Author: Michael Nadeau

Source: The DeFi Report

Compiled and edited by: BitpushNews

We believe that perpetual futures represent a significant innovation that will ultimately lead the evolution of the derivatives market structure—from fragmented, expiry-date contracts to a continuous, funding-rate-driven market.

This model is particularly well-suited for trading macro assets (such as foreign exchange and interest rates, which are among the world's largest markets) because traders in these markets seek exposure rather than actual ownership. We also anticipate that Real Assets (RWAs) will initially be tokenized via perpetual futures, as this structure avoids many of the frictions associated with tokenization, custody, transfer agency, and corporate behavior.

Hyperliquid , a perpetual futures decentralized exchange (DEX ) and the emerging L1 ecosystem, is built on first principles and aims to bring these advantages on-chain.

This report analyzes the latest developments in Hyperliquid's recent performance, including the progress of the HyperEVM Layer 1 blockchain. (The views expressed are those of the author and should not be considered investment advice.)

Let's begin.

Perpetual Contract DEX Financial Data

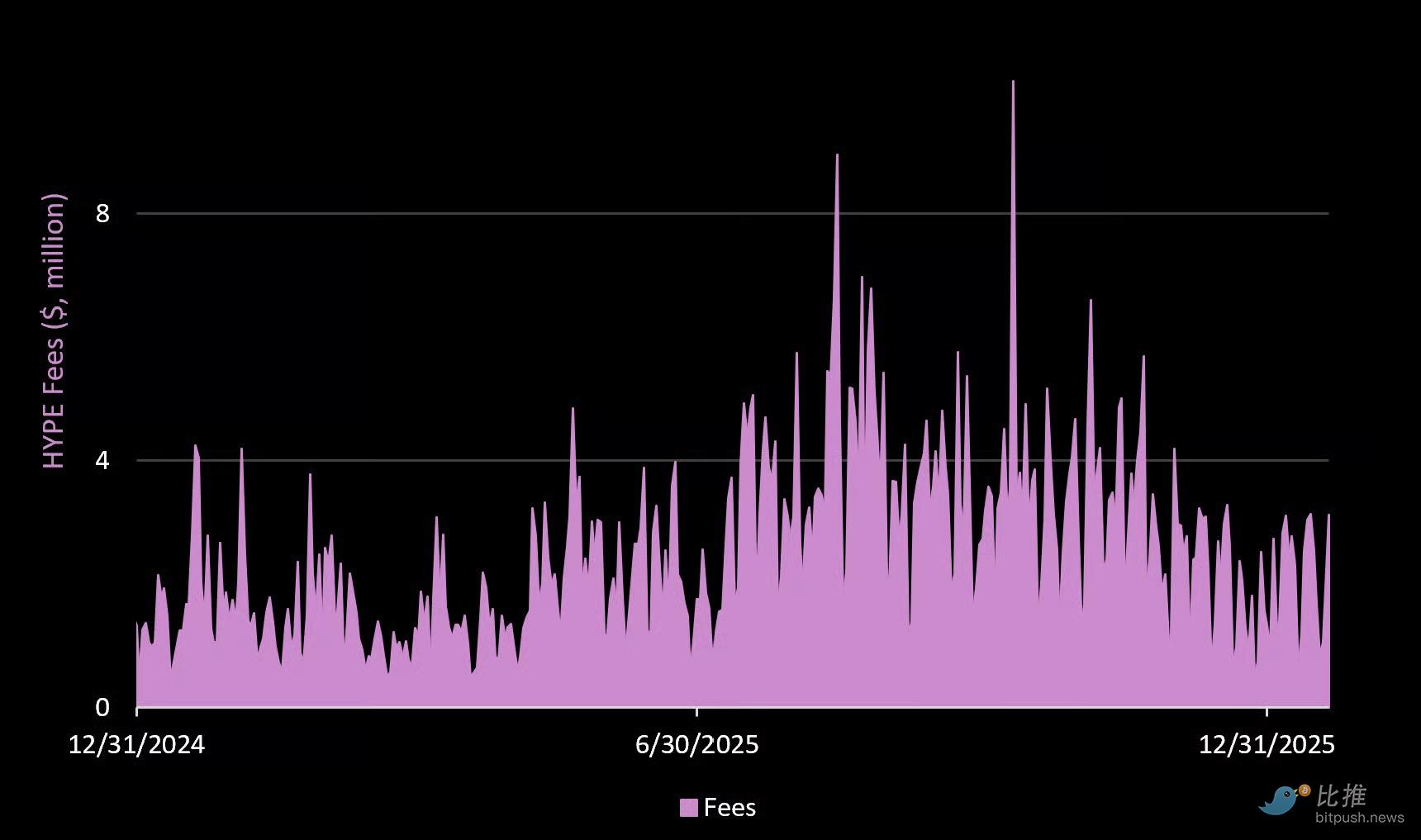

Fee income

- Total transaction fees over 365 days: $915 million

- Cumulative fees over 90 days: $230 million

- Total fees over 30 days: $57 million

Perpetual contract trading contributes approximately 97% of transaction fees, while spot trading accounts for only 3%.

Key Points

Fee revenue from Hyperliquid perpetual contract DEX has declined, but the decline is much smaller than what we have seen on Solana and its leading applications.

For example, in the fourth quarter, Hyperliquid generated $270 million in fee revenue (a 16% decrease from the third quarter). During the same period, Solana 's REV declined by 60%. So how did the leading applications on Solana perform during that time?

- Raydium : Down 79%

- Jito: Down 76%

- Axiom : Down 61%

- Jupiter : Down 37%

- Pump.Fun : Down 19%

Amidst heightened risk aversion and a precipitous drop in market interest in cryptocurrencies, Hyperliquid has demonstrated remarkable resilience compared to other top public chains and applications. This is unique, especially for a "high-flying" application experiencing its first bear market.

