This article is machine translated

Show original

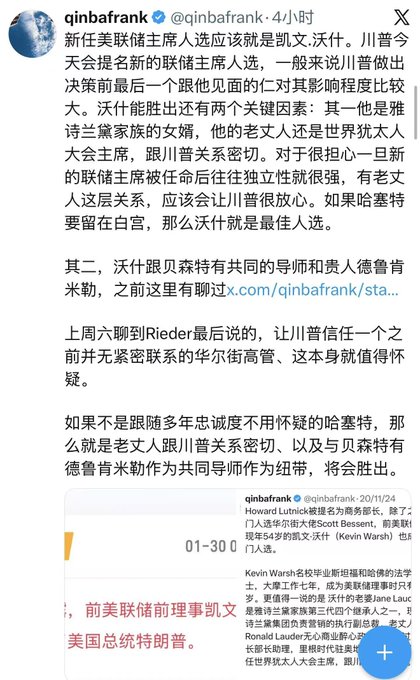

With Walsh highly likely to be nominated as the new Federal Reserve Chairman, how should we understand his future policy proposals? From a personal perspective, we should understand Walsh's policies by starting with two relationships: First, naturally, is his relationship with Trump. Walsh's wife comes from the Estée Lauder family, and his father-in-law has close ties to Trump. Many media outlets have been adding details about Walsh's background this year, but in fact, after Trump's second presidential victory in late 2024, Walsh was a leading candidate for Treasury Secretary, and his background was already being investigated at that time.

Second, Druckenmiller is a partner at the Quantum Fund under George Soros. In the 1990s, Bessant was a fund manager in the Quantum Fund's London office, and after Walsh stepped down from his position as a Federal Reserve governor in 2011, he also became a partner in the Druckenmiller family office (while also working at the Hoover Institution). Essentially, Druckenmiller is a mentor and benefactor to both Bessant and Walsh.

While his close relationship with Trump is one aspect, we shouldn't overlook his close relationships with Bessant and Druckenmiller, which are perhaps even more important. Warsh's relationship with Trump influenced his nomination, but his relationships with Bessant and Druckenmiller profoundly impacted his future policy stances.

1. What are Warsh's policy stances?

As discussed in a previous tweet about the shift in the power axis of US economic policy, Druckenmiller, Bessant, and Warsh all shared the view that the old approach (fiscal stimulus + ultra-loose monetary policy, supporting demand, leading to an economy of "asset wealth, income poverty"—soaring stock market but weak productivity and wage inequality) is outdated. They all aimed to end the 15-year Keynesian demand management experiment and shift to a supply-side system, emphasizing productive capital rather than financial engineering.

Bessant's current approach involves: providing fiscal and industrial support, drawing on the Hamiltonian tradition: deregulation, investment-friendly tax rules, targeted tariffs, and attracting domestic production and capital expenditure (capex). The government sets the rules, the private sector takes the lead.

Warsh and Druckenmiller have previously collaborated on numerous reports and articles discussing these issues. Warsh repeatedly uses the term "regime change" to describe the necessary reforms at the Federal Reserve. This doesn't simply mean changing leadership, but rather a fundamental reshaping of the Fed's overall policy framework, mindset, role, and operational model. He argues that the Fed has deviated from its core mission (price stability), excessively expanded its role, become involved in fiscal policy, overly rely on quantitative easing (QE), and has a massive balance sheet, leading to runaway inflation, market distortions, and undermining the Fed's independence and credibility.

