The crypto seems to never lack young, talented traders, just like Jeff Ma, our interviewee today.

This college student achieved a remarkable leap in assets from A6 to A9 in just three years. Even after experiencing margin calls and debt, he still managed to reach a peak personal wealth of 1 billion RMB. His growth trajectory is nothing short of legendary, achieving exponential wealth growth through a high-leverage rolling strategy. Having participated in numerous Bitget trading competitions and achieved impressive results, behind the impressive numbers lie countless sleepless nights, the high-pressure environment of 24/7 market monitoring, and the unwavering willpower to recover from repeated margin calls.

Through this conversation, BlockBeats attempts to reconstruct Jeff Ma's trading system. He is both an aggressive trader who dares to go all-in with 40x All In and a fund manager who deeply understands the importance of risk control; he acknowledges the role of luck in wealth accumulation but also emphasizes the value of discipline and systematic thinking. This is not a "get rich overnight" story, but rather the process of a young trader struggling and evolving in a high-risk market. The following is the full interview:

From CS:GO arbitrage to crypto trading

Q: You are a young trader born in 2004. What prompted a college student like you to become so passionate about trading?

Jeff Ma: All my trading systems are self-taught. I genuinely love trading, and only true passion can be the driving force that takes you the furthest and gets you the best results. If you don't love trading, you can't do it well; you have to love this industry.

I started with CS:GO item trading. But that market was quite limited and lacked depth. Moreover, it was controlled by the game company. If Valve, the developer, wanted to curb the market and prevent scalpers or resellers from profiting, it could simply issue a negative policy that could wipe out a large amount of market value overnight.

So I was very cautious at first. I didn't dare to immediately start trading, but instead researched cross-region trading opportunities. I discovered that CS:GO has different price zones, and the Argentinian zone was a low-price zone at the time. Cross-region trading isn't as easy as it used to be, but back then, whenever the official game released new items, I would use my USD card to buy a cross-region account to purchase official game items at a lower cost. After the 7+7 day trading cooldown period, I would sell them immediately—it was simple arbitrage, just like arbitrage in crypto exchanges.

Initially, I bought these things for my own use and to play with, but I also knew they could be resold. Then, CS:GO (now called CS2) received a major update, and I instantly made a profit of almost 30%. That's when I realized: this game could make money, and real money at that, more practical than anything my teachers taught me in school. I started researching how to earn even more, and this became my fastest way to improve my life.

Many of my classmates probably wanted to take the postgraduate entrance exam or the civil service exam to find stable jobs, but I already sensed that the overall economic climate wasn't looking good. I realized I had to do something different, not follow the majority. I felt that what I learned in school wasn't very valuable. I needed to become a rare talent, doing things that others couldn't imitate or replace. And trading is something that creates scarcity. Later, a friend introduced me to the crypto, and I slowly started trading crypto.

Q: You mentioned that you first started learning by copy trading from a trader named "A Millionaire's Dream Since Childhood." For a trading novice, identifying truly skilled traders among thousands is extremely difficult. How did you discover this person? What indicators made you feel he was worth following—was it return rate, win rate, maximum drawdown, or some other factor?

Jeff Ma: Yes, a friend introduced me to the trade, but at the time I was just copy trading off-exchange, following the legendary trader I mentioned before who "had a million-dollar dream since childhood".

That friend entered the industry very early, watching "a dreamer of becoming a millionaire since childhood" gradually build up his capital from a small start. Crucially, even during his lowest point, when his trading performance was at its worst, he only ever lost half his capital; he never experienced a margin call. This is extremely important.

At that time, he already had a large number of followers, and many of them criticized him for the losses, so he shut down all his public channels. But it was precisely after shutting them down that he suddenly took off.

He used right-side breakout trading, and his return and drawdown data were excellent. At the time, I didn't understand what rolling over positions was, but his swing trading was outstanding, employing a right-side breakout strategy with narrow stop-losses. Except for a very few cases, he almost always used small stop-losses. I continue with this approach now, except that I adjust my profit targets based on different market conditions.

He quit the network about a year ago. Before he quit, there was a classic market trend - BTC was at 72,000, 73,000, and 74,000. He short at 72,000, and it later dropped to over 50,000. Although he exited early, that was the last trade he made before quitting, and I still remember it.