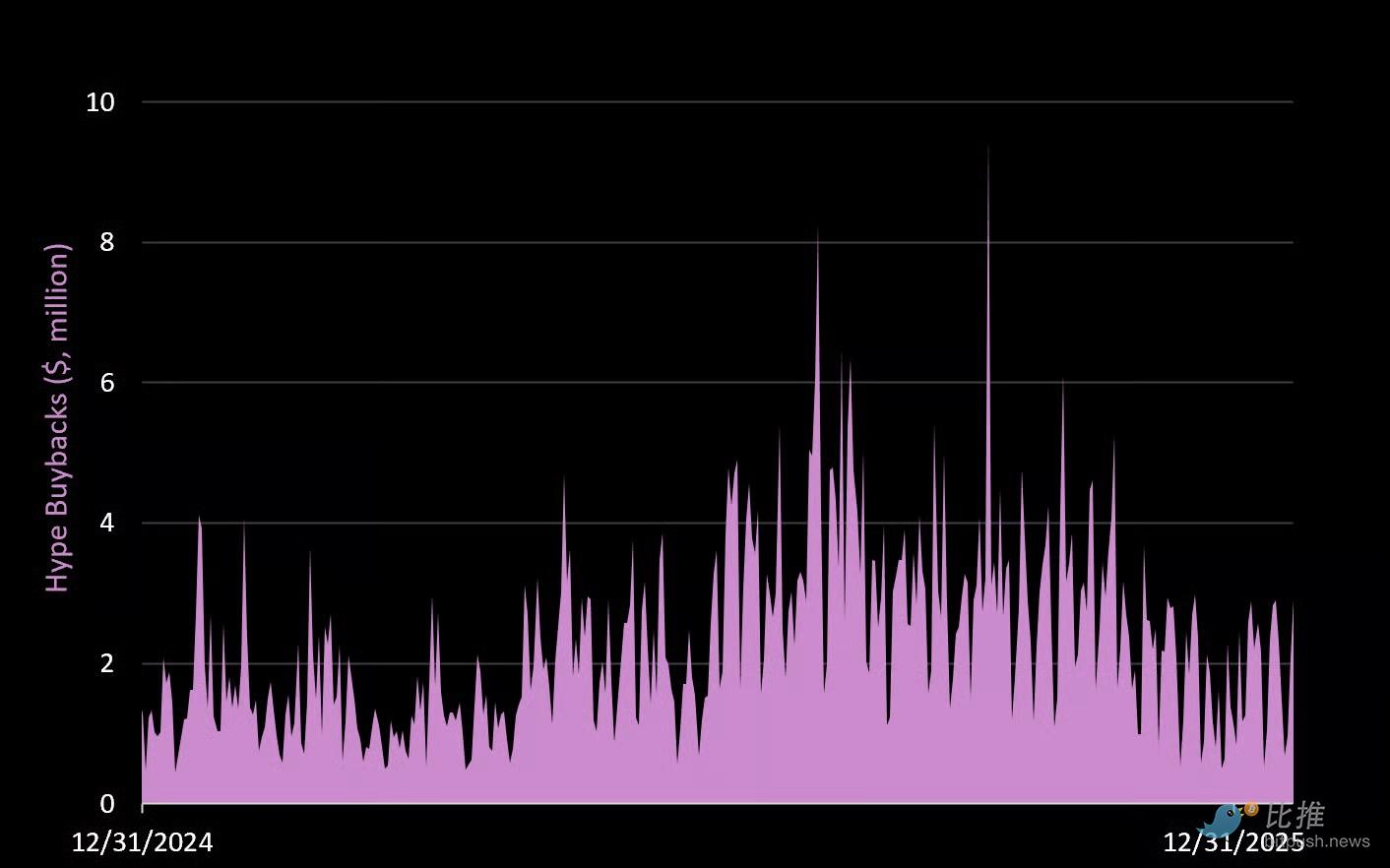

Repurchase Status

Over the past year, Hyperliquid has used 93.3% of its transaction fees for HYPE token buybacks, totaling $854 million (an average of $2.3 million per day).

Key Points

If Hyperliquid can maintain its user base during the bear market, then steady buying of the token could help offset any increased selling pressure, meaning its "cycle low" could be shallower than we typically see in new projects during their first bear market.

Further details regarding the token economic model and team unlocking will be provided in a later section of the report.

