I'm getting more and more obsessed with thinking around the various fundamentals of Web3. As a person with a builder's mindset, I think that blockchain will become the infrastructure technology of the next wave of Internet innovation, with endless potential (perhaps optimistically). But for the masses, there is still a lot of education and recognition work to be done. Tragically, credibility is sorely lacking in an area where Rug Pull and fraud happen every day.

This highlights the need to fully simplify the Web3 entry. As builders, our goal should be to: 1. Increase the inflow of new users and 2. Maintain continuous participation in the field. We "fanatics" can't keep curious people out, but let them join in the mission of transferring value from the tech giants to independent creators. Our role is to make Web3 more approachable, so that it can broadly gain the trust of newcomers.

It's time to lower the barriers to entry.

This might be the solution.

Social wallet gameplay

This guide was originally written to promote the community platform islands. Sadly, it didn't quite win them over, as their leadership had a different vision of how the future should play out. But the article itself was well-received, and the discussions around feasibility and usability were fruitful. So, in order to make these efforts not in vain, I am posting it to share with readers.

The following is the full text of "Web3 Social Wallet Gameplay" written from the perspective of the community platform (mentioned later in the relevant platform article).

forward-looking

The progress in the field of currency wallets has been very sufficient. Top players such as Metamask, Phantom, and Rainbow have greatly solved the use cases of currency storage and transactions, and are greatly improving the problem of Web3 access. In my opinion, the next wave of popularity of Web3 will be achieved by "democratization of community participation". Social wallets are just one of the many ways.

status quo

Social tokens are a means of proving community connection through on-chain ownership of digital assets. More precisely, there are two types of tokens that can provide Web3 access experience: homogeneous and non-homogeneous. Here are two examples:

- Homogeneity » FWB needs to own $75 worth of tokens, once approved to experience its community in depth.

- Non-homogenization » Anti requires Antipass to gain instant access to the community without approval.

Each of these types of tokens has advantages and disadvantages, and which one to adopt largely depends on the specific use case. Why is this important? Because at the bottom of Web3, a development trend has emerged, that is, the infrastructure supporting various communities based on social tokens is being put into construction. See: islands, metalink, matrica, backdrop and guild.

Roughly speaking, there are two types. 1. Aggregators that provide software infrastructure for token-based communities to attract users. 2. Shaping classes to provide the community with the tools to issue and trade their tokens at scale. Here's an overview for 2022:

Web3 large community competition analysis matrix

Web3 large community competition analysis matrix

Right now, for all platforms, there seems to be marketing through feature set differentiation. In order to stand out, you must hit the sweet spot between highly differentiated and highly demanded, and use this as your product positioning. In my opinion, this is the social wallet - no one is developing it at the time of writing.

Strategy

First, we need to map out a guiding strategy that will help us stay focused, aligned, and agile. We can challenge, borrow from elsewhere, or stay in the dark. But all of these are not as effective as "going first", because we should use our first-mover advantage. Next, we need a solid plan to achieve product market fit. To do this, we need to clarify our market, product and business operation model.

market

In order to estimate the activated market in social wallet products, we can look at the number of new wallets added each year. It gives us a rough idea of the expected user inflow:

TAM (100%) = 70 million users.

SAM (30%) = 21 million users.

SOM (10%) = 2.1 million users.

(Note: Abbreviations represent potential market, accessible market and accessible market respectively)

Now that we know the size of the Available Marketplace (SOM), we can narrow down Available Target Audience to 3 distinct Web3 groups: newcomers, believers, and veterans - each group faces unique problems and has different motives. I have observed that what newbies need most is service. In short, newcomers are high-intent latecomers, excited to try out fungible or non-fungible social tokens for themselves. They are severely lacking in solution services, and have a serious surplus of educational resource services. Let's look at these 3 segments together:

3 Segments of Social Wallet Users in Web3.

3 Segments of Social Wallet Users in Web3.

Sadly, most people only see the tip of the iceberg and put all their energy into developing complex solutions for believers and patriarchs. A good product should solve the core pain points first, and then follow up with education, not the other way around. What is currently lacking is an extremely simple, reliable, and thoughtful Web3 product.

product

Knowing whom to serve makes it easier to understand what we are going to develop. But why not just use any of the above mainstream crypto wallets? Even though most wallets integrate Moonpay or Simplex, they are overly complicated... For some reason, crypto skeptics still fail to understand the need for a Web3 crypto wallet onboarding process.

