This article is machine translated

Show original

🚨 THE FED HAS FINISHED RAISING INTEREST RATES - WHAT IS THE MARKET WAITING FOR NEXT?

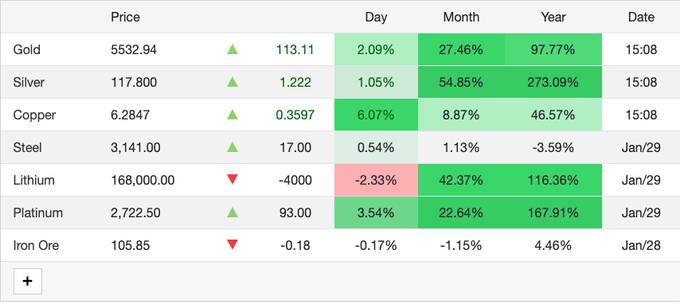

Gold, silver, and copper are continuously reaching new highs, while Bitcoin and crypto have remained almost stagnant for weeks.

This isn't because the market lacks a story, but because money flows are reacting very differently to the current economic context.

The Fed has stopped raising interest rates, but hasn't lowered them either. The economy is still growing, the workforce hasn't collapsed, and inflation is falling slowly. This "not bad enough to warrant easing, but not good enough to take risks" situation is causing strong market divergence.

So what exactly is the market defending against, what signals are it waiting for from the Fed, and why are money flows choosing gold and commodities instead of crypto at this time? 🧵👇

MarginATM

@MarginATM

01-29

Sau Vàng, Bạc tăng giá

Bây giờ là đến Đồng :))))))

Thời kì đâu tư Kim loại à anh em? Sau Đồng rồi còn có gì nữa nhỉ? 😅 x.com/MarginATM/stat…

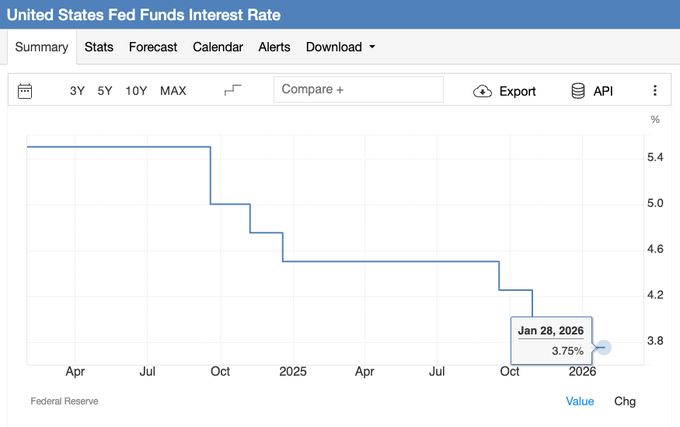

1⃣ The Fed has ended its tightening cycle but hasn't moved on to easing yet.

Following its most recent meeting, it can be confirmed that the Fed has ended its interest rate hike cycle.

Current interest rates are considered high enough to control inflation and slow the economy when necessary.

However, it is important that the Fed is not in a hurry to lower interest rates further at this time. This is because:

+ The US economy is still maintaining acceptable growth.

+ The labor market shows signs of stabilization, not a clear weakening.

+ There is no urgent pressure forcing the Fed to ease immediately.

In its post-meeting statement, the Fed indicated that current interest rates will be maintained for a period of time, and any further steps depend entirely on actual economic data, not on a pre-determined roadmap.

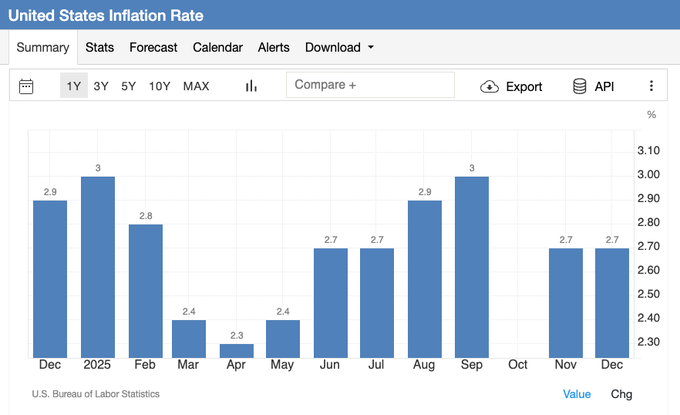

2⃣ Inflation still exists, but its nature has changed

A major change in the current inflation landscape is that its source is different from before.

Instead of stemming from a sharp increase in consumer demand, most price pressure is now coming from: tariffs, logistics costs, and the price of basic raw materials.

When inflation becomes cost-effective, the response of money flows also changes. Investors are not seeking growth in profits, but rather preserving their purchasing power.

👉 This is why assets directly tied to real value and production costs are beginning to be prioritized.

3. Why are gold, silver, and copper constantly increasing in price?

The sharp and sustained rise in precious and industrial metals over a short period suggests that the market is defensive against systemic risk, not betting on strong growth.

Several factors are driving this trend:

+ Large and prolonged budget deficit

+ High public debt

Confidence in the ability to control fiscal policy has declined.

Central banks in many countries continue to accumulate gold reserves.

In that context, gold, silver, and copper become logical choices because:

+ Not dependent on business profits

No need for additional liquidation injection.

+ Not affected by expected growth valuations

4. Are Crypto and Bitcoin still stuck in the same place?

Despite its long-term narrative of combating inflation and decentralization, Bitcoin and cryptocurrencies are currently still classified by the market as high-risk assets.

In the current economic environment:

+ Real interest rates remain high

+ Liquidation has not yet been eased.

Investors prioritize preservation over profit.

Large amounts of capital have no reason to accept significant volatility. Therefore, crypto hasn't fallen sharply, but it hasn't risen significantly either.

The economy has undergone significant changes. And at this point, perhaps it's not the right time for Bitcoin and crypto.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content