Perpetual Contract DEX Fundamentals

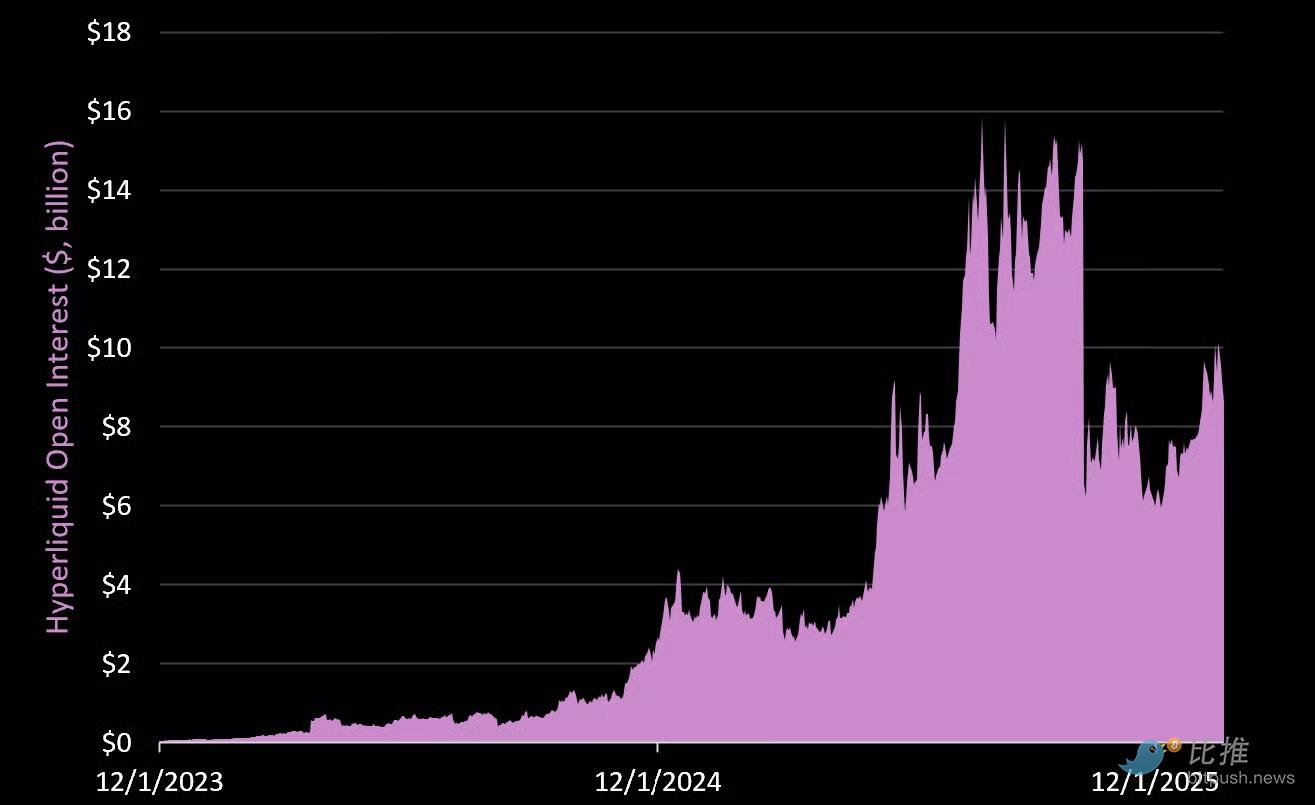

Open contracts

Hyperliquid's open interest is currently just under $10 billion, down from a peak of $15.8 billion last August.

Binance , the largest centralized perpetual contract exchange, currently has $29 billion in open interest, having peaked at $44.5 billion in early October last year.

Compared to its decentralized competitors:

- Aster open interest = $2.5 billion

Lighter open interest = $1.2 billion

- Drift open interest = $247 million

Jupiter open interest = $181 million

Key Points

In just over a year, Hyperliquid has captured a significant share of the centralized perpetual exchange market (equivalent to 34% of Binance open interest and 54% of CME crypto futures open interest).

Meanwhile, its open interest is more than twice the combined total of its top four decentralized competitors.

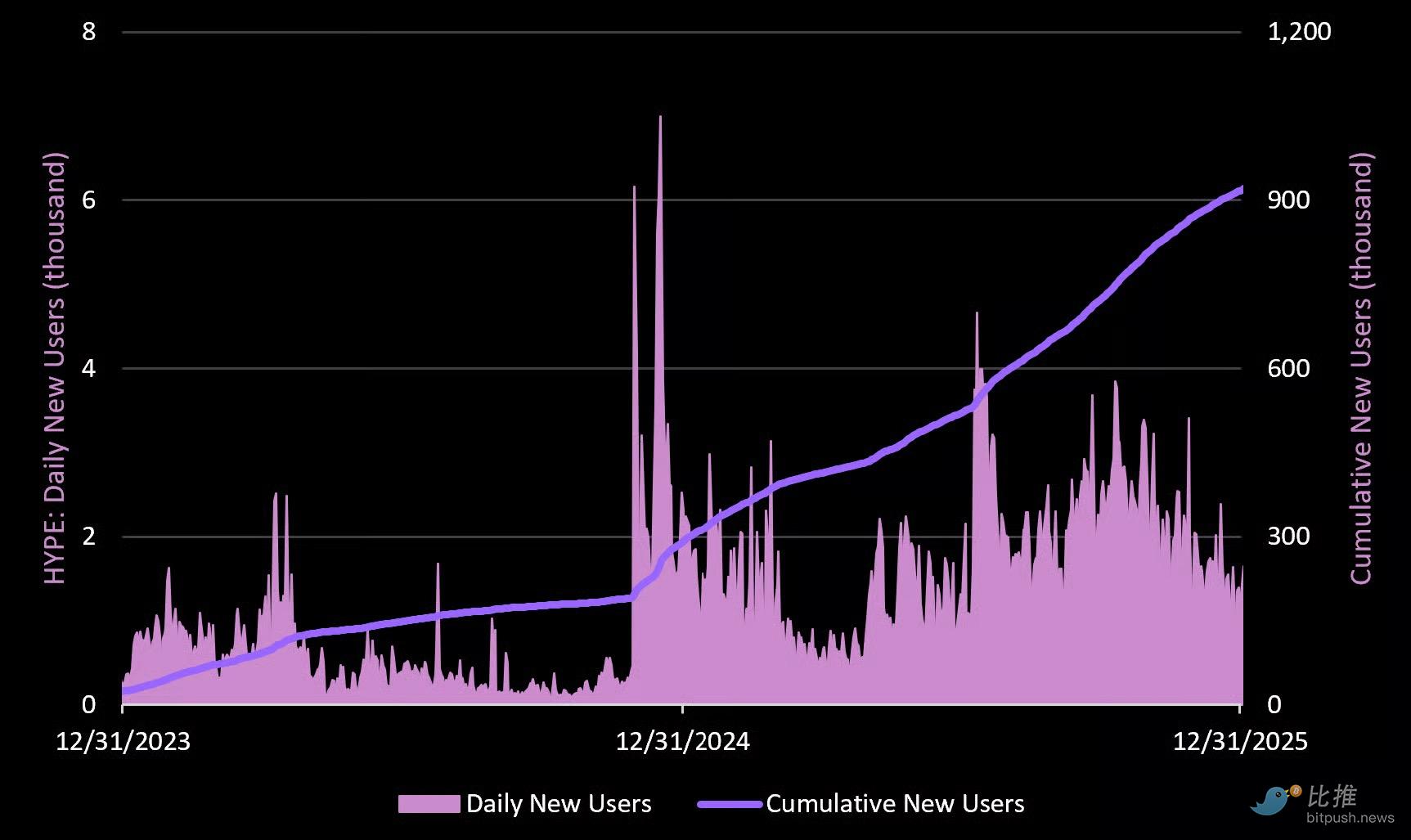

Active address

At its peak, the Hyperliquid perpetual contract DEX added approximately 2,600 new users per day. Over the past 30 days, that number has dropped to approximately 1,600 new users per day (a decrease of 38%).

