- Crypto Deleveraging Deepens BTC dropped 36% ($126K→$80K) with persistent outflows. No reversal—capital rotates to safe havens, not crypto.

- Fed Independence Under Threat Powell held rates amid political pressure. Rieder (49% odds) leads succession race, signaling White House-aligned policy shift.

- War Pricing Takes Over Multiple crises—tariffs, shutdown (76-80% odds), Greenland, Taiwan, Venezuela, Iran—spike war index. Gold surges, crypto bleeds.

Btc and Eth at a Crossroads: Where the Market Direction Is Being Decided

From the monthly chart, Bitcoin (BTC) has closed lower for three consecutive months.

After reaching a high of $126,199, BTC fell sharply, dropping to a low of $80,600 on November 21, a decline of approximately 36%. Although the price subsequently rebounded to around $88,868, it remains well below the previous high, and there are no signs of a trend reversal at the structural level. Ethereum (ETH) has largely followed BTC’s direction, lacking independent momentum or a clear capital-driven factor.

In summary, the current monthly price structure and overall market behavior indicate that the cryptocurrency market has entered a “crypto winter,” with risk appetite declining and capital prioritizing safe havens.

Image source: Binance BTC monthly chart

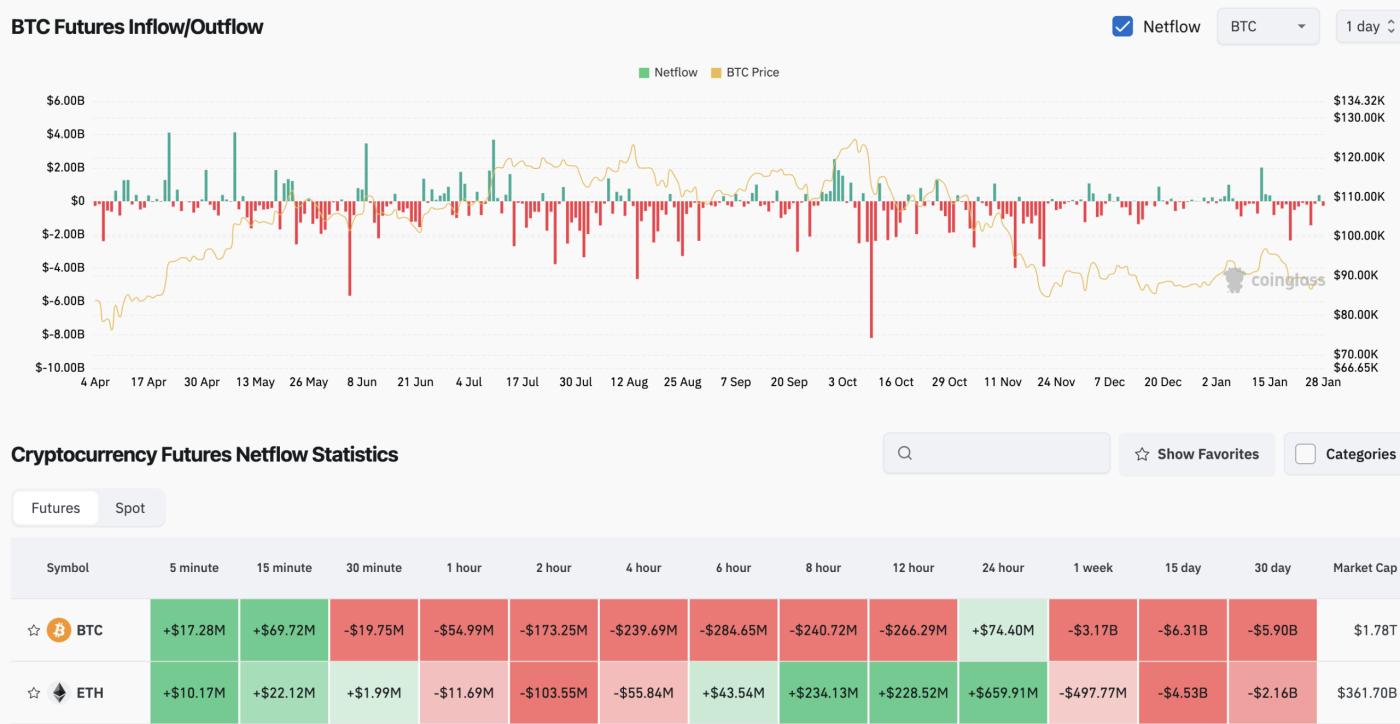

TRACKING MARKET DIRECTION THROUGH SPOT AND PERPETUAL FLOW DYNAMICS

Coinglass spot position data reveals persistent net outflows, with no clear reversal pattern emerging. Fund flows into both contracts and spot markets remain sporadic and lack the continuity needed to signal conviction.