Later, he completely disappeared from the internet, no longer promoting products in either public or private domains. He hasn't made a comeback since, and it's practically impossible to find him now.

He only trades BTC and ETH, which is what I admire most about him. This is because it's the only way to truly test someone's skill – Altcoin might have insider information or be manipulated by big players to lure retail investors into a liquidity trap. But this doesn't happen with BTC; trading BTC and ETH is a true test of skill.

Q: Copy trading and independent trading are two completely different levels. How did you transform from a simple copy trader into an independent trader who can understand and replicate trading logic? This includes your experience of losing everything before starting to learn options trading. Options trading is a very challenging area even for traders with a finance background. As a young person without a finance background, how did you learn this knowledge on your own? What specific channels did you use to learn? What books or courses did you read? Approximately how long did it take you to go from knowing nothing to being able to apply options strategies in practice?

Jeff Ma: To put it simply, it's about learning from books, learning from successful people, and learning from the market.

I read various books and watched videos, and chose a trading system that suited my style. I also asked others for book recommendations, but purely from a technical perspective, "Japanese Candlestick Charting" was enough for me; it's probably equivalent to what many people call "naked candlestick trading." I think it's the best technical indicator—naked candlesticks based on chart patterns.

I never learn from people who haven't achieved results. Many "teachers" haven't achieved significant results themselves; they only talk about other people's cases—like Livermore or the story of some legendary trader. But they haven't actually practiced it themselves, or they haven't achieved outstanding results. I'm unwilling to learn from such people. I'd rather trade myself, even if I lose money, at least I'll be a practitioner.

I learned very quickly because I started practicing with small amounts of capital while I was learning. I was really anxious after my account was wiped out. I didn't want to slowly recover my losses, but I wanted to find a really good strategy and rebuild a better trading system.

I learned that options can yield very high returns, especially end-of-term options, but the risks are also very high. So, my learning ability really kicked in, and I mastered it and applied it in practice in a very short time.

I can only say that I might have had some talent, and I was also lucky at the time, which allowed me to successfully implement some newly learned strategies in the trading environment at the time. Generally speaking, I didn't expect to make money so quickly, so there was definitely an element of luck involved. Otherwise, when I first started learning options, I had relatively little capital, so I went all in, mainly buying end-of-term options with only 1 to 3 days of settlement time, and they were out-of-the-money options, not in-the-money options.

However, I don't want my orders to be monitored by others. Even large funds trading spot or futures may use "iceberg orders"—breaking large orders into many smaller orders and buying in batches to prevent others from easily seeing their movements through data. This is a way to protect large funds.

Q: You mentioned using 40x leverage for rolling positions on ETH, reaching A7 in February 2024 through BTC rolling, and breaking through A8 in November 2024 through ETH rolling. While the rolling strategy is highly profitable, it carries extremely high risk. Could you explain your rolling logic in detail? What are your specific entry point selection criteria? How do you set stop-loss and take-profit orders? Under what market conditions would you choose to initiate rolling? How do you control the position size for each trade in terms of money management?

Jeff Ma: The core of my rolling position strategy is to confidently and heavily buy the buy the dips on the left side, not in buy the dips, but by heavily investing in buy the dips contracts. I might have already bought a batch in the spot market, but the market is still falling. At this point, I'll convert my spot holdings to cryptocurrency or USDT and start heavily investing in buy the dips as well. The actual leverage is typically 5 to 10 times.

Rolling over a position involves adding to a position when there's unrealized profit. For example, if the market bottoms out and rebounds, and I buy at the very bottom, and it continues to rise, I will make judgments based on various technical indicators, fundamentals, and macroeconomic factors, and then start adding to the position.

Adding to a position typically involves taking half of the initial holding. I used to be even more aggressive, using half or even the same amount as the initial holding, whether it was with 40x leverage or when I was rolling over my Bitcoin position in February 2024 – I used the most aggressive rolling strategy. Now, it might be more accurate to call it adding to a position based on unrealized profits, rather than rolling over, because I've toned it down considerably and will be adding smaller amounts.

Regarding stop-loss and take-profit orders, I usually set a break-even stop-loss order when BTC is up 1 to 2 points, placing it slightly above my cost price. BTC is currently around $100, so I'd only be making enough to cover transaction fees. Even if this trade is wrong, I won't lose my principal; adding to a winning position is like waking up from a dream. Even with recent market conditions, I've been rolling over positions, and that's also failed.