The number of new addresses may not seem high, but this aligns with our understanding of the unit economics of the crypto trading market. A small group of highly active traders tends to contribute the majority of revenue. The key is to observe how this holds true during a bear market.

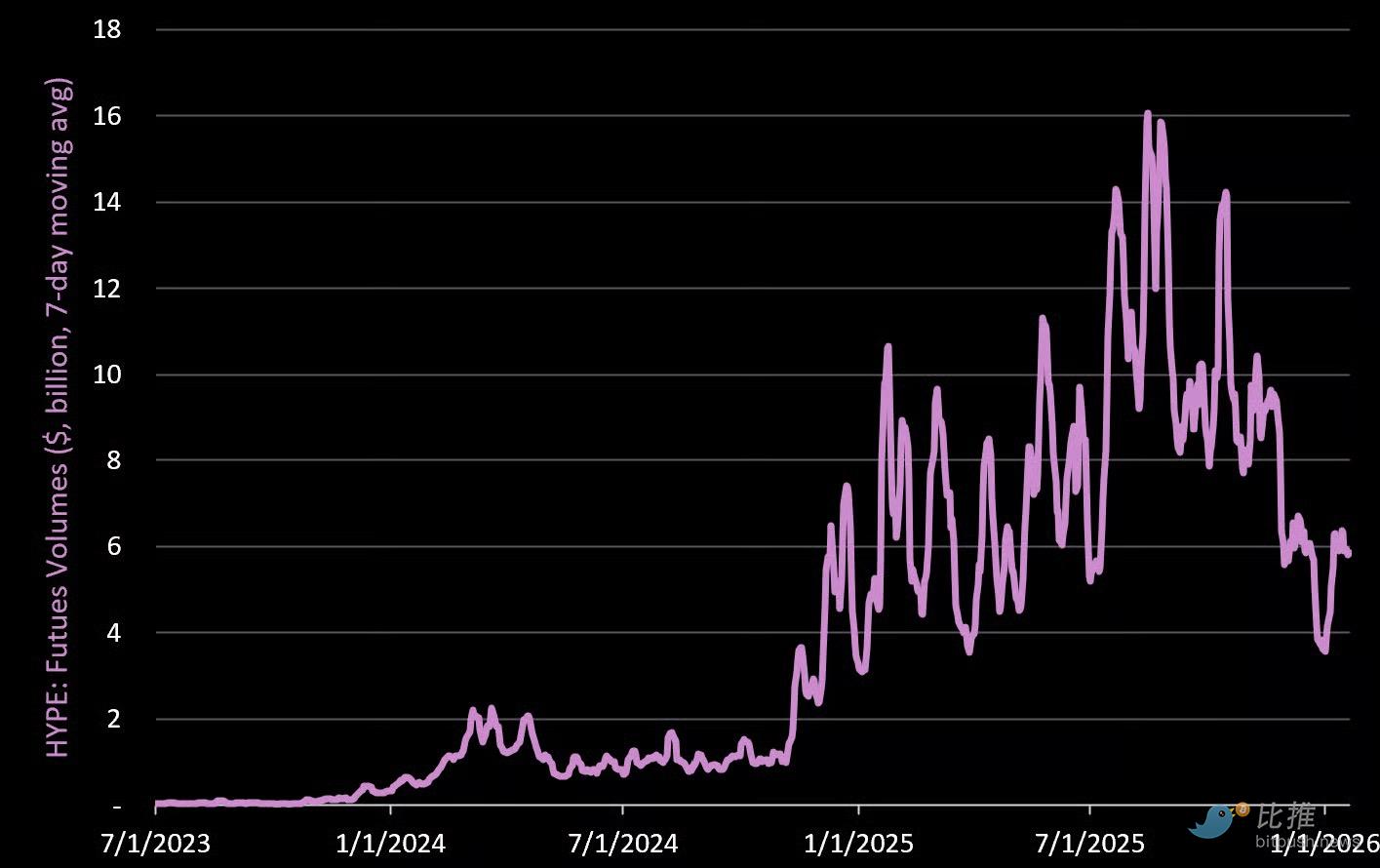

Perpetual contract trading volume

Over the past 30 days, Hyperliquid's average daily futures trading volume was $5.2 billion—a 47% decrease from its peak of approximately $9.8 billion per day.

Interestingly, Real Assets (RWAs) currently drive the third-highest trading volume, after BTC and Layer 1 tokens.

Key Points

The decline in futures trading volume (relative to fee revenue) was even greater, suggesting that clearing fees may have partially filled the gap. For reference, the DEX processed over $90 billion in clearings on October 10th of last year, generating over $10 million in fees (almost double Hyperliquid's second-day profit).