1) Balance sheet reduction is only part of the reform: He advocates for a significant and orderly reduction of the Fed's current $6 trillion balance sheet (shifting from crisis-era "emergency liquidity" to normalcy), thereby freeing up resources, reducing bias towards Wall Street, and shifting support to Main Street (i.e., households and small and medium-sized enterprises). However, this is not an isolated measure, but rather combined with lower short-term interest rates to achieve "policy rebalancing." 2) Broader Systemic Reform:

He called for abandoning the "monetary dominance" era (i.e., artificially suppressing interest rates and fueling government debt through large-scale QE) and returning the Federal Reserve to its narrow role as a central bank. This includes:

Abandoning "dogmatic" views on the causes of inflation (such as believing that inflation is solely due to an overheated economy or rising wages);

Coordinating debt management with the Treasury to avoid the Federal Reserve indirectly monetizing debt;

Reforming regulatory and supervisory methods to restore market discipline;

Overall "regime change in the conduct of policy," including shifts in mindset, decision-making framework, and institutional governance.

This is also the source of Warsh's "interest rate cuts + balance sheet reduction" policy, as reported by many media outlets, the core of which is his inclination to solve problems through systemic reform.

2. Why Did Trump Choose Warsh?

Today, the market is hesitant due to the possibility of Warsh's nomination, so why would Trump choose Warsh? Previously, in x.com/qinbafrank/status/200044...…这里有聊过:, if Hassett takes office: the Federal Reserve may be more inclined to aggressive interest rate cuts (but not particularly extreme), aligning with Trump's economic agenda (such as tariffs + low interest rates), leading to greater controversy regarding its independence.

If Warsh were to take office: policies would be more balanced and rule-oriented, focusing on balance sheet reduction and inflation control, with potentially more moderate interest rate cuts, making him more popular with Wall Street and reducing concerns about his independence.

Then Trump's choice logic becomes clear:

1) Hassett is undoubtedly Trump's first choice, but choosing Hassett might face strong opposition from Wall Street. However, the White House does need Hassett, as Chairman of the National Economic Council, to speak publicly, especially in 2026;

2) Warsh stands between Trump and Wall Street, relatively neutral, but also advocates for interest rate cuts (though only slightly more moderately), suggesting a continued downward trend in interest rates. Furthermore, due to his family background, Trump would have leverage to communicate with Warsh in the future, preventing a complete loss of control.

3) From this perspective, Trump actually agrees with Warsh's policy proposals. Trump's biggest demand of the Federal Reserve is for interest rate cuts (to reduce the debt burden), which is also Warsh's proposition, though the specific magnitude may differ. Moreover, since Bessett endorsed Warsh's proposed reforms to the Federal Reserve system, Trump is likely to agree as well.

3. What exactly does Warsh's policy advocacy of "balance sheet reduction" involve?

As discussed earlier, Warsh's policy advocacy essentially involves lowering interest rates to control debt interest, but he adopts a hawkish approach to the balance sheet. In the Fed's monetary policy, price-based tools involve interest rate adjustments, while quantity-based tools involve balance sheet adjustments. If we look at it this way, Warsh's advocacy for both interest rate cuts and balance sheet reduction is essentially a quantity-based adjustment. It seems contradictory, but it has its merits.

If you've noticed, Bessett is a critic of the Fed's massive balance sheet, arguing that it created excessive reserves through QE, distorting market pricing. The "ample reserves regime" that the Fed transitioned to after the 2008 crisis—where banks held large amounts of excess reserves and the Fed controlled short-term interest rates through interest payments (IORB)—now appears to be "potentially causing problems." The massive reserves (plus post-crisis regulatory requirements) have led to over a quarter of bank assets being allocated to safe assets like reserves, passively earning interest, which ironically reduces banks' willingness to lend and hinders real economic growth. Consider this: over the past decade or so, the proportion of loans provided by US banks to businesses has dropped from a peak of 50% to the current 20%, leading to the proliferation of private lending.

The Federal Reserve's previous quantitative easing (QE) injected massive amounts of funds into the financial system through indiscriminate asset purchases. On the one hand, this resulted in ever-increasing bank reserves, allowing banks to simply collect interest. On the other hand, it also caused banks to become increasingly detached from their core business, unwilling to lend, which actually harmed the real economy more.

