The importance of options is being realized by people, here are 7 decentralized option projects.

Written by: Chinchilla

Compiler: Jiang Haibo

As a trading tool, options are gradually being realized by many people. Here are 7 decentralized options projects that are driving the utility of options for ease of use and widespread adoption.

opyn

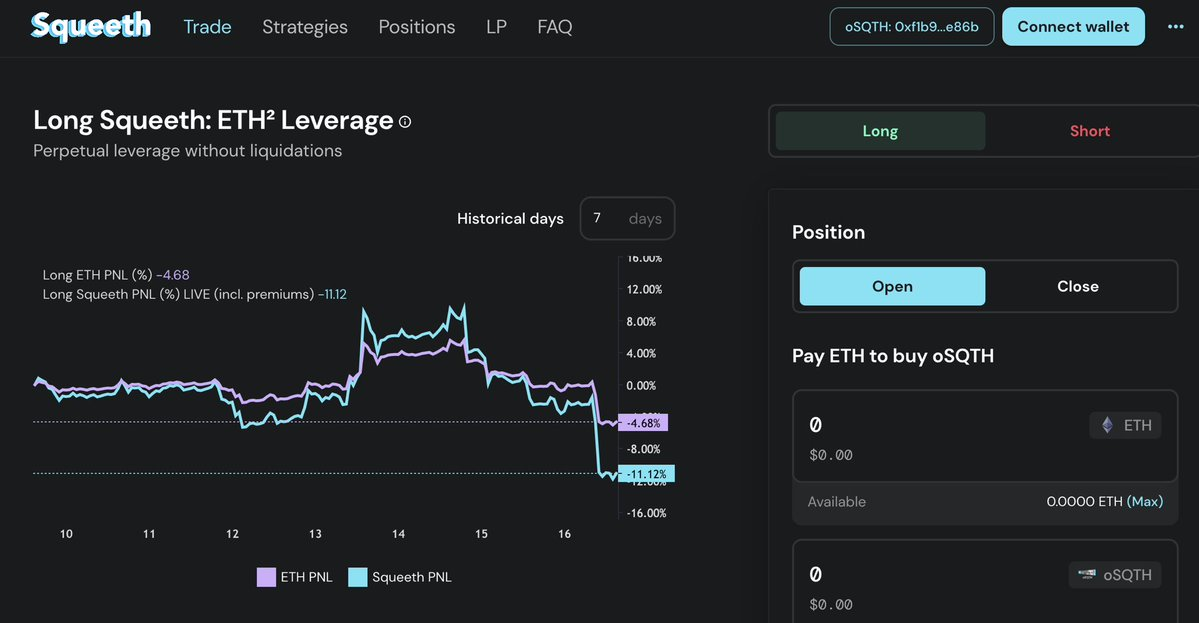

Opyn is currently the largest options agreement, with a TVL of $54 million, deployed on Ethereum, and has not yet issued governance tokens. It provides two unique functions.

The first is Squeeth. When a user goes long, he will buy an ERC-20 token "oSQTH", which represents the square of ETH (ETH^2). Therefore, when rising, holding sSQTH has higher income, and also when falling, the loss is more.

When the user goes short, he will get the option fee, which is equivalent to selling Squeeth with ETH as collateral.

The second feature is Crab Strategy, which is the only strategy currently open. The crab strategy will automatically rebalance every day, and when ETH remains within the range of 5% within a day, you can get a profit. Since July, the crab strategy has returned about 9%.

Related reading: " Understanding Squeeth in one article: the new strategy launched by the option agreement Opyn after two failed versions "

