OpenAI is developing new social networking applications and is considering using World Iris scanning technology to verify user identities.

Written by: Mahe, Foresight News

On January 29th, the World token WLD surged over 18% in the past 24 hours, jumping from approximately $0.46 to around $0.65, with a current market capitalization of approximately $2.5 billion. The price spike was directly attributed to a Forbes report: OpenAI is developing a new social networking application and is considering using iris scanning technology similar to World's to verify user identities, aiming to solve the problem of rampant online bots.

According to The Information, Nvidia, Amazon, and Microsoft are in talks to invest up to $60 billion in OpenAI. This new round of funding could value OpenAI at $730 billion.

Fake bots are becoming increasingly prevalent, and OpenAI urgently needs real-person authentication.

OpenAI aims to use biometrics to achieve "proof of personhood," thereby filtering out AI-generated fake accounts. The rapid development of AI is creating problems it cannot solve on its own, and World fills this gap. Sam Altman's dual role is a key link; he is not only the head of OpenAI but also a co-founder of World.

As early as 2020, Altman foresaw that AI would blur the lines between humans and machines, leading to a collapse of trust online. OpenAI's AI models, such as the GPT series, have penetrated into fields such as social media, recruitment, and finance, but this has been accompanied by the abuse of bots: fake accounts spreading misinformation, AI agents manipulating the market, and even forging resumes on recruitment platforms.

OpenAI needs a reliable "personality filter" to maintain the purity of its ecosystem; otherwise, its products will face regulatory pressure and user churn.

OpenAI's social applications reportedly aim to create a "bot-free" cyberspace, but traditional CAPTCHAs or mobile verification are no longer effective—AI can easily bypass them. World's Orb provides zero-knowledge proofs through iris scanning, allowing users to prove they are the only human without revealing personal information. This technology is already used in the World App, covering 15 million users, and is expanding into payments and gaming. If OpenAI integrates a similar system, it could directly enhance the competitiveness of its applications.

For example, by embedding World ID verification into the ChatGPT interface, users can securely make encrypted payments or authenticate their identities, avoiding AI-generated fake interactions. This could also open up new revenue streams for OpenAI: charging verification fees or sharing data infrastructure with World.

By combining with token economics, everyone can benefit from the AI boom.

Altman has publicly stated that AGI (Artificial General Intelligence) will reshape the global economy, but only if wealth distribution is ensured to be equitable. World was designed to distribute "Universal Basic Income" (UBI) through WLD, allowing everyone to share in the benefits of AI prosperity.

OpenAI can embed World's token economy into its platform to drive user adoption. For example, social network users can earn WLD rewards after iris verification, which can be used to subscribe to AI services. This creates a closed business loop: OpenAI provides AI tools, and World handles identity and payments, together combating the monopoly of centralized platforms.

From a regulatory perspective, World's collaboration with OpenAI can also mitigate risks. World already faces privacy investigations in Europe and Asia (such as bans in Spain and Kenya), but by partnering with OpenAI, it can leverage the latter's influence in Washington to push for policy deregulation. Altman has lobbied the White House to discuss digital identity standards, paving the way for this collaboration.

OpenAI has not yet released specific details, but insiders have revealed that the application may integrate biometric hardware to ensure that every user on the platform is a real human.

Of course, critics point out that iris scanning carries privacy risks, especially in the AI era, where data could be misused. OpenAI itself also faces antitrust scrutiny, and its partnership with World may attract even more regulatory attention. However, from a business perspective, this move is beneficial to OpenAI: it can benefit from World's blockchain infrastructure while injecting practical value into WLD, driving the token from speculation to real-world application.

In 2025, World propelled the protocol from a controversial project to mainstream adoption. In May, World officially launched in the United States. In early October, the World Chain mainnet went live; it's a blockchain optimized for human activity, prioritizing the verification of user transactions. On October 21st, World partnered with Mythical Games to integrate Orb technology into the game economy, allowing users to participate in the on-chain economy through iris verification, preventing bots from manipulating rewards.

In addition, World partners with platforms such as Razer and Tinder to embed World ID into hardware and dating apps, allowing users to verify their identity and avoid scams.