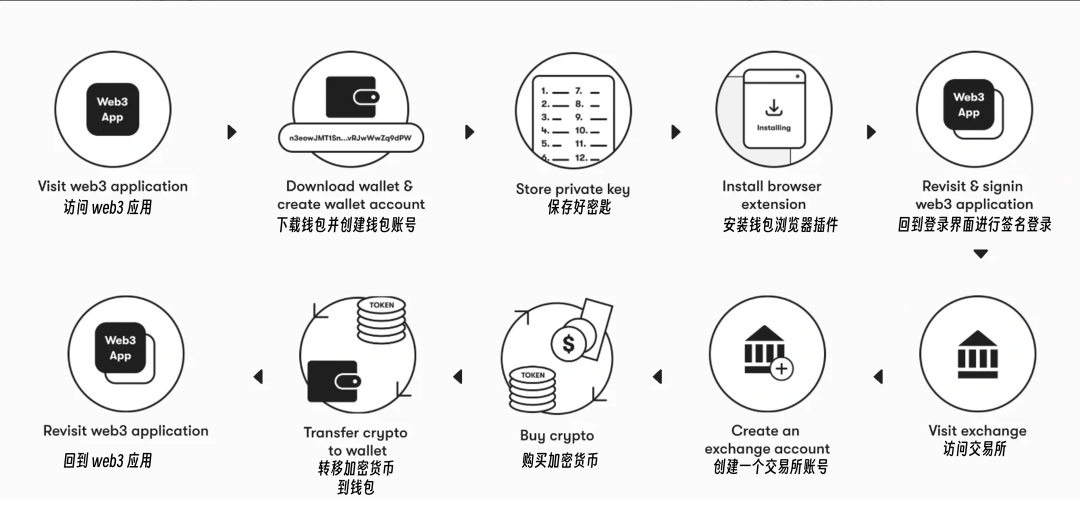

Thanks to ramper.xyz for the Web3 wallet onboarding process.

Thanks to ramper.xyz for the Web3 wallet onboarding process.

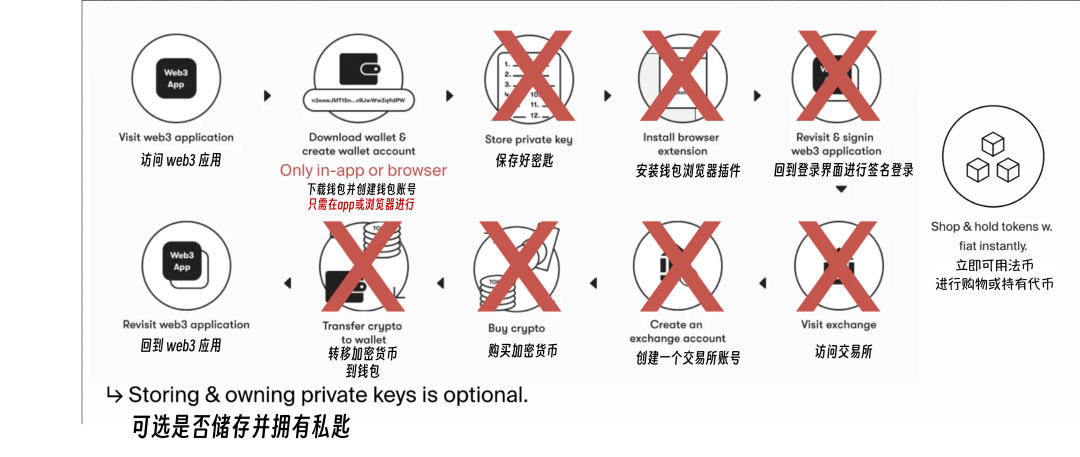

Social Wallet simplifies this by focusing only on social tokens for participation and not on all other cryptocurrencies. This greatly lowers the barrier to entry and provides a concise product specification sheet:

support:

