This article is machine translated

Show original

#Gold #TIPS When trading any asset currently associated with "interest rate cuts + short-term inflation," please note the following:

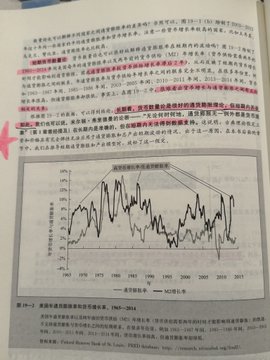

1. Inflation's feedback on the money supply typically lags (by 2 years).

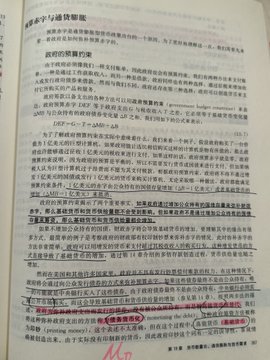

2. The monetization of government debt leads to an increase in high-powered money (base money), but this does not necessarily cause inflation in the short term—only long-term efforts to offset budget deficits through money creation will lead to sustained inflation.

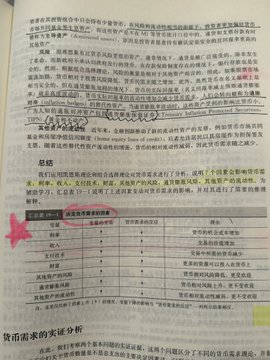

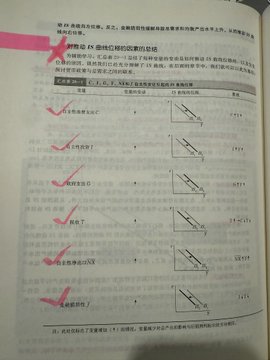

3. Analysis of the money demand side is also worth noting. Monetary policy, by impacting the fundamental demand factors for money, shifts the demand-supply curve, ultimately achieving economic equilibrium.

Therefore, the main impact of inflation on the returns of various assets in 2026 may not be clear, and the impact may not be unipolar. It is also necessary to discuss whether some assets have already preemptively benefited.

*Monetary Economics*—Part Six

I'll get a book cover, and then I'll study it carefully twice.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content