The data suggests large capital is rotating toward safe-haven assets—and crypto isn’t making the cut. For now, neither institutions nor retail are treating digital assets as their preferred defensive play. Major capital appears stuck in wait-and-see mode, hesitant to commit.

Image source: coinglass.com/spot-inflow-outflow

Short-Term Market Data Performance

Bitcoin recently rebounded from 89,000 to 98,000 on January 15th, but has been declining for the past week, breaking through the 90,000 support level and repeatedly testing the strong short-term support at 86,000. It has now stabilized above the key level of 88,500. If it can regain the 90,000 psychological level, a further rebound could be expected.

Even so, I don’t believe this is a reversal, but rather a rebound. A true rebound requires stronger and more sustained buying pressure, as well as a new narrative-driven trend.(The above is not investment advice).

Image source: Binance BTC 4h chart

Events and Prediction Market Outlook

US-EU TRADE TENSIONS: TRADITIONAL ALLIES ON THE BRINK OF A TARIFF WAR

Early 2026 has seen US-European relations deteriorate sharply over trade protectionism, creating significant headwinds for global markets.

STEEL AND ALUMINUM TARIFFS RETURN

Washington is threatening to slap 25%+ tariffs on European steel and aluminum exports, citing “national security” and domestic industry protection. The target? Germany’s industrial heartland. Berlin isn’t happy, and neither are European manufacturers facing potential shutouts from the US market.

MARKET IMPACT: CAPITAL FLIGHT FROM EUROPE

EUR/USD has weakened noticeably as investors bail on European equities to dodge escalating trade war risks. That capital isn’t disappearing—it’s rotating into gold and US Treasuries, which helps explain the recent surge in gold prices you’ve been tracking.

