I'm leveraging my loop on the new @pendle_fi pools via Prompt-to-DeFi.

Here's the detailed flow:

Choose the pool to perform the loop: sUSDai - Feb 19th at 13.65% implied APY.

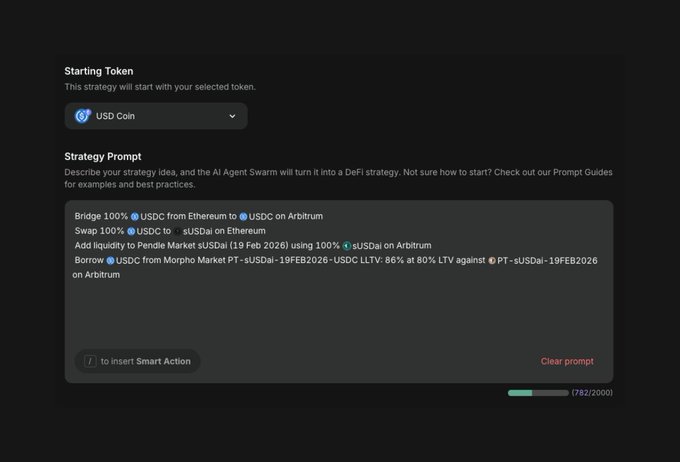

Start the loop with your USDC on Ethereum, set up the loop:

+ Bridge USDC from Ethereum to Arbitrum using @lifiprotocol

+ Swap USDC into sUSDai using KyberSwap

+ Add liquidity (single-sided) to the sUSDai (19 Feb 2026) on Pendle

+ Borrow USDC using PT-sUSDai from @Morpho (at 80% LTV)

+ Repeat from 1 to 4 eight times

Look at the detailed prompt below. Name the strategy: 'sUSDai looping'.

Simulate the prompt to check if the progress can run smoothly.

Tbh, @Infinit_Labs really helps me to understand how the assets flow between protocols and how looping can print yields. Perfect idea.

sUSDai looping looks powerful, but careful with compounding and risks.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content