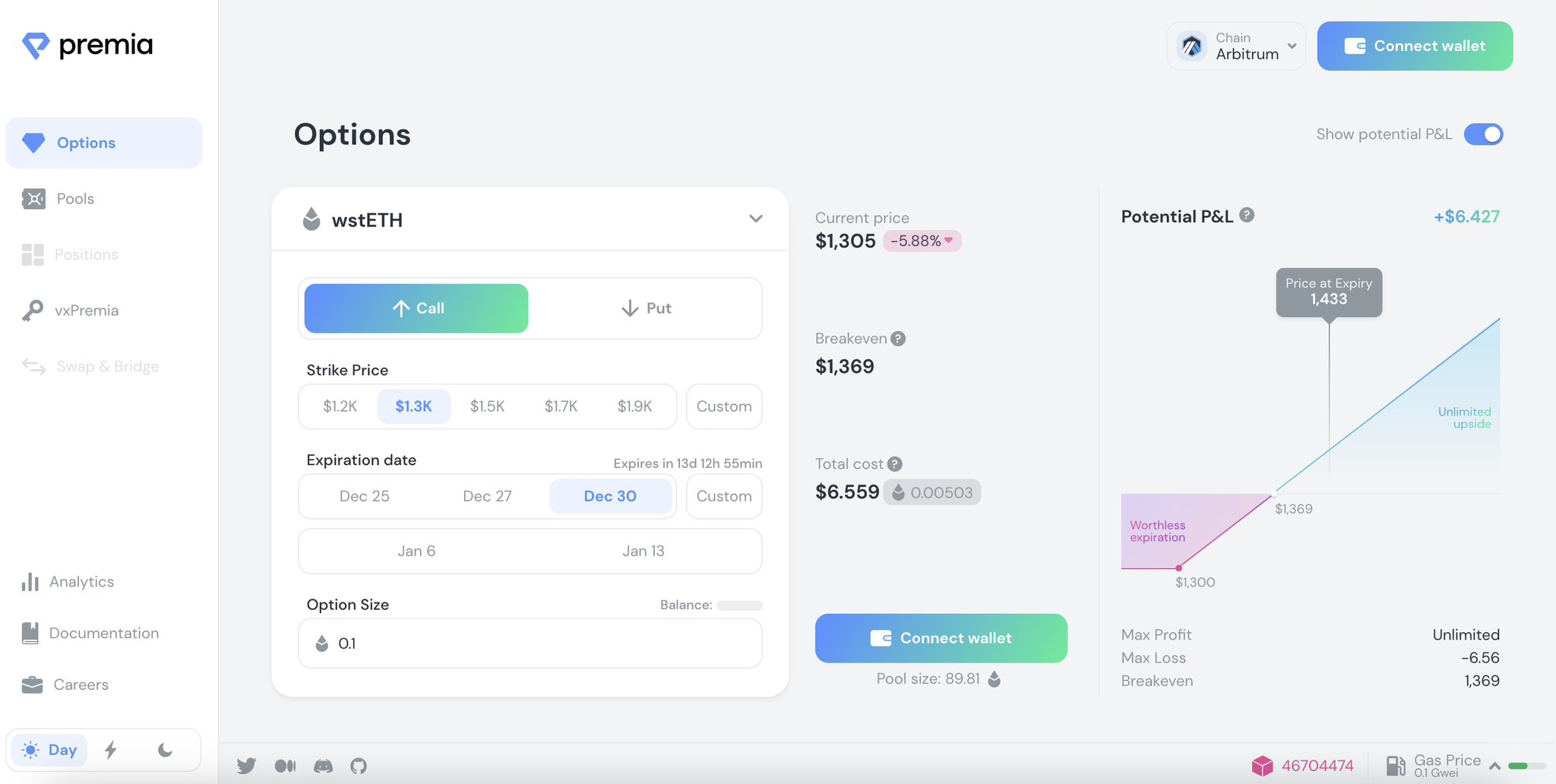

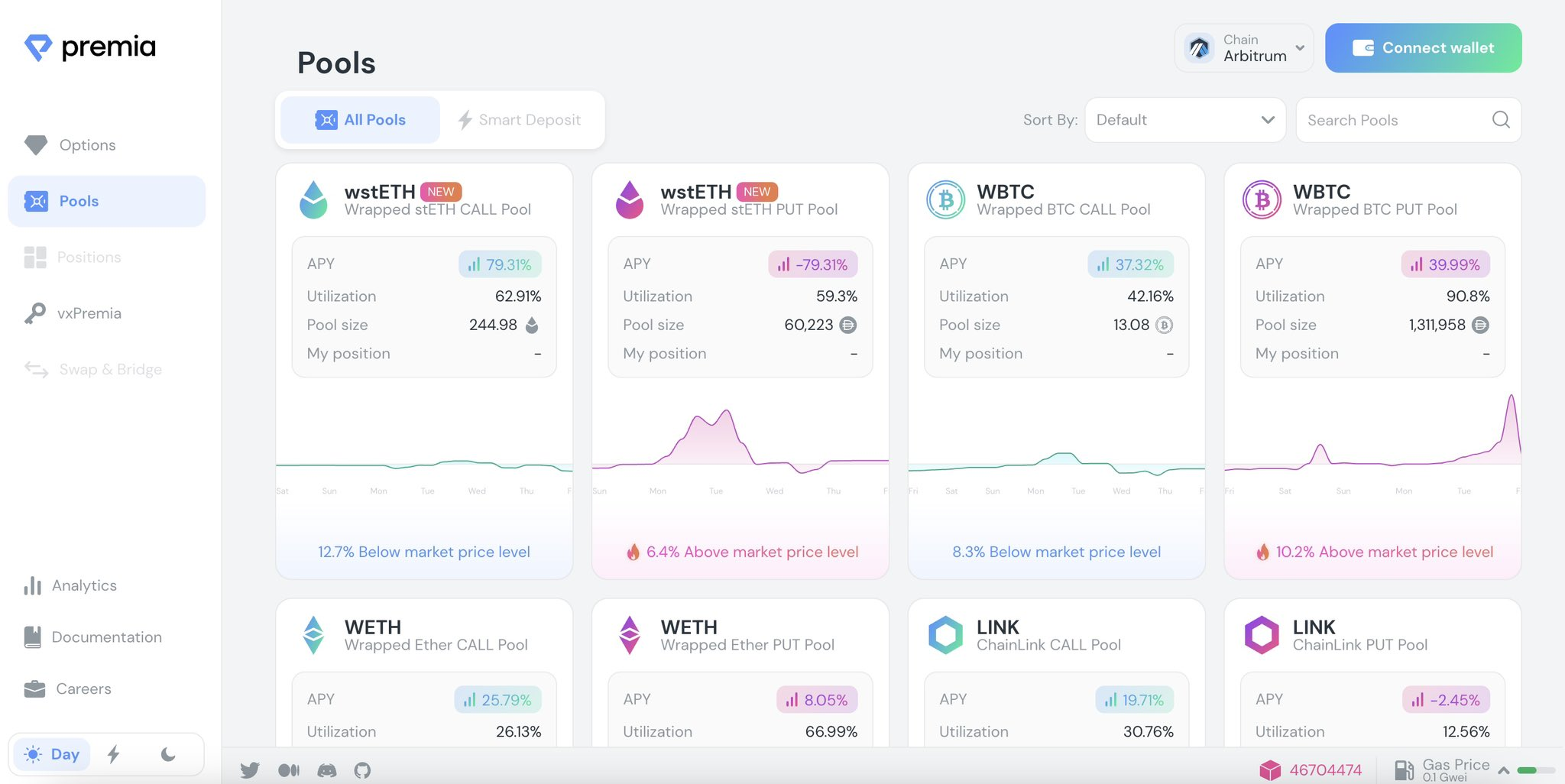

Premia Finance

Premia has been deployed on multiple chains including Arbitrum, and its TVL totals $7 million. Premia's user experience is fascinating, everything is easy to find and visualized, and its options can be exercised at any time before or after expiration.

Similar to Dopex, users can provide liquidity in Premia's liquidity pool and get token rewards. For example, if you are bearish on ETH, you can put ETH into the ETH/DAI call option pool. And vice versa, if you are bullish on ETH, you can put ETH into the ETH/DAI put option pool.

Dopex

Dopex is a very interesting protocol on Arbitrum, they also recently announced that they will be deployed on Polygon. So far, there are two types of Vaults available on Dopex: Single-Stake Option Vaults (SSOV) and Straddles.

In SSOV, users can buy call or put options, and can also provide liquidity for option vaults, and collect option fees from those who buy options to obtain income.

Instead, Straddles allow users to profit from volatility. Users can buy Straddle directly and bet on volatility; or provide liquidity for Straddle and earn option fees from buyers (hope the price remains stable).