The key is that my biggest profits come from unidirectional trends, not from swing trading, scalping, or day trading. They all come from a single major market move. Rolling over positions is the strategy that generates the most profits, but it's also the one that causes the most losses. If you experience consecutive stop-losses, it can be extremely painful.

Besides rolling over positions, another frequently used strategy is swing trading, which might not be intraday but rather holding positions for several days, with a risk-reward ratio of approximately 1.5 to 3. Both strategies use narrow stop-loss orders—typically 1 point for Bitcoin and 1.5 to 2 points for Ethereum. Regarding capital allocation, I currently allocate 60% to spot trading, 20% to futures, and 20% to options.

Why I chose Bitget

Q: You've participated in several Bitget trading competitions, such as fourth place in the 2025 King of Kings Global Invitational Tournament (KCGI) and 60th place in the 2024 KCGI. How have these competition experiences helped improve your trading skills? Have Bitget's trading competition mechanism, leaderboard system, and real-time verification function helped you build trading credibility?

Jeff Ma: Through participating in the Bitget Trading Competition multiple times, my biggest takeaway wasn't how strong I am, but rather a growing awareness that this market is never short of geniuses. You'll see countless highly skilled traders on the leaderboards, but the question is, can geniuses stay in this market long-term? Many only win for a while, failing to go further.

I keep reminding myself of Liang Xi's example. Before his account wipeout, he was undoubtedly a highly talented trader in the market, but since then, he hasn't been able to return to his former form for a long time. To me, this precisely illustrates one point: trading isn't just about making a profit once, but more importantly, about being able to hold onto that profit. Money can never be fully earned, but losses can often be incredibly rapid. If you can't lock in profits in time, even the most impressive profit curve can be wiped out in a single mishap.

In these competitions, I've seen too many peers and so-called genius traders who are often just flashes in the pan and find it difficult to survive in this market in the long run. This has made me realize more clearly that there are always people better than you, and there's always something beyond your reach. I don't consider myself to be the best trader, but at least I've learned to be aggressive when necessary and to choose a relatively conservative strategy when uncertainty is higher, instead of blindly pursuing maximum returns.

As for the trading competition itself, it does indeed help enhance personal visibility and trading credibility. Many exchanges regularly host contract-related events, but Bitget's competitions are relatively rich in mechanisms and formats. It's not just a single ranking system, but rather a combination of leaderboards and real-time verification, making your results visible and verifiable. Furthermore, its incentive design is quite diverse, offering not only cash rewards but also a points system that can be redeemed for virtual currency, mobile phones, luxury goods, and even travel rewards. For example, a recent event incorporated physical prizes like LV bags. This design makes trading more than just a cold, numerical competition; it creates a more complete participation experience and is more likely to attract top traders to stay within the ecosystem.

Q: There are many cryptocurrency exchanges, including Binance, OKX, and Bybit, which are all mainstream choices. What ultimately made you choose Bitget as your primary trading platform? For example, from the perspective of a high-frequency trader, what unique advantages does Bitget have in terms of product design, trading depth, slippage control, and funding rates? Also, you mentioned in a previous video that you no longer recommend using Metamask Wallet, but instead use Bitget Wallet. What do you find advantageous about Bitget Wallet?

Jeff Ma: I don't really like to describe different exchanges as "better" in terms of which is better. More accurately, it's about which one is more suitable for my trading habits and capital size at the current stage. Binance, OKX, and Bybit are all very mature mainstream platforms, each with its own advantages. In terms of functionality, Bitget has now integrated with a system similar to Tradestation, launching the TradeFi section, which allows trading US stock indices, gold, silver, and various commodities, making it quite similar to Bybit in this respect.

But what truly keeps me on Bitget long-term isn't any single feature, but rather the overall stability of the experience and the low cost of use. On one hand, the platform's activity frequency is indeed high, with consistent trading competitions, incentive programs, and various rewards and benefits. On the other hand, the platform's speed and quality of service feedback make the experience feel smoother, which is crucial in high-frequency trading. When your trading pace is fast, any minor inconvenience can be magnified.