From this perspective, Warsh's advocacy for the Fed to reduce its balance sheet, in my opinion, is essentially about reducing bank reserves through systemic reforms, giving banks a greater incentive to lend and provide leverage to real businesses. This is also consistent with what was discussed at the beginning of the year x.com/qinbafrank/status/200656...…聊到,要关注美国监管层对美国银行业的松绑。金融去监管,通过放松监管,让银行巨头做大、做强、重新放贷,让美国银行业重新直接介入到经济发展之中。

In a sense, it's all part of the same logic.

4. Is the market overly worried?

The market's concerns are not unfounded. Although Warsh's advocacy for interest rate cuts is still beneficial, as lower interest rates can control debt interest, the magnitude of the rate cuts should be smaller than Hassett's. A hawkish stance on the balance sheet will indeed impact short-term liquidity, and the market's concerns cannot be said to be unfounded.

However, it's important to note that Warsh tends to control inflation through quantitative easing (QT), thereby creating room for lowering nominal interest rates. This is logically consistent with the Trump administration's desire to reduce borrowing costs. He calls this strategy "practical monetarism," advocating that the Federal Reserve and the Treasury must "separate their roles": the Fed manages interest rates, and the Treasury manages fiscal accounts.

The two need to reach some kind of "new agreement" to address the problem of excessively high debt interest rates, rather than having blurred boundaries and intertwined relationships as in the past.

In fact, it's crucial to pay closer attention to the pace of Warsh's policy implementation. If, as he himself says, the tapering is orderly and not excessive, the market may gradually adapt to this situation. If its policy propositions can truly be realized, it will lead to a healthier and more sustainable economy.

The best-case scenario for the future is:

Interest rates will decline slowly, perhaps three more times or slightly more;

The decoupling of the SLR will lower the yield on debt service;

The Fed's balance sheet, especially bank reserves, will return from an excess state, allowing banks to return to their core business and truly support the real economy through lending, thereby achieving asset quality growth that drives capital market growth.

Of course, we must also note that the anticipated unlimited quantitative easing may be becoming increasingly distant. This is actually quite normal; in this era of globalization, fiscal policy is increasingly taking the lead rather than monetary policy.

The new economic and monetary policy axis for the future in the United States will be:

Trump providing political support;

Bessett controlling fiscal/industrial leverage;

Wash anchoring a more market-oriented Fed;

Drukenmiller bridging the central bank and the market.

qinbafrank

@qinbafrank

12-15

美国经济政策权力轴心的转变,这篇推文角度还挺有意思的。沃什突然在美联储主席人选的竞争中概率被提上来,看起来一方面是华尔街的担忧起了作用,另一方面德鲁肯米勒也发挥了作用。德鲁肯米勒是量子基金索罗斯的合作人,九十年代贝森特是量子基金伦敦办公室的基金经理,而沃什在2011年从美联储理事位置 x.com/DrJStrategy/st…

Teacher Wu had already seen through everything 👍

Teacher Wu had already seen through everything 👍

I get bombarded with all sorts of messages and actions from the gods every day 😂

I get bombarded with news about the gods' every move every day 😂

Clearly, Warsh was the best choice.

From the complete abandonment of the gold standard in the 1970s to QE and unlimited QE, further QE is obviously no longer suitable.

Warsh's policies were not directional changes, but rather structural incentives for change.

Moderate interest rate cuts combined with balance sheet reduction actually give commercial banks more options. With less money, but also lower costs, commercial banks will use their relatively limited funds in the most efficient ways. This allows for autonomous optimization of asset allocation between commercial banks and the main players in the US economy.

It directs funds to efficient industries, driving economic development.

Moreover, interest rate cuts themselves help lower US Treasury yields, addressing one of Trump's current dilemmas.

Interest rate cuts set the tone, while balance sheet reduction allows for flexible adjustments to the dollar supply.

I think Trump has great foresight.

x.com/blockTVBee/status/201722...…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content