An $800M on-chain derivatives engine is not a bull-market anomaly.

It’s what happens when liquidity stops leaving crypto rails.

@HyperliquidX now operates at roughly that scale.

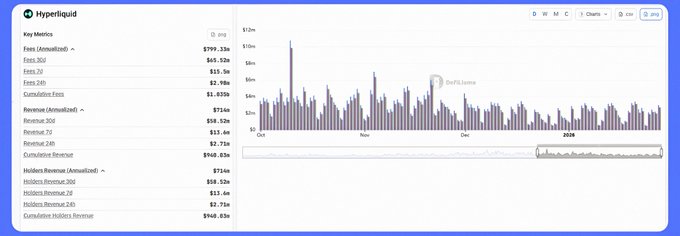

➣ Annualized gross fees: $799M

➣ Annualized holder revenue: $714M

➣ Open interest: $8.6B

➣ 30d perp volume: $173B+

➣ Daily buybacks: $2M

➣ Fee capture: 89%

What stands out is not growth.

It is control.

Fees are being discounted through HIP-3 while absolute revenue keeps expanding. That only works if volume elasticity is real. Lower taker costs are not compressing margins because execution is internalized. There is no external chain extracting rent.

This changes the risk profile.

Liquidity is no longer subsidized through emissions. It is being maintained through fee recycling and buybacks. The Assistance Fund converts throughput directly into token demand, which reduces float while volume stays high.

The setup is mechanical.

Lower fees pull flow. Flow funds buybacks. Buybacks tighten supply. Tight supply improves depth. Depth attracts larger clips.

The question is not whether fees can grow.

It is whether volume remains sticky once incentives normalize.

When execution and incentives sit on the same layer, competition shifts from marketing to latency and depth.

That is where dominance becomes structural.

Hyperliquid.

Hyperliquid

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content