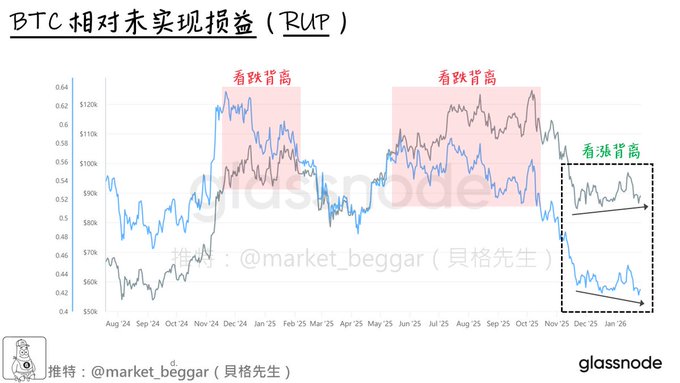

Stage Bottom Signal: RUP Bullish Divergence Taking Shape 🌱 Following up on yesterday’s update (quoted below), I want to share some fresh signs I’m seeing in the market—and give all the bulls a little faith recharge 🔋 Today, I’m bringing back a classic indicator I haven’t talked about in a while: the RUP, aka Relative Unrealized Profit. If you’re new here, check out the tutorial series at the end of this post 📚 The chart below shows the RUP indicator, which stands for Relative Unrealized Profit—basically, it measures the total unrealized profit in the market, normalized by market cap. It’s a go-to metric for gauging the overall profitability of the market 📊 I’ve shared this indicator multiple times in early 2025 and during the July 2025 top-hunting campaigns. To this day, the “RUP Divergence” signal has maintained a mind-blowing 100% accuracy in calling market tops‼️ If you want to dig deeper into the concept, how it works, and real-world usage, check out the resources linked at the end 🔗 // Before we dive deeper, let’s recap what “divergence” means. As shown in the chart, during the two tops in 2025, RUP divergence nailed both tops in advance. The logic is simple: “Price makes a new high, but RUP (profitability) doesn’t follow”—which means a lot of low-cost coins have already been offloaded, or “distributed.” In BTC markets, distribution by low-cost holders is a classic top signal ⚠️ But today, we’re seeing the opposite: a bullish divergence 📈 On the right side of the chart, you can clearly see: “Price lows are getting higher, but RUP lows are actually dropping, creating divergence.” Why is this bullish? Easy—on-chain analysts often measure “market profitability” to identify different market stages and spot tops/bottoms. AVIV, Realized Profit, etc., are all similar approaches 🔬 ➡️ If profit multiples are too high, holders get tempted to sell, forming a top. ➡️ If profit multiples are very low, it amps up buying interest from the sidelines, creating a bottom. So, this “RUP bullish divergence” we’re seeing right now, simply put, means: “Price is higher, but profitability is lower—bags are lighter, which is bullish for upward moves ✅” Given the current market setup, if we do get a proper bottoming Stop Hunt (x.com/market_beggar/status/201...…), with price wicking to a new low, then combined with this emerging RUP bullish divergence, I believe there’s a high probability we’ll see a true golden bottom 📈 💬 Bonus: If the Stop Hunt completes and quickly gets bought up (even making a new low), the RUP bullish divergence could still hold, since RUP is calculated based on closing prices. That’s it for today—hope this helps, frens 🫡 // 📚 Further Reading (RUP Series Tutorials) RUPL Indicator Intro & Bottom-Fishing Guide x.com/market_beggar/status/187...… RUP Divergence Top Signal Explained (with historical examples) x.com/market_beggar/status/187...… Early 2025 Top: RUP Divergence Nails the Exact High x.com/market_beggar/status/188...… Oct 2025 Top: RUP Divergence Pinpoints the Top Again x.com/market_beggar/status/197...… // 【Shill Time】 Sitting on a bag of stables but don’t wanna ape in yet? 💰 Here’s a solid yield play: Bitget Wallet On-Chain Earn ✅ Long-term APY = 10%, sourced from AAVE + Bitget Wallet subsidies ✅ Stablecoin yield (USDC), as low as 1U to start, redeem anytime ✅ Transparent, no re-staking, no looping—keepin’ it low risk If you’re interested, feel free to use my invite code below 👇 Invite Code: “3jTNi6” (manual binding required)

This article is machine translated

Show original

貝格先生

@market_beggar

01-28

向下逼近的短期持有者成本 & 強力支撐區域數據更新📊

承接下方引文,今天再來和各位更新「偏離度調整的 STH-RP 模型」。

結合技術面分析帖的內容(https://x.com/market_beggar/status/2015601869922631908…),

文中提到的三個劇本,其實都和偏離度調整的 STH-RP 模型有所呼應;

本文,我將藉此模型再次演繹未來可能的劇本👇:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share