From a trading perspective, in terms of market depth, slippage control, and overall fee structure, my personal experience suggests it's closer to a mature centralized exchange system. In contrast, while many on-chain DEXs offer advantages in transparency—with all data, rankings, and trading activity publicly available—essentially, people can see the results but don't know who you are. In practical use, I've also clearly felt that, in terms of fee structure and overall execution efficiency, on-chain products are currently far from being able to completely replace centralized exchanges, especially when dealing with large sums of money.

Regarding wallets, as I mentioned in a previous video, I don't recommend frequently using general-purpose hot wallets like Metamask. For me, large sums of money are still kept in cold wallets, such as imToken; for daily operations, I only use a few relatively stable wallets with clearly defined functions, such as Bitget Wallet.

One of the things I find particularly useful about Bitget Wallet is how naturally it integrates with real-world spending scenarios. Its built-in U-card is incredibly convenient for small purchases, such as everyday expenses under $200, which can be easily swiped without frequent withdrawals. With regular international cards, whether Visa or Mastercard, there's usually around a 3% transaction fee, but the U-card eliminates that cost entirely – you spend and it's done, and the process is much simpler.

Additionally, Bitget Wallet has an Earn Coin Center that periodically hosts airdrops or lightly interactive events. I occasionally participate myself and recommend it to my followers. Although sometimes I get scammed, haha, overall the barrier to entry is low, the operation is quite smooth, and it's something you can easily do incidentally. For me, these features aren't necessarily core, but all these features combined make the overall user experience more complete.

Q: What benefits has Bitget brought you? What specific support do they offer in helping outstanding traders?

Jeff Ma: I've actually participated in several offline events organized by Bitget, and they're generally quite well-organized and substantial. For example, I attended the Shanghai event in the city-wide series. This series started in Changsha, then moved to Chengdu, and now Shanghai. For me, the value of these events isn't in the format, but in the exchange itself. Sitting down with these peers to talk about trading and the market is comfortable, and it significantly broadens my cognitive horizons.

In offline interactions, you'll find that participants aren't solely from the crypto. Some peers primarily manage US stocks or institutional funds, and crypto assets aren't necessarily the largest component of their overall portfolio. Communicating with these individuals offers valuable insights into different market logics and perspectives, such as how they view macroeconomic cycles, select investment targets, and make trade-offs among various asset classes. This knowledge may not provide direct answers, but it offers invaluable references for your subsequent judgments.

Bitget's support system for outstanding traders and high-net-worth users is quite clear. For higher VIP levels, there are targeted events and benefits, such as free tickets to the Singapore F1 race and Token2049 in September and October; and recent plans for similar island trips. Even VIP3 users regularly enjoy airdrops and exclusive benefits. This support is not one-off but continuous, and the experience is particularly noticeable for users who are consistently active and trade stably on the platform.

How to establish trading discipline for trading beginners

Q: You founded Ma Shen Capital, marking a significant transition from individual trader to capital manager. What is the current management and team size of Ma Shen Capital? What are its future development plans? What role do you envision Ma Shen Capital playing in the cryptocurrency investment field?

Jeff Ma: I'm very selective about who I partner with. I only work with people I know in person, especially when it involves large sums of money. I would never discuss financial collaborations online or via private messages; that's a bottom line for me. I can't disclose the size of the funds I manage. I currently have one partner, but I remain the primary operator and executor of the fund management.

In terms of positioning, I never make horizontal comparisons with any institution or individual. My only competitor is myself. Whether it's the crypto market, US stocks, gold, or commodities, what I care about most is whether this year's data is better than last year's. Even if the returns aren't higher, as long as the drawdown is smaller and the risk control is more stable, that's progress in my eyes.

As the amount of capital increases, trading methods will inevitably change. Previously, when I traded on my own, I could All In, use heavy leverage, and be very aggressive, but this is unacceptable when managing funds. The importance of risk control becomes infinitely amplified. Simply not losing money already outperforms most people in any market; consistently achieving an annualized return of 20% over the long term is already an excellent fund performance. Of course, I still care about returns, but now it's more important to control the maximum drawdown to within 20% through hedging and structural adjustments.

Q: As a young trader who achieved A9 level at the age of 21, what advice do you have for beginners? How can they avoid the pitfalls you made? What core qualities do you think a good cryptocurrency trader needs? What percentage of your current trading ability comes from books/courses, and what percentage comes from market "tuition fees"? Which stage was the most difficult to break through from A6 to A9?

