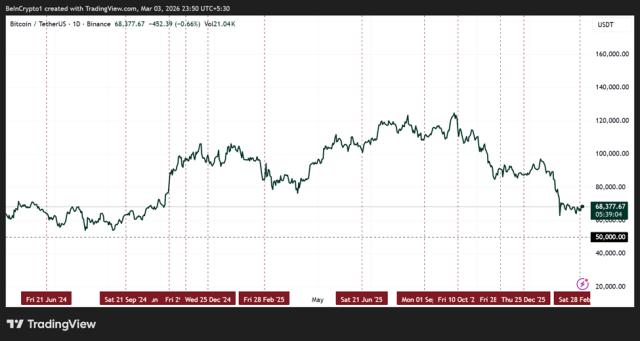

Market analysts believe that Marathon's move is intended to mimic Strategy's leverage strategy, taking advantage of the relatively low current financing costs to rapidly expand its Bitcoin balance sheet during this crucial window after the halving, in order to mitigate the risk of declining mining output.

Deepening Ecosystem Investment in Hong Kong Stocks

Boyaa Interactive (HKSE: $0434), a Hong Kong-listed company, disclosed the latest progress of its Web3 strategy yesterday. The company announced a $1 million investment in the "Bitcoin Ecosystem Fund" and reiterated its board-approved "$100 million crypto asset purchase plan".

Boyaa's management stated that, in addition to directly purchasing Bitcoin (BTC) and Ethereum (ETH) on the secondary market as reserves, the company is actively investing in primary market ecosystem projects to obtain potential token dividends, aiming to build a two-tier asset growth model of "treasury holding + ecosystem benefits".

Market perspective

Yesterday's news released strong signals of an "arms race": First, the "billion-dollar threshold"—Strategy's massive $2.1 billion investment has raised the bar for enterprise-level asset allocation to a new level, making small, single-amount investments insufficient to shake the market landscape; second, a "race to raise funds"—Marathon's $850 million funding round indicates that mining companies are accelerating their transformation into "financial holding companies," with the efficiency of directly financing cryptocurrency purchases gradually surpassing the model of simply accumulating through mining. (Source: ME)