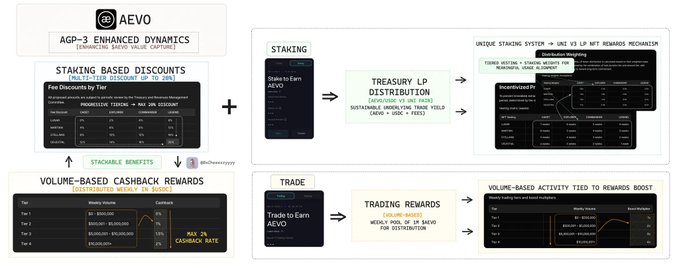

.@aevoxyz just rolled out volume-based fee cashback in $USDC, offering up to 2% back depending on your tier.

This stacks on top of existing staking benefits, meaning stakers now enjoy both (1) discounted fees (up to 20%) and (2) direct $USDC rebates which effectively lowers trading costs across the board.

Cashback is calculated based on weekly trading volume and is automatically distributed at the end of each epoch.

*Note: Cashback currently applies to perps only, not options or pre-launch markets.

IMO this is a pretty meaningful upgrade for active traders.

Note that with AGP-3 in-place, Aevo also has the following usage perks:

🔸 Trading Rewards → Volume-based w/ weekly 1M $AEVO to distribute to active traders on a rolling weekly cycle.

🔸 Enhanced $AEVO Staking → Significant share of Treasury LP distributions in June ($AEVO + $USDC + trade fees) which represents direct platform-to-token value transfer.

🔸 Buyback & Burn Mechanism → Recurring monthly program where buybacks scale with platform-wide volume

Between staking multipliers, LP-based real yield, and now direct fee rebates, Aevo is steadily turning its incentive design into a self-reinforcing loop:

Lower effective fees → more volume routed → higher rewards generated for aligned power users

A strong direction overall, and one that positions Aevo as one of the most cost-efficient venues for perps rn.

They’re heading in the right direction

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content