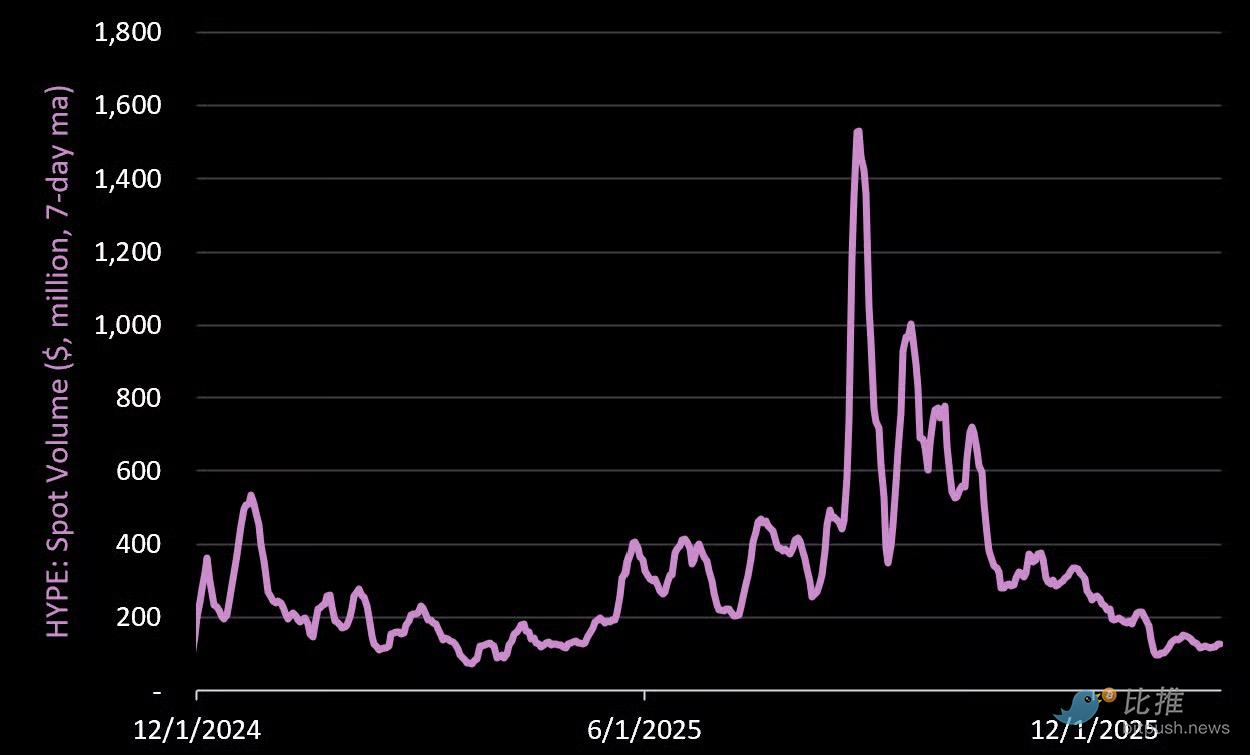

Spot trading volume

At its peak, Hyperliquid's daily spot trading volume was approximately $820 million. Over the past 30 days, its average daily spot trading volume has been $127 million (a decrease of 84%).

At its peak, Hyperliquid's daily spot trading volume was approximately $820 million. Over the past 30 days, its average daily spot trading volume has been $127 million (a decrease of 84%).

Over the past 365 days, spot trading volume has accounted for approximately 3% of Hyperliquid's total transaction fees.

