Cardano price has surged again, but the outcome seems familiar. Since January 20, 2024, ADA has increased by about 7%, a slight rise followed by a plateau and stabilization around $0.35. This isn't a new breakout. In fact, it's just another upward surge that couldn't sustain the recovery.

There are three main reasons why Cardano price has repeatedly surged and then failed, and why the old pattern continues.

Reason 1: A weak hidden bullish divergence triggered the rally.

The latest surge occurred when a hidden bullish divergence appeared on the 12-hour chart. From the end of December to January 20, 2024, the price of ADA formed a higher Dip , while the RSI formed a lower but very slight Dip .

This detail is crucial. The slight decrease in the RSI suggests that selling pressure is easing somewhat, rather than buyers dominating the market. This type of divergence typically only supports short-term rallies and is not strong enough for sustained price increases.

Weak divergence: TradingView

Weak divergence: TradingViewWant more insights on Token like this? Sign up for Editor Harsh Notariya's daily crypto newsletter here.

That's exactly what happened. The price of Cardano surged by about 7% to $0.37 on January 21, 2024, but the recovery was short-lived and quickly stalled.

The reason relates to this timing. On January 21, 2024, when the price of ADA approached $0.37, Cardano 's development activity index also peaked at nearly 6.94 – its highest level in about a month.

Development activity indicates that the project has received numerous updates, which often boosts price confidence. In mid-January 2024, the peak price of ADA in the small region occurred shortly after this peak in development activity.

Peak activity develops and then declines: Santiment

Peak activity develops and then declines: SantimentHowever, the support from development activity didn't last long. As the data cooled down, prices followed suit. They have now edged back up to around 6.85 but are still unable to surpass the month's high. The divergence helped halt the sell-off, but didn't create enough demand for prices to continue rising as development activity slowed.

Reason 2: Profit-taking skyrockets every time Cardano price increases.

The bigger issue lies in what happens after Cardano begins its price recovery.

The "spent coins age band" index tracks the amount of coins moved across different age groups, and an increase in this index usually indicates increased profit-taking or selling pressure. In the past month, coin movement has surged after each price surge.

In late December 2023, Cardano price increased by approximately 12%, while coin movement exceeded 80%, indicating strong selling pressure as the price rose. In mid-January 2024, ADA increased by about 10%, and this indicator then jumped to nearly 100%, once again confirming that investors took advantage of this surge to take profits and exit their positions.

Peak coin activity: Santiment

Peak coin activity: SantimentThis trend continues. Since January 24, 2024, coin movement has increased by over 11% – from 105 million to 117 million, even though the ADA price has yet to make a clear breakout. This indicates that sellers are ready to sell as soon as the price rises, instead of waiting for a clear confirmation signal as before.

That's why the upward momentum keeps weakening. Each recovery is met with profit-taking that happens even faster than before.

Reason 3: Whales are reducing their risk levels and not absorbing the sell-off.

Normally, whales would help absorb this kind of selling pressure. However, they are not doing so now.

Wallets holding between 10 million and 100 million ADA have seen their ADA holdings decrease from approximately 13.64 billion to approximately 13.62 billion ADA, a reduction of over 20 million ADA since January 21, 2024. Similarly, wallets holding between 1 million and 10 million ADA have seen their holdings decrease from approximately 5.61 billion to approximately 5.60 billion ADA since January 22, 2024, a further reduction of nearly 10 million ADA .

Whales reduce their ADA holdings: Santiment

Whales reduce their ADA holdings: SantimentThis isn't a sell-off, but it does indicate that whales are clearly reducing their ADA holdings. The lack of buying pressure from whales means profit-taking isn't being absorbed, leaving ADA prices vulnerable to downward pressure when selling emerges.

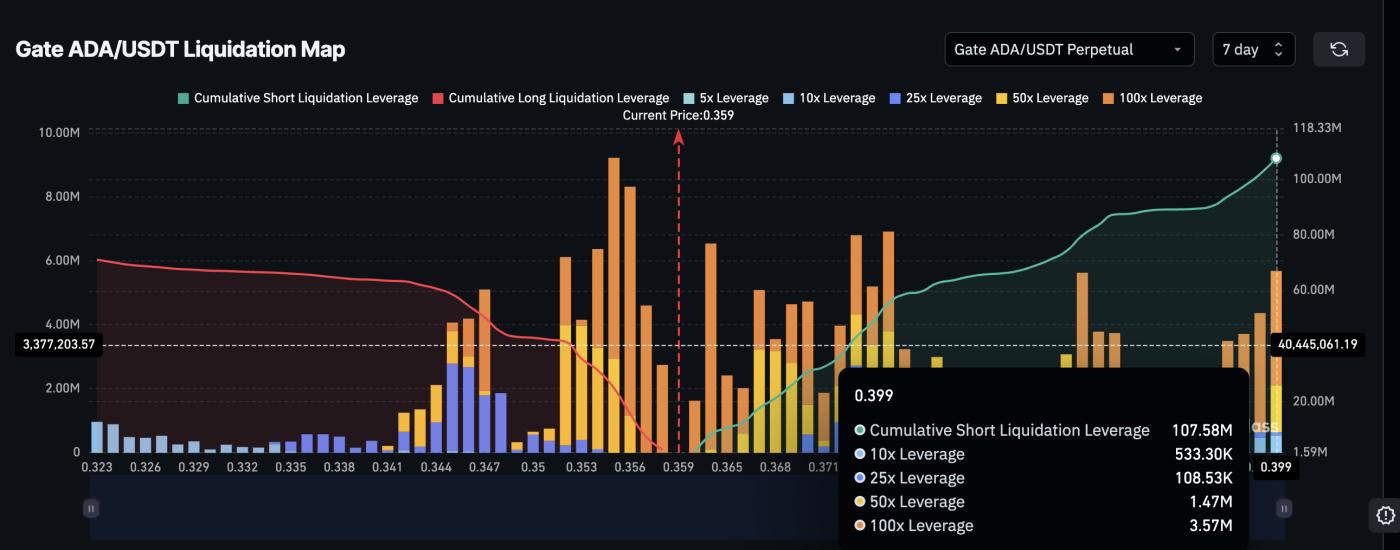

Derivative data further reinforces this weakness. Over the next seven days, nearly $107.6 million worth of Short positions were liquidated, while only about $70.1 million worth of Longing positions were liquidated. Short positions outnumbered Longing by more than 50%, suggesting that traders' expectations of a price increase were dashed rather than continuing to rise.

Liquidation map: Coinglass

Liquidation map: CoinglassThis imbalance suggests the market anticipates selling pressure will quickly return if Cardano attempts a recovery, especially as the price approaches resistance levels.

Cardano price levels will determine its next development.

The current price structure makes things much clearer.

On the upside, the $0.37 mark remains the first crucial level. If the price breaks through and holds above this level, it could trigger a mass liquidation of Short positions, creating a short-term rebound. However, the $0.39 area is even more important. If the price surpasses this area, most remaining Short positions will be liquidated, and this is also the first sign that the trend may reverse. Further up, the $0.42 area would be where a broader bullish structure could reappear.

Conversely, the $0.34 level is a crucial support. If the price breaks below this level, a large number of Longing positions will be liquidated, and downward pressure could increase rapidly as loans are closed.

Cardano Price Analysis: TradingView

Cardano Price Analysis: TradingViewFor Cardano to emerge from this phase , three factors need to occur simultaneously: development activity must rebound and remain above recent highs; the number of coins in use needs to decrease instead of increasing with each rebound; and whales need to return to net buying.

Until then, Cardano 's recovery phases remain quite fragile and vulnerable.