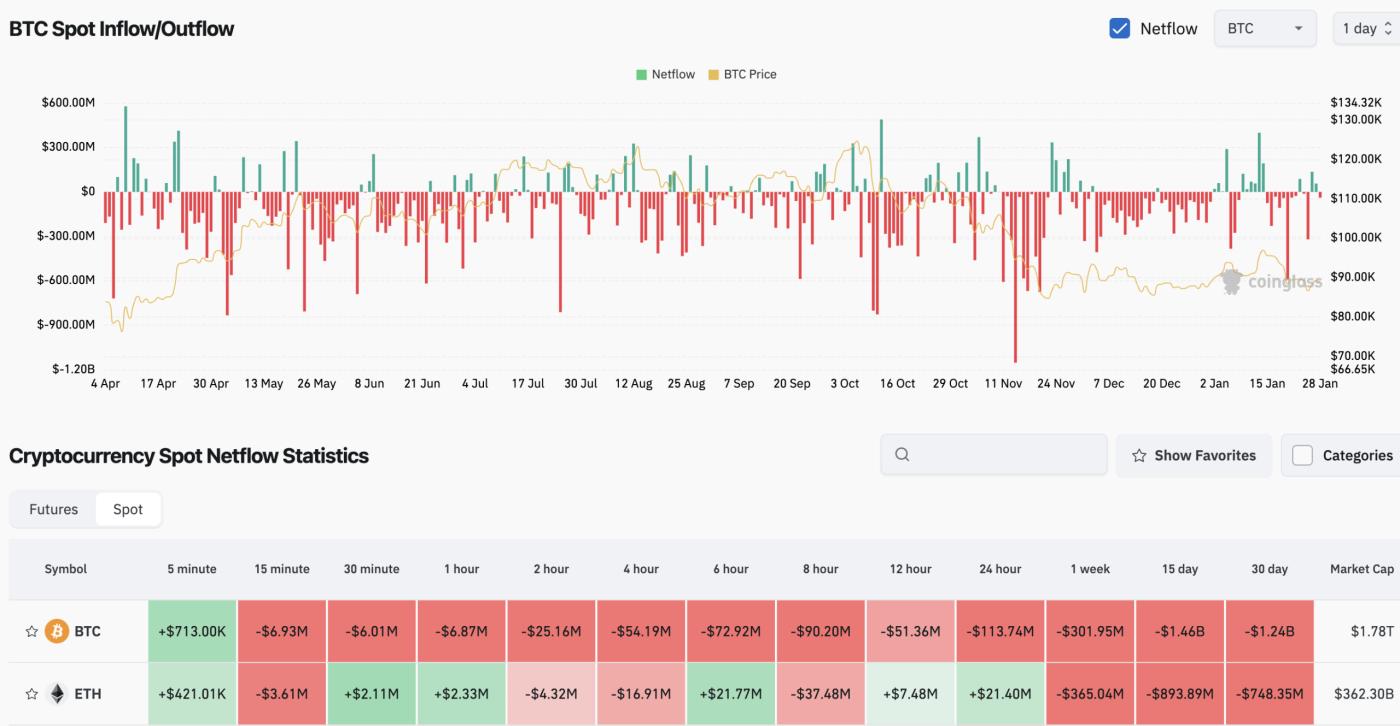

GOVERNMENT SHUTDOWN LOOMS: 76-80% ODDS BY JANUARY 31ST

Federal funding runs dry on January 30th, and Congress is nowhere near a deal. Senate Democrats are blocking appropriations bills tied to the Department of Homeland Security (DHS) budget—the trigger? A recent incident where a federal immigration agent fatally shot an American nurse in Minneapolis has turned this into a political standoff nobody wants to blink on first.

Image source:US government shutdown Saturday? Betting Odds & Predictions | Polymarket

If lawmakers can’t strike a deal by Friday midnight, the government goes into partial shutdown. That means delayed economic data releases—no jobs reports, no CPI updates. The Fed would be flying blind heading into future policy decisions, forced to set rates without the numbers it relies on. Markets hate uncertainty, and this would deliver it in spades.