- hosting (optional)

- Signature, transaction (minting/buy/sell)

- Cross-chain (ETH, SOL, XTZ)

- Holding (non-)fungible social tokens

not support:

- Legal currency is not supported in the wallet

- Cryptocurrencies are not supported in the wallet

- Currency exchange is not supported in the wallet

- send, receive or withdraw

There is an obvious tradeoff here compared to Metamask. Social wallets are more secure due to the extreme constraints on capacity, and thus are able to serve a unique use case: seamless token ownership. Its design philosophy embodies the "Three Rules of Minimalism" proposed by Harvard professor George Whitesides:

- Predictable » Immediately understandable.

- Accessibility » Dramatically shortens the learning curve for encryption.

- Can be used as a building block » Uses well-known Web2 authentication.

Even better, it makes it possible to slowly guide newcomers into Web3, and accompany them along the way as they grow into true believers and elders. All of this can be achieved through a frequently used digital product. Social wallets have changed the complicated user experience of digital wallets in the past:

The changes brought by Web3 social wallet to the onboarding process.

The changes brought by Web3 social wallet to the onboarding process.

Now only four steps can replace the original ten-odd steps: enter the Web3 application → hosting login/signup [SSO] → automatic fiat-to-crypto exchange with credit card → interact with social tokens → repeat.

The goal of the social wallet is to simplify the participation of Web3 tokens - both fungible and non-fungible tokens. Newbies don’t need to be crypto experts to implement tokenization operations. Even better, it's not just newcomers, the main target audience, who can benefit from this - the believer group can also participate in Web3 social in a safer way, while the veteran group can also benefit from higher user inflow and overall larger benefit from token purchases.

It is an all-round win-win situation for all stakeholders.

Model

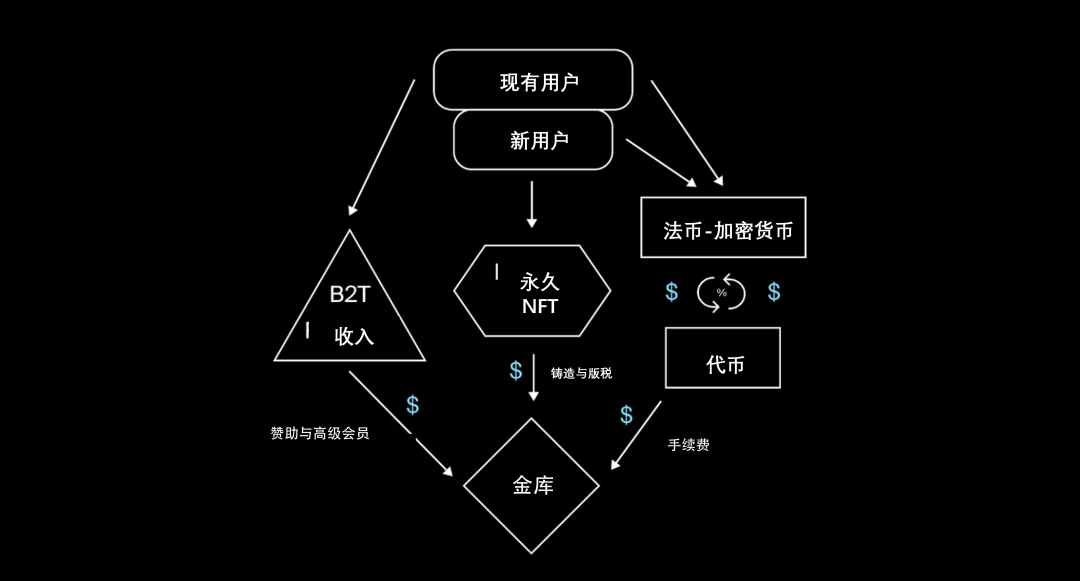

So how does this all work? That's a good question. Social wallets operate by charging fees. Free for end users to use, but charged per interaction. Companies earn percentages from currency exchange (Fiat~Crypto) and transactions (minting, buying or selling tokens). If lifetime NFTs are introduced to unlock 0 fees and other perks, we can further explore the B2T (business-to-token) experience, opening up a series of revenue streams to fill the company's coffers. The indication is as follows:

Business Models for Web3 Social Wallets, by @itsjulianpaul.

