The fundamental principle of trading is survival, followed by profit. Therefore, before each transaction, carefully consider whether your actions are reasonable and whether your principal is safe. Develop your own trading strategy and continuously optimize it. While the advice of crypto experts may not make you rich overnight, it can provide consistent support. Only those who survive and persevere in the long run in the crypto will achieve their desired results. I hope you understand.

Don't forget, the darkest hour is often just before dawn. On the road to pursuing your dreams, you are never alone; you have me.

I am a crypto academician, a warrior who has always protected retail investors. I wish my followers financial freedom in 2025. Let's work hard together!

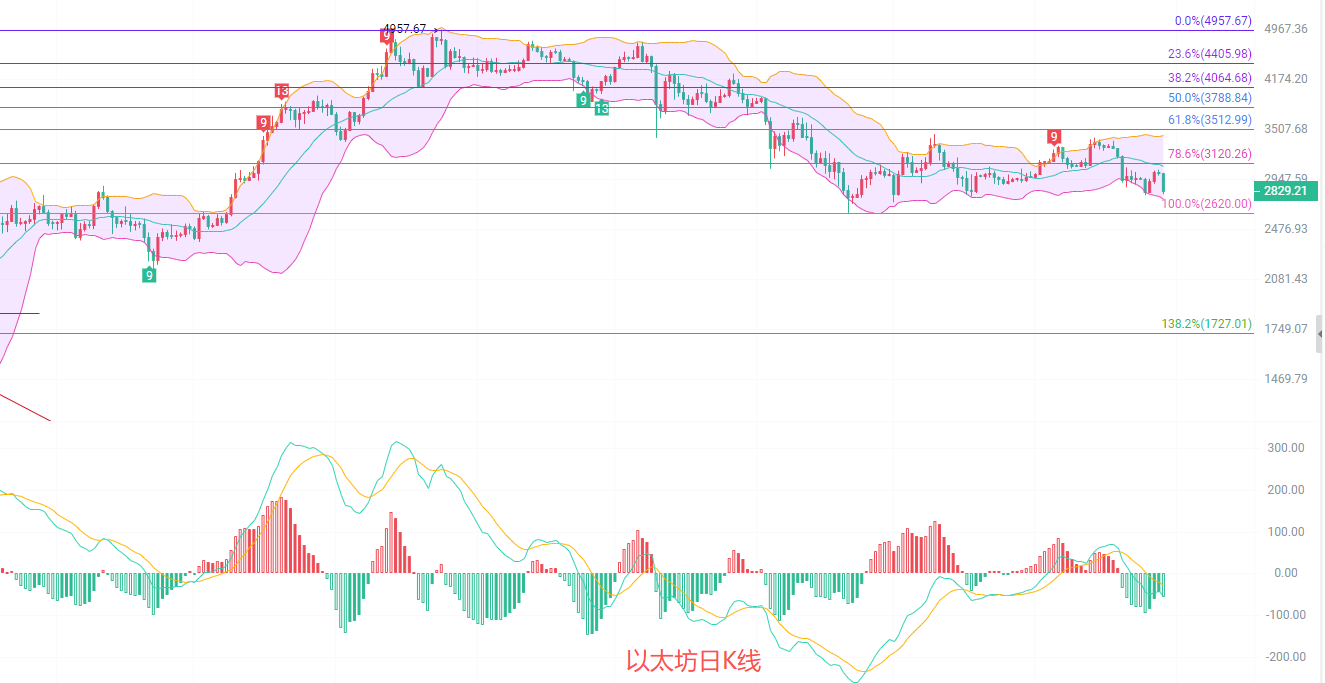

Crypto Expert: Ethereum (ETH) Latest Market Analysis and Reference (January 30, 2026)

Ethereum is currently priced at 2830, which is 2:30 AM Beijing time. Many followers don't understand why I'm still advising everyone to go south when the price has already broken 3000. Some are even smearing the market in the comments and encouraging everyone to go north. Thank you to my long-time followers for your trust. From 3000 all the way south to 2800, everyone can take profits and leave. The rest can look for opportunities to go north.

The daily candlestick chart shows a high of 3012 and a low of 2795 before publication. The EMA trend indicator is diverging downwards, maintaining its southward trend. The 15-day EMA fast line has reached the 3000 level. The MACD shows decreasing volume but increasing volume, with the DIF and DEA lines contracting below the zero line. The lower Bollinger Band is around 2745, and the middle band is around 3085. Overall, the southward trend still has momentum, so don't rush northwards. It's better to miss an opportunity than to make a mistake; simply observe.

The 4-hour candlestick chart shows a "gate" pattern. Watch for the 0.618 Fibonacci retracement level at 2749. The EMA indicator is trending downwards, the MACD is showing decreasing volume with increasing volume, and the DIF and DEA death cross crossed below the zero line. The lower Bollinger Band has fallen below 2830. If the price falls further to around 2750, it will enter extreme oversold territory. This would present an opportunity to move north to establish medium- to long-term positions. Conversely, those moving south should take profits and wait for a better opportunity to move north.

Short-term reference: (Real-world data has been updated; please contact the author for details)

The support level is 2750-2700, with a stop-loss at 2650 and a stop-loss of 40 points. The target is 2800-2900, and a break above that level could lead to 2950-3000.

The upside target is 2950-3050, with a stop-loss at 3100 and a stop-loss of 40 points. The target is 2950-2900, and if it breaks through, the next target is 2850-2800.

For specific operations, please refer to real-time market data. For more information and details, please contact the author. There may be a delay in article publication; this advice is for reference only, and you assume all risk.

This article is exclusively contributed by the Crypto Academician and represents only the Academician's exclusive views. The Academician has in-depth research on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of article publication, the above views and suggestions are not real-time and are for reference only. Investors assume all risks. Please indicate the source when reprinting. Manage your positions reasonably and avoid over-leveraging or full-margin trading. The Academician also hopes that investors understand that the market is always right. If you are wrong, you should analyze your own problems and not let profits slip away. Investing doesn't require being smarter than the market. When a trend emerges, follow it; when there is no trend, observe and remain calm. It's never too late to act after the trend becomes clear. Tomorrow's success stems from today's choices. Heaven rewards diligence, earth rewards kindness, humanity rewards honesty, business rewards integrity, industry rewards excellence, and art rewards dedication. Gains and losses often occur unexpectedly. Develop the habit of strictly setting stop-loss and take-profit orders for every trade. The Crypto Academician wishes you happy investing!