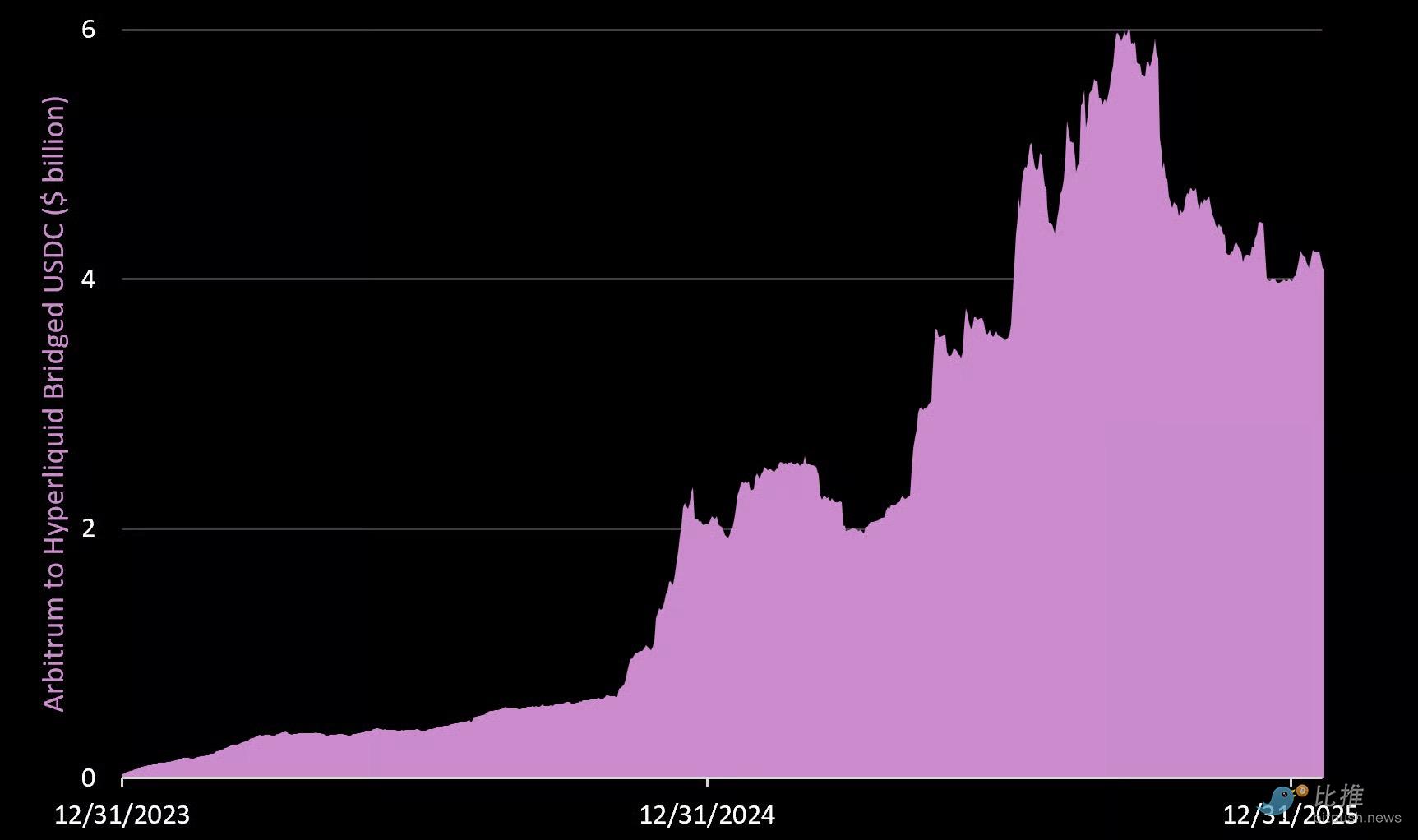

Cross-chain bridging value

There is currently over $4.1 billion in value locked on the Hyperliquid DEX. This is lower than the peak of $6 billion last September.

For reference, Solana's TVL is currently $8.7 billion.

Since its launch, a total of $318 billion has been deposited for transactions, of which $314 billion has been withdrawn.

HyperEVM Fundamentals

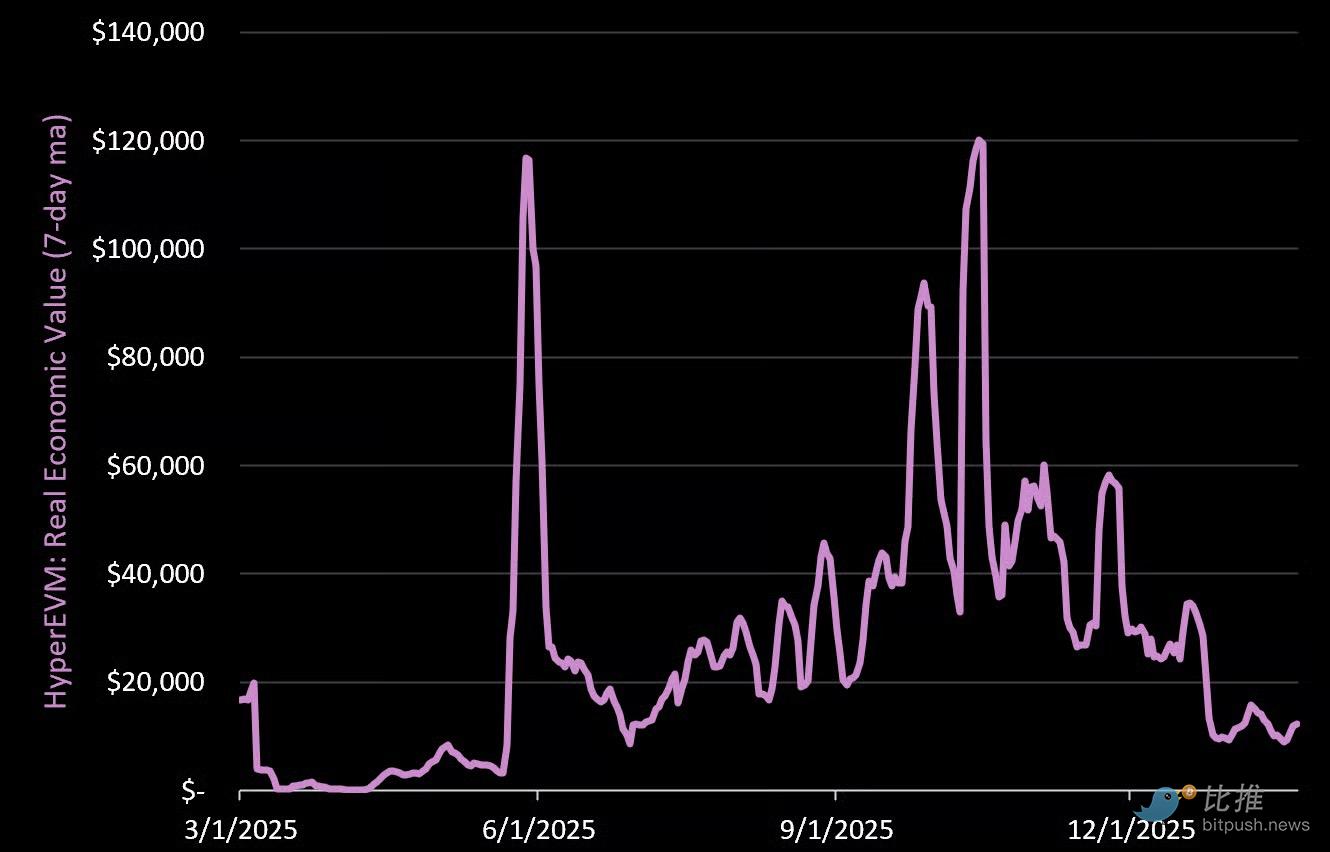

Hyperliquid is unique in that it started as a perpetual contract DEX, but it is also a Layer 1 blockchain. In this section, we provide an update on the emerging but still developing HyperEVM.

REV (Income)

Since its launch (last February), HyperEVM has generated $8.9 million in REV. Over the past 30 days, its daily REV averaged only $11,700, down from its peak of $66,000 per day. On October 10th of last year, the protocol generated $450,000 in fees.

In terms of TVL (TVL), Hyperliquid L1 currently holds slightly less than $12 billion in value. This includes over $500 million in the liquid staking protocol Kinetiq, over $300 million in the lending protocol Morpho, and over $240 million in the lending protocol HyperLend.

Active address

Over the past 30 days, the L1 address has averaged approximately 12,000 unique active addresses per day. This is lower than the peak of approximately 20,000 per day in September/October of last year.