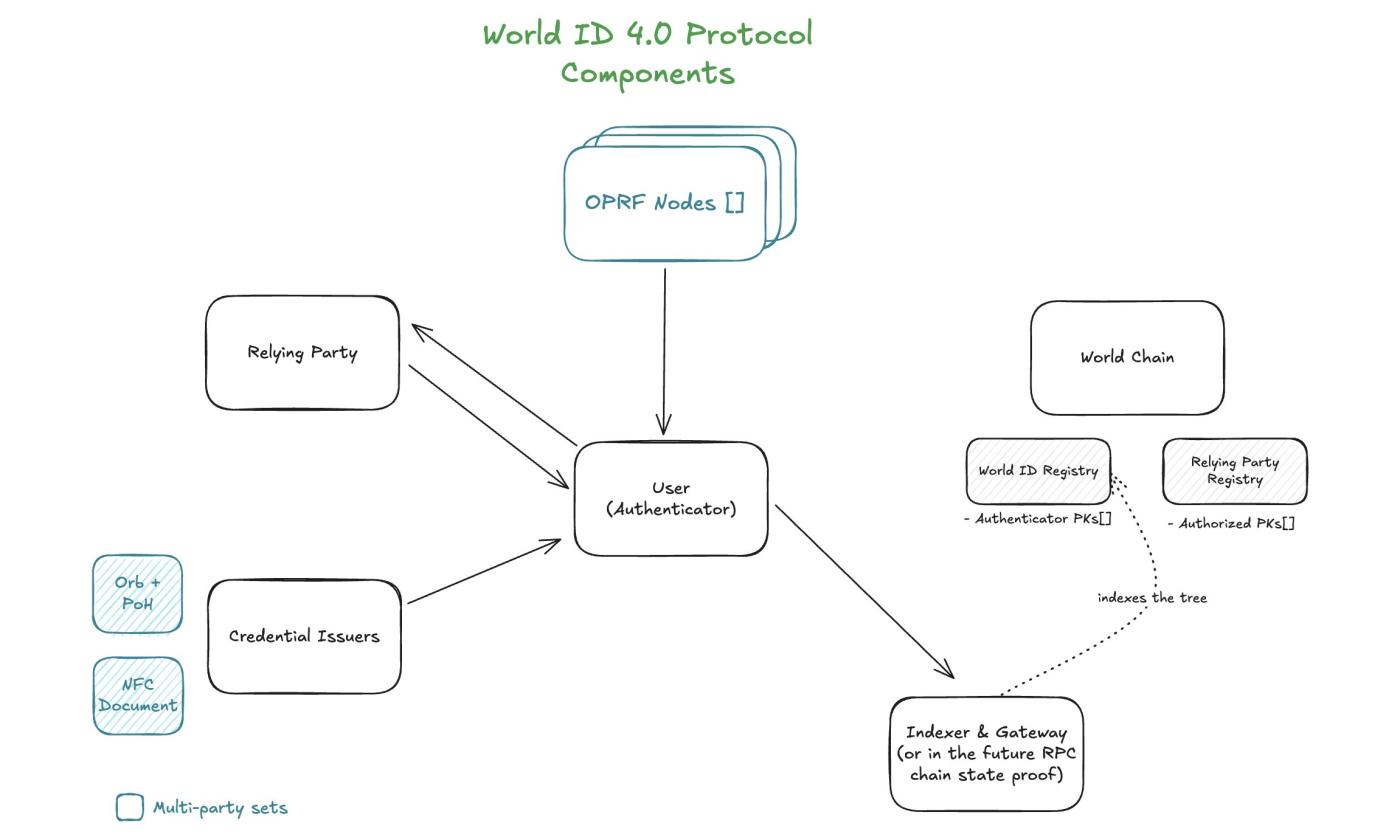

Next-generation ID authentication 4.0

In January 2026, World released product and technical specifications for its next-generation identity recognition protocol.

Its core technology is OPRF nodes (unintentional pseudo-random functions). When you log in to different apps, these nodes will help you generate a "pseudonym", making it more difficult for the user's identity to be tracked.

Compared to version 3.0, the new version 4.0 is a true "cloud-based identity account":

- No fear of loss: Supports login on multiple devices, so you can find your phone if it's lost.

- More privacy: The introduction of multi-node (OPRF) makes it extremely difficult to track your behavior path.

- More flexible: You can join even in places where there's no ball to sweep, just by swiping your passport.

In the future, if the collaboration with OpenAI is successfully implemented, World may leap from a peripheral project to a core AI infrastructure.

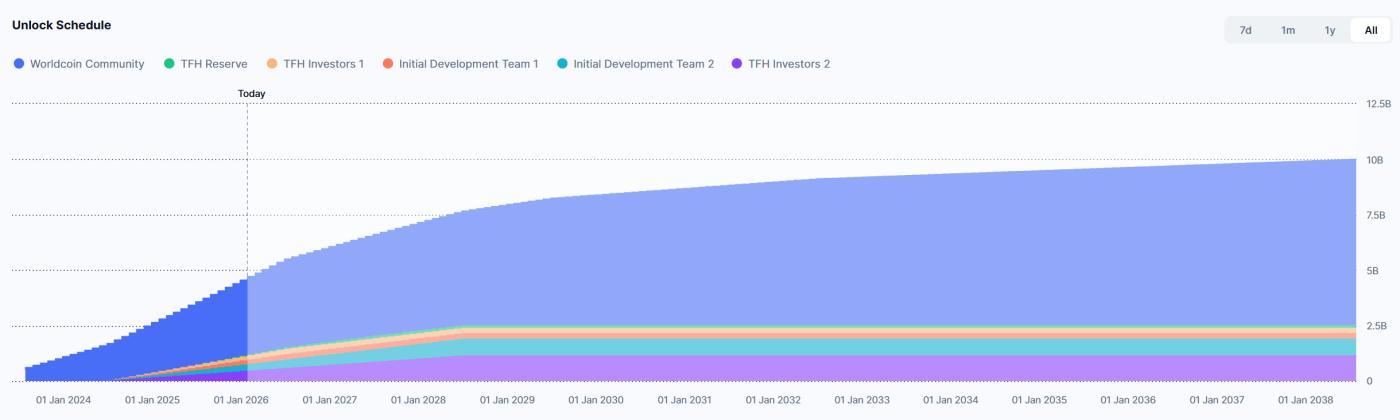

However, due to the sluggish market, weak demand for tokens, and selling pressure from unlocking, the price of WLD has fallen by about 20 times from its historical high. Investors should pay attention to risk control.