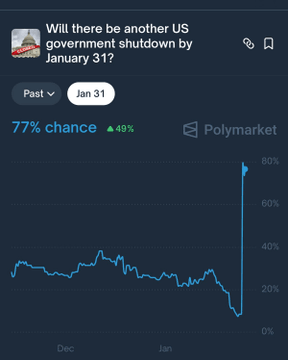

🚨 SHUTDOWN RISK IS BACK ON THE MARKET

The probability of a US government shutdown by January 31 is now close to 80%

This risk is driven by political confrontation with no signs of compromise

Plus the debt ceiling has already been raised to $41.1T

This allows the conflict to drag on and increases the probability of a shutdown

Why this really matters for crypto:

> When a shutdown starts the US Treasury usually rebuilds the TGA

> As is known this process directly drains liquidity from financial markets

During the last shutdown the TGA increased by roughly $220B

This liquidity outflow hit risk assets hard

The market reaction was typical:

1) A short period of resilience

2) Tightening liquidity conditions

3) Selling of risk assets

4) $BTC and $ETH dropped by 20 to 25%

5) Altcoins dropped much harder

The current market setup looks weaker

BUT

> Liquidity is already tight

> Market confidence remains fragile

On top of that crypto is already reacting sharply even to small capital flows

A TGA rebuild during a shutdown could hit harder than last time

That is why I recommend being prepared for the worst case scenario to avoid chasing FOMO later

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content