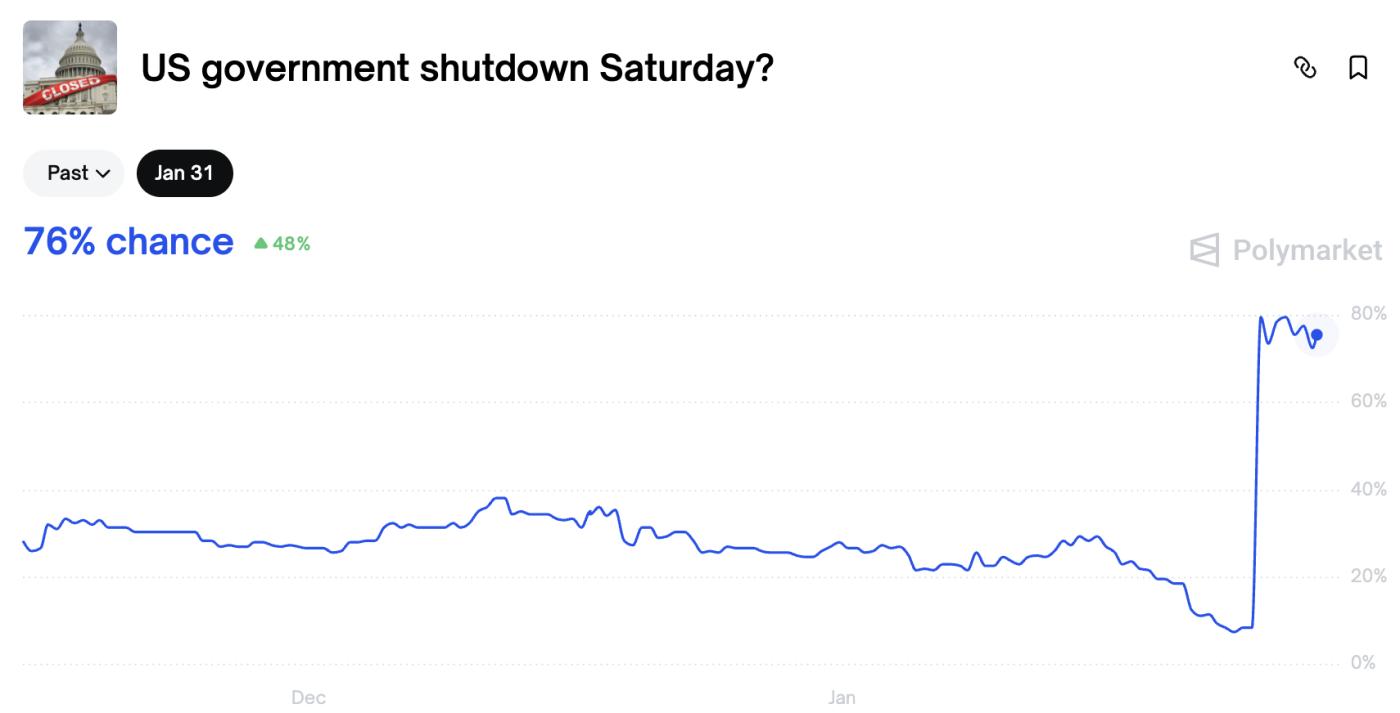

FED STANDS PAT: 99.6% PROBABILITY OF NO RATE CHANGE TODAY

The market’s basically certain the Fed won’t move rates at today’s January 28th meeting—and the data backs that up at 99.6% probability.

Image source:Fed decision in January? Betting Odds & Predictions | Polymarket

After a series of cuts through late 2025, Chair Powell and the FOMC are hitting pause to see if inflation tries to creep back up. But Powell’s facing unprecedented political pressure. The White House has publicly pushed for more cuts, and the Justice Department just launched a criminal probe into the Fed headquarters renovation project—which Powell has called out as a blatant attempt to undermine Fed independence.

The question today isn’t whether rates move (they won’t). It’s how Powell defends the Fed’s autonomy during the press conference, and whether that sends any signals about his willingness to resist political interference in the months ahead.