Jeff Ma: The first thing, always, is to avoid being liquidated. The most direct way is to set a stop-loss order when you open a position and strictly adhere to it. Many failed trades are not due to incorrect judgment, but rather to a breakdown in discipline, such as temporarily canceling the stop-loss when the market is falling, or constantly moving the stop-loss position down. Even if the price eventually recovers, in my opinion, it is still a failed trade because your trading system has been destroyed.

Secondly, don't be misled by the concept of high leverage. Many people see nominal leverage of 100x, 150x, or 200x and think it's equivalent to All In. But in reality, most professional traders use a cross margin strategy. For example, with 100x leverage, if you only open a 1% position, the actual leverage is only 1x. The purpose of high leverage is to improve capital utilization and facilitate simultaneous investment in multiple assets, not to amplify risk.

In terms of learning path, I've always believed that you don't need to learn too many technical aspects. The book *Japanese Candlestick Charting* is sufficient to lay a solid foundation. More importantly, you need to supplement your macroeconomic understanding, such as basic macroeconomics and microeconomics, and sensitivity to important events like interest rate hikes, cuts, policy meetings, and international conflicts. These directly affect asset trends, such as the impact of war on gold prices.

To be honest, my success from A6 to A7 involved a large element of luck. I had just learned how to roll over positions and happened to catch the main upward wave of Bitcoin starting from $40,000. I added to my positions with the floating profits, and I caught that part very well. But from A8 to A9, this was definitely the most difficult stage, and also the most difficult stage of my entire trading career. This stage is very prone to mistakes. Many people get flustered and end up with their accounts wiped out, losing everything. Moreover, the disappointment from failing at this stage is extremely great and very painful.

This phase is extremely demanding on mindset and execution. The pressure is immense. Even if my overall portfolio was in a profitable state before I went to sleep, the first thing I did every morning was check to see if my positions had been wiped out and I was at breakeven. My partner and I were practically monitoring the market 24/7, even sleeping with headphones on, ready to call immediately at the first sign of a market signal, prepared to execute it at any moment. Without a strong heart, it's very difficult to get through this.

Q: Looking ahead to the beginning of 2026, how do you view the cryptocurrency market this year? How will major cryptocurrencies like Bitcoin and Ethereum perform? What trading opportunities or sectors do you particularly favor? What adjustments will you make to your personal trading strategy this year?

Jeff Ma: I don't think we'll see a major breakout or extreme surge this year, but I also disagree with the notion that it's just a one-sided bear market. Even in a bear market, it won't be a perpetual decline; there will definitely be periods of rebound. For me, it's not about just short, but about buying in buy the dips at the right price levels to catch a sufficiently large rebound.

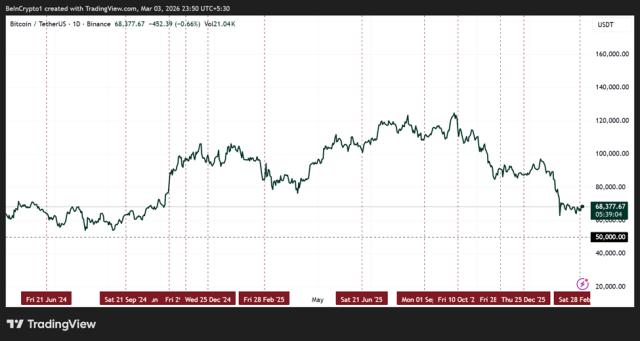

For mainstream assets, I mainly focus on Bitcoin, Ethereum, BNB, and SOL. Buy the dips Bitcoin in batches within the $60,000 to $84,000 range is perfectly fine; if a deep bear market truly arrives, I wouldn't be surprised if SOL falls below three digits, and it could fall very sharply.

I'll be very conservative in the Memecoin market. If I were to invest, I'd probably only go for Pepe and Doge, or similar tokens that have been repeatedly validated by the market. I generally avoid newly released coins and projects whose logic I don't understand.

In terms of overall asset allocation, a very important adjustment this year has been to increase the allocation to gold and US stocks, while reducing the proportion of Web3. US stocks have been continuously hitting new highs recently, such as the S&P 500 index, and my ETF portfolio has already achieved significant returns. This cross-market allocation is crucial for reducing overall volatility and drawdowns.