Business Models for Web3 Social Wallets, by @itsjulianpaul.

One thing I personally like about the concept of a decentralized vault is its transparency, companies can allocate a certain percentage of the total revenue to causes that the community deems important: such as charity, creator funds, and community publishing platforms... the possibility is infinite.

increase

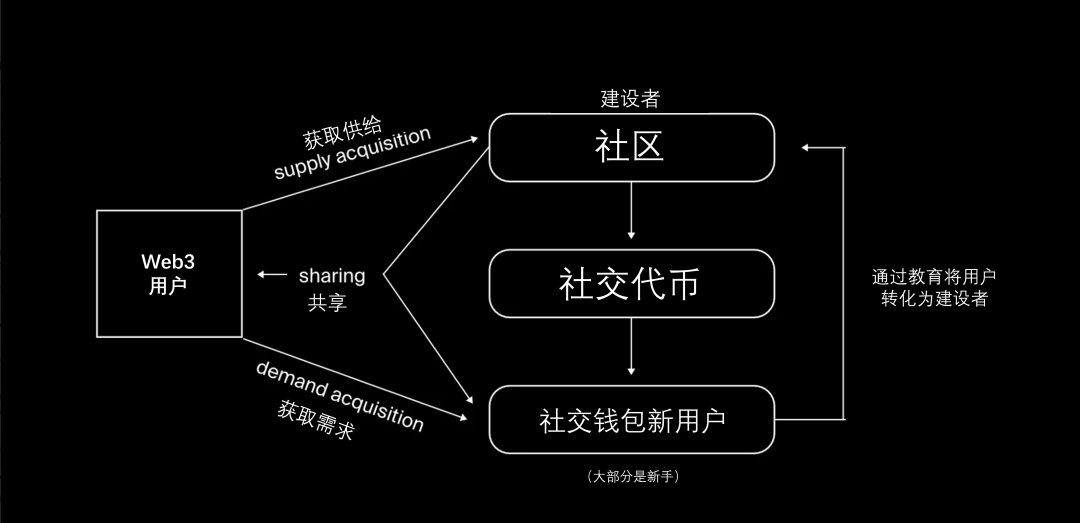

After understanding the market, product, and business model, there is only one thing left to do: a solid flywheel to nurture this new product category... For this, the framework behind demand-driven supply again It couldn't be more suitable. It minimizes the "chicken and egg" problem in market models.

What levers are most important to get your growth strategy off the ground and, if user growth slows, which ones should you focus on? Flywheel visualizes how to answer these questions:

The Web3 Social Wallet Flywheel for Community Platforms by @itsjulianpail.

The Web3 Social Wallet Flywheel for Community Platforms by @itsjulianpail.

Initially, there will be a race between each community to use their own native tokens to recruit new users, or to accept new social wallet users at the same time. Afterwards, once the core features are fully functional and stable, the race changes rapidly to see who can best convert users through content-driven education to launch their tokens, Actively build your own community. To achieve this goal, we need to conduct community-driven experiments to find out what infrastructure our core members want most - and then redouble our efforts.

future

The goal of the social wallet is to allow non-encryption-native people to participate in community building with their own Web2.5 wallets. But as soon as any new product category enters a market, we always want to use our first-mover advantage to stay invincible. Here are three metrics to measure success:

- Usage: DAU (Daily Active Users), MAU (Monthly Active Users), and number of transactions.

- On-chain user activity – activity of new and old token users.

- Percentage of social wallets out of total new wallets added each month and year.

Get these indicators right, and social wallets can become the long-term defensible moat that all Web3 platforms have been looking for.

Back to the topic

If more users can see the magic of digital assets, we will all benefit in the long run. The time has come to create a permissionless and trustless society.

Web3 will bring many of these new product categories. But we are still in the early days. Regardless of the risks, developing a large-scale social wallet requires a lot of investment, manpower, and engineering strength.

Betting on building a platform that 70%+ of the community and its members love is much riskier than relying on technology to generate demand-driven supply capable of capturing a whole new market: the constant influx of new users .