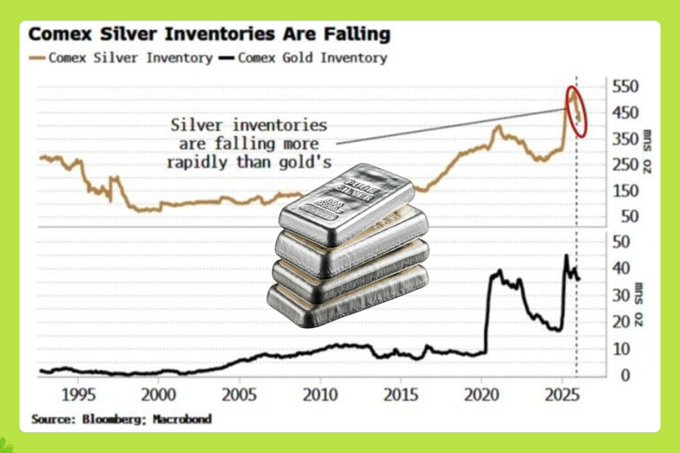

SILVER IS UNDER SUPPLY STRICT CONTROLS – HAS Short SQUEEZE BEEN TRIGGERED? 🤔 Silver reserves on the COMEX exchange are declining very rapidly. Since its most recent peak, COMEX silver inventories have fallen by 34 million ounces to 415 million ounces, the lowest level since March 2025. Looking further back, since last September's peak, inventories have evaporated by 117 million ounces, or -22%. What does this indicate? According to @KobeissiLetter, the demand for physical silver is surging. It's no longer about paper contracts or Derivative , but about real silver – real metal. The problem is that many traders are Short silver in the futures market, but when the delivery date arrives, they can't find enough physical silver to fulfill the order. Without the physical silver, they are forced to buy it on the open market – and the sellers then have the power to dictate the price. Price rises → Short position incurs a loss → forced to buy to cut losses → price rises even higher. A very familiar pattern. That's the mechanism of a Short squeeze – and with silver, this scenario is becoming increasingly apparent. 🧲

This article is machine translated

Show original

Upside GM

@gm_upside

01-29

MỘT THỰC THỂ ÂM THẦM THU GOM 10% TỔNG CUNG LINK – DANH TÍNH VẪN LÀ ẨN SỐ 🧐

Một phát hiện on-chain gần đây đang khiến cộng đồng chú ý: xuất hiện một mô hình tích lũy $LINK cực kỳ bất thường, cho thấy khả năng một thực thể duy nhất đã âm thầm thu gom x.com/gm_upside/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content