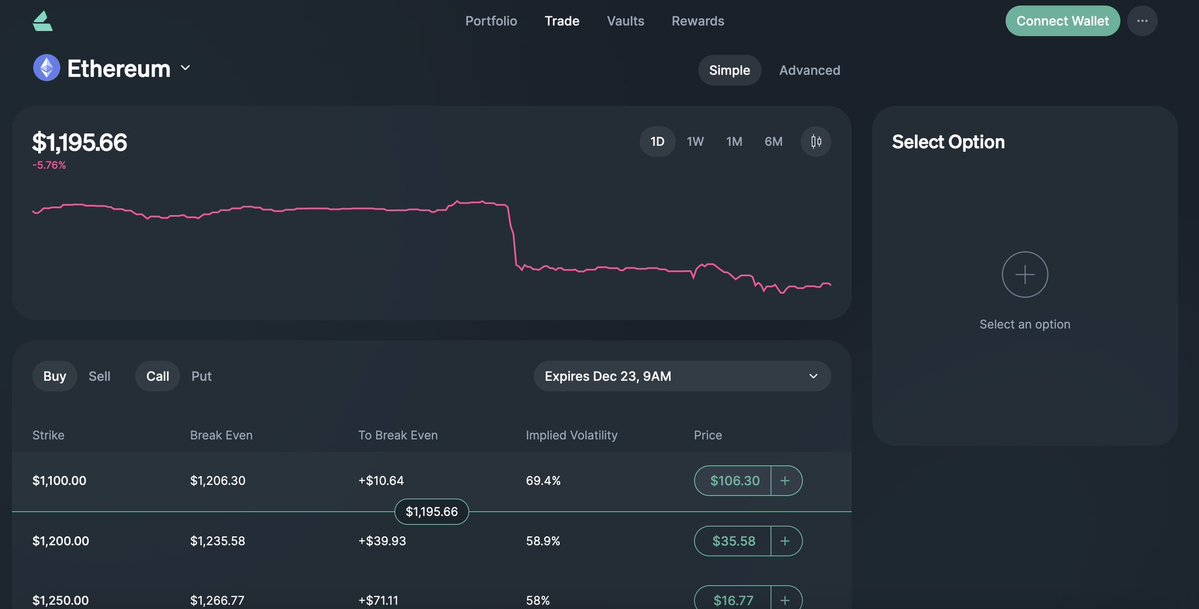

Lyra Finance

Lyra , built on Optimism, has a TVL of $13 million. Its "simple" part is intuitive and easy to use, with options to buy or sell calls or puts based on strike price and expiration date.

You can also choose to use the Advanced features if desired.

Buffer Finance

Built on Arbitrum, Buffer is a fork of GMX , providing binary options trading. Its operation is very simple and intuitive. You only need to select the execution price, expiration time and "up" or "down" to start betting.

Get an extra 70% bonus if you go in the right direction. For example, choosing a $100 call would net a $70 profit when correct. A portion of the fee will be paid directly to token holders.