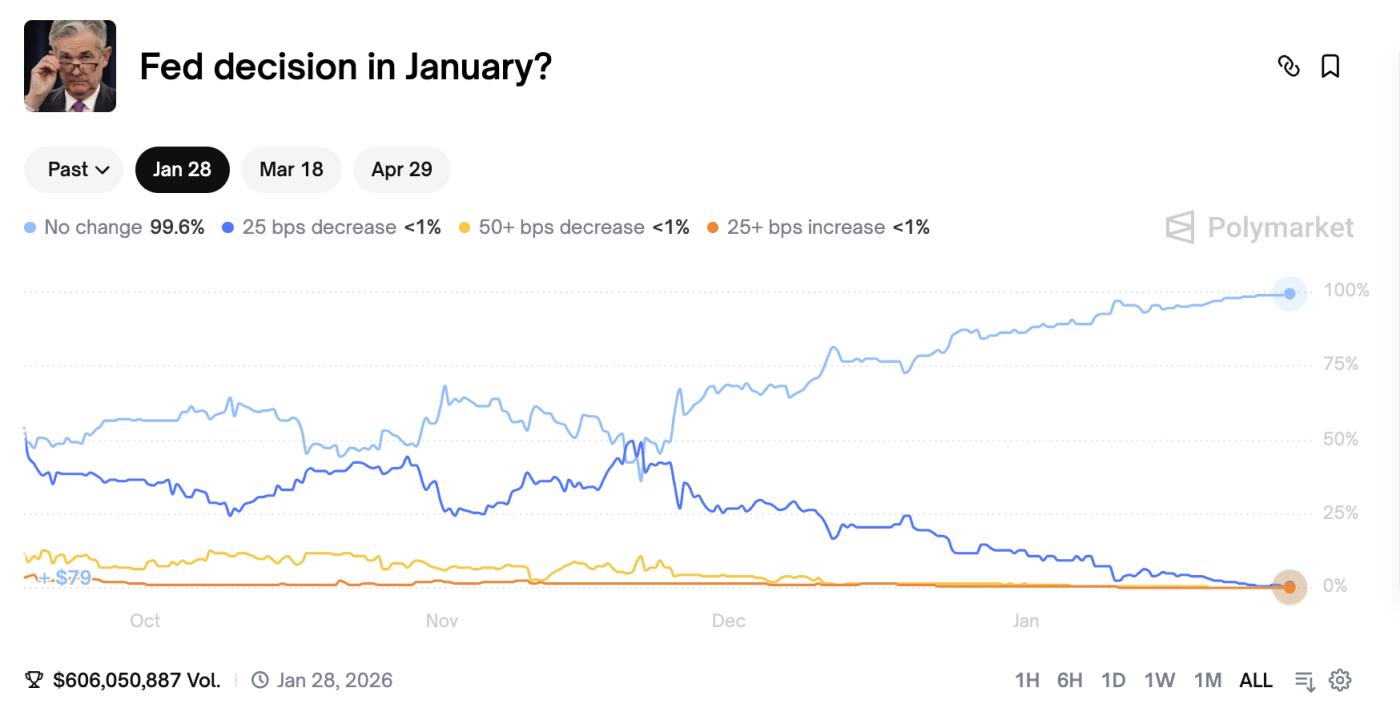

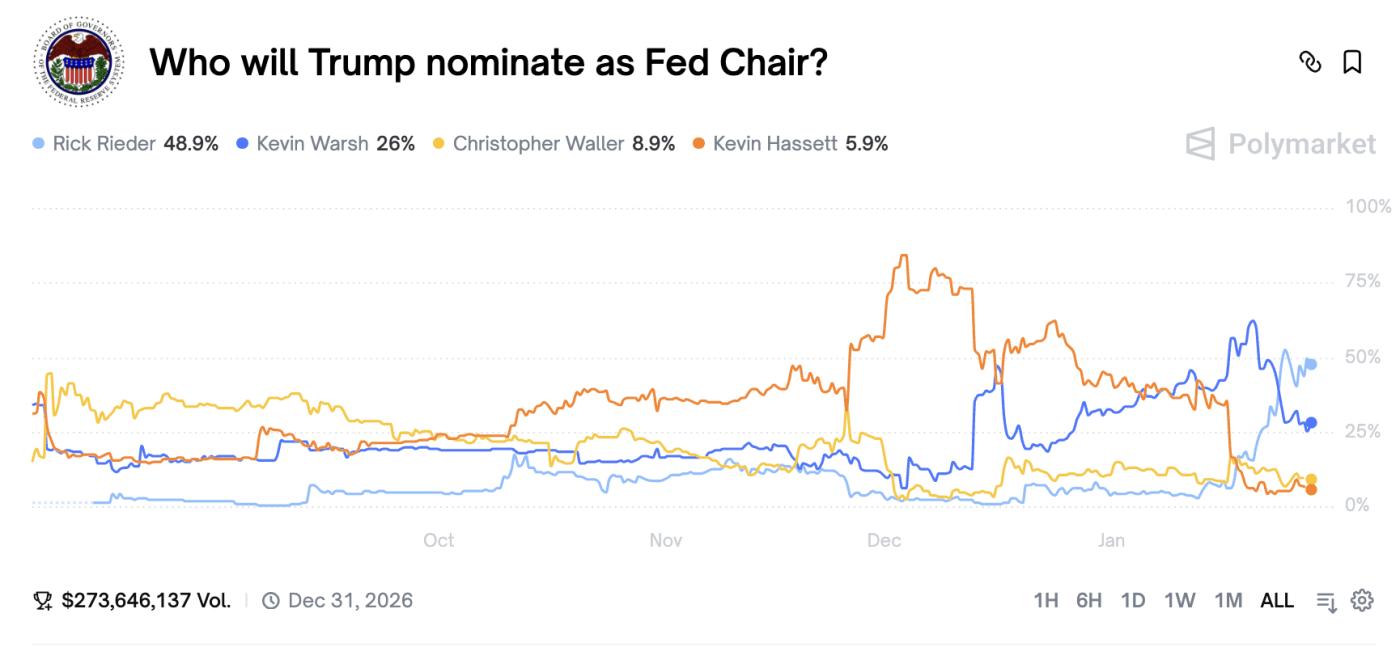

TRUMP’S FED CHAIR PICK: THE MAY 2026 SUCCESSION BATTLE HEATS UP

Powell’s term expires in May 2026, and prediction markets are already pricing in Trump’s potential nominees. This isn’t just Fed gossip—it’s a fundamental shift in monetary policy direction.

Image source:Who will Trump nominate as Fed Chair? Predictions & Odds | Polymarket

Rick Rieder (BlackRock’s Fixed Income CIO) has surged to ~49% odds after Trump publicly praised him as “a very impressive candidate.” White House advisor Kevin Hassett called him “the strongest bond expert out there.” Rieder’s appeal? He’s seen as willing to deploy unconventional tools—like directly influencing mortgage rates—to deliver the low-rate environment the White House wants.

Kevin Warsh (former Fed Governor) sits at ~26% probability. He’s the establishment pick—steady, predictable, less likely to rock the boat. Christopher Waller (current Fed Governor) represents continuity from within, but his odds are lower.

Markets are reading between the lines: Rieder signals policy experimentation and White House alignment. Warsh means institutional stability. Whoever Trump picks will define the next era of US monetary policy—and crypto, equities, and bonds are all repricing around that uncertainty.

A QUALITATIVE SHIFT IN RISK AVERSION: CROSS-ASSET VOLATILITY AND CAPITAL FLOWS AMID SOARING WAR INDICES.

Early 2026 has seen geopolitical risks erupt across multiple fronts simultaneously, pushing markets into a sustained “war pricing” mode.

