This article is machine translated

Show original

Looking forward to Sister Bee's analysis.

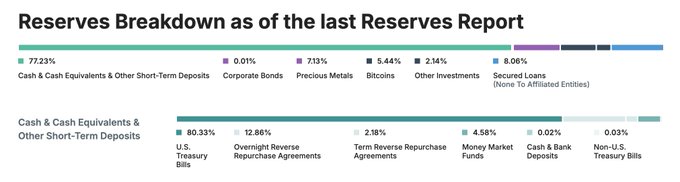

A personal opinion: Saying that stablecoins are fully collateralized is a misinterpretation of the balance sheet. Leaving aside the issues of having too many high-risk assets as reserves, lacking central bank liquidity support, and not having commercial deposit insurance, you can also use commercial bank standards to calculate and evaluate Tether's balance sheet, looking at its core reserve ratio and capital adequacy ratio. While commercial banks no longer have a statutory reserve ratio, they generally maintain around 12% for many years. Their capital adequacy ratios are even more inadequate.

TVBee

@blockTVBee

01-23

稳定币据我所知是全额抵押的,只不过大部分都不是100%美债。基于美债的生息稳定币的利率本身就体现了银行赚了市场多少钱,对商业银行存款还是有些影响的。但影响不大,我下一篇写这个。本来想放一起写的,但太长了就拆开了。

Haha, we've gotten a bit off-topic while chatting.

The coins in my table are interest-bearing stablecoins, meaning you earn interest just by holding them, without needing to pledge them. USDT and USDC are not interest-bearing stablecoins.

I was just talking about interest-bearing stablecoins, not specifically USDT and USDC. USDT's so-called full collateral is really just that—collateral—and it even includes BTC.

USDC's collateral often includes a lot of US Treasury bonds. The collateral for the interest-bearing stablecoins in my table is primarily US Treasury bonds.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content