🚨 THIS IS THE MOST IMPORTANT MACRO EVENT THIS WEEK

And almost nobody is watching it.

This isn’t about Trump tariffs.

It’s not about gold or silver highs.

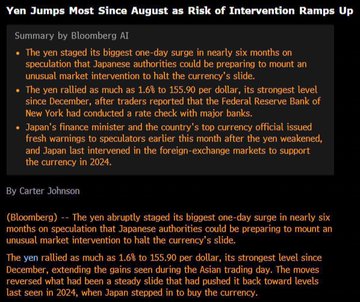

🇯🇵 The New York Fed is signaling potential intervention in the Japanese yen.

That’s huge.

Here’s why 👇

- Japanese bond yields keep pushing higher

- BOJ remains hawkish

- Yet the yen keeps falling

That should NOT happen.

Rising yields usually strengthen a currency.

When they don’t, something is breaking.

Markets are losing confidence in Japan’s economy.

And now U.S. policymakers are paying attention.

NY Fed comments suggest willingness to support the yen.

How does that work?

- Sell dollars

- Buy yen

Translation: dollar weakness by policy choice.

Markets noticed immediately.

The DXY just printed one of its weakest weekly candles in months.

This isn’t charity for Japan.

A weaker dollar:

- Makes U.S. debt easier to manage

- Boosts U.S. exports

- Shrinks the trade deficit

It’s a win-win for governments.

But the real winners?

Asset holders.

When the reserve currency is devalued:

- Stocks rise

- Real estate rises

- Commodities rise

We’re already seeing that.

Almost everything is near all-time highs.

Except one market: Crypto...

Crypto is still massively below prior highs

and has not fully priced in:

- Dollar debasement

- Liquidity shifts

- Policy-driven currency weakness

That’s the setup.

When investors rotate out of crowded trades,

they look for undervalued assets.

Crypto is the cleanest catch-up trade on the board.

Pay attention.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content