Image source:https://www.tradingview.com/script/PKSJoBWc-War-Index/

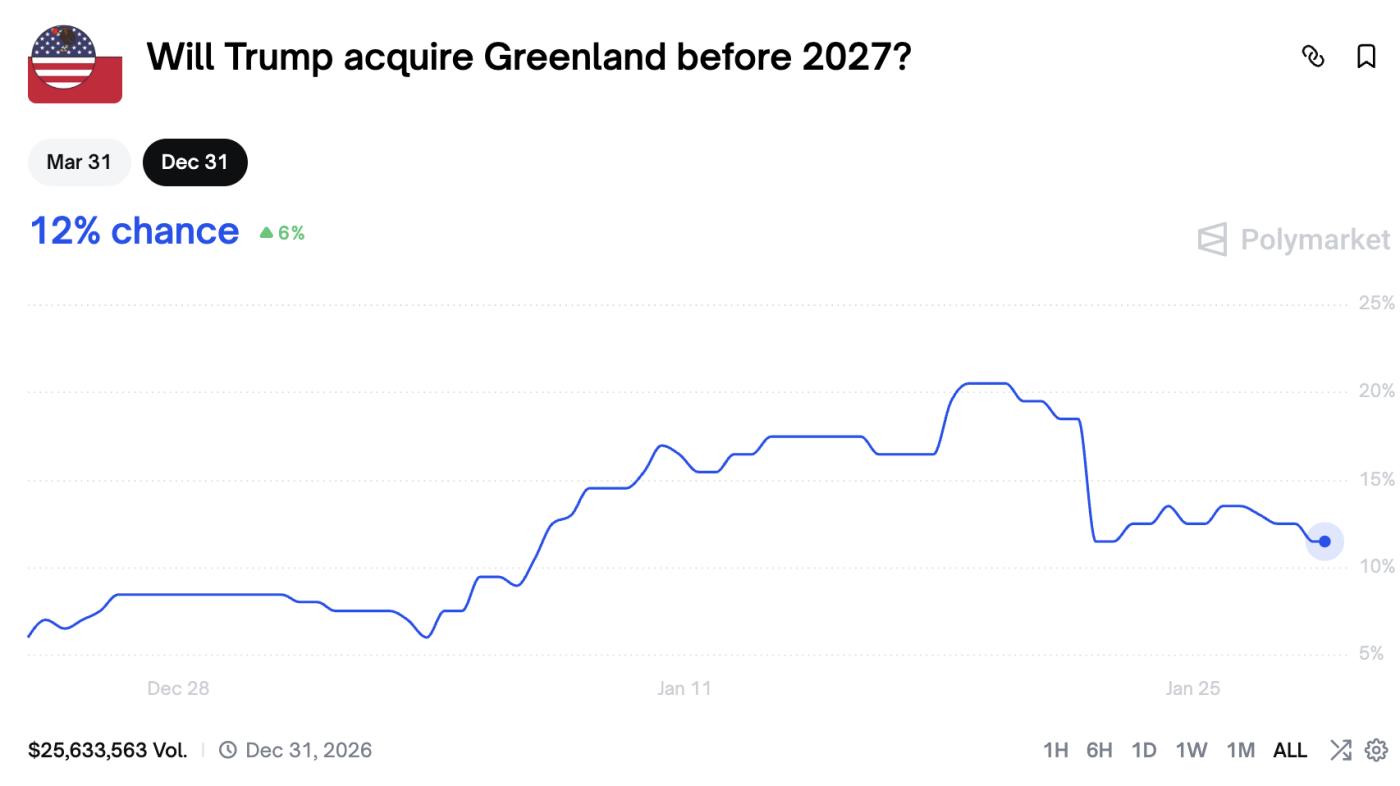

The North Atlantic alliance is fracturing over Greenland. Trump’s push to acquire Greenland from Denmark has escalated beyond rhetoric—Washington is now threatening tariffs against Copenhagen, a NATO ally. Transatlantic security cooperation has hit its lowest point in decades, with European capitals openly questioning US reliability.

Image source:polymarket.com/event/will-trump-acquire-greenland-before-2027

The Taiwan Strait remains a flashpoint. Kinmen has emerged as a potential military testing ground, while multinational corporations are accelerating their “Taiwan+1” supply chain diversification at record pace. War risk premiums for the region have spiked to all-time highs as insurers and logistics firms reprice the cost of doing business near the strait.