Over the past 30 days, the L1 address has averaged approximately 12,000 unique active addresses per day. This is lower than the peak of approximately 20,000 per day in September/October of last year.

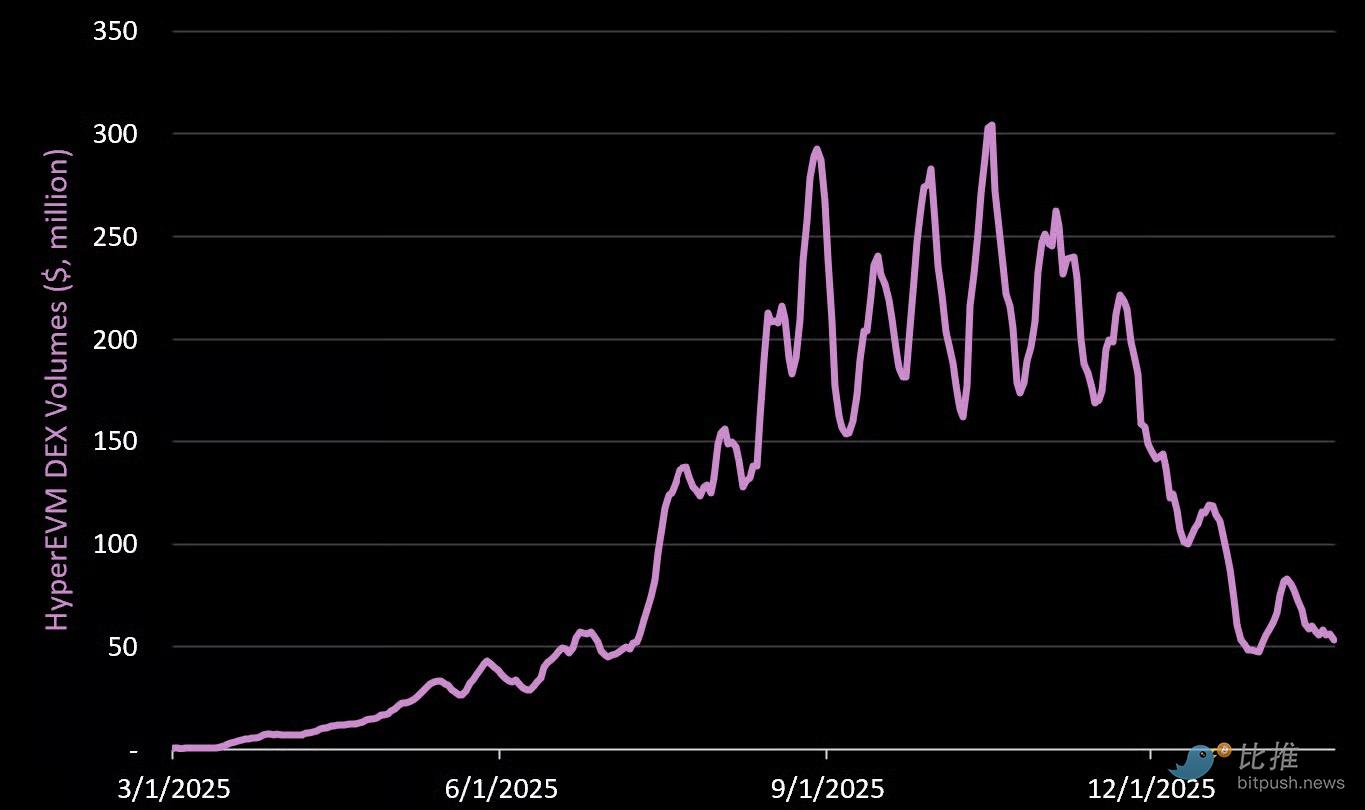

DEX trading volume

In terms of DEX trading volume, the L1's average daily trading volume over the past 30 days was $62 million—negligible compared to Ethereum and Solana.

In terms of DEX trading volume, the L1's average daily trading volume over the past 30 days was $62 million—negligible compared to Ethereum and Solana.

Stablecoin supply

As of January 21, 2026, there are over $674 million in stablecoins on Hyperliquid L1. Recent growth can be attributed to Circle (USDC)'s deployment on Hyperliquid, where it holds a 50% market share. Tether accounts for 21% of stablecoins on Hyperliquid, Paxos 12%, and Ethena 11%.

Token economic model

This section covers the HYPE token—which represents equity in the Hyperliquid perpetual contract DEX and L1.

- Maximum supply: 1,000,000,000

- Released supply: 395,494,480

- Core Contributors: 22.3M

- Hyper Foundation: 60M

Genesis Airdrop Allocation: 310M

- HIP-2: 120K

- Community: 3M

Token distribution

- Genesis Airdrop: 31%

- Future release and community rewards: 38.88%

- Core Contributors: 23.8% (Unlocked starting in November 2025, continuing until November 2027)

- Hyper Foundation budget: 6%

- Community grant: 0.3%

- HIP-2 (Hyperliquidity): 0.012%

Token unlocking

Team tokens began unlocking last November. From now until November 2027, the protocol will release 9,916,666 HYPE tokens to the team each month (worth $213 million per month at the current HYPE price).

Hyperliquid has no venture capital backing, so no investors have unlocked it.

Buyback

Over the past 30 days, the average daily repurchase amount was $1.7 million (79,000 HYPE tokens per day). At this rate, approximately 2.3 million HYPE tokens are removed from circulation each month, or 28 million HYPE tokens per year.

Key Points

Hyperliquid's buyback program provides solid buying support for the token, but the team is currently unlocking more than four times the amount of tokens each month. Of course, if user activity declines, the buybacks will decrease accordingly.

More analysis on "repurchase yield" is below.