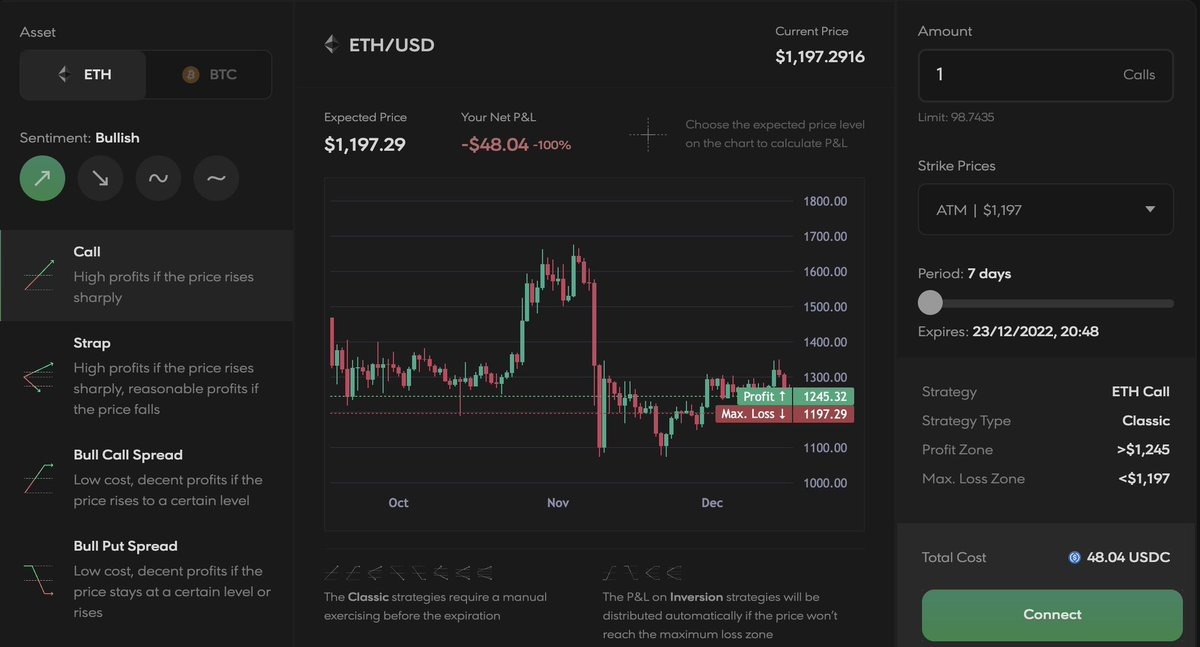

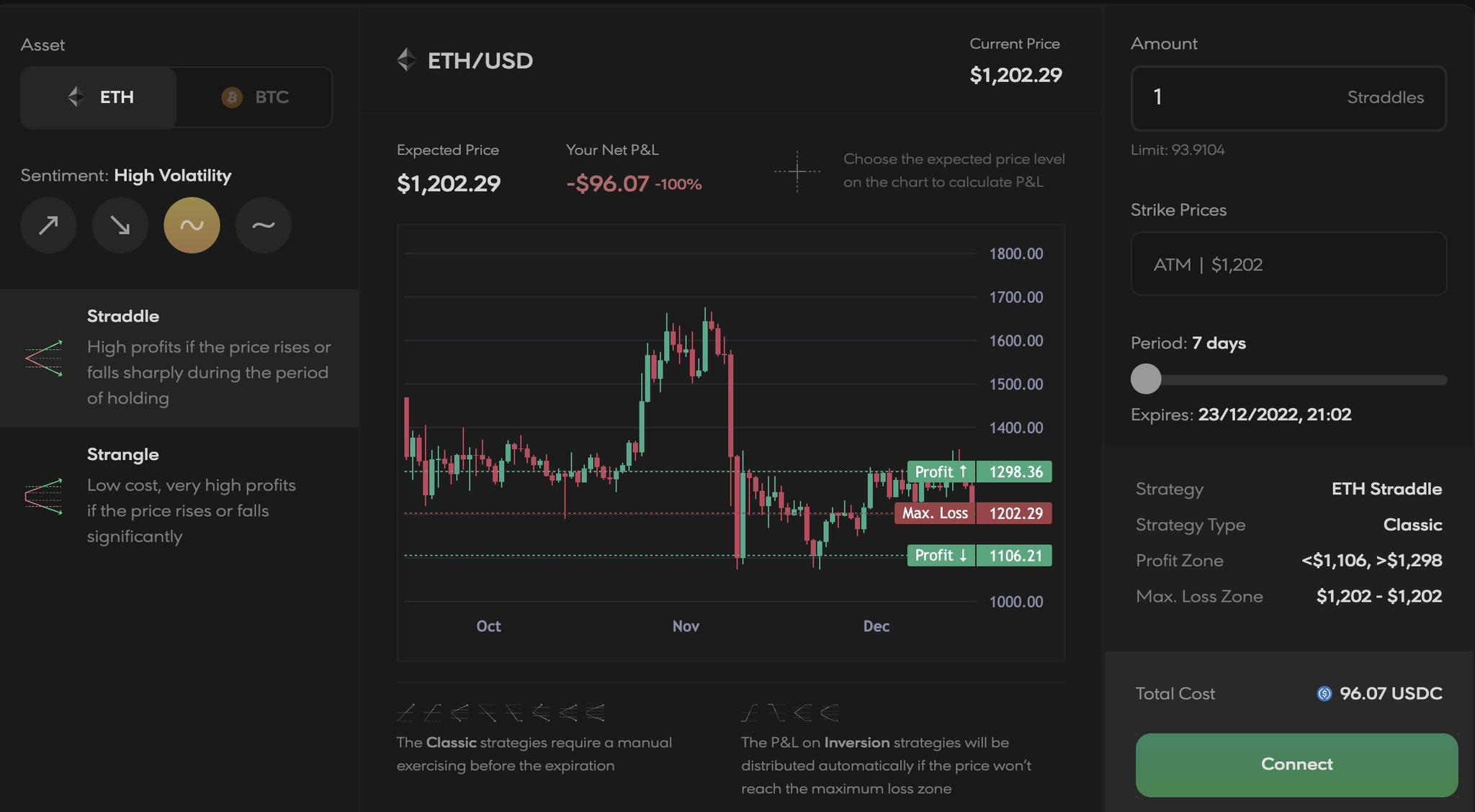

Hegic Options

Hegic , built on Arbitrum, has a TVL of $6 million, up 150% in the past month. Interestingly, in each direction, Hegic intuitively provides multiple strategies. For example, if you are bullish, you can choose the four strategies of Call, Strap, Bull Call Spread, and Bull Put Spread in the figure below. Similarly, for the bearish, there are also four strategies to choose from.

In addition, there are high volatility and low volatility options available on Hegic, offering two strategies each. For example, to choose high volatility, there are Straddle and Strangle strategies.

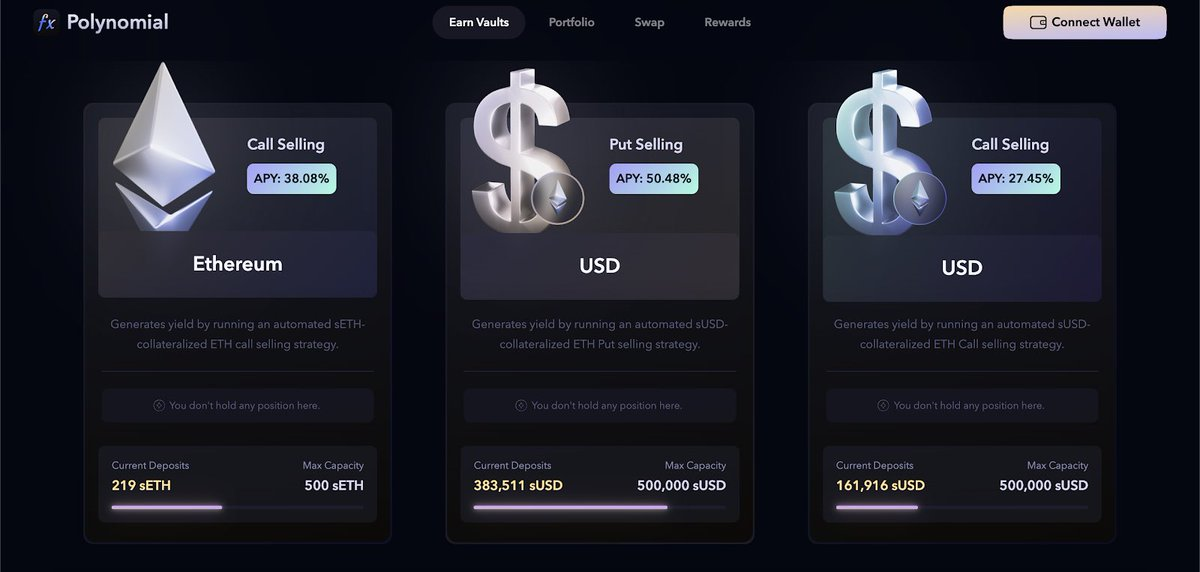

Polynomial Protocol

Polynomial is built on Optimism's Lyra Finance, using Synthetix's synthetic assets, the main product is Earn Vaults. These Vaults are option-based automated strategies that provide passive income. If you choose a suitable fund pool, APY may be high (~30%), because when the strategy is profitable, the rate of return obtained by the depositor through the option fee can be compounded, and you can also earn a 10% performance fee.

So far, with only 3 strategies, the TVL is ~$800k. Note that APY is not guaranteed. Whether it is a short/medium/long term call or put option, it is necessary to choose the correct fund pool (call option/put option).

UX is also a place that attracts attention, and the large-scale application of encryption technology also requires good UX. On Polynomial, information on strategy, performance, applicability, on-chain transactions, and more can be easily found.

Additionally, the project recently launched “Portal,” through which funds from Polygon, Arbitrum, and the Ethereum mainnet can be deposited. Although Polynomial runs on Optimism, it also allows users to add liquidity from other chains.

Currently Polynomial has not issued governance tokens.