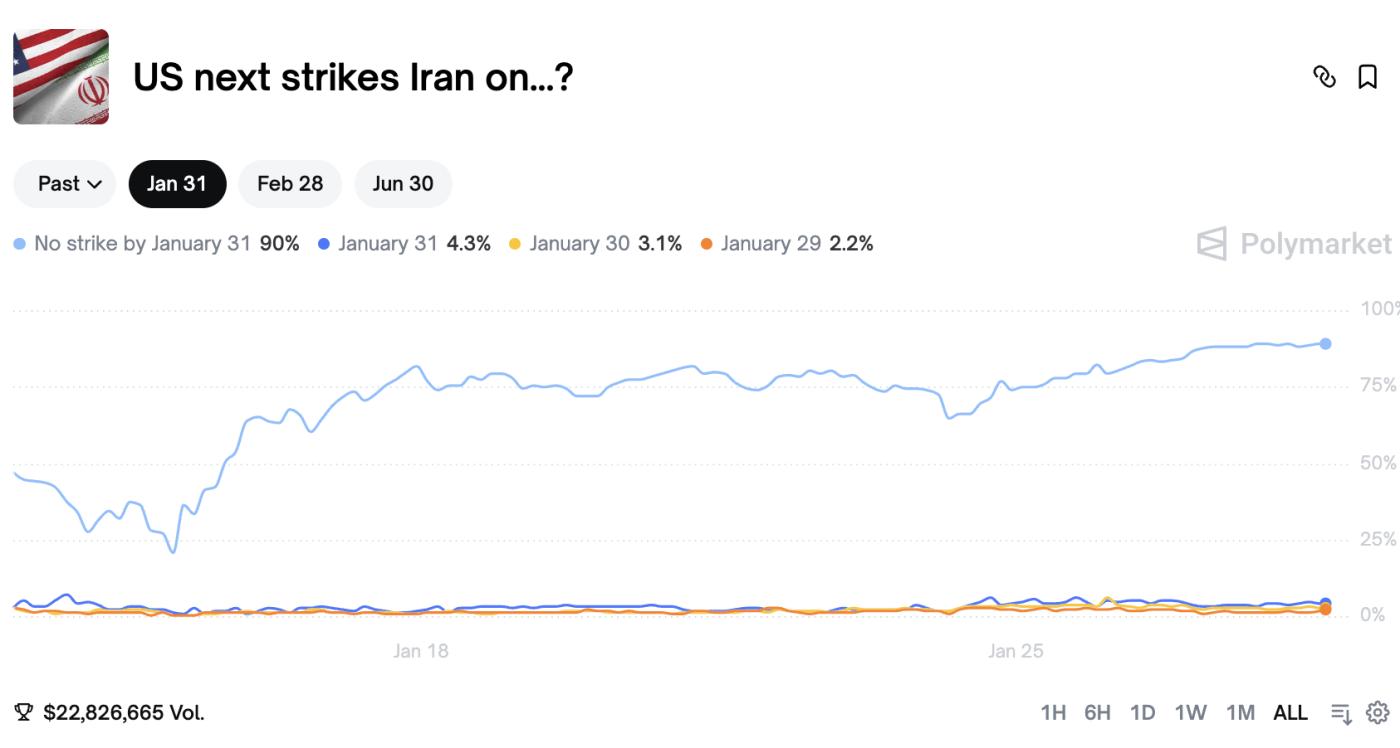

Venezuela is now classified as an imminent armed conflict zone by international monitoring agencies. US military assets have been repositioning throughout the Caribbean with apparent focus on the Maduro regime, raising the specter of direct intervention in a region already destabilized by migration crises and energy disruptions.

Iran faces pressure from all sides—domestic unrest, external threats to its nuclear facilities, and ongoing proxy conflicts. The country’s conflict index remains elevated with no clear de-escalation path in sight.

Image source:US next strikes Iran on…? Betting Odds & Predictions | Polymarket

These overlapping crises aren’t abstract geopolitical developments—they’re actively repricing global assets. Gold has surged as the default safe haven. Commodities are climbing on supply disruption fears. And markets are operating in a constant state of tension, pricing in tail risks that used to be dismissed as unlikely but are now treated as plausible near-term scenarios.

SURVIVAL GUIDE UNDER POLITICAL AND ECONOMIC DISORDER

The cryptocurrency market has plummeted for four consecutive months. Bitcoin’s price has fallen from $126,000 to just over $80,000, with Ethereum following suit. The entire industry has entered a deleveraging phase, characterized by continuous capital outflows. Investors have not bought on the dips but have instead turned to physical assets as risk aversion spreads.

The macroeconomic situation is chaotic. Following the budget impasse triggered by the shooting of an ICE agent, Washington faces a 76% to 80% risk of a government shutdown. If Congress fails to reach an agreement, key economic data will not be released, forcing the Federal Reserve to make policy decisions haphazardly.

Regarding the Federal Reserve: Powell kept interest rates unchanged on January 28, as expected, but the real focus is on the escalating debate surrounding the Fed’s independence.

The White House continues to pressure for rate cuts, the Justice Department is investigating renovations at the Fed headquarters, and Powell is defending the Fed’s institutional autonomy in an unprecedented manner. Meanwhile, the succession struggle for the Fed chairmanship is intensifying. BlackRock’s Rick Riddell has unexpectedly emerged as a frontrunner to succeed Powell in May—an appointment that would mark a significant shift in monetary policy experimentation toward alignment with the White House.

Geopolitical tensions are escalating. The Greenland territorial dispute has already fractured the transatlantic alliance. US military action suggests that intervention in Venezuela is under consideration. The risk premium for war in the Taiwan Strait continues to rise. Tensions remain high in Iran. All of this has driven up the “war index” and pushed gold prices to record highs.

The trend is clear: global capital is abandoning efficiency in favor of safety. This repricing is not silent—it is a massive rotation of funds, withdrawing from

〈Polymarket Signals: Fed Battle and War Risks Extend Crypto Bear〉這篇文章最早發佈於《CoinRank》。