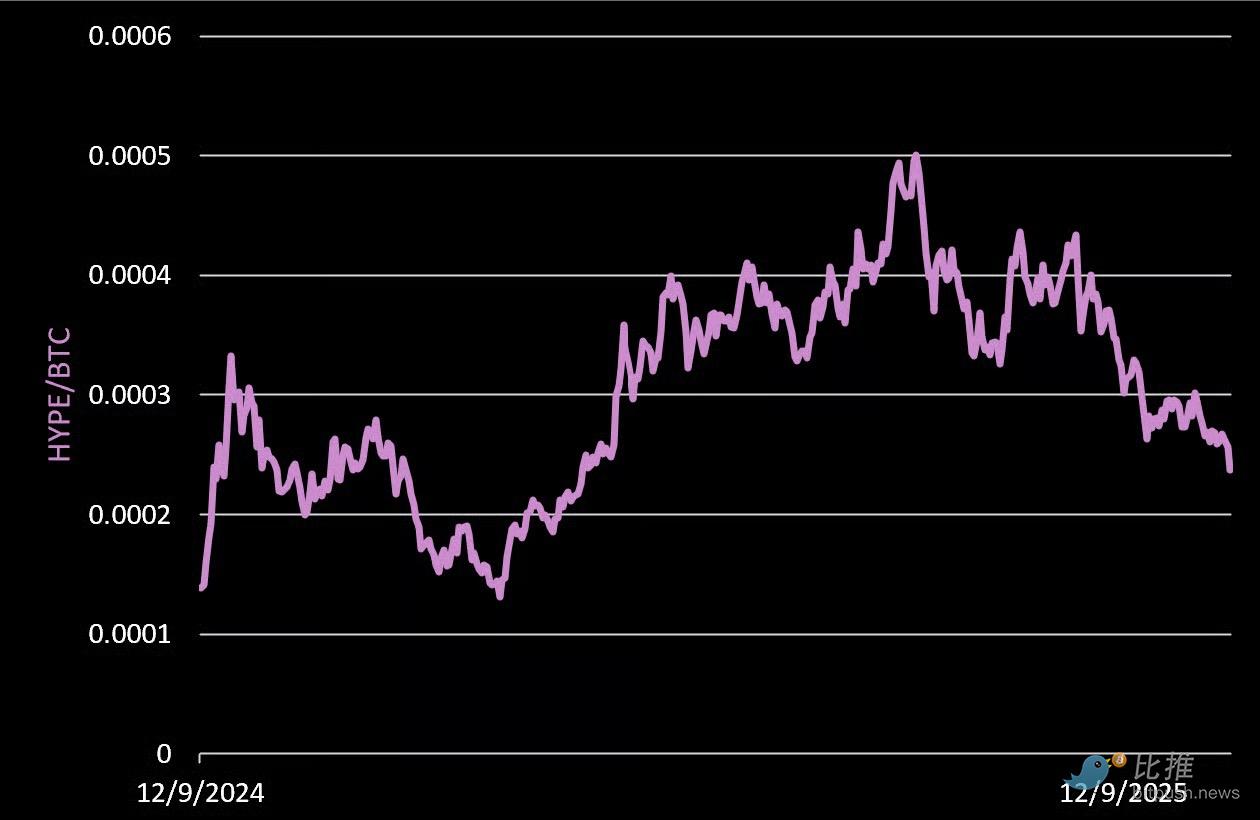

Relative performance

Since its launch, HYPE has risen 71% relative to BTC. From April to September last year, it outperformed BTC by 278%.

However, since its peak last September, HYPE has lagged behind BTC by 52%.

For reference, ETH fell 21% relative to BTC during the same period, and SOL fell 47% relative to BTC.

Valuation Analysis

HYPE's current fully diluted valuation is $20.5 billion. Its 365-day fee revenue is $915 million. This translates to a fully diluted price-to-sales ratio (P/S) of 22.4x (down from 66x in August).

In terms of price-to-sales ratio based on free float market capitalization, it is 7.1 times (down from 21.9 times in August). This is currently lower than the levels we typically see in high-growth tech/fintech companies (8-16 times).

Repurchase yield

This analysis differs from traditional tech/fintech companies due to Hyperliquid's buyback mechanism—because its revenue is not hoarded by the company (and held in fiduciary duty to investors), but is instead used to buy back HYPE tokens.

- Total repurchase amount over 365 days = US$854 million.

- Market capitalization = $6.5 billion.

- The current implied "repurchase yield" is 13.1%.

This means that Hyperliquid has bought back tokens equivalent to 13% of its market capitalization over the past 365 days.

However, this does not take into account new token issuance/unlocking—currently, its monthly unlocking volume is more than four times the buyback volume.

Conclusion

We believe that perpetual futures are likely to become the mainstream abstraction for users trading macro financial assets, particularly foreign exchange and interest rates. Furthermore, listing and trading RWA derivatives is far easier than trading tokenized stocks/bonds themselves (tokenized assets require custody, transfer agents, corporate actions, dividends, etc. – perpetual contracts avoid all of these).

The key risks at present are regulation and whether Hyperliquid/decentralized solutions can be included in the US Crypto Markets Structure Act. Our view is that Hyperliquid itself may not be directly regulated, but its consumer-facing interface will be subject to regulation.

Nevertheless, Hyperliquid is succeeding. We believe there are five main reasons:

1. An excellent product with a user experience comparable to CEXs, while also allowing users to self-host.

2. The best narrative since BTC and ETH: 31% of tokens were airdropped to early users, creating a huge wealth effect and a loyal community.

3. An excellent token economic model that is highly aligned with the interests of users and token holders.

4. The founding team has strong technical capabilities and clear goals.

5. Having been integrated with mainstream wallets such as Phantom and applications such as Axiom from its early stages, Hyperliquid is now gradually becoming the default "perpetual contract trading" infrastructure in the entire crypto space, allowing users to trade through a user-friendly front-end interface while utilizing Hyperliquid's liquidity in the back-end.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush